Social Security income can be confusing when it comes to the Covered California ACA health insurance subsidies. This confusion is a result of the difference between how you calculate Social Security for income tax purposes and how the same income is listed on the Covered California application. I review how Social Security income is used for the ACA health insurance subsidies and how Social Security income is calculated for taxable income.

Covered California Social Security Income

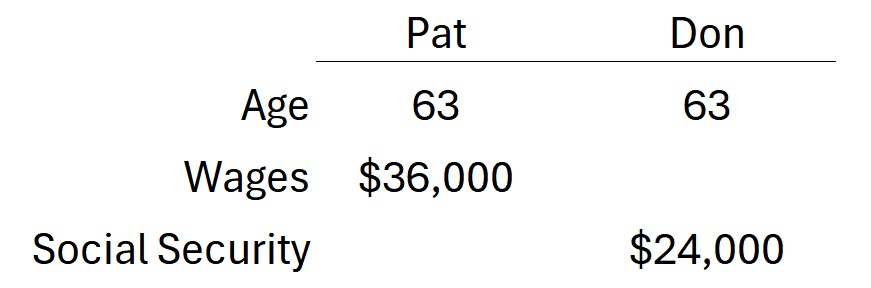

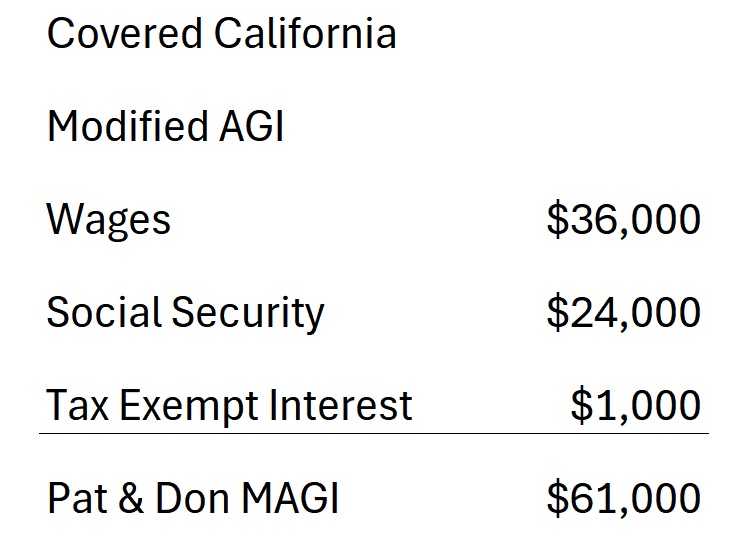

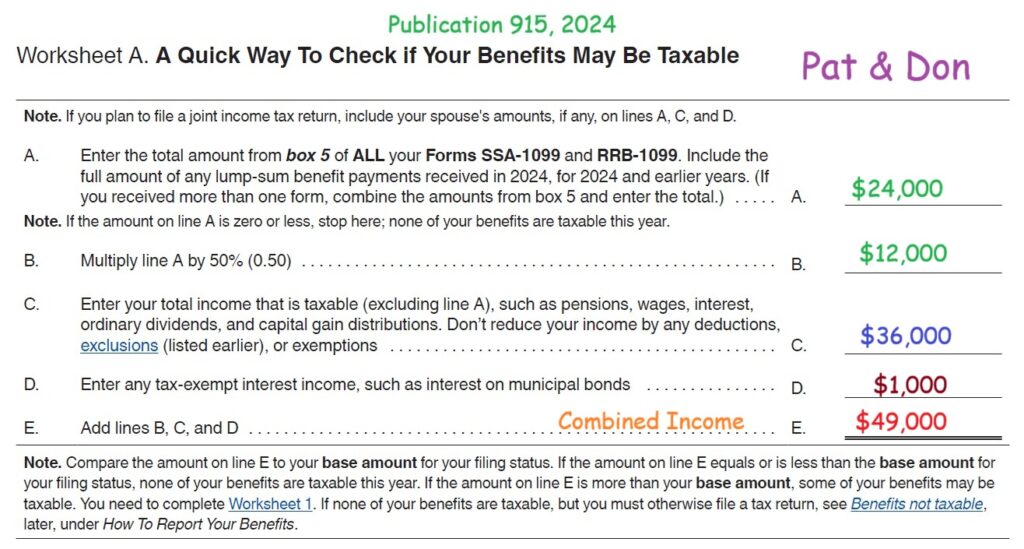

This example uses Pat and Don, a married couple, who are eligible for Covered California and must also calculate the taxable portion of their Social Security income. Pat and Don are both 63 years of age. Pat has part-time job and earns $36,000 annually. Don is retired and collects $24,000 annually in Social Security benefits.

