If your federal income tax return lists an income amount in the Medi-Cal range, you don’t have to repay the Covered California subsidies you received during the year and you will not be flipped into Medi-Cal. Conversely, you may receive additional Premium Tax Credit on your federal tax return than you received from Covered California.

Many people believe that if their prior year’s federal tax return’s adjusted gross income is below the annual dollar amount for the Covered California health insurance subsidies (Premium Tax Credits), they will be reported and dropped into Medi-Cal. This is not true. Part of the confusion rests with California expanding Medi-Cal for adults with incomes of less than 138 percent of the federal poverty level.

If Your Final Tax Return Income Is Medi-Cal Range

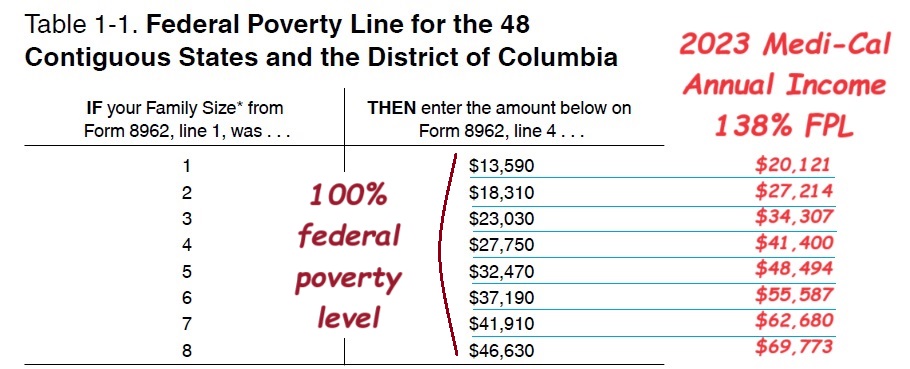

However, under the Affordable Care Act, individuals are eligible for the health insurance Premium Tax Credit subsidies down to incomes of 100 percent of the federal poverty level (FPL). If a family or individual estimates their income within the subsidy range on their Covered California application – over 138 percent of the federal poverty level – and the final income is less on their federal income tax return they can still claim the Premium Tax Credits.

Health Insurance Subsidies Down to 100% Federal Poverty Level

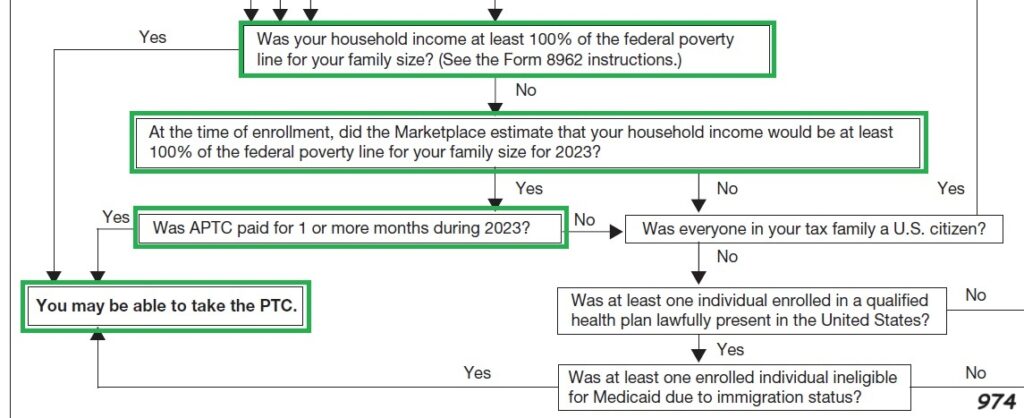

IRS Publication 974 has a flow chart for determining the eligibility for the health insurance Premium Tax Credits.

If your estimated income is greater than 100 percent of the federal poverty level, you may be eligible to claim the Premium Tax Credits on form 8962. Adults are determined eligible for Medi-Cal on the Covered California application if the estimated monthly income is below 138 percent FPL.

For 2023, a single adult needed to estimate an income greater than $20,121(138% FPL) on their Covered California application to be eligible for the subsidies. If the individual estimated an income under 138 percent FPL monthly, they would have been determined eligible for Medi-Cal. If the final Modified Adjusted Gross Income on the taxpayer’s form 8962 is below 138 percent FPL, they can claim additional Premium Tax Credit.

