A new health insurance subsidy curve was ushered into existence in 2021 that provided greater subsidies for both low and high income earners. In 2022, the subsidy curve is still in place without the complications and benefits of the Covid pandemic relief unemployment benefits. The net result should be a slightly easier navigation of reconciling the Affordable Care Act health insurance Premium Tax Credits on the 2022 tax return.

The following information is derived from the instructions for form 8962 Premium Tax Credit.

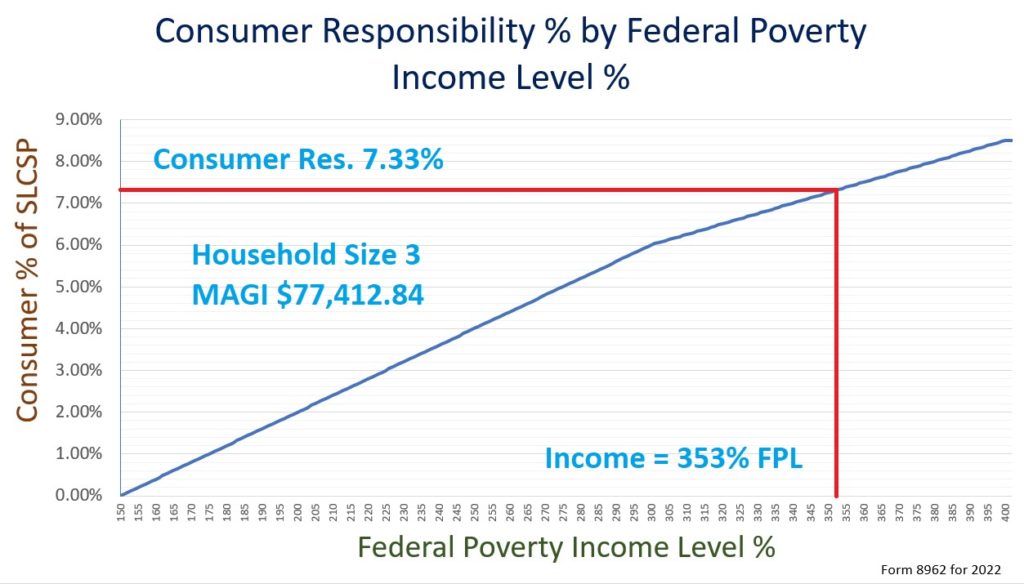

The American Rescue Plan smoothed out the subsidy curve and extended it for household incomes over 400 percent of the federal poverty level.

