Older individuals you are not eligible for Covered California tax credits because of low income might consider Medi-Cal to save money.

If you are over 50 in California you are facing really high health insurance rates for 2018. If your income is low enough, you can get the subsidy from Covered California to make the rate affordable. But what if you are not working and have very little taxable income. In this case, with no income, you are either deemed eligible for Medi-Cal or you must pay the full rate for a health insurance plan. Some older individuals, who have been paying for full health insurance rates, are contemplating going Medi-Cal and just paying out-of-pocket to see their preferred doctors not in Medi-Cal HMO plans.

Older Folks Getting Hit With High Health Insurance Rates

With open enrollment season, I have been doing a lot of quotes for prospective and current clients trying to find lower cost alternatives to their existing health insurance. A sub-section of this population is people in their mid-50s to early 60s. They may be between jobs or have decided to just coast until they hit 65 when they can enroll in Medicare and start collect Social Security. These folks have always had pretty good health insurance either through the individual market or from employer plans. They have been paying the really high health insurance rates for older people and burning through cash at the same time.

These older Californians currently have enough money in savings to pay for health insurance, even at very high rates, but many are wondering if that is the highest and best use of their limited retirement savings? These folks are looking at health insurance rates between $600 and $1,200 per month for a Bronze plan with virtually no benefits. That’s $7,200 to $14,400 per year. That is more than Medicare pays the Medicare Advantage plans for a nominally healthy 65 + year old Medicare beneficiary.

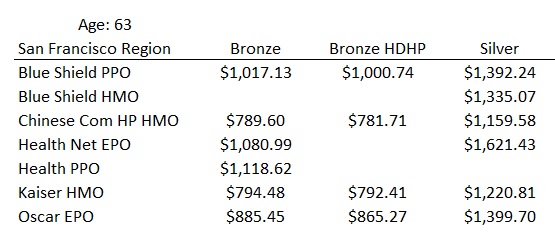

Bronze and Silver health insurance rates for a 63 year old individual in the San Francisco region.

Once that cash is gone in the form of premium payments, you can’t get it back. Health insurance is not an investment. For older Americans, health insurance before Medicare looks more like asset protection racket designed to drain a person’s savings down to zero. Folks in this conundrum face three alternatives.

- Keep the high rate health insurance that covers their preferred doctors, hospitals, and drugs.

- Select the least cost HMO Bronze plan as an emergency back and pay out-of-pocket to see their preferred doctors who may not be in-network.

- Enroll in Medi-Cal, which is zero monthly premiums, and continue to see their preferred doctors and pay out-of-pocket.

For people who only occasionally use health care services, health insurance is asset protection. It is there to protect your savings from being completely wiped out in case of an emergency. All plans cover emergency services in California or in another state. However, follow-up services such as rehabilitation or additional surgery usually need to be received in your home region.

Cheap Bronze Plan For Asset Protection

Some individuals are considering enrolling in the cheapest Bronze plan just as a backstop to expensive unexpected emergency care and asset production. I have one client who will enroll in the Kaiser Bronze High Deductible Health Plan, Health Saving Account eligible, just for asset protection. She has no intention of ever visiting a Kaiser facility or seeing a Kaiser doctor. She will continue to pay out-of-pocket to visit her preferred doctors for her medical conditions. The savings between the bare-bones Kaiser plan and a Silver plan that includes some of her providers is over $4,000 per year. She doesn’t expect spending more than $2,000 on her doctors and prescriptions, so she feels she is $2,000 a head of the game.

However, if you enroll in a plan you don’t expect to use except for the asset protection it provides with the annual maximum out-of-pocket amount in case of an emergency, carefully study the member agreement or Evidence of Coverage documents for exclusions. For example, Kaiser will only recognize drugs prescribed by their doctors as eligible for purchase at their pharmacy. This can be important because the cost of prescription medications does add to the annual maximum out-of-pocket amount. If you spend $3,000 on drugs outside of the health plan, those dollars don’t go toward meeting any deductible or maximum out-of-pocket amount under the terms of the health plan.

Consider Medi-Cal To Save Cash

Finally, some folks are considering just enrolling in Medi-Cal because they are eligible. They have very little or no income to report on their taxes because they are living off of savings, interest, and dividends. Here again, Medi-Cal would be used as a containment strategy to an unexpected accident or illness. Medi-Cal is typically a HMO plan which requires a Primary Care Physician to make referrals to specialists, order tests, or imaging.

Medi-Cal is no cost for household incomes under 138% of the federal poverty level. This means older adults in their 50s and early 60s could be saving $6,000 to $12,000 per year. That is a lot of money that is now free to visit a favorite doctor you have been seeing for many years and who doesn’t accept any of the individual and family plans offered in California. The downside is if a chronic health condition does arise that needs frequent and expensive treatment, you will most likely have to go through the Medi-Cal HMO plan for health care services.

Regardless of whether you decide to stay in an expensive individual and family plan, enroll in a bare-bones Bronze plan, or opt for Medi-Cal to save money, carefully review all the conditions and exclusions of the health plan. If you are able to save $6,000 per year, it is worth spending a couple of hours reading through boring documents to make sure you are not locking yourself into a health care cage. Because once open enrollment is over on January 31, you can’t change plans or enroll in a new plan without a qualifying event. In other words, you are locked out of the individual and family market and can’t get your old plan back outside of open enrollment.