Covered California Income Estimate vs. Final MAGI

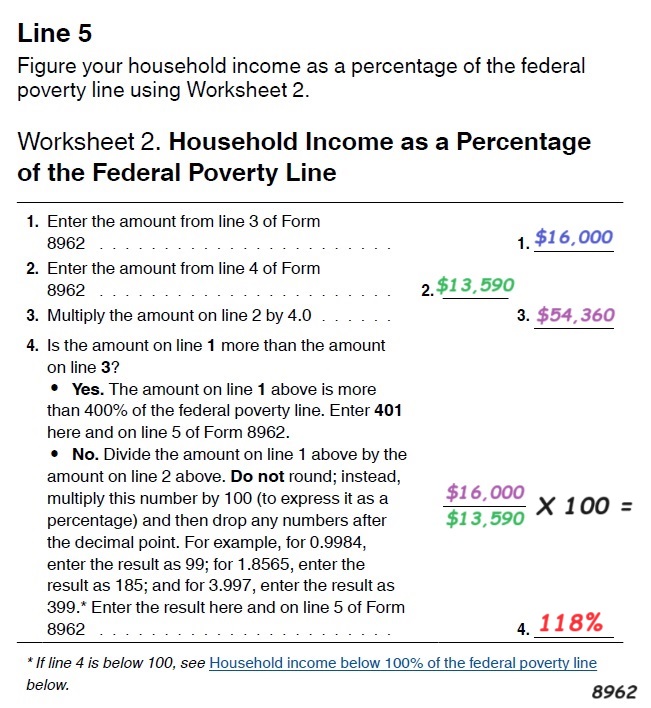

As an example, Joey applied for Covered California and estimated his income at $32,000 for 2023 from the small business he had started in 2022. When Joey did his 2023 taxes, his adjusted gross income was only $16,000. For 2023, the federal poverty income level was $13,590 in California. Joey used form 8962 (line 5, worksheet 2) to calculate his income as a percentage of the FPL. His income was 118 percent FPL.

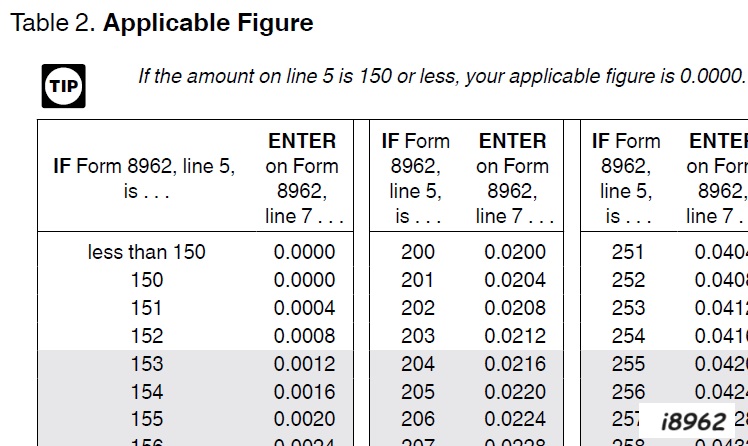

The instructions for form 8962 for 2023 states that if the household income is less than 150 percent, the applicable figure or consumer responsibility fair share for the second lowest cost Silver plan offered to them is 0. This means that any Advance Premium Tax Credit subsidy should be equal to the monthly cost of the second lowest cost Silver plan. If the individual is enrolled in the second lowest cost Silver plan, or a health plan with a smaller premium, the individual’s subsidy would cover the cost of the health plan.