Larger Subsidies for Families in 2022 Under New Subsidy Curve

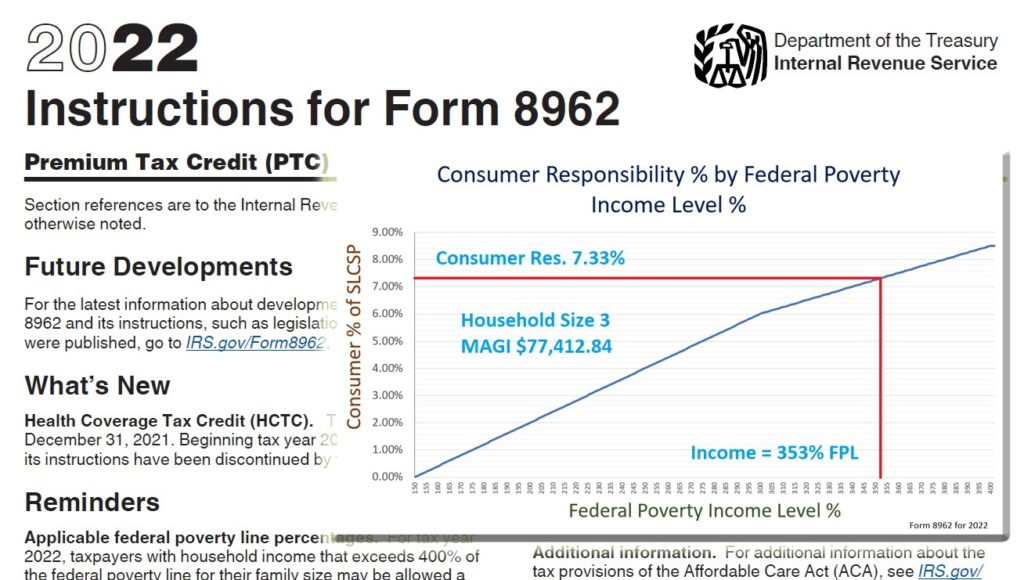

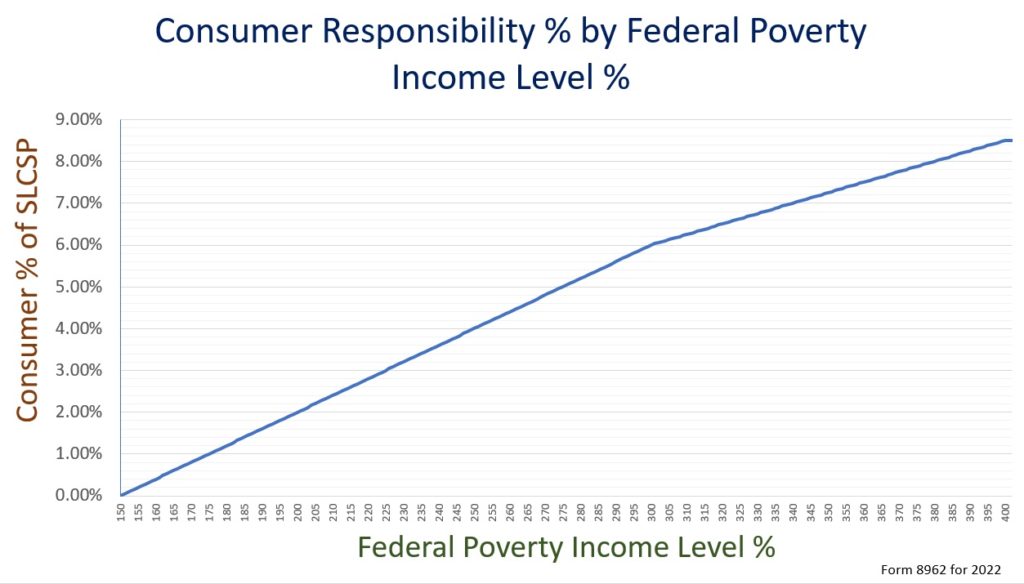

For household incomes below 150 percent of the federal poverty level (FPL), the consumer responsibility for the second lowest cost Silver plan (SLCSP) is 0%. In other words, the subsidy offered to the consumer will equal the cost of the SLCSP. The consumer responsibility for health insurance gradually increases as a percentage of the household income until the income equals 400 percent of the FPL. Household income over 400 percent of the FPL will have a consumer responsibility of no more than 8.5 percent of the SLCSP. This means a household whose income is 700 percent of the FPL could receive a subsidy to make the SLCSP no more than 8.5 percent of their annual Modified Adjusted Gross Income.

