New 2016 California pharmacy benefits help cap prescription drug costs.

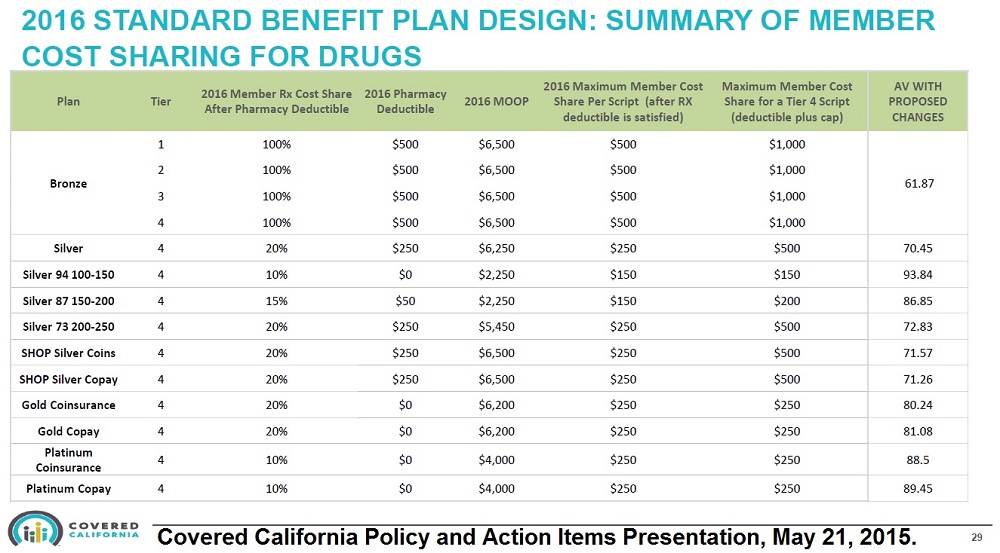

Individual and family plans offered through Covered California in 2016 will include new pharmacy prescription drug benefits. The benefit, also mirrored in many off-exchange health plans, caps the amount a consumer must pay every month for a particular prescription. While that sounds straight forward, the rules surrounding any pharmacy deductible and tiered drug formulary can be complicated and confusing.

Prescription drug formulary

First, we have to understand what a drug formulary is and how it works. Every health plan must have a list of prescription medications that it will cover. It does not have to include every drug made and available in the United States. Generally, it must include at least two drugs that treat the same medical condition such as high cholesterol or high blood pressure.

List of prescription drugs

This drug list is also known as the drug formulary and is usually available online or in print form from the health plan or insurance company. If you down load the formulary make sure it is for your specific health plan. Health insurance companies can have a variety of different drug formularies. They might have one for individual and family plans, small group plans, large employer plans and Medicare Advantage plans. Some drugs covered in one formulary may not be covered in another formulary or they may be at a different tier level. Hence, it is important to know you have correct drug list. Plus, the health plans can make changes to the formulary during the year, adding or dropping medications.

The drug formulary is broken up into tier levels. Most individual and family plans have four tiers.

- Tier 1: Most generic drugs or low cost-cost drugs.

- Tier 2: Preferred brand name drugs

- Tier 3: Non-preferred brand name drugs

- Tier 4: Specialty and high cost drugs

Copayments and coinsurance

Many health plans will have a set copayment amount the member must pay for each prescription drug in each drug tier. Sometimes a pharmacy deductible must be met before the member receives the set copayment benefit. For example, the copayment amounts for a Silver 70 plan after the $250 deductible is met will be Tier 1 – $15, Tier 2 – $50, Tier 3 – $70, Tier 4 – 20% coinsurance, for each drug for a 30-day supply.

$ Copayments are set a dollar amount for a medical service or prescription.

% Coinsurance is a set percentage of the negotiated cost for medical service or prescription.

The prescription must be filled through an in-network health plan pharmacy and a lower price, if offered by the pharmacy, will be honored. It’s important to fill prescription using the health plans membership identification in order for the cost of the drugs to accrue to meeting any pharmacy deductible, cost cap, and maximum out-of-pocket annual amount.

Pharmacy deductibles

The pharmacy deductible of the health plan, if there is one, must be met before the member goes into any prescription drug coinsurance, copay or cost cap mode. (Prescription drug copayments and cost caps don’t apply to Health Savings Accounts.) Once a deductible is met, it is satisfied for the remaining amount of the calendar year and any coinsurance, copayments or cost caps would then be applied to all prescriptions.

Always check with your health plan’s Member Agreement, Evidence of Coverage, and drug formulary for specific details on the pharmacy benefits and exclusions. The following information only applies to California individual and family plans.

Bronze plan pharmacy benefits

Previously, Bronze plans had a combined medical and pharmacy deductible. In other words, the member first had to meet the combined deductible of $5,000 ($4,500 for H.S.A. plans), before there was any prescription drug coinsurance coverage. In 2016 Bronze plans will include a $500 pharmacy deductible (excluding H.S.A. plans) that is separate from the medical deductible. Once the Bronze plan member spends $500 dollars on prescription drugs through their health plan they will now go into 30% coinsurance.

Unlike the Silver, Gold, and Platinum plans, the Bronze plans don’t include any specific drug Tier copayments. After the deductible is met the member will pay 30% coinsurance per prescription. Because there are no set copayments, Bronze plans will include a $500 cap per prescription in each drug Tier for a 30-day supply. The $500 cap doesn’t apply to H.S.A. plans.

Silver plans pharmacy benefits

Silver 70 plans have a $250 pharmacy deductible before the set copayments for Tiers 1, 2, and 3 or 20% coinsurance for Tier 4 drugs are triggered. Enhanced Silver 87 and 94 plans have a reduced pharmacy deductible and coinsurance. The new prescription drug cost cap applies to only Tier 4 drugs for Silver plans. The cost cap for Enhanced Silver 87 and 94 plans Tier 4 drugs is $150. Enhanced Silver 73 and Silver 70 plans will have a $250 cost cap for Tier 4 drugs per prescription for a 30-day supply. Before the cost cap is triggered for the Tier 4 drugs the applicable coinsurance must be met.

For example, a family has a Silver 70 health plan and they have already met the individual or family pharmacy deductible. If 20% coinsurance for a Tier 4 prescription equals $249, the drug cost cap is not triggered because it is under $250. If the 20% coinsurance for a 30-day supply of medication equals $251, the member will only pay $250. Even if the 20% equals $1,000, the member will only pay $250 for the drug.

Gold and Platinum plan pharmacy benefits

Like the Silver plans, Gold and Platinum have set copayments for drug Tiers 1, 2, 3 and coinsurance for Tier 4. The cost cap per prescription of Tier 4 drugs is set at $250 after hitting the coinsurance. If a Tier 4 drug has a price of $1,500 for a 30-day supply the 20% coinsurance would be $300. Under the new pharmacy benefit for 2016 Silver 70 and Gold plan members will have that medication capped at $250. Platinum plans have a 10% coinsurance for Tier 4 drugs so the $1,500 drug would only cost the member $150.

“The Price of Prescription Drugs” on Health Perch