President Joe Biden signed the Social Security Fairness Act in early January 2025, potentially giving many individuals a big boost in their Social Security deposit. Social Security retirement benefits are part of the income calculations for Covered California health insurance subsidy. A large bump in Social Security deposits, either a one-time lump sum or monthly increase, can trigger the repayment of excess Premium Tax Credit subsidies on the individual’s federal tax return.

Individuals who might be the beneficiary of the Social Security Fairness are people who have had their Social Security retirement benefit reduced because of government employment. The act repealed two provisions, passed in the 1980s under President Reagan, that specifically targeted government employees.

The first provision is the Windfall Elimination Provision (WEP), a law that affects Social Security benefits. It reduces the benefit amount if you receive a pension from an employer who wasn’t required to withhold Social Security taxes. The reduction is a recalculation of the Social Security benefit when you also have a pension from “non-covered” work. The reduction can be significant, depending on the number of years you paid Social Security taxes.

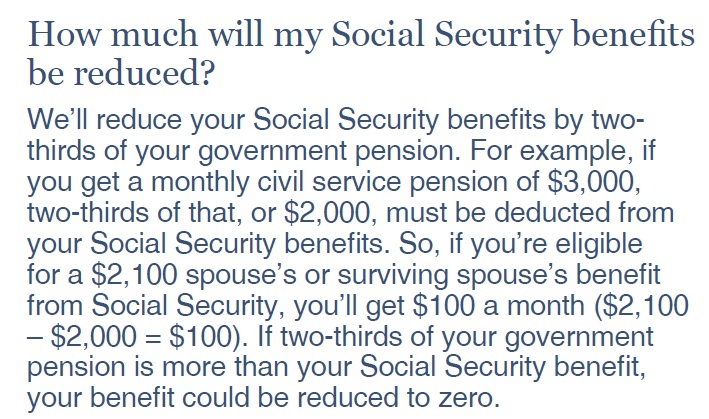

The second provision is the Government Pension Offset (GPO) law that affects Social Security spousal and survivor benefits. If an individual receives a government pension based on work not covered by Social Security, their Social Security spouse, widow, or widower benefits may be reduced by two-thirds of the amount of their government pension. An individual’s Social Security benefit is reduced by two-thirds of the government pension. Some people receive no Social Security retirement benefit because of the law.

As of early January 2025, the Social Security Administration was still working on implementing the Social Security Fairness Act. It may take several months, or longer, before people see any increase in their Social Security benefits. The act is retroactive to January 2025, which means some people will receive a large one-time lump sum payment, then increased monthly Social Security deposits.

To illustrate how this can affect families receiving the Advance Premium Tax Credit subsidy for health insurance through Covered California, let’s consider the couple of Jan and David. Jan is retired and has Medicare. David, who is younger, has health insurance through Covered California.

Jan and David’s household income is solely based on Jan’s government pension of $3,000. Jan was employed before going into public service but the Government Pension Offset provision prevents him from collecting the Social Security benefit. David has no income. Consequently, when Jan and David enrolled in Covered California with a household income of $36,000, David received a monthly subsidy of $1,736 to lower his health insurance premium.

Because of the Social Security Fairness Act, Jan will receive a monthly benefit of $1,000. Unfortunately, Jan doesn’t receive the one-time lump payment for 2025 until December, too late to amend their Covered California income estimate. Jan and David must reconcile the higher annual income on their federal income tax return.

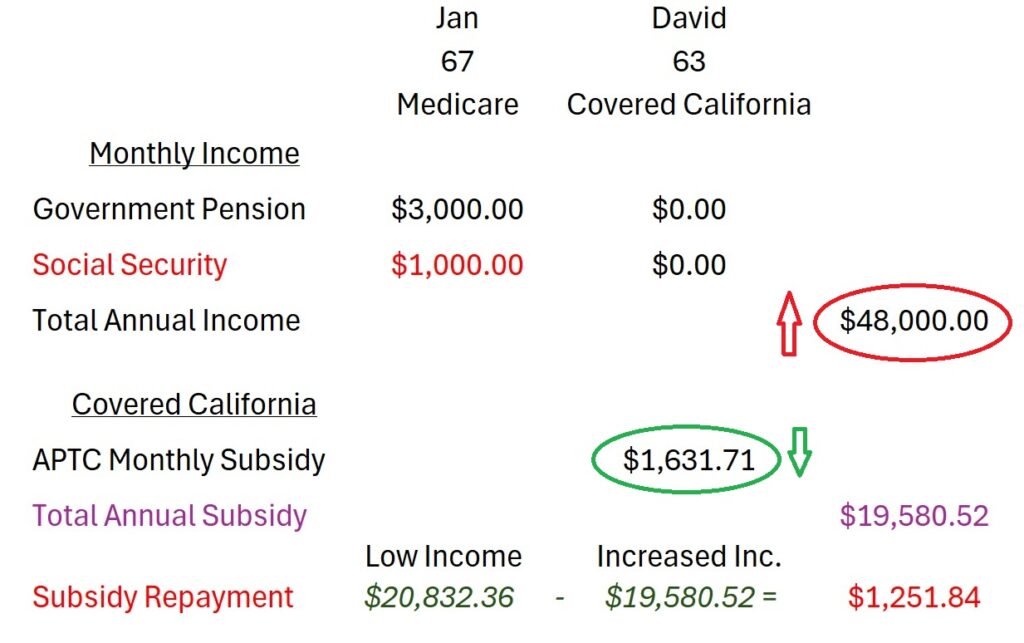

With the additional $12,000 income, their Modified Adjusted Gross Income reported on tax form 8962 is $48,000. At the higher income, David is only eligible for a monthly subsidy of $1,631. Jan and David received an annual subsidy of $20,832 (12 x $1,736), but are only eligible for an annual subsidy of $19,580 (12 x $1,631.) This means that Jan and David will need to repay $1,251 in excess Advance Premium Tax Credit subsidy during the year.

Regardless of whether you receive a bump in your benefits from the Social Security Fairness Act or not, most Social Security retirement and disability benefits are treated as income for the Affordable Care Act Premium Tax Credit subsidies administered by Covered California. The sooner you include the Social Security in your income estimate, the lower the likelihood that you will have to repay any excess subsidy you receive because of underestimated income.

2025