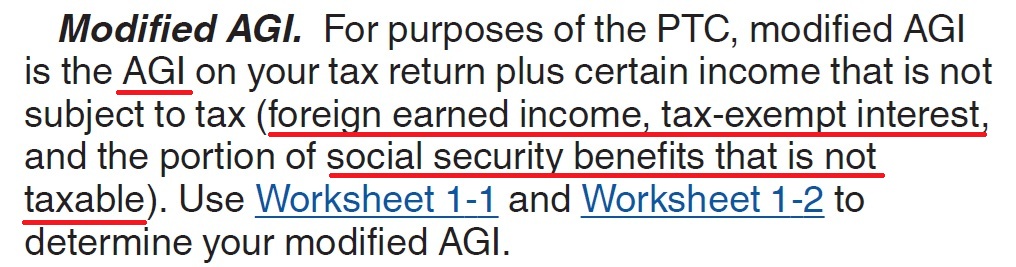

They apply with Covered California for health insurance with the Affordable Care Act subsidies. For their income they use the Modified Adjusted Gross Income. This includes the estimated adjusted gross income from their federal tax return plus foreign earned income, tax exempt interest and the full Social Security amount.

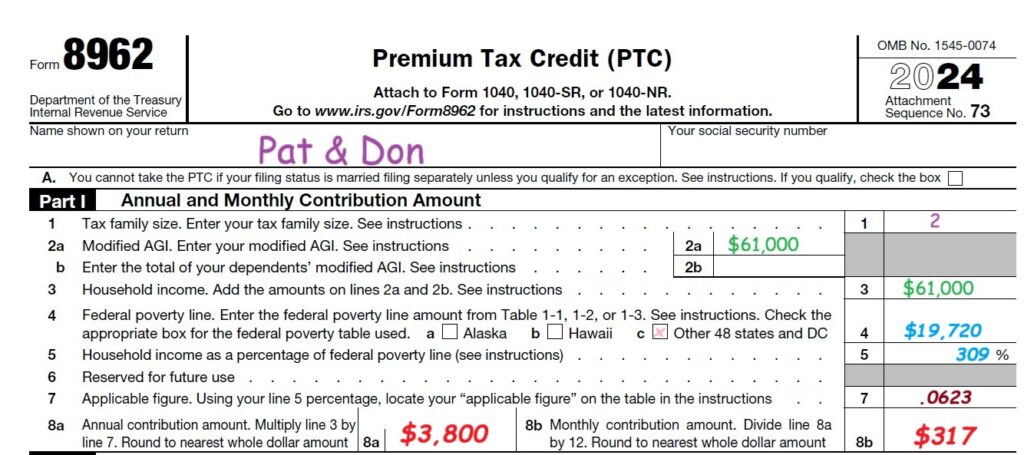

This makes Pat and Don’s MAGI $61,000

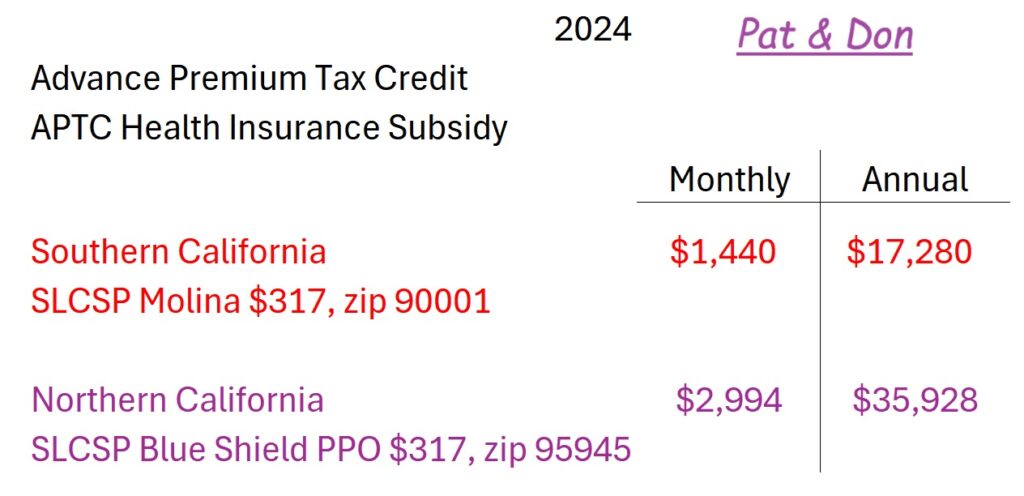

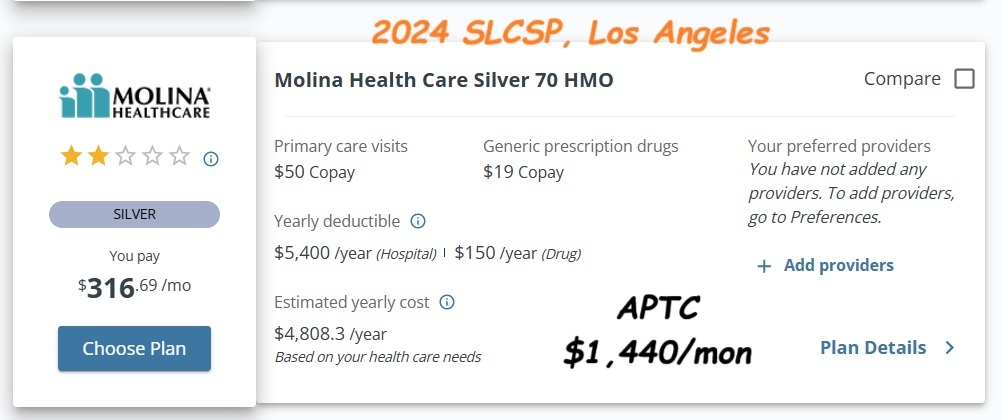

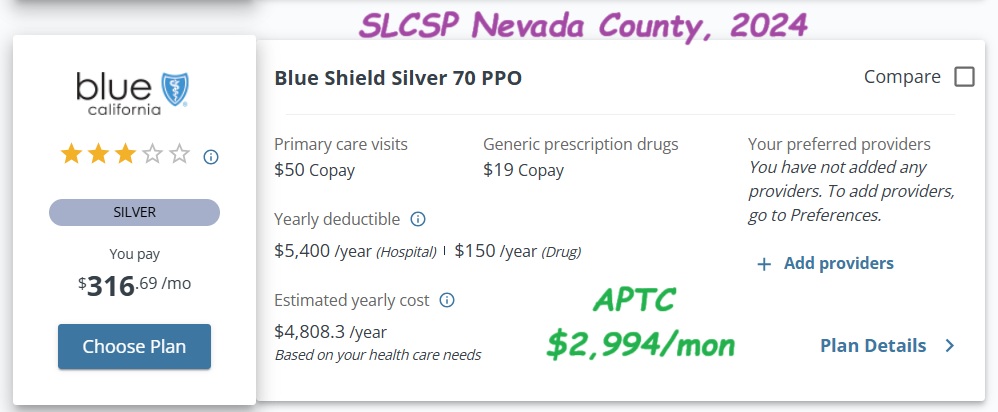

IRS Form 8962 reveals the rules that determine the household responsibility cost for health insurance. Pat and Don’s consumer responsibility based on their MAGI of $61,000 is $317 per month for the second lowest cost Silver plan. The Advance Premium Tax Credit subsidy they receive is the difference between the full monthly premium amount and their consumer responsibility.

