2017 Tax Cut and Jobs Bill will change the estimated income for Covered California consumers.

Under the 2017 Tax Cut and Jobs Bill, signed into law in 2017, changes to the tax code regarding taxable income and deductions could impact individuals and families who have estimated their income for the ACA Covered California tax credits for 2018 based on 2017 tax rules. Most consumers estimated their Modified Adjusted Gross Income (MAGI) for their Covered California 2018 monthly tax credit based on 2017 taxable income. For most households they should be fine with this estimate. But there are some many families who may find that because of the new tax regulations that they have over or under estimated their 2018.

Disclaimer: I am not a tax attorney, CPA or enrolled agent. I am not giving any tax advice. I am simply pointing that the 2017 Tax Cut and Jobs Bill changes the way some tax payers should estimate their 2018 income for the purposes of receiving the Advance Premium Tax Credit through Covered California or Healthcare.gov.

Modest Changes In 2017 Tax Cut Bill For Estimated Income

The good news is that many of the proposed provisions of the 2017 tax bill that could severely impact families receiving the monthly tax credits seem to have been dropped or delayed. These were changes in the House of Representative’s tax bill that directly affected the Adjusted Gross Income (AGI) of the tax payer, also referred to as ‘above the line’ adjustments.

Perhaps one of the biggest proposed changes was that alimony would no longer be deductible to a tax payer’s AGI. This would have increased the MAGI for the payor and lowered it for the former spouse receiving the alimony. Under the compromise bill between the House and the Senate the alimony deduction has been delayed until 2019.

Changes to Alimony Deduction and Income

(Sec. 1309) This section repeals the deduction for alimony or separate maintenance payments from the payer spouse and the corresponding inclusion of the payments in the gross income the recipient spouse.

The conference agreement generally follows the House bill. However, the conference agreement delays the effective date of the provision by one year. Thus, the conference agreement is effective for any divorce or separation instrument executed after December 31, 2018, or for any divorce or separation instrument executed on or before December 31, 2018, and modified after that date, if the modification expressly provides that the amendments made by this section apply to such modification.

https://www.congress.gov/bill/115th-congress/house-bill/1/summary/17?

This delay has some couples, oddly enough, considering divorce in 2018 before the repeal of the alimony deduction. Trump’s tax bill will make 2018 a wild year for divorce

If Covered California and the ACA still exists in 2019, and the alimony deduction repeal is still law, individuals and families receiving the monthly tax credits based on either paying alimony or receiving it will have to change their estimated income.

Other changes such as the ability to deduct student loan interest, moving expenses, educator expenses, and expenses associated for performing artists were either deleted or delayed until 2025.

Lower Withholding Taxes

Many employees will begin to see increases in their paychecks to reflect the new law in February. The time it will take for employees to see the changes in their paychecks will vary depending on how quickly the new tables are implemented by their employers and how often they are paid — generally weekly, biweekly or monthly.

The Internal Revenue Service released Notice 1036, which updates the income-tax withholding tables for 2018 reflecting changes made by the tax reform legislation enacted last month. This is the first in a series of steps that IRS will take to help improve the accuracy of withholding following major changes made by the new tax law.

The lower withholding taxes and larger paycheck do not necessarily mean an increase in gross income. It just means few tax dollars are being withheld because of lower tax brackets.

Sole Proprietors and Small Business Income

However, there are many changes to business income and expenses that may affect individuals who file a schedule C, D, or E. The calculation of the taxable income from these schedules feeds into the AGI on the first page of the federal 1040 form.

- Certain entertainment expenses are no longer deductible.

- Some parking and commuting expenses are no longer deductible

- Changes to the Net Operation Loss carryover provisions

- Changes to the sale of stock for calculating your gain or loss

- Changes to first year depreciation of a new asset which is now accelerated

- Ability to deduct 20% of taxable income on schedule C for some small businesses under certain conditions

The changes to business income are complex and your specific situation should be reviewed by your tax preparer or CPA. Some of the changes will reduce the household MAGI and others may increase it.

There are two scenarios that exist because of the new tax laws for households receiving the monthly tax credit subsidy through Covered California or Healthcare.gov.

Scenario 1

The tax payer has over estimated their income when the new tax rules are applied in 2018.

- This means they may be eligible for additional tax credits on their tax return because they were entitled to a larger Premium Tax Credit because of the lower MAGI.

- A lower MAGI means they may have been entitled to an Enhanced Silver Plan with reduced member cost sharing such as a lower deductible, copayments, and coinsurance.

- The new income could be so low that they no longer qualify for the Premium Tax Credits and should have been on Medicaid or Medi-Cal.

Scenario 2

The family has under estimated their income on the Covered California application. This could occur because some deductions, that the consumer may have taken to lower their MAGI, are no longer available under the new tax law.

- If the MAGI is actually higher, but still under 400% of the federal poverty level, the tax payer may have to repay a portion of the Advance Premium Tax Credit back to the IRS.

- If the MAGI is over 400% of the federal poverty level, the tax payer must repay ALL of the monthly tax credits they received during the year.

What is Modified Adjusted Gross Income?

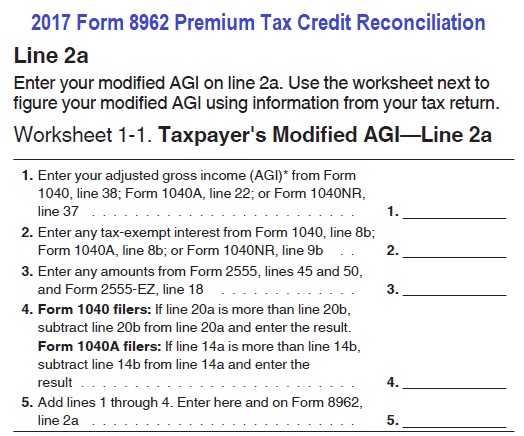

The Adjusted Gross Income reported on line 37 of federal tax form 1040 (2017)….

Plus: non-taxes Social Security retirement income, Social Security Disability Income, tax-exempt interest, foreign earned income, and sometimes State Disability Insurance payments if they are in lieu of unemployment compensation.

Calculation of the Modified Adjusted Gross Income from IRS form 8962 instructions.

If you own a small business or receive income for a service you provide, and most likely file a schedule C with your tax return, you should consider having your estimated taxable income reviewed by your tax planner. The IRS has noted that as they develop guidance for all of the changes to the tax regulations for 2018 they will be posting them on their website.

Assistance and research for this blog post has been kindly provided by Solved Tax and Accounting and Bruce Bialosky.

Countable Sources of Income For Covered California