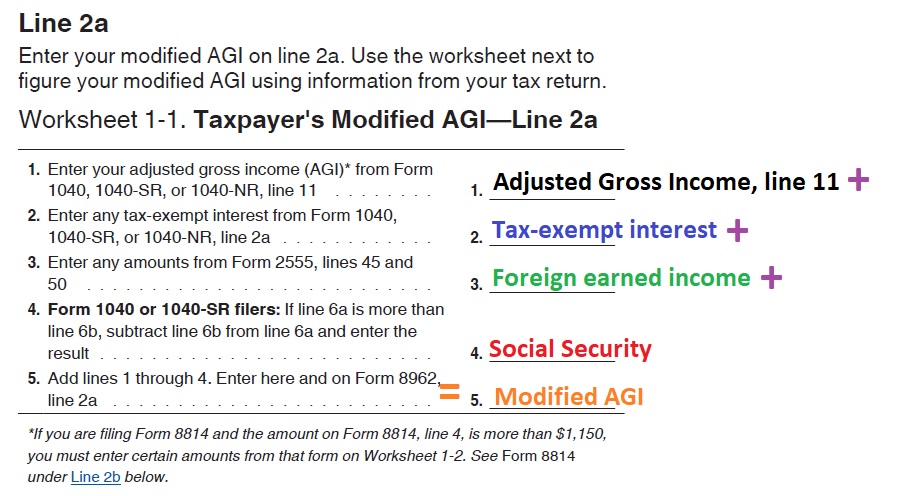

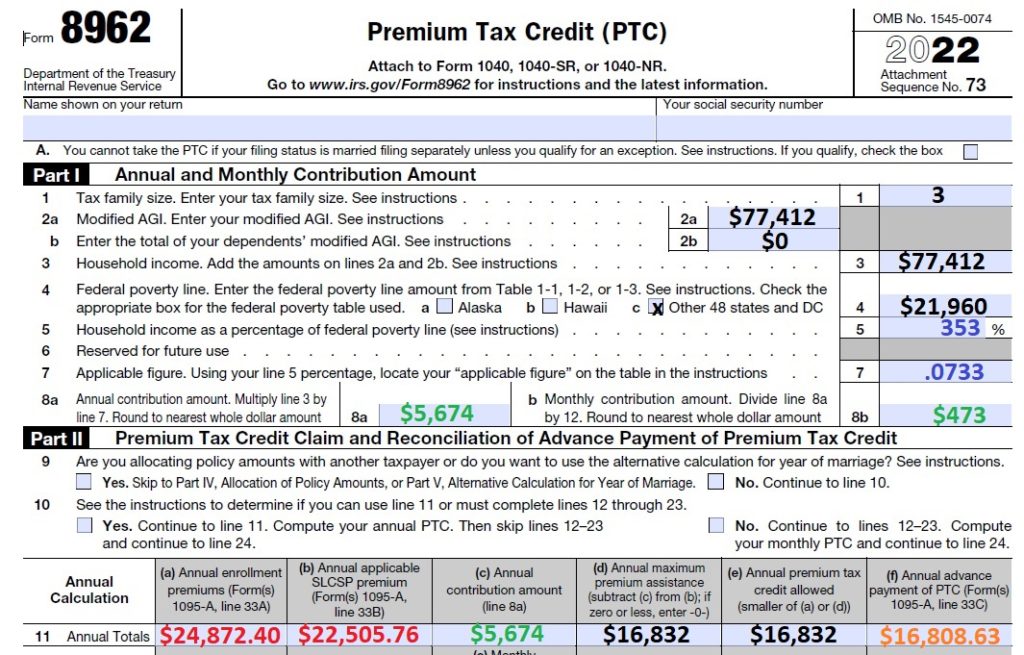

The household Modified Adjusted Gross Income (MAGI), as outlined on form 8962, is the AGI from line 11 of the 1040 plus tax-exempt interest plus foreign earned income plus Social Security benefits. This includes the income from the primary tax applicant, their spouse, and income from a tax dependent who must file a federal income tax return because they owe income tax.

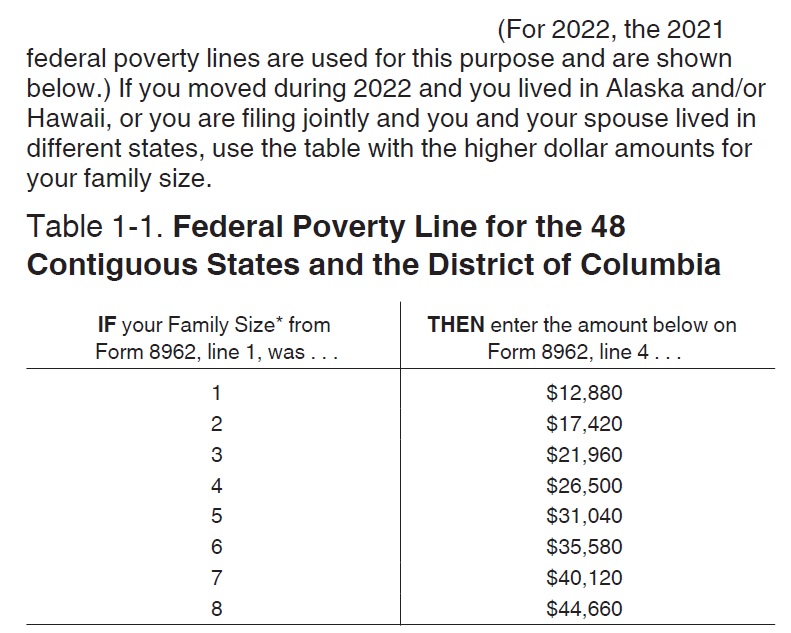

To illustrate how the subsidy reconciliation works, let’s take a household of 3 adults. The final MAGI, as computed by the dollar amounts from the 1040 tax return, is $77,412.84. That corresponds to 353 percent of the FPL ($77,413 divided by $21,960.)