If Pat and Don live in Los Angeles, they would receive $1,440 per month to make the Molina HMO Silver plan $317 per month. If they move to Nevada County in Northern California, the APTC subsidy would be $2,994 per month to make the Blue Shield Silver PPO plan $317 per month. Both of the plans are the second lowest cost Silver plan in those zip code regions.

Social Security Income Taxation

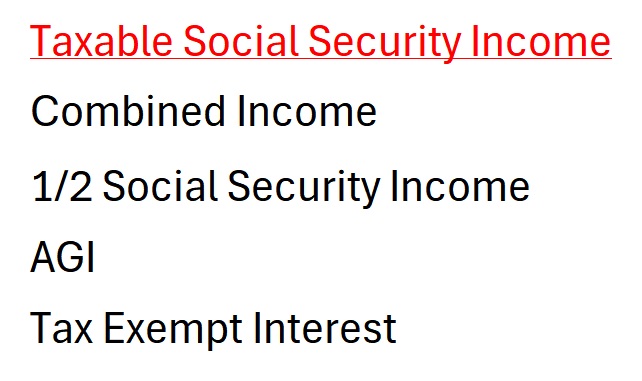

The confusion over Social Security income and the health insurance subsidies comes from how Social Security income is taxed. When determining taxes on Social Security, the IRS is looking at the household’s combined income. The combined income is ½ of the Social Security income, plus adjusted gross income, and tax-exempt interest. This sounds very similar to the MAGI for Covered California. Hence, the confusion.

