I would suggest that the ACA Premium Tax Credit subsidies are a natural evolution of our society’s desire to achieve equal opportunity and security for all regardless of income or employment.

Kevin Knauss: Health, History, Travel, Insurance

Posts related to health care reform Affordable Care Act known as Obamacare, Covered California, coverage, conditions, enrollment.

The explanation of the rule changes by CMS is peppered with terms like “protect consumers”, “stable marketplace”, “reduce adverse selection”, and “improve risk pool.” However, the individual and family market has been very stable for many years. I have not heard of any California health plans getting sick, going bankrupt, or dying because they could not get health care.

We will see some health plans not be offered if there is a parallel marketplace with non-subsidized plans that have gaps and caps. Healthy people will migrate to the lower cost health plans leaving people who need health care services in the subsidized plans. This will cause the death spiral of the health plan as claims expenses increase with shrinking premium dollars.

The Social Security retirement income is really important. Your spouse may be on Medicare, and not seeking health insurance, but if they are receiving Social Security retirement benefits, that income, even though it may not be fully taxed, it must be included in the Modified Adjusted Gross Income. Many families have failed to include the Social Security retirement benefits in their income estimated and then found they earned too much money to qualify for the Premium Tax Credit subsidy and they had to pay it all back.

When the Byrd’s put all their information into the application, it calculates that they should pay no more than 7.30% of their income toward health insurance ($3,352 per year), and subtracts that from the annual cost of the Second Lowest Cost Silver Plan ($16,368 – $3,352 = $13,014.12) The exchange then divides the annual $13,014 of the subsidy by 12 months to get a monthly subsidy of $1,084.50.

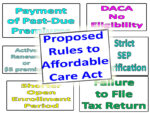

Today, the Centers for Medicare & Medicaid Services (CMS) issued the HHS Notice of Benefit and Payment Parameters for 2019. The final rule will mitigate the harmful impacts of Obamacare and empower states to regulate their insurance market. The rule will do this by advancing the Administration’s goals to increase state flexibility, improve affordability, strengthen program integrity, empower consumers, promote stability, and reduce unnecessary regulatory burdens imposed by the Patient Protection and Affordable Care Act.

The real story is that rates, especially for older people, have risen so much in the individual and family market that health insurance under the IRS definition of being unaffordable can happen at a very young age. Below are examples of the least expensive Bronze plan rates in Region 1 and Region 3. Within a thirty minute drive between Auburn (Region 3) and Grass Valley (Region 1) in Northern California the rates can be sharply higher.

Based on the data I’ve seen, the ratio of the actuarially fair cost differential of insuring someone in their 20s and someone in their late 50s or early 60s is roughly 5 to 1. Setting the ratio at 3 to 1 causes distortions that unfavorably impacts young adults and, as a result, degrades the risk pool. Insurance companies are reluctant to put themselves in a position in which they risk losing money with additional customers and will set prices for older adults so that they can recover their costs in that age group. The 3 to 1 ratio limits how much they can reduce premiums for young adults. The resulting premiums represent “unfair” insurance for young adults and discourages them from purchasing insurance. Discouraging young adults from purchasing insurance exacerbates the adverse selection problem in the insurance market and reduces the incentive for insurance companies to compete for older customers.

Spam prevention powered by Akismet