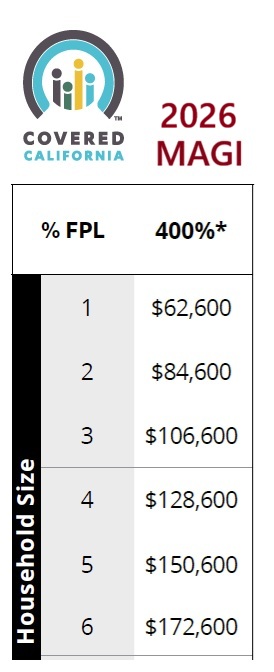

For 2026, individuals and families who earn more than 400 percent of the federal poverty level are ineligible for the ACA Premium Tax Credit subsidy for health insurance. When the individual or family calculates their 2026 federal tax return, if the income is over 400 percent FPL, they must repay all the subsidy they received during the year.

Income Cliff Triggers 100% Repayment

Unlike past years, Congress repealed the IRS repayment limitation for 2026. This means being $1 over the limit will trigger the repayment of ALL health insurance subsidies during the year.

For a single adult, if the final Modified Adjusted Gross Income on their 2026 tax return is over $62,600, they must repay all the subsidies they received. As the household size increases, so does the MAGI limit of 400 percent FPL. It doesn’t make a difference if the household is all adults or one adult and three dependents, the same dollar amount applies.

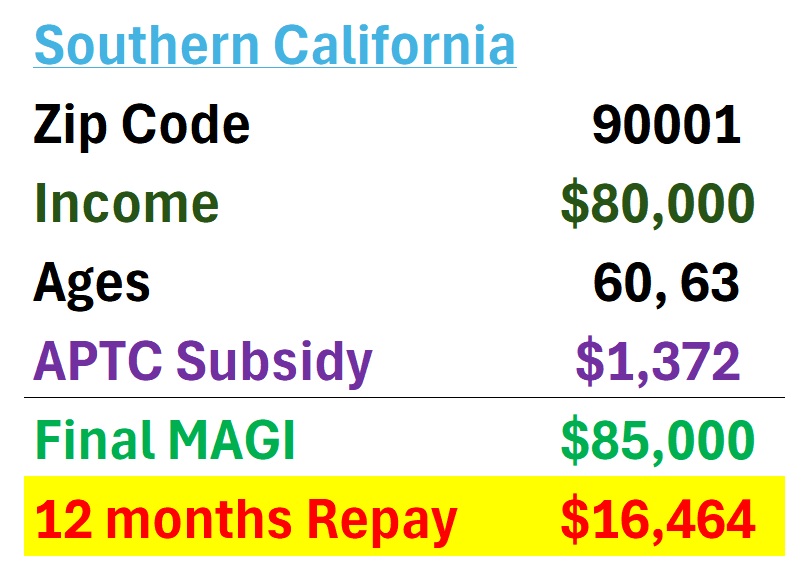

In this example, a couple, ages 60 and 63, estimated their Covered California income at $80,000 for 2026. They receive $1,372 per month to lower their health insurance premiums. When they calculate their 2026 income tax return, if their income is $85,000, they must repay $16,464 ($1,372 x 12 months) back to the IRS.

The repayment is worse if you live in Northern California. This couple, ages 60 and 63, estimated the same $80,000 on their Covered California application. They receive $3,040 a month in a health insurance subsidy. Their final MAGI, like the Southern California couple, is $85,000 triggering a repayment of $36,480 to the IRS.

What Makes Up The MAGI?