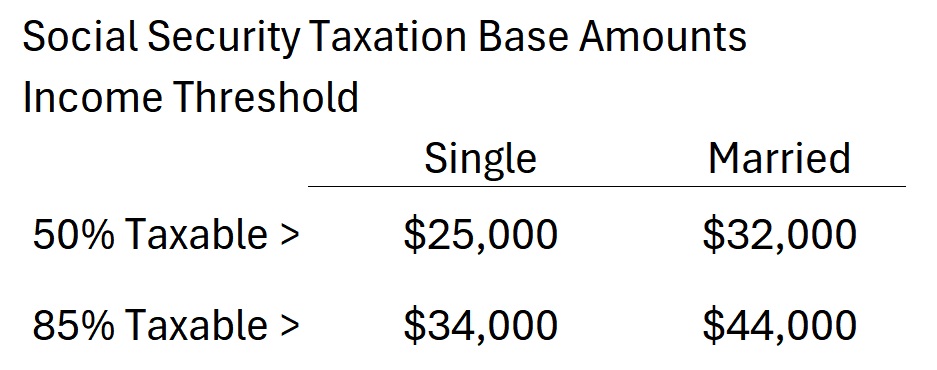

While many people will pay no income taxes on their Social Security, other people will pay taxes on 85 percent of the income. For a single adult, if the combined income is between $25,000 and $33,999, their Social Security may have 50% of the income taxed. A combined income over $34,000 for a single adult may have up to 85 percent of their Social Security considered taxable.

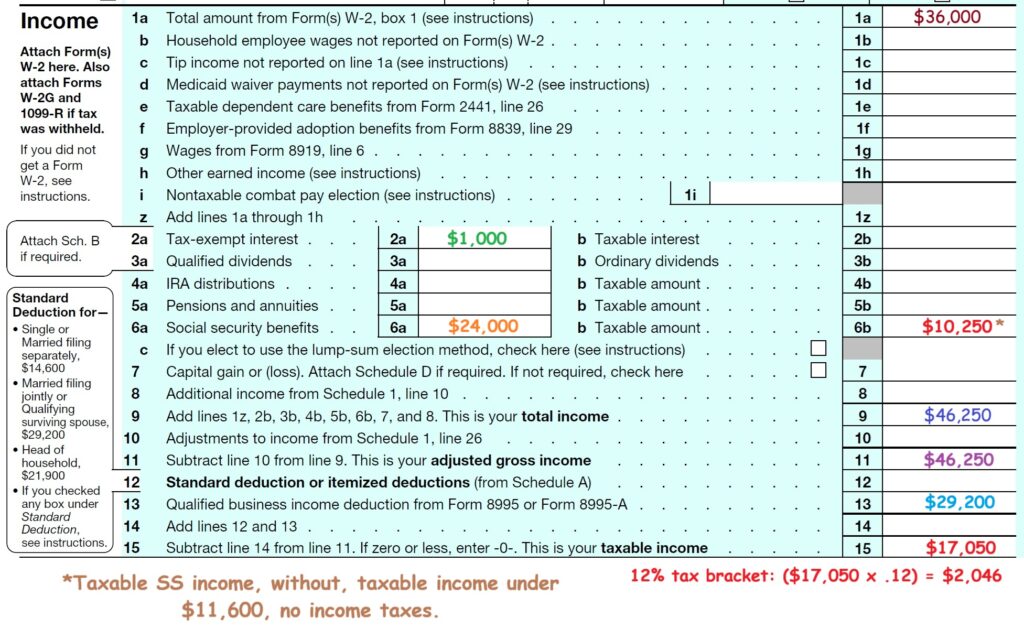

Married couples, like Pat and Don, have higher base amount thresholds for either the 50 or 85 percent taxation amount. IRS publication 915 has a quick guide for determining if your Social Security is subjected to income taxes. For Pat and Don, their combined income is ½ the Social Security income of $12,000, wages of $36,000, and $1,000 in tax exempt interest. The total of $49,000 puts their combined income into the 85% range.

