The Bronze 60 plans have improved for 2025. All consumers in Covered California will be offered a Silver 73 with reduced member cost sharing. The improvements to both plan offering can create a difficult decision. Do you select the lower cost Bronze 60 plan or enhanced Silver 73 with lower health care services copayments and lower maximum out-of-pocket amount?

Bronze 60 Less Expensive Asset Protection

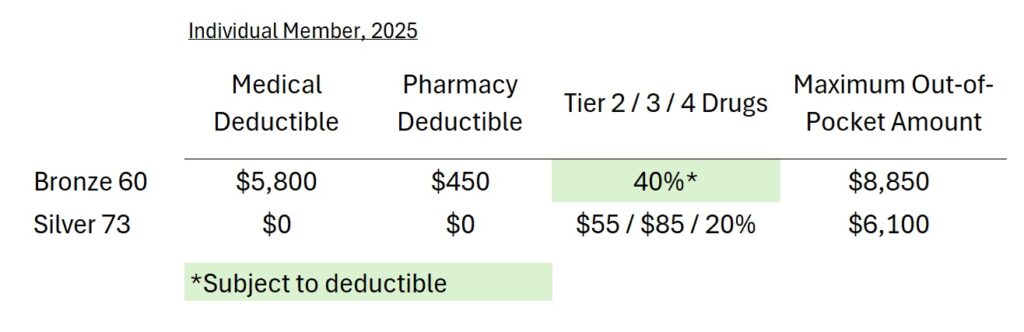

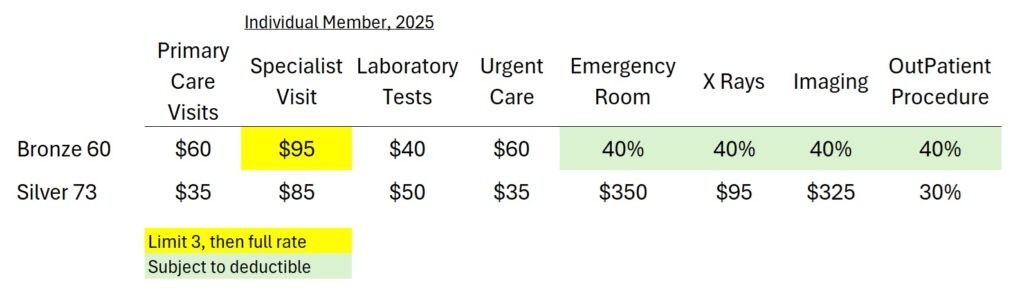

The first condition for selecting any health insurance is if the plan includes your preferred providers like doctors, facilities, specialists, and hospitals. Regardless of the metal tier of the health plan (Bronze, Silver, Gold, or Platinum) the network of providers is the same. The only thing that changes between the plans is how much the plan member must pay for health care services until the maximum out-of-pocket amount is met.

On its face, the Silver 73 health plan, with its reduced member cost-sharing and lower maximum out-of-pocket amount, appears to be the better bet. However, for some people who don’t really utilize health care services, health insurance is asset protection. In other words, they want a health plan with the lowest liability for health care services coupled with the lowest price.

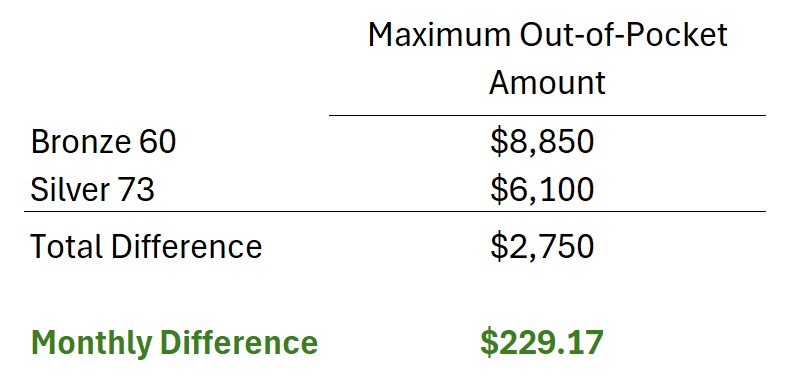

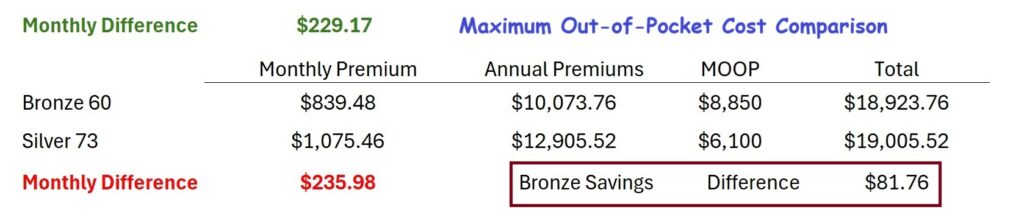

Bronze 60 plans are less expensive than Silver 73 plans. One reason for the lower premiums is the higher maximum out-of-pocket maximum versus the Silver 73. The annual maximum out-of-pocket amount for the Bronze 60 is $8,850 compared to $6,100 for the Silver 73. In a catastrophic health care event, you will pay $2,750 more with the Bronze 60 over the Silver 73, assuming you meet the maximum out-of-pocket amount.

