Covered California has updated their consumer job aid related to countable sources of income. This updated version was precipitated by the 2018 changes to the IRS federal tax return form 1040. The IRS change was prompted by the 2017 tax cut enacted by congress and signed by the president.

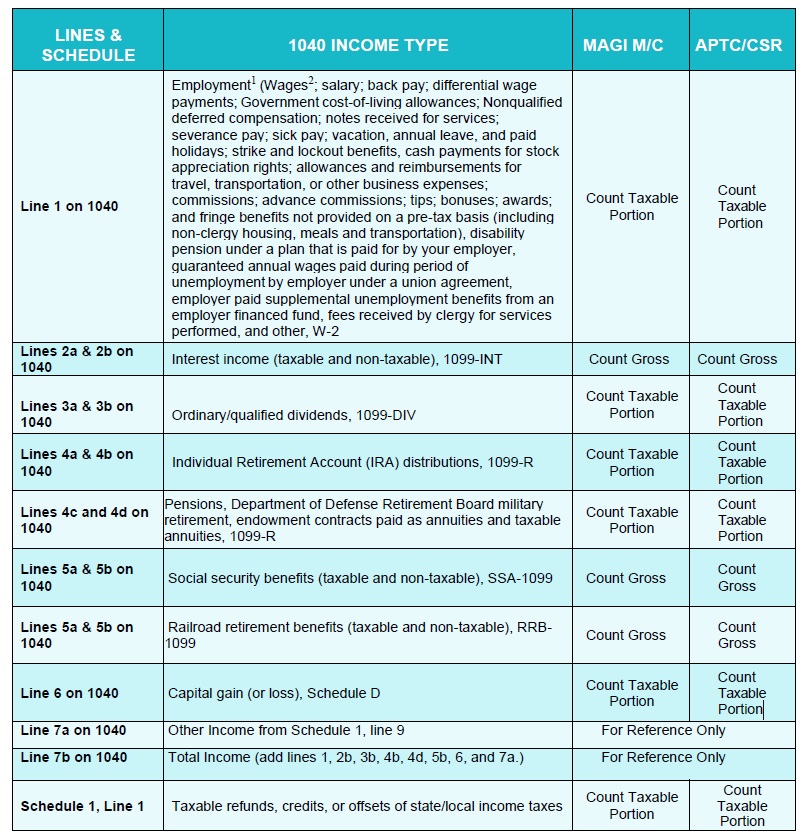

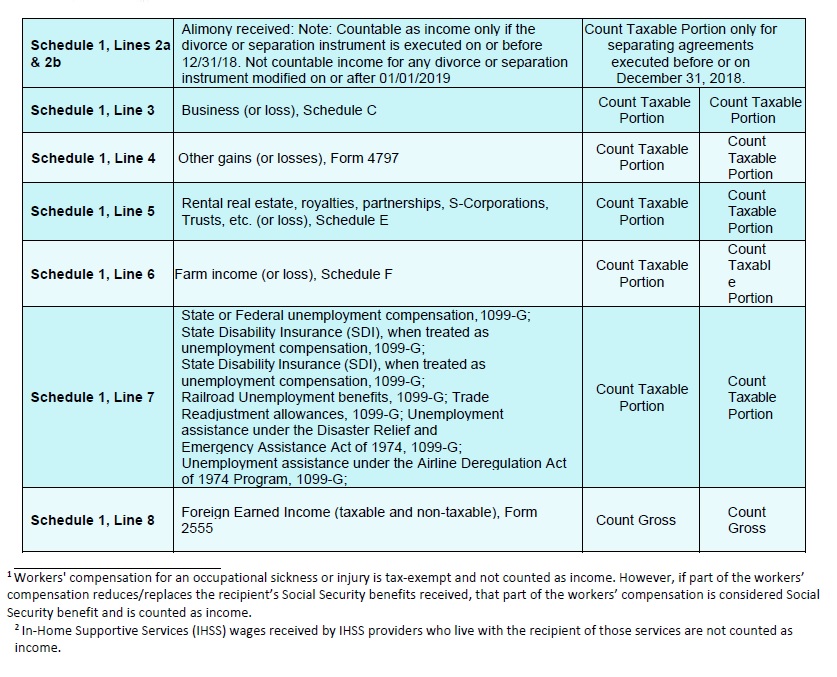

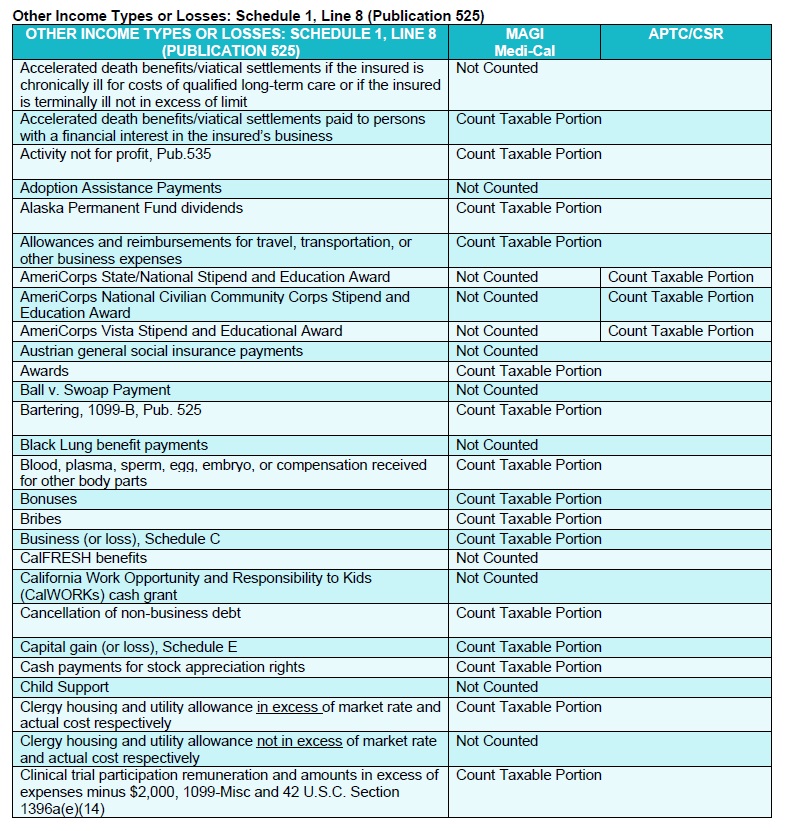

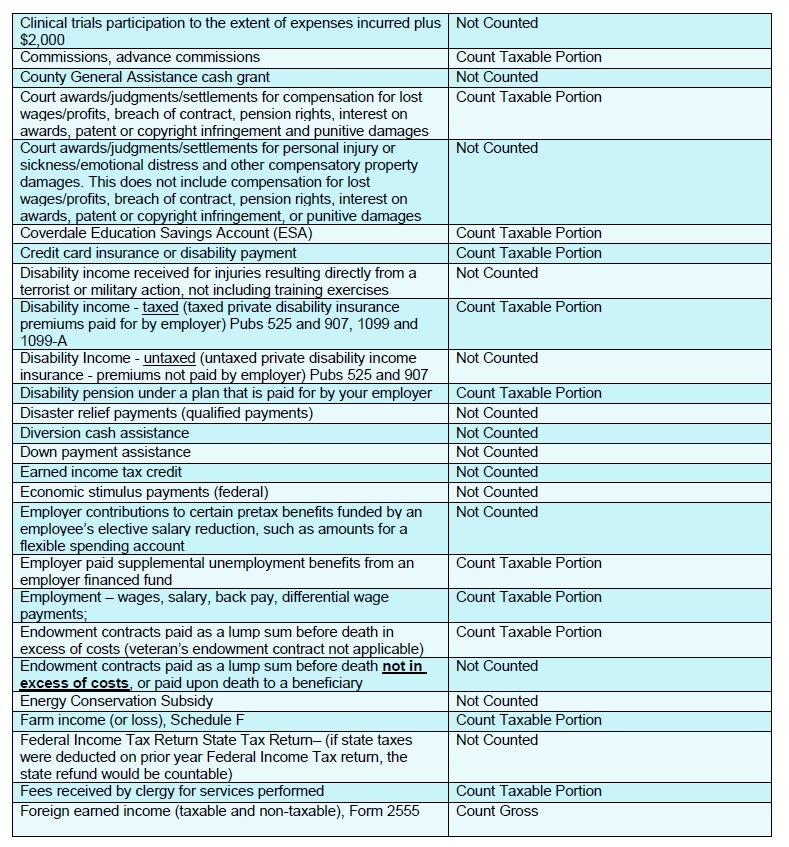

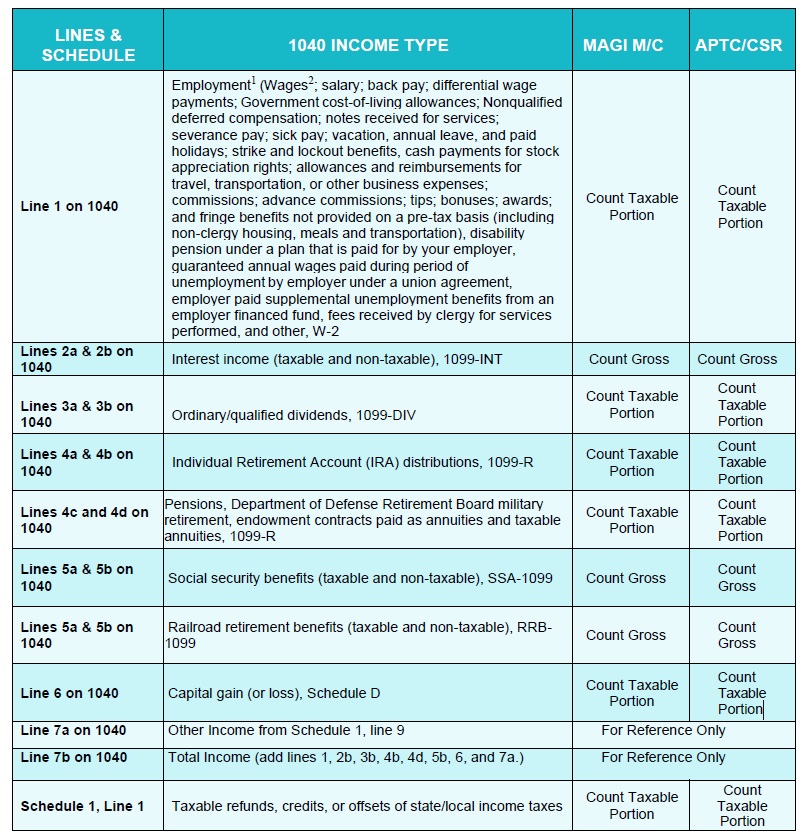

The foundation of the Modified Adjusted Gross Income (MAGI) has not changed. Where you find the information for determining the MAGI has been rearranged as the IRS added schedules and changed line numbers. Covered California has recognized the new form and has updated their document to better reflect where to find the information on the new schedules and line numbers.

Estimating Modified Adjusted Gross Income

