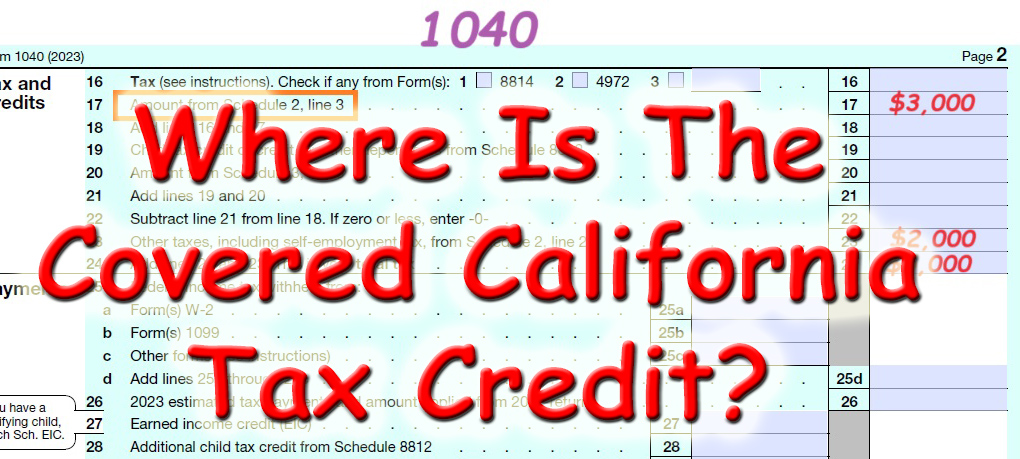

If you have someone prepare your federal tax return, it can be difficult to track the Covered California Premium Tax Credit health insurance subsidy. It is not readily apparent if you received additional Premium Tax Credit or if you had to repay excess subsidy. There is no specific reference on form 1040 to the health insurance Premium Tax Credit.

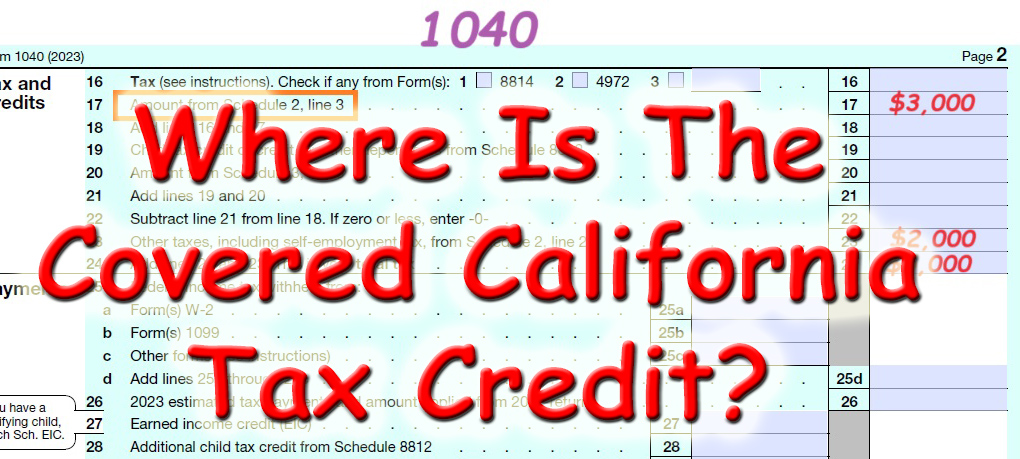

Flow Chart of Covered California Refund or Repayment

The Covered California health insurance subsidies are reconciled on your federal income tax return. If you made more money than you estimated to Covered California, then you must repay some excess subsidy. If your income was lower than the estimate, you will usually get an additional tax credit. However, the dollar amounts, credit refund or additional tax, are directed to different IRS tax forms. Eventually, the credit or tax shows up on the 1040.

Reconciliation of the health insurance subsidy Premium Tax Credit begins on form 8962. Below is an outline of how either a Premium Tax Credit refund or tax flows through the different IRS forms.

