The calculated premium assistance for health plans is the key for enhancing the affordability of health insurance under the Affordable Care Act. While playing around with the new Covered California iPad application I was surprised to learn that single parents will pay more for health insurance than two parent households. This almost seems to be a single parent penalty for those families that need affordable health insurance most.

Single parent penalty created by premium assistance rules

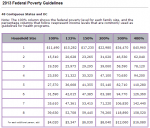

The glitch that leaves single parents paying for health insurance earlier and at a higher rate than a two parent household has to do with the way the federal poverty level is calculated coupled with the way Covered California is calculating premium assistance. Under the federal poverty level calculations, each additional individual in the household increases the income level defined as being in poverty.

Medi-Cal kids removed from calculations

Climbing on the dome skeleton at WEF

Those individuals, if they are children eligible for Medi-Cal Kids premium free health insurance, are removed from calculating the premium assistance for Covered California health plans for households. The result is that a single parent, classified as a single adult under the premium assistance formula, starts paying for insurance before a two parent household. In some instances, a single parent may actually have a higher cost of living because of day care expenses as opposed to a two parent household if one of the parents is able to stay home with the children.

Big families get premium break

Another bonus for large families is that the number of children under 18 years of age is capped at three for determining the monthly family health insurance premium. In other words, a family of seven children will pay the same premium rate as a family with four children given similar income and location. Of course, the cap also works against larger families when it comes time to determine the eligibility of the children for Medi-Cal kids. A family with seven children should theoretically be eligible to have all their children covered by Medi-Cal kids at a higher income level than what is calculated under the Covered California rules if each child was counted in the formula.

Covered California iPad application

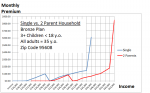

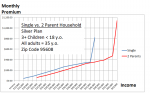

In an effort to determine the “single parent penalty” I calculated the premium rates for two families. All the adults are 35 years of age and each have three or more children in the household. I looked at the least expensive health plans offered in the zip code of 95608 which is in Sacramento County. The premiums, calculated by the Covered California iPad application, were figured in $2,000 income increments up to the point where each family exceeded 400% of the federal poverty level making them ineligible for premium assistance or the Advanced Premium Tax Credit.

One is the loneliest number

For a single parent household, that parent immediately starts paying for health insurance at an annual income of $16,000 under the Silver Plan and at $20,000 income for the Bronze Plan. The two parent household is completely eligible for Medi-Cal (adults and children) up to $20,000 annual income. At the $22,000 income level, the two parent household will start paying a premium for the Silver Plan, but the Bronze Plan, with the tax credit subsidy, will have no monthly premium until they hit $32,000 annual income.

Children drop premium rate to $0

Interestingly, the Bronze Plan premium for the single parent household drops to $0 when the income reaches $30,000. This happens because the children are no longer eligible for Medi-Cal kids and this increases the household size from “one adult” to one “adult and three children”. This also happens to the two parent family when their income reaches $40,000.

Huge premium step up after 400%

All premium assistance for the single parent household is lost at the $46,000 income level and the health insurance premiums rocket from $146 for the Bronze and $353 for the Silver Plans to $613 and $820 respectively. The two parent household gets pushed out of the premium assistance zone at $63,000. Their health insurance premiums of $182 for Bronze and $470 for Silver Plans at $60,000 income level jump to $852 and $1,140 at an income $63,000, respectively, when the two parent household no longer qualifies for premium assistance.

Enhanced Silver Plans lost earlier for single parents

The single parent household also looses eligibility for the enhanced Silver Plans, which have a lower deductible, copayments and coinsurance, at a lower income level than a two parent household. Enhanced Silver Plans are available to the single parent household from income levels $16,000 – $28,000. The two parent household is offered the enhanced Silver Plans from income levels of $22,000 – $38,000.

Is the formula fair?

Every household that applies for health insurance through Covered California will be unique and have a different set of circumstances and eligibility for programs and premium assistance. However, there will certainly be some single parent households that will feel they are being put in an unfair situation when compared to a two parent household. Should families be penalized for only having one adult in the household? That’s what seems to be happening under the current rules of the Affordable Care Act with respect to health insurance premiums in California.

Excel spreadsheet data set. All premiums are from the Covered California iPad application.

| Single | 2 Parents | Single | 2 Parents | ||

| Income | Bronze | Bronze | Income | Silver | Silver |

| $16,000 | $0 | Medi-Cal | $15,000 | Med-Cal | Med-Cal |

| $18,000 | $0 | Medi-Cal | $16,000 | $43 | Med-Cal |

| $20,000 | $3 | Medi-Cal | $18,000 | $63 | Med-Cal |

| $22,000 | $26 | $0 | $20,000 | $84 | Med-Cal |

| $24,000 | $50 | $0 | $22,000 | $107 | $62 |

| $26,000 | $74 | $0 | $24,000 | $131 | $82 |

| $28,000 | $100 | $0 | $26,000 | $155 | $101 |

| $30,000 | $0 | $0 | $28,000 | $181 | $123 |

| $32,000 | $26 | $9 | $30,000 | $206 | $147 |

| $34,000 | $55 | $33 | $32,000 | $233 | $171 |

| $36,000 | $74 | $58 | $34,000 | $262 | $195 |

| $38,000 | $90 | $85 | $36,000 | $281 | $220 |

| $40,000 | $106 | $0 | $38,000 | $297 | $247 |

| $42,000 | $122 | $10 | $40,000 | $313 | $271 |

| $44,000 | $138 | $38 | $42,000 | $329 | $298 |

| $45,000 | $146 | $53 | $44,000 | $345 | $326 |

| $46,000 | $613 | $68 | $45,000 | $353 | $340 |

| $48,000 | $87 | $46,000 | $820 | $355 | |

| $50,000 | $103 | $48,000 | $375 | ||

| $55,000 | $143 | $50,000 | $391 | ||

| $60,000 | $182 | $55,000 | $430 | ||

| $63,000 | $852 | $60,000 | $470 | ||

| $63,000 | $1,140 |