The Modified Adjusted Gross Income is the household’s estimated federal Adjusted Gross Income plus certain Social Security benefits, tax exempt interest, and foreign earned income. This all flows from the primary tax filer listed on the Covered California account. Dependents expected to be included on the primary tax filer’s federal return may also have their income included if they meet the income threshold for being required to file a federal tax return.

Of course, the update has been released when the nation is under siege by the covid-19 virus resulting in massive job losses. The federal government is appropriating more money to help employees and employers weather storm when most people are asked not to leave their homes for weeks.

While this information may change – check the IRS website for updates – the stimulus check authorized by congress and sent to individuals and families will not be counted as income for the MAGI. Extended unemployment benefits, and paid family leave will be counted as income. This will help some individuals and families maintain their private health insurance with the subsidies through Covered California, albeit at a reduce income amount.

Let me emphasize that you are ESTIMATING your income for the year. Your past income and tax return can be used as a guide, but may not be an accurate predictor of your future MAGI. For example, if your spouse is set to collect Social Security retirement benefits in 2020, that income needs to be added to the MAGI.

The consequences of not forecasting the Social Security income into the MAGI equation means you will receive too much subsidy during the year. This in turn, means you will have to repay some of the subsidy back when you do your taxes. IF, your MAGI exceeds 400% of the federal poverty level – because you forgot to include the Social Security benefits – when you file your 2020 tax return, you will have to repay ALL of the federal Advance Premium Tax Credits you received during the year.