Tracking Refundable Tax Credit

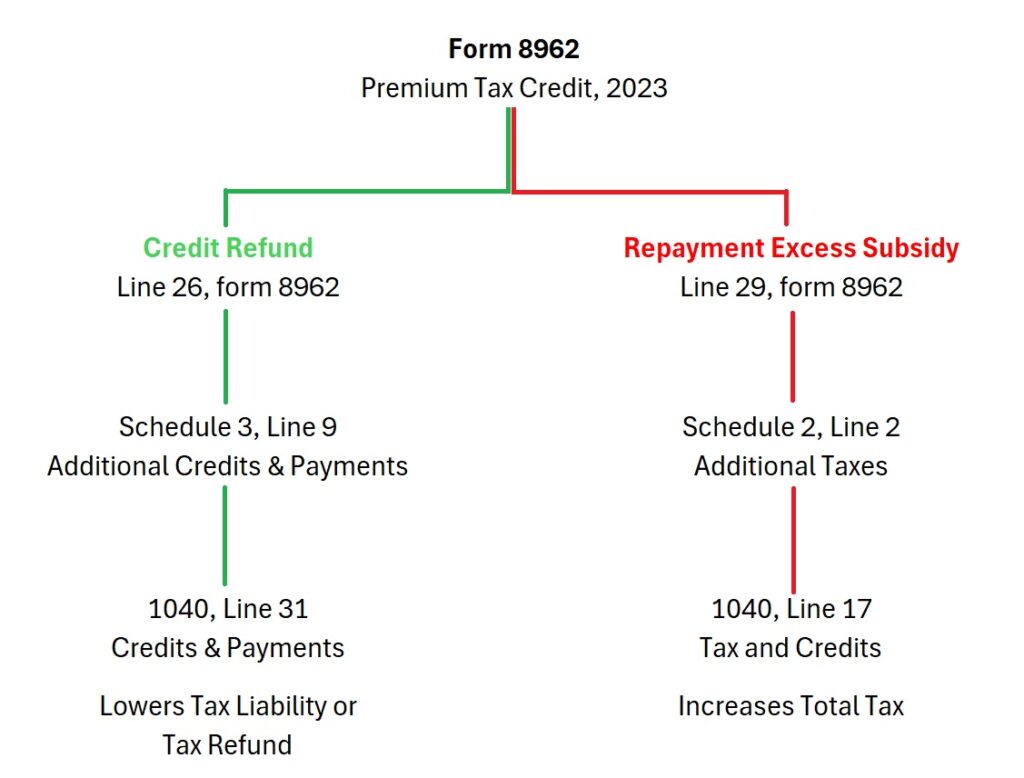

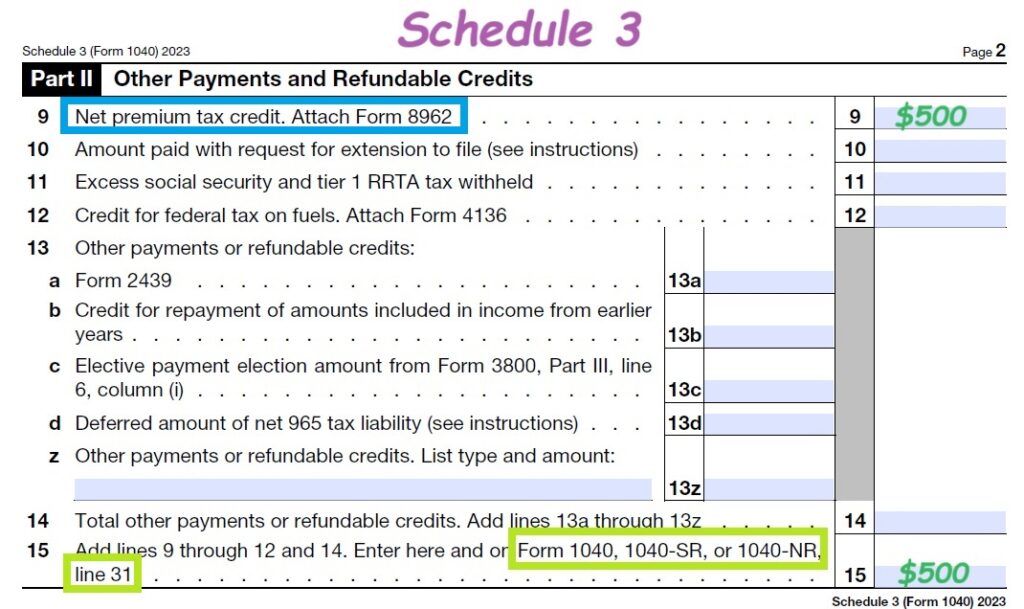

If your total Modified Adjusted Gross Income is lower than the income estimated on your Covered California application, you will usually receive an additional refundable tax credit. In this example, the household received a total of $11,000 in Advance Premium Tax Credits during the year to lower their health insurance premium. The family, based on their income, was eligible for a Premium Tax Credit of $11,500. The taxpayer can claim a $500 tax credit. The tax credit is then entered on Schedule 3, line 9.

