Sometimes, Covered California makes mistakes during the year regarding your health insurance enrollment and the subsidy. These errors are transferred onto you 1095-A that you must use to file your federal 1040 tax return. If you don’t catch the errors, you may have paid too much for health insurance during the year.

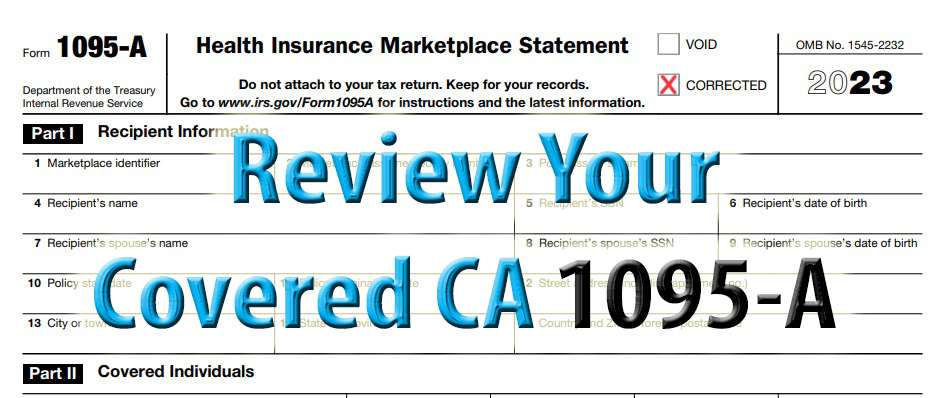

You may receive multiple 1095s for 2023 from different organizations. The 1095-C is provided by employer sponsored health plans. Medi-Cal issues a 1095-A. Covered California generates the 1095-A with important information for taxpayers to reconcile the Advance Premium Tax Credit (APTC) subsidies with their final income on form 8962 of the federal tax return.

