Health insurance is has gotten so expensive that many people with modest incomes may qualify for an exemption from the Shared Responsibility Payment on their federal 1040 tax return.

Under the provisions of the Affordable Care Act, if the cost of the least expensive Bronze plan is greater than 8.13% of the household income, then the individual or family can apply for an exemption from the requirement to have health insurance. With the exceedingly high health insurance rates in Northern California, individuals making $50,000 per year find health insurance unaffordable before they turn 40 years old.

For 2017, the highest income and individual can earn and still qualify for the monthly Advance Premium Tax Credits to lower the health insurance premium is $47,520. This is 400% of the federal poverty level as defined by the ACA for the subsidies. An individual making $50,000 under the Modified Adjusted Gross Income definition is ineligible for any assistance to help pay for health insurance. The whole point of the ACA is to ensure that individuals and families pay no more than 9.66% of their household income toward health insurance. This percentage can be as low as 3% for low income earners.

High Health Insurance Rates Trigger Exemption From Individual Mandate

The only help for people whose income is too high to be eligible for monthly subsidy and avoid a penalty is an exemption from having health insurance. The IRS will assess a Shared Responsibility Payment (aka individual mandate) on all tax payers and dependents who do not have minimum essential health insurance coverage. The Shared Responsibility Payment could be as high as 2.5% percent of the household income capped at no more than the annual cost of the least expensive Bronze plan. But for a person earning $50,000, based in 2016 IRS forms, the Shared Responsibility could be as low as $695 or as high as $1,250.

In reality, the Shared Responsibility Payment is small potatoes compared to the cost of health insurance. A penalty of $1,250 is cheap compared to spending $8,000 to $10,000 per year on health insurance. The penalty can be waived if the tax payer receives a hardship exemption from the federal government. This entails filling out some forms to show that the least expensive Bronze plan will cost more than 8.13% of your projected income. For an individual earning $50,000 per year, depending on where the person lives, the health insurance costs may exceed the percentage or hardship as early as age 32.

With the passage of the 2017 tax legislation, the individual mandate will no longer be in effect for 2019, unless congress changes the requirement again before 2019.

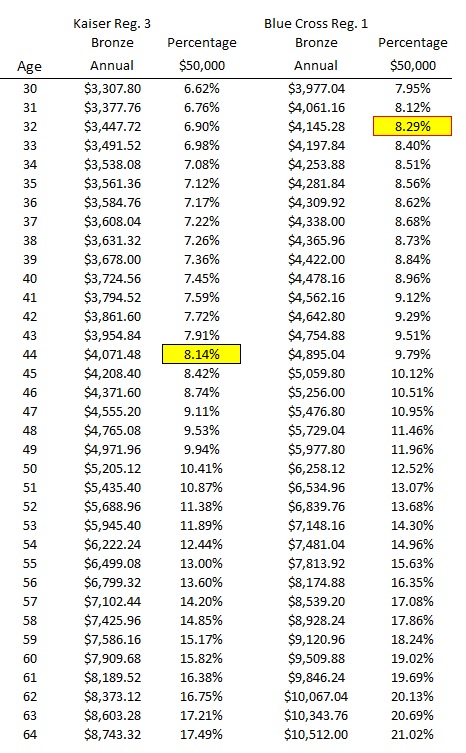

The real story is that rates, especially for older people, have risen so much in the individual and family market that health insurance under the IRS definition of being unaffordable can happen at a very young age. Below are examples of the least expensive Bronze plan rates in Region 1 and Region 3. Within a thirty minute drive between Auburn (Region 3) and Grass Valley (Region 1) in Northern California the rates can be sharply higher.

Comparison of the least expensive Bronze plan in Region 1 and 3, and at what age the health insurance rate becomes unaffordable based on IRS 8.13% for 2016.

Because rates between health plans may be very close, one carrier may not always be the lowest rate at any specific age. Kaiser may be the least expensive for age 33, but a different carrier may be less expensive for age 32.

A single individual with a Modified Adjusted Gross Income of $50,000 finds health insurance unaffordable at age 44 in Region 3. In Region 1, the health insurance becomes unaffordable at age 32.

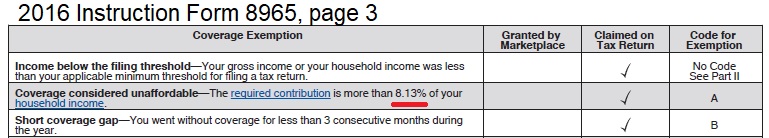

If the required contribution for health insurance exceeds 8.13% for the least expensive Bronze plan, an individual may apply for an exemption from the individual mandate.

Page 9 of the 2016 Instructions for Form 8965 Health Coverage Exemptions states,

Determining an individual’s required contribution—

Individuals not eligible for coverage under an employer plan. If you or another member of your tax household can’t purchase coverage under an employer plan, the individual’s required contribution is based on the premium for the lowest cost bronze plan available through the Marketplace minus the maximum premium tax credit that you could have claimed if the individuals had enrolled in this plan.

For this purpose, use the lowest cost bronze plan available through the Marketplace that covers everyone in your tax household:

For whom a personal exemption deduction is claimed on your tax return,

Who isn’t eligible for employer coverage, and

Who doesn’t qualify for another coverage exemption.

Always refer to the latest IRS publication for the specific tax year for the most accurate information.

To be eligible for the exemption, the tax payer must file for an exemption from the federal government. They will then issue a certificate confirming the health insurance is unaffordable and the tax payer is not subject to the individual mandate or Shared Responsibility Payment on their federal tax return.

hardship_exemption_form

Federal form requesting an exemption from the individual mandate or Shared Responsibility Payment for health insurance.