Many individuals and families are looking for ways to reduce their monthly health insurance premiums. There are a variety of options for reducing the monthly insurance premiums. You can change the metal tier of the health plan. The switch to a different health insurance company can save money. Another strategy is to split family members into different plans to save money.

1 Save Money by Changing Health Plan Metal Tiers

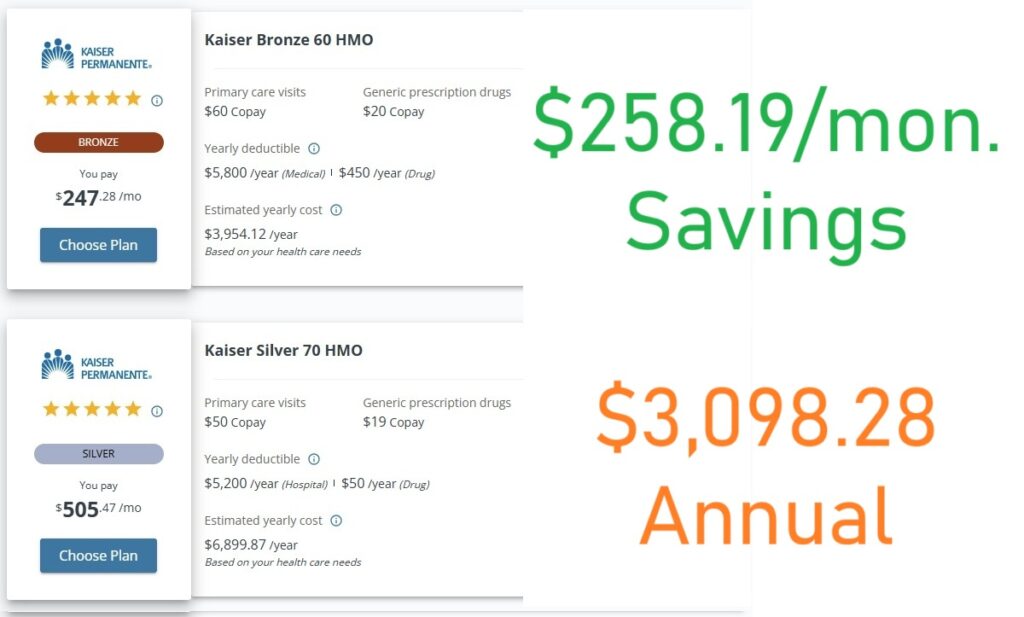

The easiest way to reduced monthly health insurance premiums is to change metal tiers. If you have a Silver plan, you can move down to a Bronze. If you have a Bronze 60, you might be able to save a few dollars by switching to a Bronze High Deductible Health Plan. Of course, moving down metal tiers will increase your health care costs.

In California, the wildcard moving down to a Bronze plan is the extra health care costs if you have to meet a medical deductible for services such X-rays, imaging, and emergency room visits. Additionally, if you are prescribed any brand name expensive drugs, you will usually always be able to save money with a Silver plan because of the prescription drug coverage.

The maximum out of pocket amount is the same with either the Bronze 60 or Silver 70 in 2026 at $9,800. This means that if a big accident happens, the maximum liability is the same with either plan.

In this example, the difference between the Bronze 60 and Silver 70 plan is $258 a month. If you only anticipate light health care utilization in the next year, then the Bronze 60 can save money while providing affordable routine office and urgent care visits.

2 Moving Up Metal Tiers Can Save Money for Some People

There can be a contradiction to the logic of dropping down metal tiers to save money. If you know you have several office visits, prescriptions, and may have a surgery next year, increasing your metal tier can save dollars overall if you never meet your maximum out of pocket.

For this individual, the Gold 80 plan is only $39 more a month over a Silver 70 plan. Since the Gold plan has no medical or pharmacy deductible, you can save money on out- or in-patient surgery compared to a Bronze or Silver. In other words, you will pay less for health care and only slightly more for the health plan.