1095-A Errors, How to Spot Them, Dispute Incorrect Information

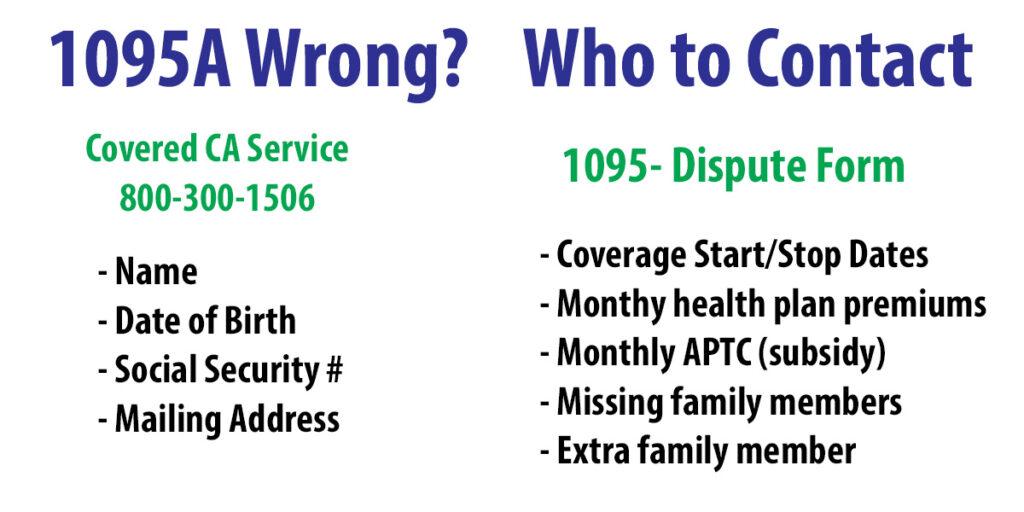

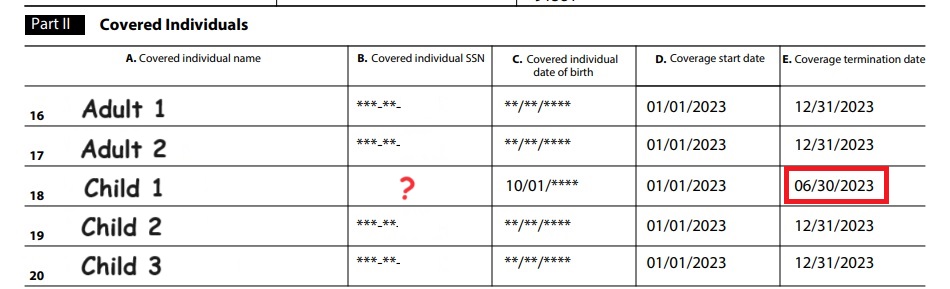

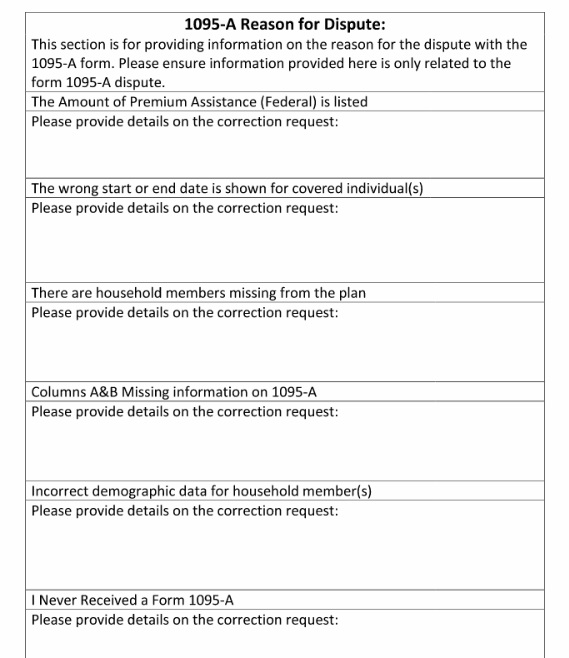

While some incorrect information may be corrected by calling the Covered California customer service line, other errors can only be fixed by filing a dispute form. The data that can be disputed are coverage start and stop dates, health insurance premiums, monthly subsidy forwarded to the health plan, missing family members, or household members who should not be in the tax family 1095-A.

If anyone in the household was in Medi-Cal, those errors must be corrected by the your county Medi-Cal case worker.

Where To Find Your 1095-A

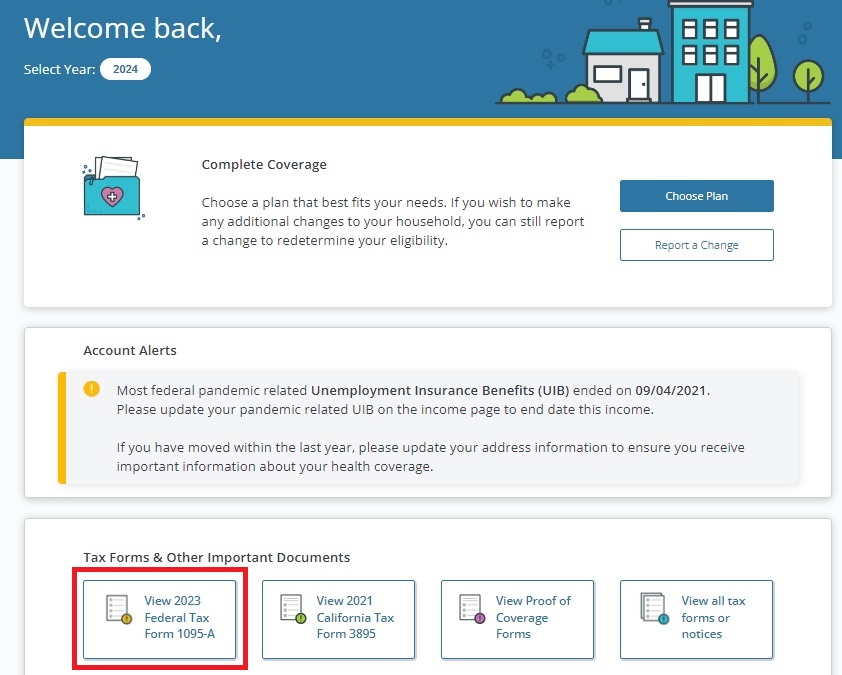

If you opted only to receive electronic communications from Covered California, you will need to access your account and download your 1095-A. Your health insurance agent should be able to download them for you. Your 1095-A will be in your secure email box of your Covered California account. Alternatively, you can click on View 2023 Federal Tax Form 1095-A on your home page.

