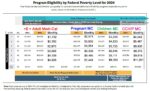

Just because Joey’s 2023 final Modified Adjusted Gross Income was in the range for Medi-Cal, he will not lose his 2024 health plan and subsidies. The IRS does not report his income to Covered California to flip him into Medi-Cal. His 2024 subsidy is based on his good faith honest estimate of his 2024 income.