Non-standard off-exchange health plans are usually less expensive than the Covered California designed plans.

For many individuals and families, 2018 is the year of extreme sticker shock over the rates for health insurance. Covered California, the health insurance exchange that is supposed to be protecting people from predatory health insurance premiums, has higher rates than the same plans health plans sold off the exchange. There are a few health insurance plans, with decent benefits and cheaper rates, outside of Covered California, but you need to read the fine print to make sure you know what you are buying.

There are a several reasons why California individual and family plan health insurance rates took a major increase in 2018.

- The rates for dependent children between the ages of 15 and 20 increased by 50%

- Everyone is a year older

- Some plans had nasty rate increases to account for increased claims experience, drug utilization, and decreased competition in some regions

- Covered California added a surcharge to all Silver Plans to make up for lost funding from the federal government

Many consumers in Covered California who receive very little or no monthly tax credit subsidy are looking for off-exchange plans for better rates.

Outside of Covered California The Rates Are Cheaper

Without question, all standard benefit design Silver 70 plans sold off-exchange, outside of Covered California, are cheaper by 10% to 15%. Some of the health insurance companies offer non-standard benefit design plans off-exchange that can have a lower rate than a cousin metal tier plan. But don’t get too excited about finding cheap rates outside of Covered California, those plans are still expensive.

What Does That Number Mean?

First, you have to realize that all plans are categorized by a metal tier level Bronze, Silver, Gold, or Platinum. Each of these tiers has an associated actuarial value percentage: Bronze 60, Silver 70, Gold 80, or Platinum 90. The number represents the average percentage of the health care costs covered by the health plan. For instance, on average, at Bronze 60 plan is estimated to cover 60% of the health care costs of members in that plan for the year.

Covered California has issued standard benefit designed health plans. Within each metal tier the health plans will have a standard menu of covered health care expenses by deductible, copayments, coinsurance, and the maximum out-of-pocket amount. For example, all standard Silver 70 plans will have a $2,500 medical deductible, $35 office visit copay, 20% coinsurance, and a $7,000 maximum out-of-pocket amount for an individual.

However, there are many ways a health insurance company can design a health plan to meet a specific metal tier actuarial value. They can lower the deductible, but increase the copayments. They can lower the copayments, but increase the coinsurance after the member has met the deductible. In a general sense, if a health plan states it will meet the actuarial level of 70%, regardless of the member cost-sharing design, then the rates will be similar between a standard benefit and off-exchange non-standard design plan. This is because the health insurance company will have a similar exposure to paying claims for the members based on the actuarial formula they use.

Non-Standard Benefit Design Off-Exchange Plans

Health insurance companies are smarter than your average house cat. They have reams of data about health care claims and demographics. They can forecast, with reasonable confidence, that altering some of the member cost-sharing benefits may reduce their final exposure to pay member claims. It has also been suggested that consumers who purchase health insurance off-exchange, paying the full premium rate with no subsidy, may be more judicious in how they use health care services. In other word, off-exchange consumer mays tend to file fewer health care expense claims. This results in lower rates to the consumer.

If a health insurance company sells standard benefit design plans through Covered California they are required to offer the same plans off-exchange at the same rates. The caveat to this in 2018 is that Covered California has allowed the health plans to offer a near mirrored version of the standard Silver 70 without the added surcharge. The minor difference is that that off-exchange Silver 70 plan has ambulance copayment $5 higher than the standard benefit design Silver 70.

If you like the standard benefit Silver 70 health plan, buying it off-exchange will save you anywhere from 10% to 15%. There are also some other non-standard plans that have lower rates also. Plan summary documents at end of post.

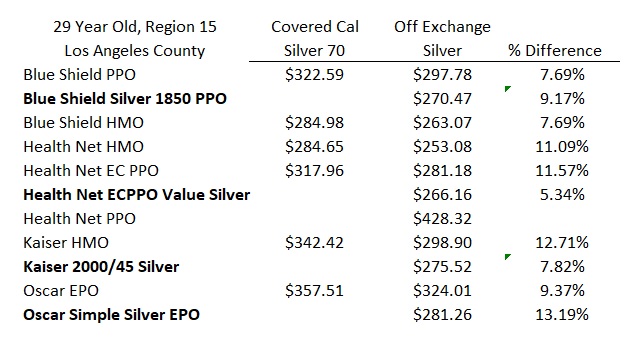

Silver 70 off-exchange percentage rate difference to Covered California for a 29 year old in Region 15, Los Angeles County

The above table compares the rates for the Silver 70 through Covered California and off-exchange for the exact same plan. The plans in bold are the non-standard benefit design Silver plans and the percentage rate difference is compared to the off-exchange rate for the standard Silver 70 plan.

Anthem Blue Cross

Anthem Blue Cross, in the few California regions it does serve, offers several Bronze and Silver non-standard benefit plans. The Bronze EPO 5250 and Bronze EPO 5850 have reduced coinsurance percentage after the deductible of $5,250 and $5,850 respectively, has been met. The Bronze 5250 has 25% coinsurance and the Bronze 5850 has 20% coinsurance for many services. By comparison, the standard Bronze 60 plan has 100% coinsurance by the member after the medical deductible of $6,300 has been met. This means that with the standard Bronze 60 plan the consumer is still paying the full amount for the health care services (100%) even after they have met the deductible.

Once a member of the Bronze 5250 or Bronze 5850 has met that deductible they pay 25% and 20% respectively for future health care services. The downside of the Anthem Bronze plans is a higher maximum out-of-pocket of $7,350 compared to $7,000 for a standard Bronze 60 plan. These Bronze plans can actually be more expensive than the standard Bronze 70 plan.