Review all of the demographic information to make sure it is correct such as address and Social Security numbers. Next, check that the covered individuals are correct with the proper social security number, date of birth, and the start and stop date of coverage.

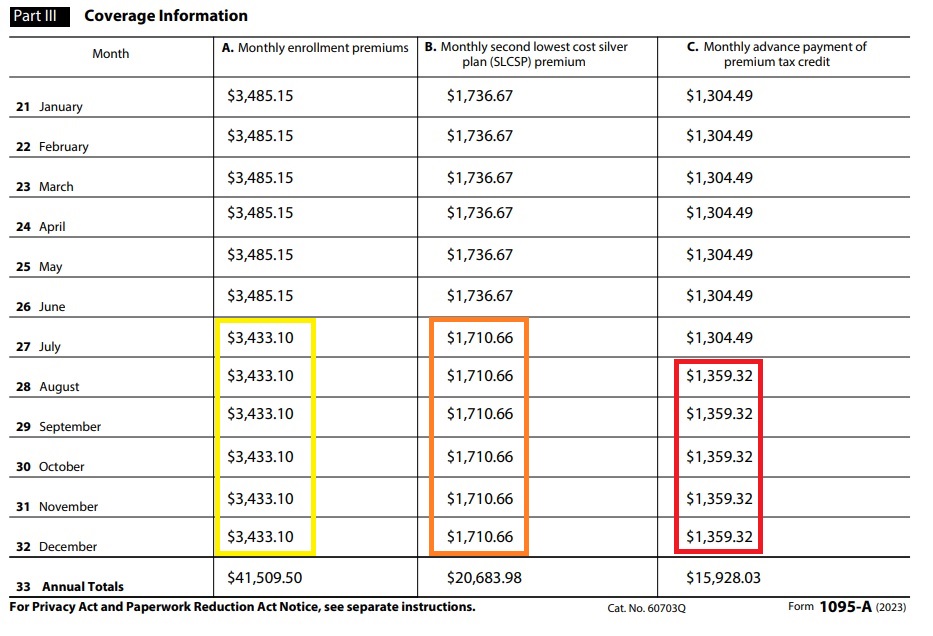

Part III, Coverage Information, can be a blur of columns of dollar amounts. Column A is the full monthly premium amount of the health plan that you were enrolled into. If a household member was enrolled in a different health plan, there will be a separate 1095-A. Column B is full monthly premium amount of the second lowest cost Silver plan. This number is important because it is the dollar amount that is used to calculate the monthly subsidy. Column C is the monthly dollar amount of subsidy that was sent to your health plan to lower your monthly health insurance premium.