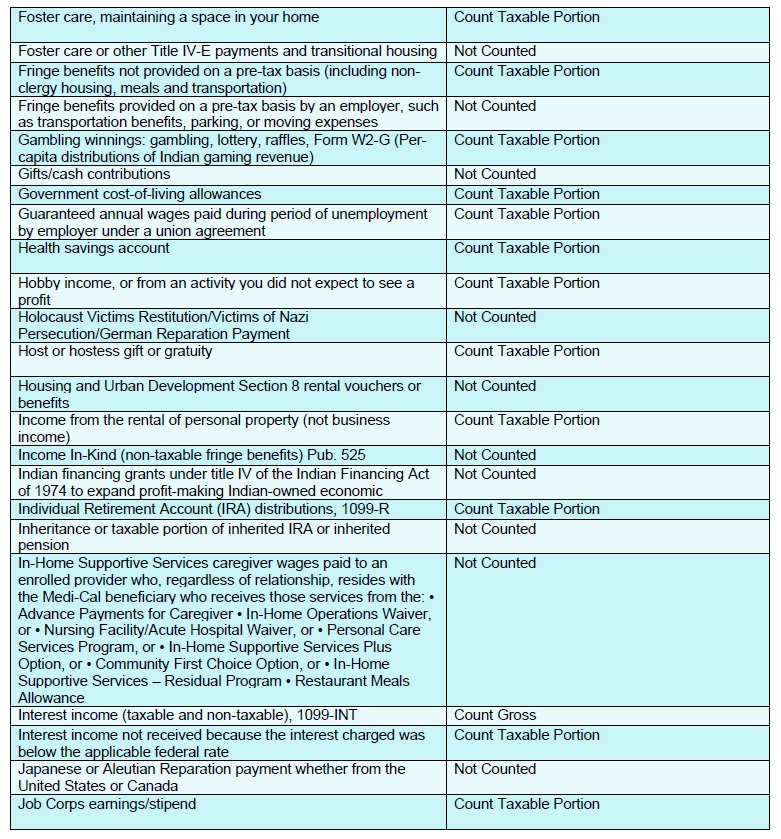

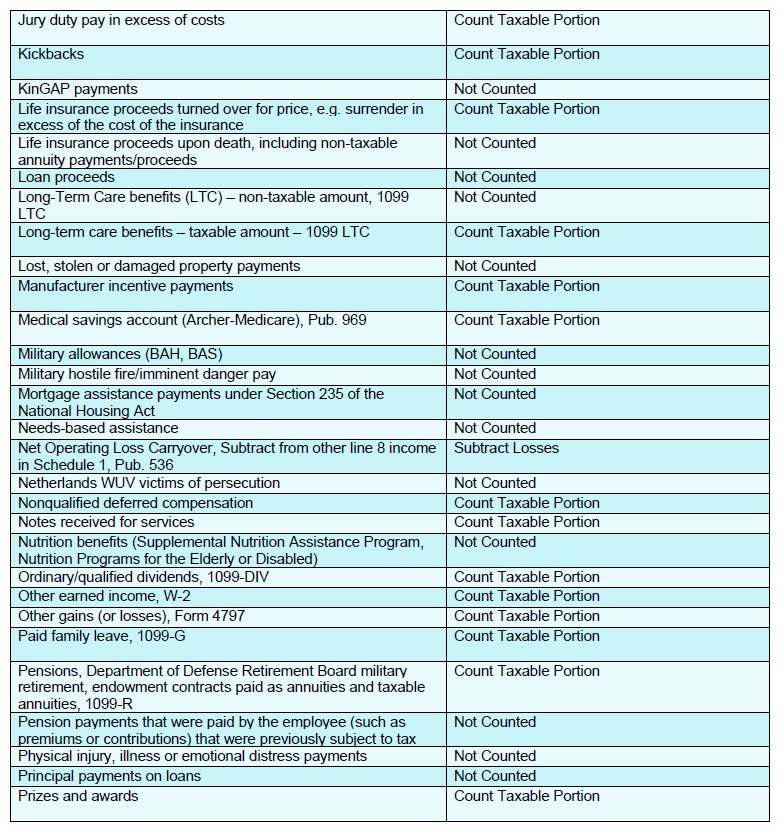

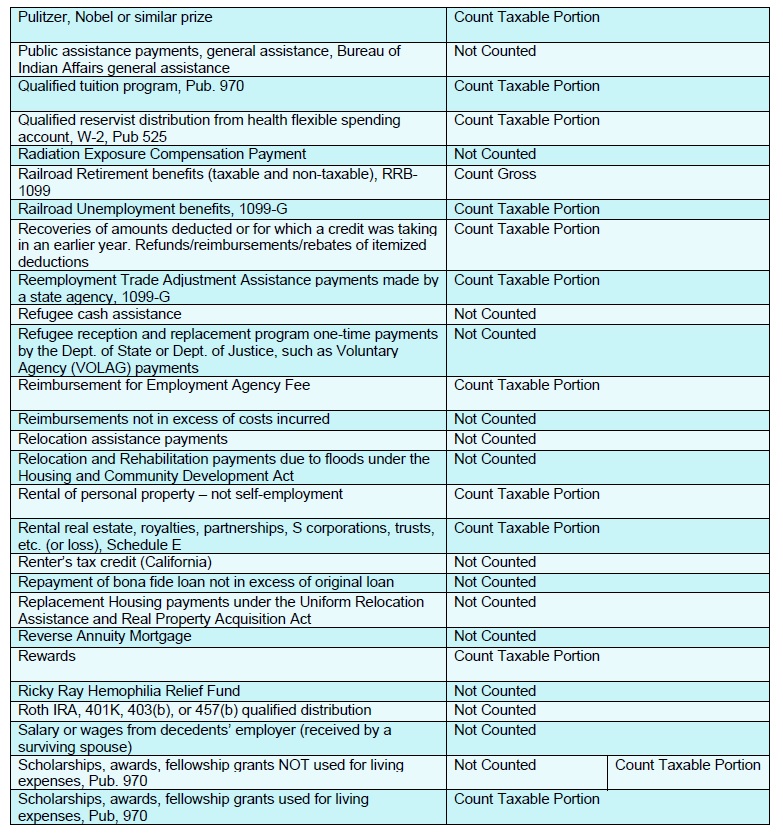

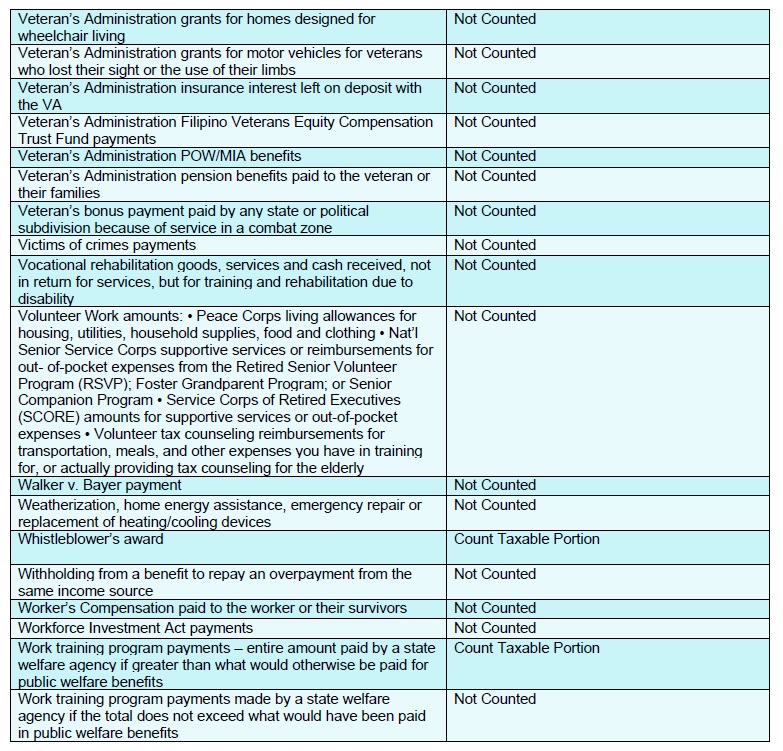

The Covered California Countable Source of Income document is meant to be paired with the income section of the application. The application has several different pages for various income types and deductions. However, if you have no Social Security, tax exempt interest, or foreign earned income, then line 8b of the 2019 federal 1040 – marked “This is your adjusted gross income” – is your best bench mark. Line 8b includes all of the taxable income and all of the deductions capture on the other schedules.

The Covered California income section recreates the different schedules and lines from the 1040 as if you are calculating your adjusted gross income plus modifications for the first time. There is no problem with this approach. But if you are self-employed, and you use your net income from Schedule C, line 31, then add business deductions in the Covered California income section, you will be artificially lowering your MAGI. This is because Schedule C already captures business expenses to reduce the gross revenue to net taxable revenue.