The 353% MAGI intersects the subsidy curve at 7.33% consumer responsibility. When the family applied for the health insurance subsidy through Covered California, a monthly subsidy was determined that would make the annual cost of the SLCSP no more than 7.33 percent of the estimated household income.

Additional Tax Credit or Repayment, Form 8962

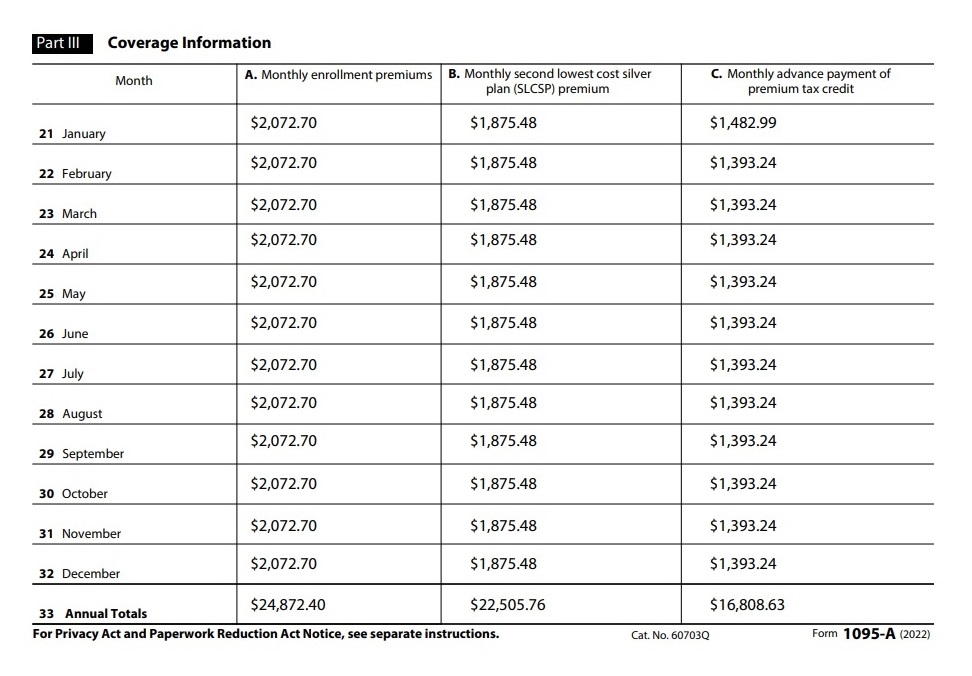

The monthly subsidy advanced to the health plan to lower the family’s health insurance is reported on tax form 1095A. This family had the same health plan for the entire year and did not adjust their income during the year. Consequently, all of the dollar amounts are the same for all 12 months of enrollment.

The household MAGI, along with the 1095A data, is transferred to form 8962 part 1 and II. Part I of form 8962 captures the how the family income intersects with the subsidy curve to yield a 7.33 percent consumer responsibility and determines that the household should have spent no more than $5,674 on health insurance (line 8a) for the year for the SLCSP.

Part II of form 8962 summarizes the annual dollars amounts for the health insurance and the subsidy from form 1095A. Note that column 11e limits the household subsidy amount. If the family enrolled in a Bronze plan, that was substantially less expensive than the SLCSP, and less than the maximum qualifying subsidy, the primary tax filer can only claim a subsidy equal to the lower Bronze health insurance premiums.

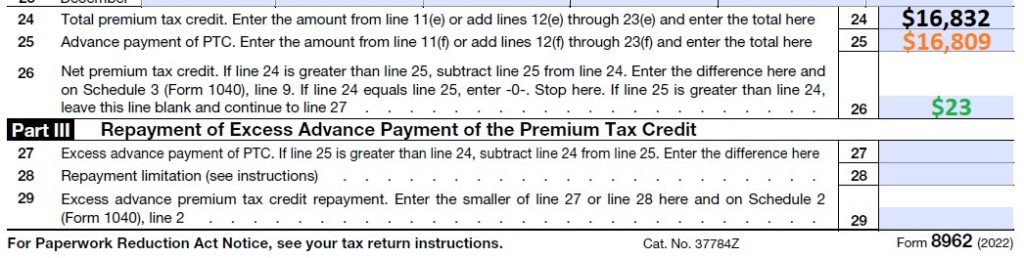

Lines 24 through 26 of Part II of form 8962 determine if the household is eligible for an additional Premium Tax Credit. In this situation, the final household MAGI was slightly lower than estimated income amount of the Covered California application. The result is that the household is eligible for an additional $23 in Premium Tax Credit. They were eligible for an annual subsidy of $16,832, but only received $16,809.