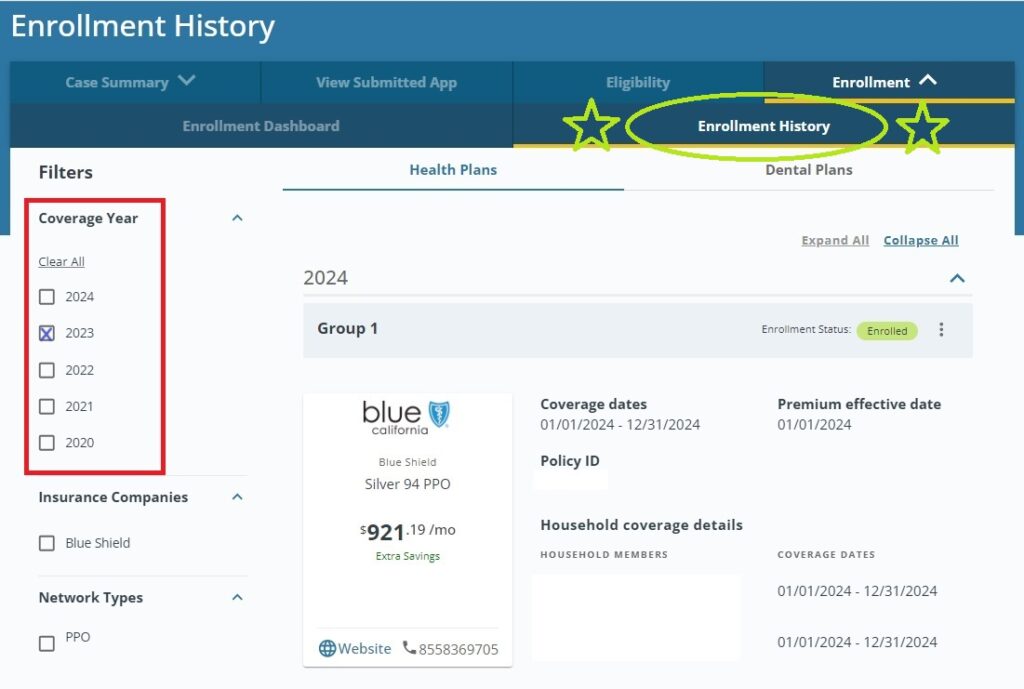

Cross-check 1095-A with Covered California Enrollment History

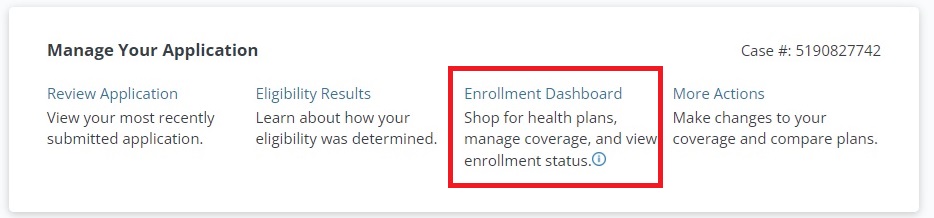

Are the dollar amounts right or wrong? How do you know? Within your Covered California you can access your Enrollment Dashboard, then select Enrollment History. The Enrollment History will show all the plans you were enrolled into and changes to the subsidy you received.

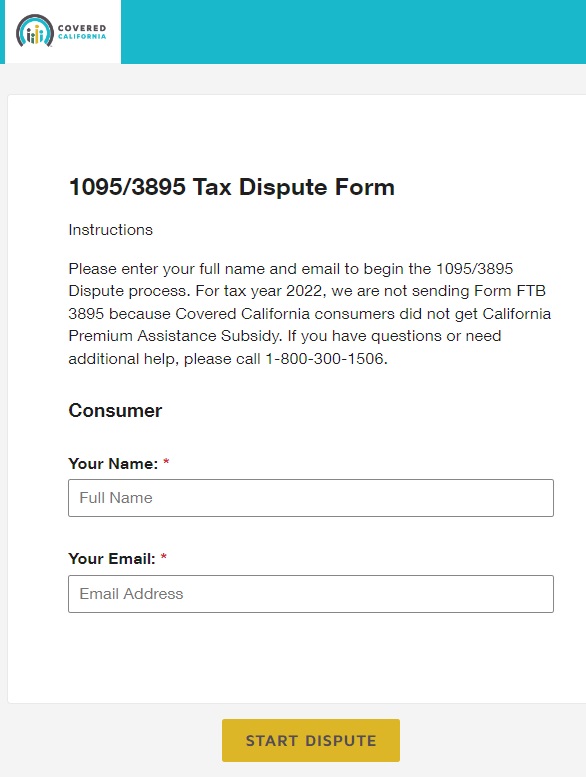

Filing a 1095-A Dispute

That information should mirror the 1095-A data. If it does not, and you cannot account for the changes (such as a change to income during the year that changes the subsidy) then you may need to file a 1095-A dispute form.

The Covered California 1095-A dispute form is a DocuSign online form. It allows you to provide Covered California all of the pertinent information and the specific areas that you believe are in dispute. You should be as specific as possible with the information you believe is incorrect and the possible reason for the error. There are times when Medi-Cal or the health plan has made an error that results in erroneous information being presented on the 1095-A.

If Covered California agrees with your assessment, they will issue a corrected 1095-A for you to file with your tax return. For more details on potential errors, you can view my YouTube video below.