Medi-Cal Income

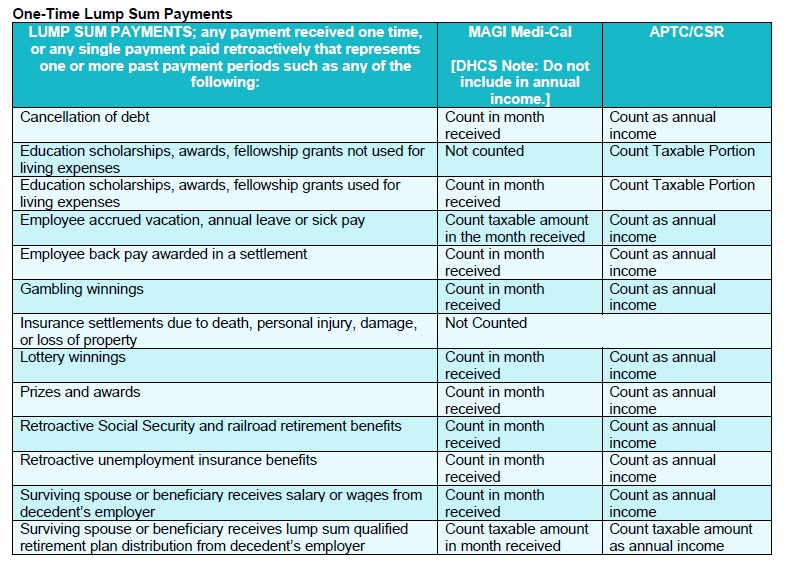

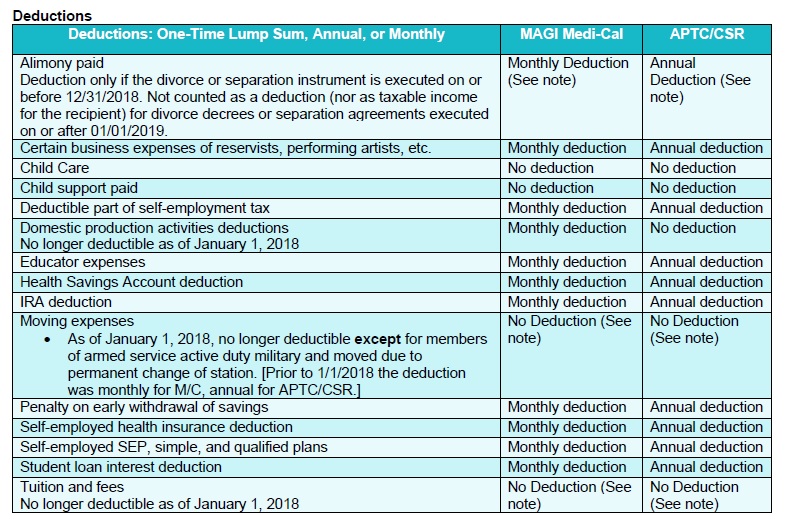

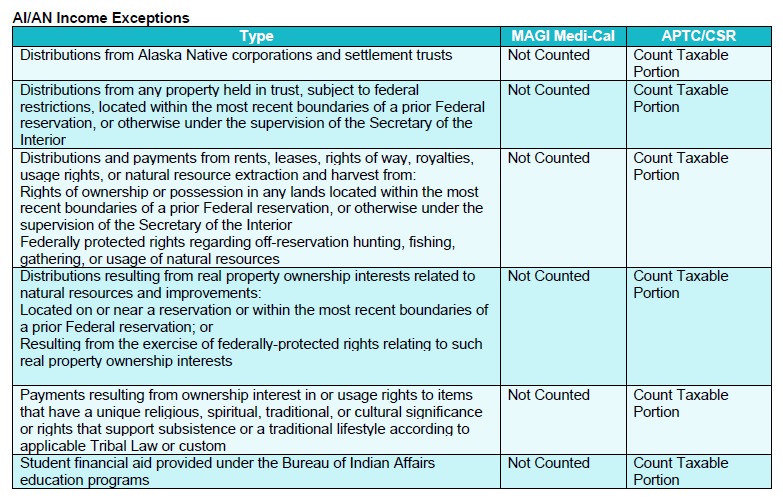

On some of the pages there will be two columns: MAGI M/C and APTC/CSR. The first column MAGI M/C references whether the income or deduction is countable for MAGI Medi-Cal. The MAGI Medi-Cal eligibility can have slightly different types of income counted. The second column APTC/CSR stands for Advance Premium Tax Credit/Cost Sharing Reduction. The APTC is the monthly subsidy, and the CSR refers to the Enhanced Silver Plans 73, 87, and 94 that have reduced cost-sharing benefits.

Countable_Sources_Income 2020 Covered California

2020 guide to countable sources of income from Covered California for the Modified Adjusted Gross Income based on revised federal income tax form 1040 for 2019.