Once you have met the maximum out-of-pocket (MOOP) amount, all in-network health care services are covered 100% by the health plan for the remainder of the year. This means that if you have met your MOOP under the bronze plan, you will continue to pay a lower monthly premium when compared to the Silver 73, Gold, or Platinum.

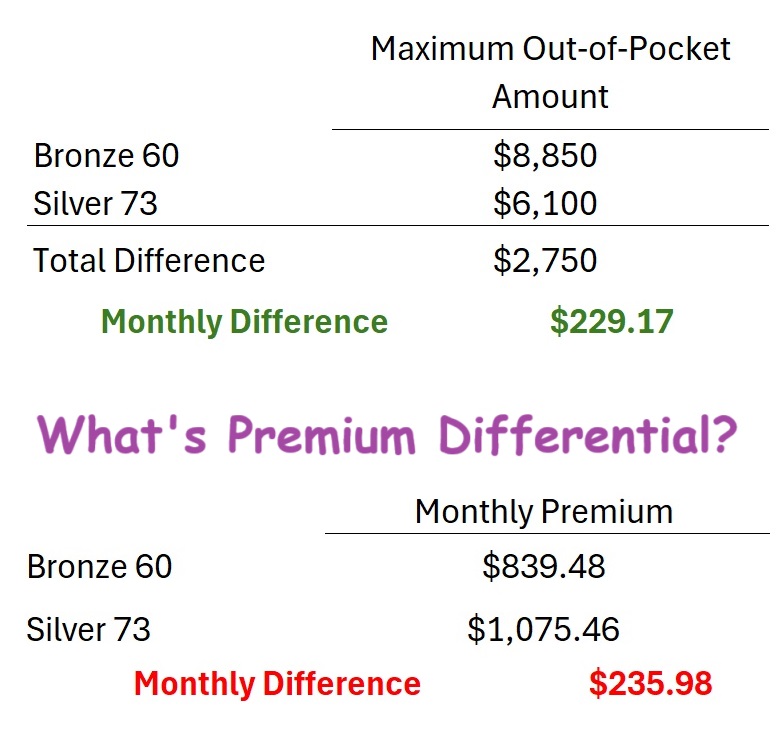

If all you want is the lowest total cost (MOOP plus premiums), you would opt for a Bronze plan if the premium differential is greater than $229.17 per month between the Bronze 60 and Silver 73. If the premium differential is greater than $229.17 per month with the Silver 73, the total costs of MOOP and premium will be more than if you had a Bronze 60.

In this quick comparison of an individual, the monthly differential between the Bronze 60 and Silver 73 is $235.98 per month. When you total the annual premiums for each plan and add the MOOP, the Bronze 60 plan saves $81.76. The savings, or additional cost, will depend on age, region, and estimated income for the year. There are situations where the Silver 73 is only $100 more per month, making the Silver plan a better deal in the event of a major illness or accident where you hit the MOOP of either plan.