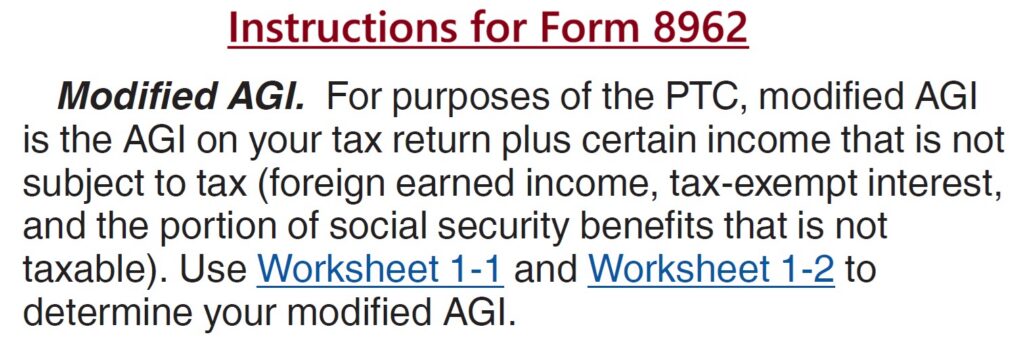

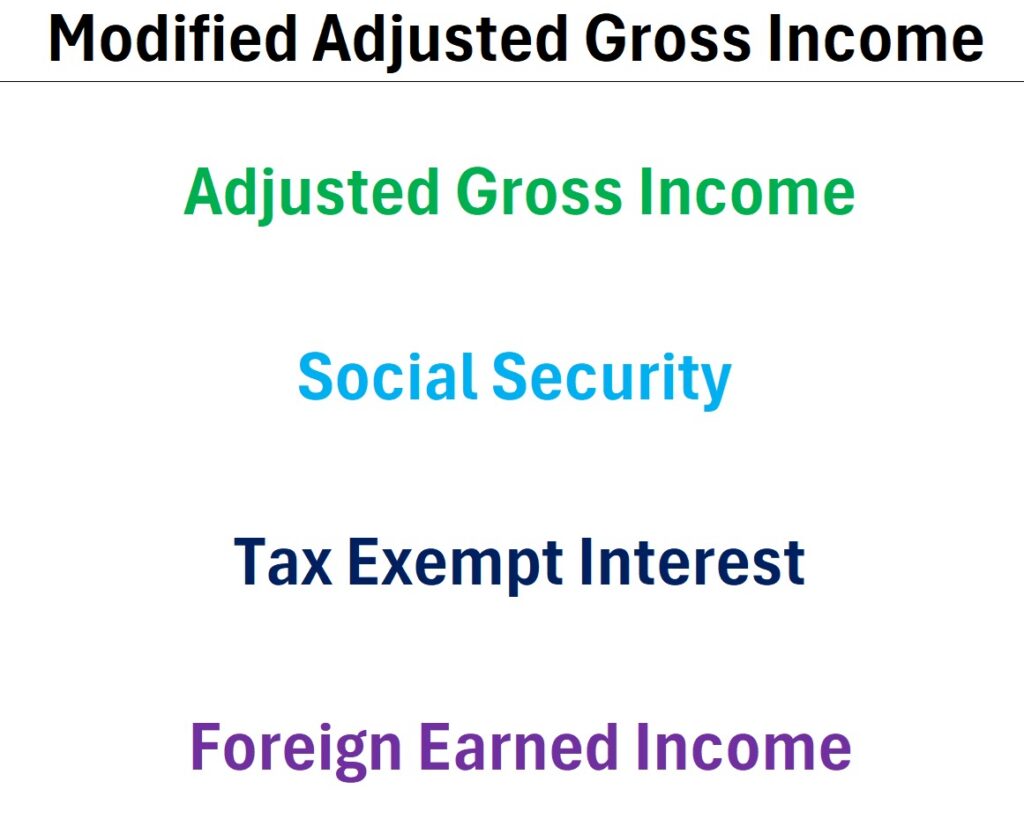

The Advance Premium Tax Credit subsidy for health insurance is calculated using the household’s Modified Adjusted Gross Income (MAGI). The MAGI is the adjusted gross income plus Social Security plus tax exempt interest plus foreign earned income.

The specific definition of the MAGI is found in the instructions for IRS form 8962. You use form 8962 to reconcile the subsidies you received with your final MAGI on your federal tax return.

The adjusted gross income, line 11 of the first page of the 1040, is an aggregation of various forms of income from different schedules. Some of the income includes wages, self-employment, rents, capital gains, interest, dividends, unemployment compensation, IRA, pensions, prizes and award.

Surprise Income that Triggers Repayment

The two categories that have triggered subsidy repayments in the past are capital gains and prizes. These are unexpected forms of income that are hard to control or suppress. Some families have delayed to sale of assets to keep their income under the 400 percent threshold. However, if you or your spouse starts job in the middle of year that may also trigger the repayment of the subsidies as your income may be higher than you anticipated at the beginning of the year.

Social Security retirement benefits are included in the MAGI. This includes taxed and untaxed Social Security benefits. You need to be careful if you or your spouse decides to begin collecting Social Security benefits as the total amount may put your household over 400 percent of the federal poverty level.

Similarly, Social Security Disability benefits are added to the MAGI. What surprises people is that they may receive a lump sum check for previous months of disability payments from when the disability application was first file. This lump sum benefit covering several months can push the household income over 400 percent.

Change of Household Size

Finally, a change in household size may trip you up. For example, you enter Covered California as a household of three at an income of $100,000. Your young adult dependent, away at college, isn’t even on your health plan. If your child graduates, gets a job, and can’t be claimed as a dependent, you are now a household of two. If your MAGI comes in at $100,000, you will have to repay all the subsidies because it is over the $84,600 cap for a household of two.

YouTube video on 400% FPL Income Cliff