Schedule 3 gathers additional credits and payments of the taxpayer. In this case, the taxpayer only has the $500 additional Premium Tax Credit to report and that goes on line 31 of form 1040.

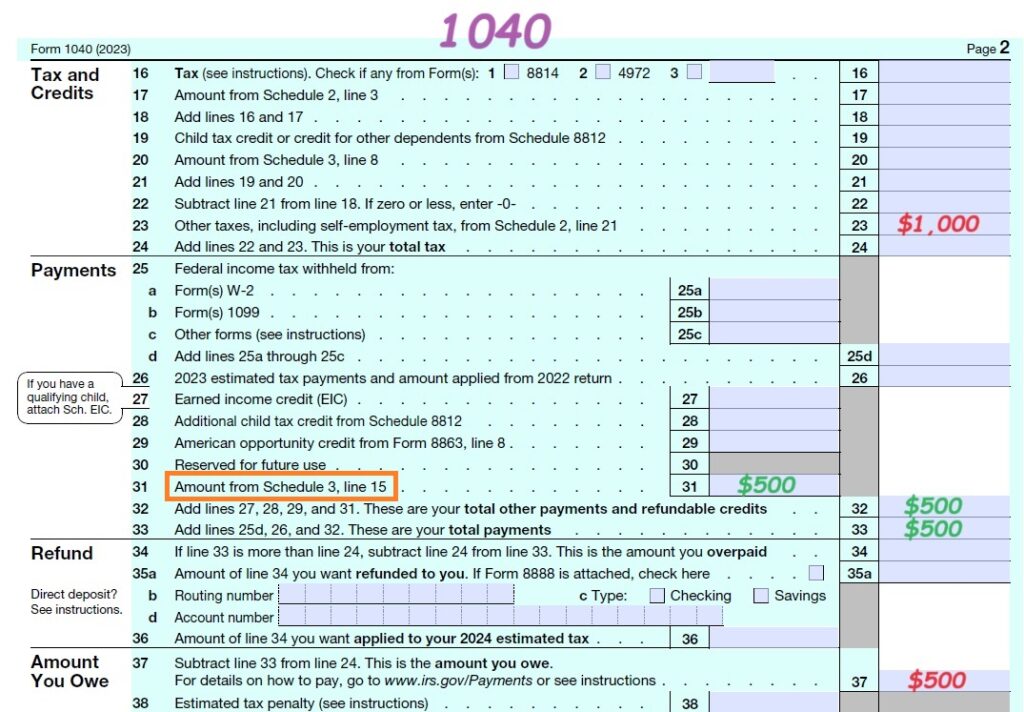

Line 31 shows the $500 credit. For this taxpayer, who is self-employed and runs a small business, they owe $1,000 in self-employment tax. The $500 additional Premium Tax Credit lowers the federal income tax liability from $1,000 down to $500. From glancing at the 1040, it is not readily apparent that the health insurance subsidy reduces the tax liability because line 31 does not specifically state the Covered California Affordable Care Act health insurance Premium Tax Credit.