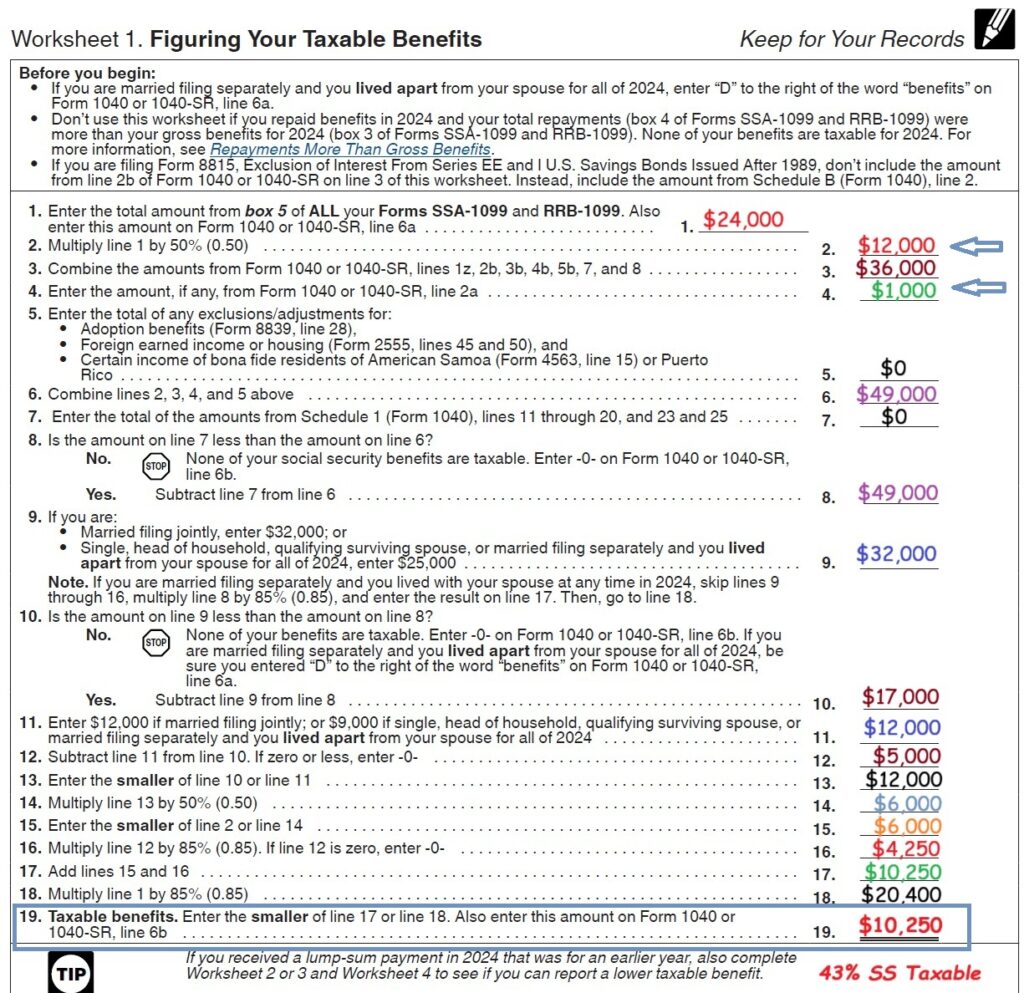

The worksheet and calculations for determining the exact amount of Social Security subject to income tax makes the health insurance subsidy form 8962 look like child’s play. It is complicated. It is a multi-step process comparing the combined income through the 50 and 85 percent thresholds, biased toward the lowest amount possible.

For Pat and Don, they determine that $10,250 of the Social Security income is subject to income taxes. This represents 43 percent of the total $24,000 annual amount.

The $10,250 amount is transferred to line 6b of the 1040 (2024) and added to the adjusted gross amount. Note that while the tax exempt interest is part of the health insurance subsidy and combined income calculation, it is not included in the adjusted gross income. After the standard deduction, Pat and Don’s taxable income is $17,050.

The main takeaway is that the calculations for the ACA health insurance income estimates are separate from determining the tax on Social Security benefits. Specifically, all the Social Security income is included on the Covered California application as income, but only ½ is used for the combined income calculation of Social Security income taxes. And even though ½ of the Social Security is used in the steps, less than 50 percent, or even zero, may be considered taxable income.