Similar to the trend we have seen with other insurance carriers, Sutter Health Plus individual and family plans will have a modest rate increase for 2021. The rate increases specific to each metal tier health plan are the same percentage across all the regions Sutter offers plan in, from Sacramento to Santa Cruz.

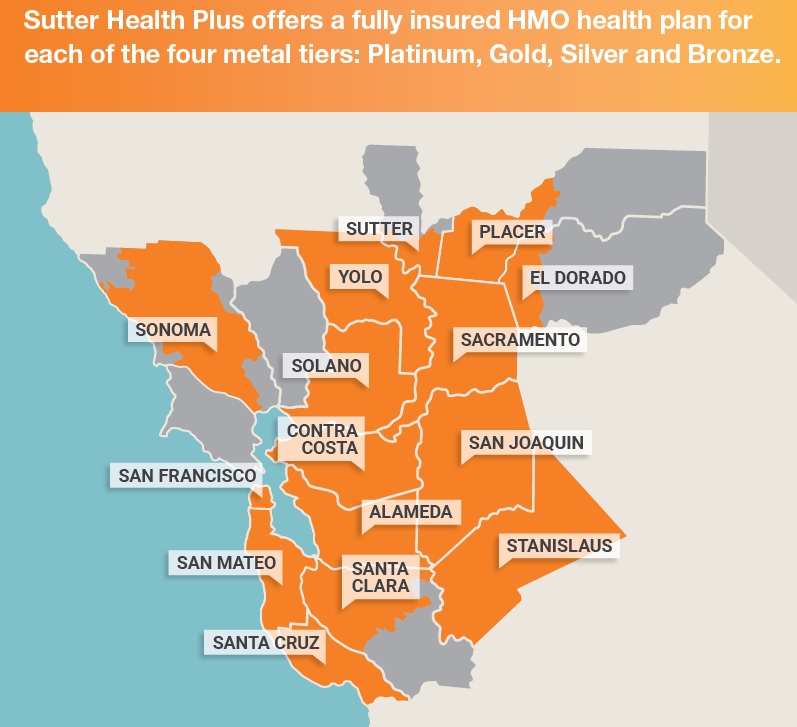

Sutter HMO individual and family plans are not offered through Covered California. Consequently, there are no subsidies to reduce the health insurance premiums. Sutter only offers standard benefit designed health plans that mirror the Covered California plans: Bronze 60, Silver 70, Gold 80, and Platinum 90. Sutter offers their HMO plans in nine different rating regions of Northern California.

Bronze Sutter HMO Smallest Rate Increase

Regardless of the rating region or age, the following rate increases will apply to the metal tier plans.

- Bronze 0.50%

- Silver 3.98%

- Gold 4.92%

- Platinum 6.64%

This rate increase is in addition to any increase for the member being one year older in 2021. Rates for ages 0 -14 are the same.

If enrollment in the Sutter HMO plans is similar to Covered California trends, over 80% of the members are enrolled in either a Silver or Bronze plan. The big benefit design change for the Silver and Bronze plans for 2021 is that the maximum out-of-pocket amount has increased from $7,800 to $8,200 per individual. Family MOOP is double the individual amount.

Most likely, the large rate increase percentage between the Bronze and all the other metal tiers is driven by drug cost. Prescription medication costs has been one of the large drivers of rate increases for all health plans in the last couple of year. The Bronze plans have minimal coverage for prescription drugs. Consequently, an individual with one or several prescribed medications will usually select a Silver plan or higher for the embedded drug copayments these plans offer.

Sutter Health Plus Rates Vary By Region

California is broken into 19 different rating regions. Sutter Health Plus HMO plans are offered in 9 of those regions. The least expensive rates – based on the Bronze plan for a 40-year-old individual – are in the Sacramento, El Dorado, Placer, Yolo counties service area. The most expensive are found in Santa Clara County, 15.92% higher than the Sacramento region.

Bronze 60 Rate, Age 40, by Region

- Sacramento, El Dorado, Placer, Yolo: $430.03

- Alameda: $443.40

- Santa Cruz: $450.80

- Solano, Sonoma: $454.37

- San Mateo: $461.83

- Sutter: $464.03

- San Francisco: $480.47

- Contra Costa: $489.45

- Santa Clara: $511.47

The only Covered California health plans to include Sutter physicians and facilities is the Blue Shield PPO health plans. The rate for a Blue Shield Bronze plan for a 40-year-old in Sacramento is 17% higher than Sutter and 10% more expensive in Santa Clara. But if you are applying through Covered California, you are probably getting a subsidy that will reduce the Blue Shield PPO rates below Sutter Health Plus. If you are not eligible for a subsidy and all of your doctors and other providers are Sutter affiliated, the Sutter Health Plus HMO may be a good option.

2021 Sutter Health Plus