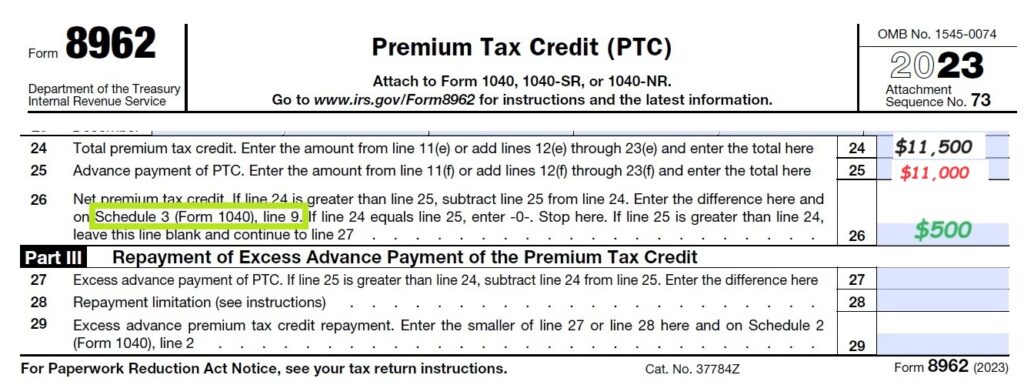

Tracking Repayment of Excess Subsidy

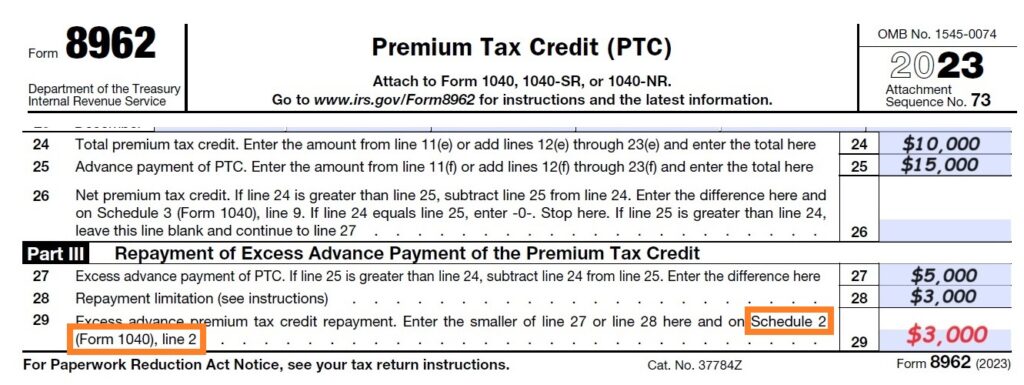

If your final income is higher than the Covered California estimate, you may have to repay excess Premium Tax Credit subsidy you received during the year. In this example, form 8962 calculates the household is eligible for an annual $10,000 Premium Tax Credit subsidy. Unfortunately, they underestimated their income and received $15,000 in subsidy. They received $5,000 too much subsidy, line 27. Fortunately, the household income was under 400 percent of the federal poverty level, so their repayment of the excess subsidy is limited to $3,000 for 2023. The $3,000 repayment is then entered on line 2 of Schedule 2.

