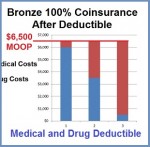

But as you can see, there are far more services with a specified copayment or coinsurance percentage, not subject to the deductible, than health care services subject to the medical deductible. It’s possible to meet your maximum out-of-pocket amount without ever meeting the medical deductible.