The Bronze EPO 6900 includes a $55 office visit copayment not subject to the deductible. It has coinsurance of between 20% to 50% and a modest benefit for prescription drug coverage. The Bronze 6900 is more expensive than the standard Bronze plan, but upwards of 30% cheaper than a Silver 70 plan.

There is also the non-standard Anthem Blue Cross Silver EPO 1900 and Silver EPO 2000 health plans. They have a lower medical deductible than the Silver 70, but higher maximum out-of-pocket amounts. They also limit the number of office visits at a set copayment and more services are subject to the deductible before the member cost-sharing coinsurance is triggered. These non-standard Silver plans can be 13% less expensive than the standard Silver 70 rates.

Blue Shield

Blue Shield only offers one non-standard designed plan called the Silver 1850 PPO. It has a $1,850 medical deductible, but higher coinsurance of 30% once the deductible is met. It also has labs, x-rays, and ambulance benefits subject to the deductible whereas the standard Silver 70 has set copayments for those services. The Silver 1850 PPO can be 9% less expensive than a standard Silver 70 plan.

Health Net

Health Net offers their full network PPO plans in parts of the Bay Area, San Joaquin Valley, and Southern California. But there is no rate savings with the Health Net PPO plans versus on-exchange health plans. You will be paying a premium for a much larger provider network of doctors and hospitals.

For 2018 Health Net introduced a new PPO plan called EnhancedCare. It will be offered in the Sacramento and Southern California regions. Two non-standard benefit plans offered off-exchange are the Silver Value and Gold Value plans. The Silver Value has a $4,500 deductible and $7,000 maximum out-of-pocket amount. Office visits are $45 copayment and $60 for specialist. Once you’ve met the deductible, you go into 30% coinsurance. Both the deductible and coinsurance are higher than the standard Silver 70, but the pharmacy deductible is lower at $50 with reasonable copayments for Tier 1, 2, and 3 drugs.

The Gold Value has a $1,000 deductible and $6,000 maximum out-of-pocket amount. The standard Gold 80 has no medical deductible. Similar to the Silver Value, there are fewer services with a set copayment, but the coinsurance of 20% is the same as the standard Gold 80 plan. There is a pharmacy deductible of $50 with modest copayments for drugs in Tiers 1, 2, and 3. You can expect a 5% to 6% rate savings for the Silver and Gold Value EnhancedCare PPO plans over the standard plans.

Kaiser

Kaiser has two different off-exchange High Deductible Health Plans (HDHP) that are Health Savings Account compatible. The first is the Bronze 5500/40% which has a higher deductible than the standard Bronze HDHP. For the $5,500 deductible versus the $4,800 standard deductible you will save about 2%. The second is the Silver 2700/15% HDHP. It has a $2,700 deductible and then 15% coinsurance until you meet the $6,500 maximum out-of-pocket. The Silver 2700/15% is priced about 13% below the standard Silver 70 plan and only about 14% more than the standard Bronze 60 HDHP.

There is also the Kaiser Silver 70 2000/45 off-exchange plan. It has a lower deductible of $2,000 versus the $2,500 standard Silver 70. It has $45 office copayment and slightly higher drug copayments. Instead of 20% coinsurance of a standard Silver plan, the Silver 2000/45 has 35% coinsurance for high cost health care services. You can look to save about 8% with the Silver 2000/45 compared to the standard Silver 70.

Oscar

Oscar, serving the Bay Area and Southern California, offers several off-exchange non-standard benefit design plans. The Simple series of plans foregoes any health care services subject to any coinsurance. The deductible is the maximum out-of-pocket amount. The plan member either pays the full negotiated rate or a set copayment. Once the maximum out-of-pocket is met the health plan covers the virtually all health care services at 100%. The only copayment for the Simple Bronze is a $50 urgent care copay. The Simple Bronze has a $7,350 maximum out-of-pocket which is $350 more than a standard Bronze plan. Similarly, the Simple Silver has $7,350 maximum out-of-pocket amount and six health care services with a set copayment such as office visits at $25.

The Simple Gold has a $3,400 maximum out-of-pocket amount and the same six health care services as the Simple Silver plan with a copayment. Both the Simple Gold and Silver have generic and preferred brand name drugs at a set copayment not subject to any deductible. But non-preferred and specialty drugs have no coverage until the maximum out-of-pocket amount is met. The Simple Silver has a rate about 13% below the standard Silver and the Simple Gold is approximate 5% less than the standard plan.

The Oscar Saver plans are health savings account compliant plans. They come in metal tiers of Bronze, Silver, and Gold. The Bronze plan is the standard HDHP plan. The Saver Silver has deductible and maximum out-of-pocket of $4,500. Once that is met, everything is covered. The Saver Gold has $1,500 deductible and $6,000 maximum out-of-pocket amount. It has 10% coinsurance after the deductible. It is hard to compare the Saver Silver and Saver Gold saving because there are no comparable HDHP standard metal tier plans in those categories. The Saver Silver is 20% less than the standard Silver 70 and the Saver Gold is about 10% less than a standard Gold 80 plan.

Of course, it doesn’t matter how low the price is if the health plan doesn’t have the doctors and hospitals you want to see. But if you are not getting a subsidy from Covered California, and you are not married to you doctor of choice, off-exchange plan premiums can easily be 20% less than the standard benefit design plans ordained by Covered California.

Some of these files are stupidly large. Individual plan summaries for the different off-exchange plans can be found on the IMK File Explorer page under Health Plans Individual/Family.