Many self-employed gig workers received unemployment benefits while also receiving the ACA health insurance subsidies. The Covid-19 pandemic unemployment benefits, which are taxable income, may push many individuals and families into the income zone where they have to repay health insurance subsidies on their federal or state tax return.

Estimated reading time: 4 minutes

Taxable Unemployment And No Business Expenses

Individuals and families who receive health insurance subsidies through a market place exchange such as Healthcare.gov or Covered California agree to report a change of income within 30 days. For many self-employed gig workers, the unemployment benefits replaced their lost income stream. What was also lost were the expenses associated with running their business. This can translate into a higher taxable income.

For example, an individual runs a small business as a caterer for in-home events. Normally, the caterer would have all sorts of costs associated with organizing an event such as the cost of the food, rental of chairs and canopies, along with vehicle expenses. All of these costs are deducted from the gross revenue of the event for a net taxable income amount.

Unfortunately, many of us don’t fully factor in the costs of doing business when we think of our monthly income stream. Consequently, many small self-employed individuals may have applied and received unemployment benefits greater than the actual net taxable income received during normal business operations.

Another way of looking at is that the caterer averaged $6,000 per month of gross income. In reality, after expenses, the net average income may have been closer to $2,000. The caterer applied for the unemployment benefits and received $3,000 per month, fully taxable, with little to no business expenses to reduce that amount.

The net result is the caterer may realize higher net taxable income of $6,000 for the year (6 months of unemployment benefits.) The caterer never thought to adjust their income estimate in the market place exchange because their business had closed and they needed the unemployment benefits to survive. For some people, the unemployment benefits were larger than their hourly wage because there were no payroll deductions.

If the caterer had estimated their taxable Modified Adjusted Gross Income at $24,000 (12 months x $2,000), their final MAGI may be closer to $30,000. The higher income will trigger a repayment of excess premium tax credits received during the year. Stated another way, the caterer received too much monthly subsidy based on the lower original income estimate.

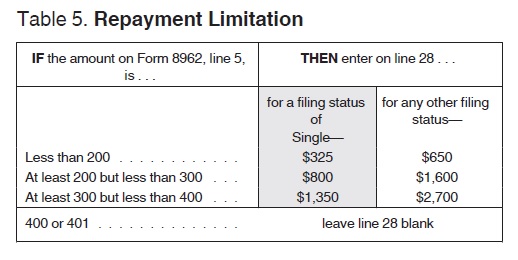

For the caterer, with an income under 400 percent of the federal poverty level, there is a repayment limitation. The repayment limitation will reduce the sting of having to pay back excess subsidies. Other families are not so lucky.

I was contacted by one family who has to repay ALL of the subsidies, approximately $11,000, on their federal tax return. One spouse was able to pick up extra hours at work to off-set the loss of income from their partner’s small business being shut down due to the pandemic.

The small business owner was able to secure unemployment benefits for his shuttered business. But that income, combined with no business deductions and the spouse’s increase income, pushed the family over 400% of the federal poverty level. This has triggered the repayment of all of the subsidies they received during the year for their health insurance.

A small silver lining is that the family lives in California that has subsidies for household income above 400 percent of the FPL where the federal government assistance stops. The downside is that the California Premium Assistance is nowhere near large enough to compensate for the repayment of federal subsidy. Hence, the repayment of $11,000 to the federal government.