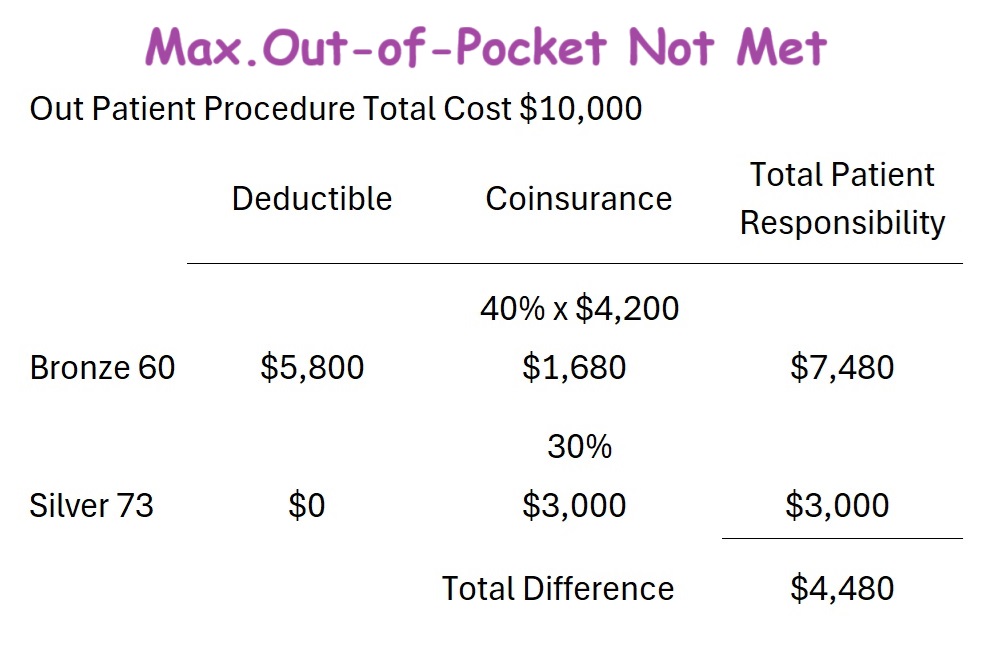

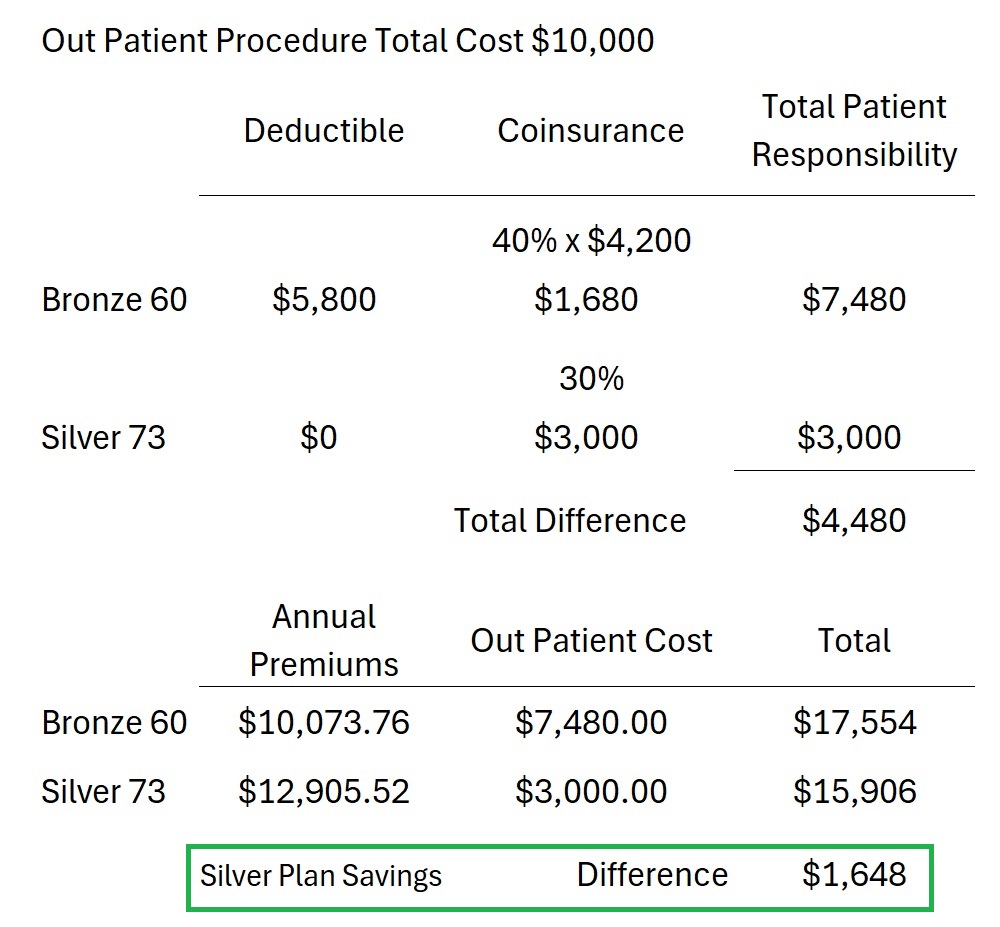

Silver 73 Saves Money on Outpatient Procedures

In reality, few of us ever reach the MOOP. We usually have minor chronic health care challenges, sometimes requiring an outpatient procedure. This is where the Silver 73 can really save money. With the Bronze 60, you must move through the medical deductible for $5,800 before you go into 40% coinsurance. If we have an outpatient procedure that costs $10,000, the Bronze 60 plan member will pay the deductible ($5,800) plus 40 percent of the remaining balance or $1,680. The total cost would be $7,480. Under the Silver 73, outpatient coinsurance is 30 percent so the $10,000 procedure would cost the plan member $3,000.

When we add annual premiums plus the final cost of the outpatient procedure, the Silver 73 saved the plan member $1,648 over the lower premium Bronze 60 plan.