Excess Subsidy Repayment Limitation

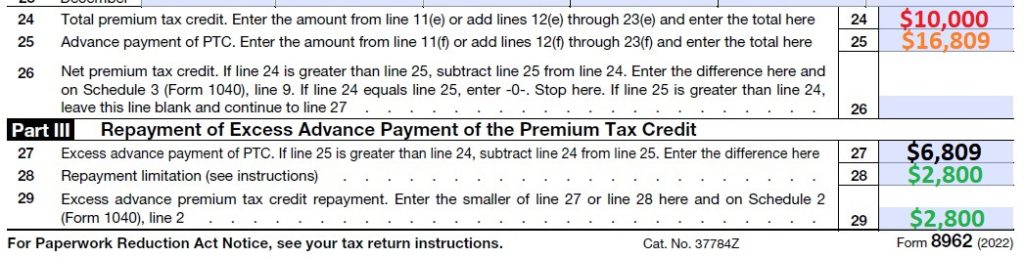

However, it could have been the situation that the household has a higher MAGI than they estimated. In this hypothetical scenario, the family was only eligible for $10,000 in Premium Tax Credits, but received $16,809. The family received $6,809 in excess Premium Tax Credits to lower their health insurance.

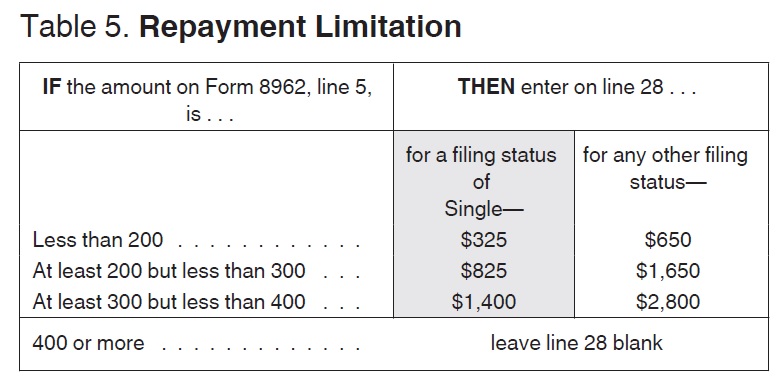

Fortunately, for this family, their final MAGI is under 400 percent of the FPL. This means they will have to repay only $2,800 of the excess subsidy. If the income had been over 400 percent of the FPL, they would have to repay all of the excess subsidy.

Instructions 8962

The instructions for form 8962 also answer some frequently asked questions about employer-sponsored COBRA health insurance, eligibility for the subsidy when an individual might have been Medicaid (Medi-Cal) eligible, and if the final MAGI is below 100% FPL and not eligible for any Premium Tax Credit.

COBRA Employer Insurance Offer

Waiting periods and post-employment coverage.

If you cannot get benefits under an employer-sponsored plan until after a waiting period has expired, you are not treated as eligible for that coverage during the waiting period. Also, if you leave your employment and are offered post-employment coverage such as COBRA or retiree coverage, you are not considered eligible for that post-employment coverage unless you actually enroll in the coverage. See Coverage after employment ends under Employer-Sponsored Plans in Pub. 974 for more information.

Medicaid and CHIP.

You are generally considered eligible for coverage under a government-sponsored program for a month if you met the eligibility criteria for that month, even if you did not enroll. However, if a Marketplace made a determination that you or a family member was ineligible for Medicaid or CHIP and was eligible for APTC when the individual enrolls in a qualified health plan, the individual is treated as not eligible for Medicaid or CHIP for purposes of the PTC for the duration of the period of coverage under the qualified health plan (generally, the rest of the plan year), even if your actual 2022 income suggests that the individual may have been eligible for Medicaid or CHIP.

Household income below 100% of the federal poverty line.

Estimated household income at least 100% of the federal poverty line. You may qualify for the PTC if your household income is less than 100% of the federal poverty line and you meet all of the following requirements.

• No one can claim you as a dependent for the year.

• You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

• The Marketplace estimated at the time of enrollment that your household income would be at least 100% of the federal poverty line for your family size for 2022.

• APTC was paid for the coverage of one or more months during 2022.

• You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).