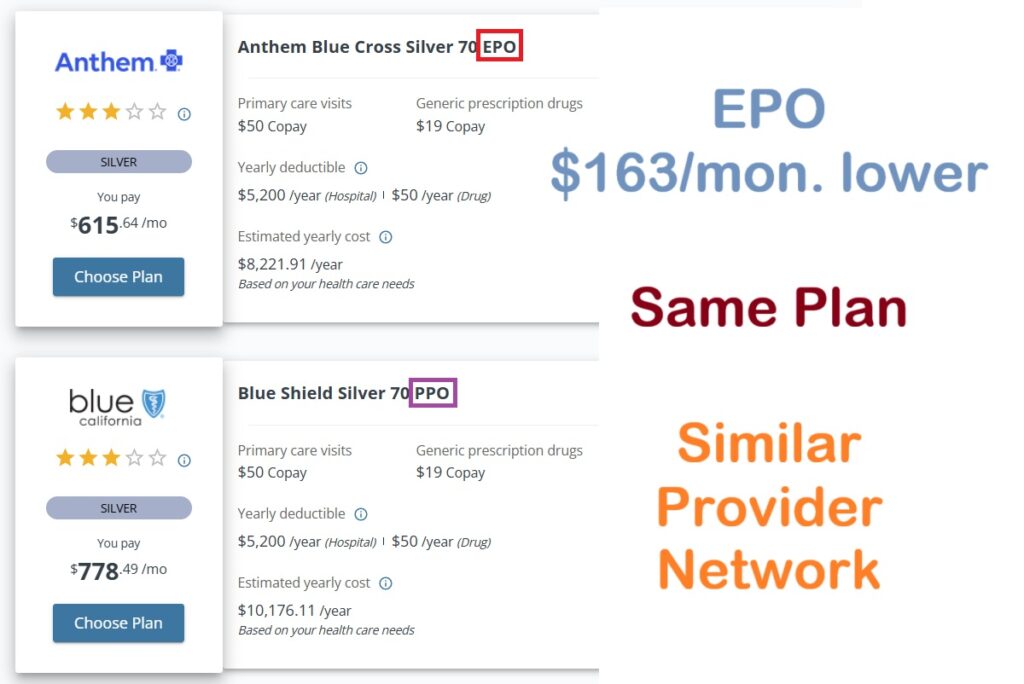

3 Change the Plan Type to Save on Monthly Premiums

In general, HMO plans are the least expensive and PPO plans are the most expensive. You can save money moving from a PPO to an EPO or HMO plan if either are offered in your region.

For this individual, the exact same Silver 70 in an HMO plan type saves $331 a month. The downside is that the HMO may not have the same doctors and other providers in the network.

An EPO (exclusive provider organization) is similar to a PPO (preferred provider organization). With an EPO you can visit any provider in the network without a referral from a Primary Care Physician. Similar to an HMO (health maintenance organization), EPOs have no out of network coverage. In this example, changing from a Silver 70 PPO to Silver 70 EPO saves $163 per month. Bonus is that the EPO has a similar network of doctors and providers as the PPO offered in the area.

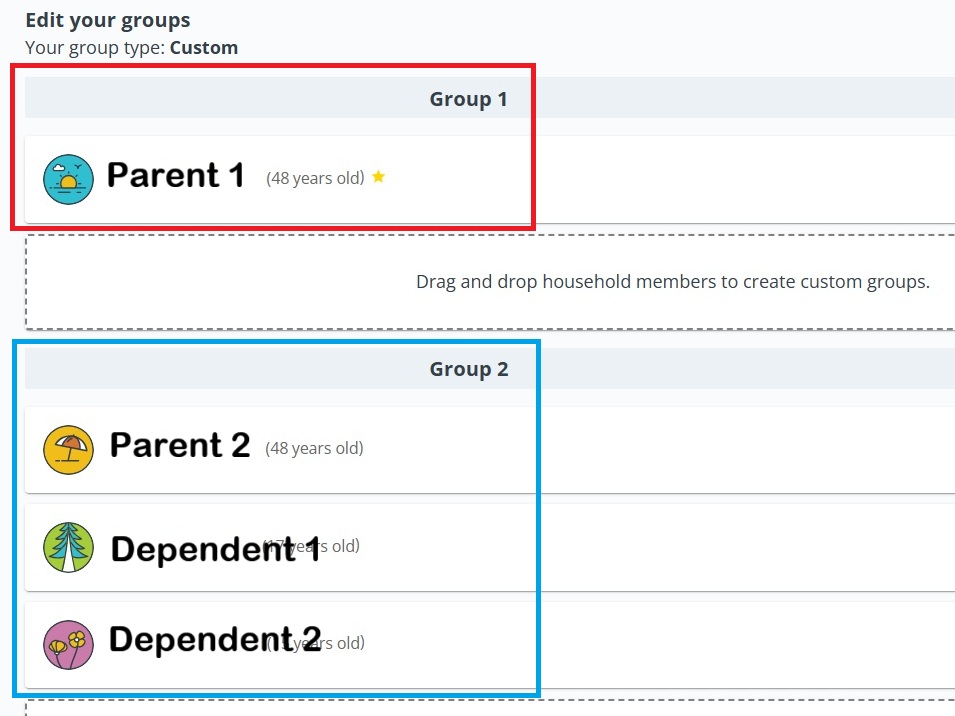

4 Splitting Up Family Members into Different Plans can Save Lots of Money

Another powerful strategy to save on monthly health insurance premiums is the split family members into different plans. Covered California makes splitting family members into different groups very easy. From your Enrollment Dashboard select Manage Groups. Then at the bottom of the page click on Add a Group. Then drag the family members into different groups.

This family has one parent in Group 1. The second parent and two children are in Group 2.

When you go back to the Enrollment Dashboard, each group is prompted to select health plan. You can select a different metal tier plan with different insurance company for each group. The subsidies calculated for each family member are applied to the individual’s premium regardless of what group they are in.

This family has one parent and the three children in Group 1 with a Kaiser Bronze 60 plan. The other parent who has a chronic illness and needs specialized doctors, is in Group 2 with the Blue Shield PPO Bronze HDHP. This family saves over $1,000 a month by NOT having all the family in the Blue Shield PPO plan.

Another great advantage of Covered California is that if you make one change in your account it is distributed to ALL the health plans as an update. For instance, you move from one apartment to a condo down the road. The address change is sent to all the health plans. Any changes to the subsidy, and subsequent monthly premiums, are sent to the health plans. You don’t have to worry about notifying each health plan separately.

YouTube video reviewing suggestions to save money on health insurance.