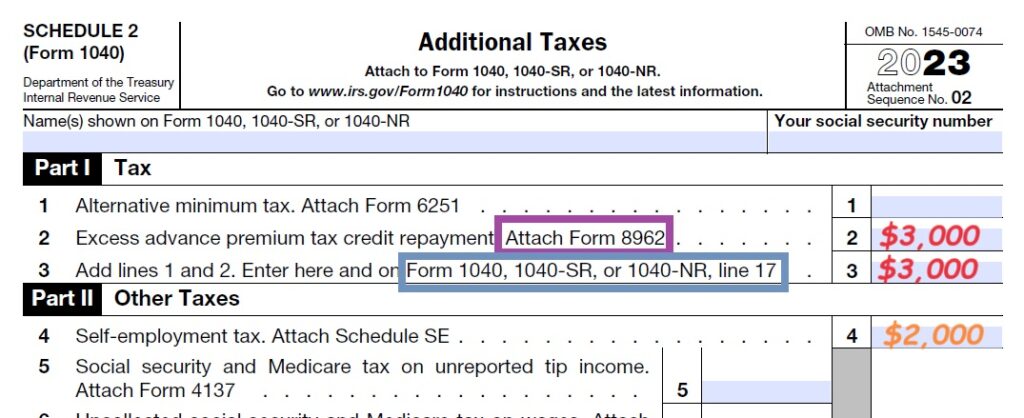

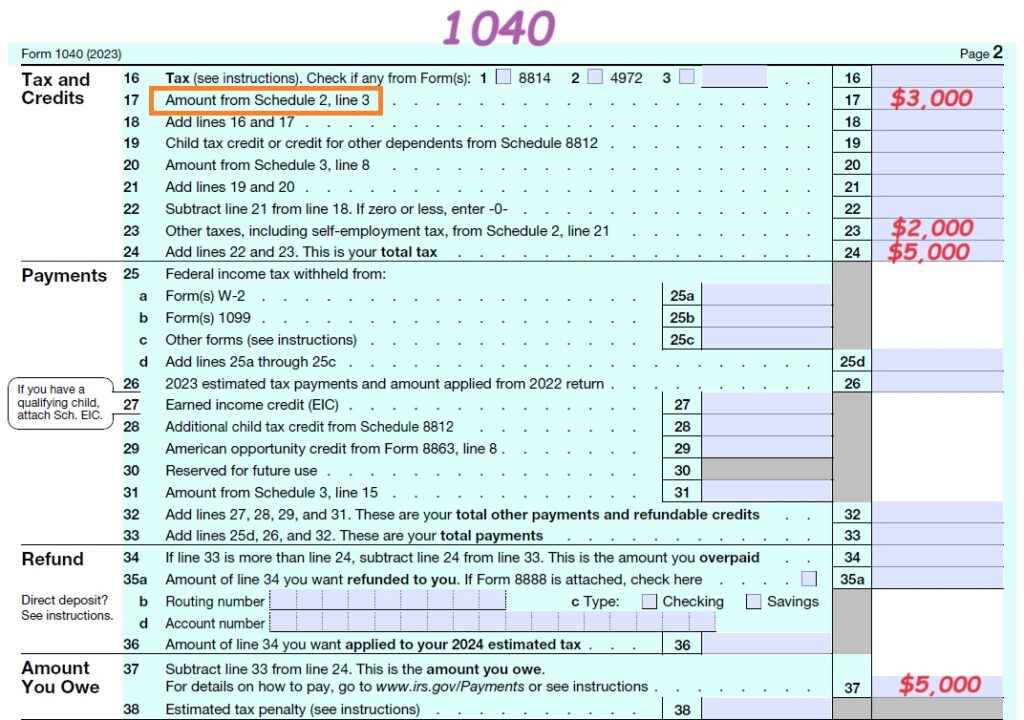

Schedule 2 captures additional taxes of the taxpayer. The repayment of the excess subsidy is entered on line 2. This taxpayer is also self-employed and must pay $2,000 in self-employment tax, line 4.

The additional taxes from Schedule 2 move over to form 1040. On line 17, the $3,000 subsidy repayment is entered. The self-employment tax is entered on line 23. When line 17 and 23 are added together, the taxpayer has tax liability of $5,000.

Some people have assumed that the tax they owe on their federal tax return is solely attributable to repaying the Covered California subsidies. This assumption may not be correct. There are times when the taxpayer receives a tax credit refund that lowers their tax liability. In other situations, the total tax liability may not be all from the Covered California subsidies. This is the situation for many self-employed individuals who may not make quarterly estimated tax payments and have a large self-employment tax when they do their taxes for the year.