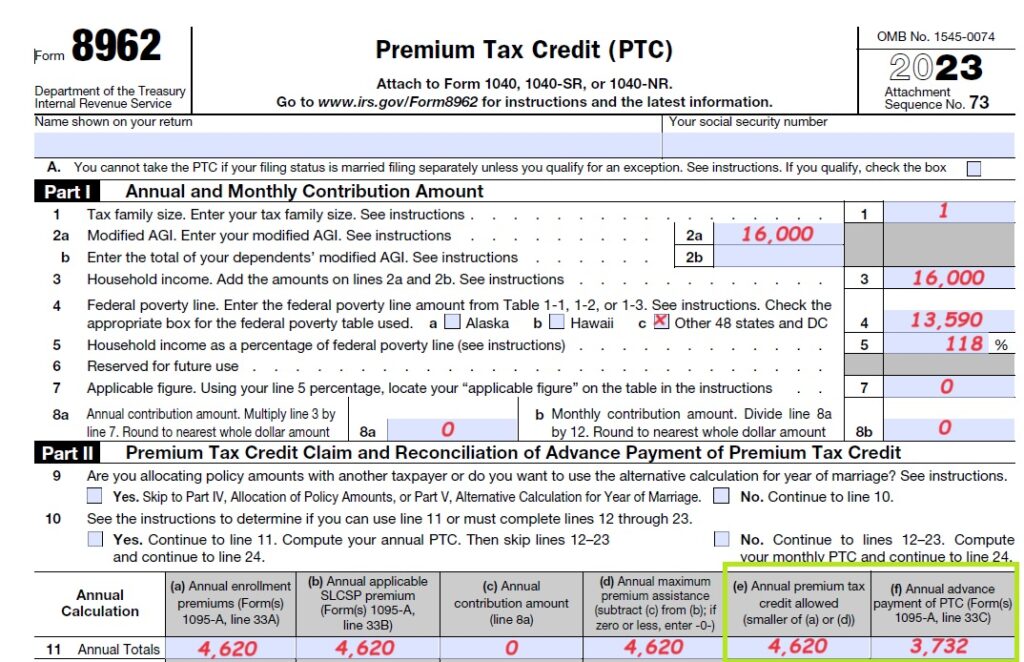

Joey fills out form 8962, Premium Tax Credit reconciliation, with his information. A household of one with an income of $16,000 makes his income 118 of the federal poverty level. Joey’s consumer fair share for health insurance as a percentage of the second lowest cost Silver plan is 0 as figured on line 8a and 8b of 8962. In other words, if Joey selected a health plan with a premium equal to or less than the second lowest cost Silver plan, he should make no contribution to the premiums. The Premium Tax Credit subsidy would cover the cost.

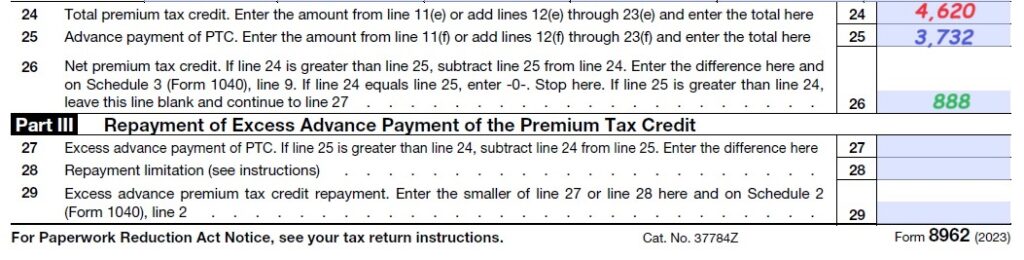

Joey uses the 1095A he received from Covered California to fill in the fields on Part II of form 8962. Joey did enroll in the second lowest cost Silver plan as indicated by the fact that line 11a is the same as 11b. Line 11e shows that Joey was eligible for a subsidy equal to the cost of the second lowest cost Silver plan, 11b or $4,620. However, because Joey estimated his income higher on the Covered California application, he only received an Advance Premium Tax Credit subsidy of $3,732 during 2023.

Because Joey only received $3,732 in Premium Tax Credit subsidy during the year, but was eligible for $4,620, he is eligible for an additional Premium Tax Credit of $888, line 26. Maximum Premium Tax Credit $4,620 – minus – Advance Premium Tax Credit received through Covered California $3,732 equals and additional Premium Tax Credit of $888 to Joey.

The income estimate Joey used on his 2023 Covered California application was a good faith honest estimate. It was based on the prior year’s income from his small business. In 2023, Joey had to make legitimate IRS business expenses to expand his business. These expenses dramatically cut his estimated income down to $16,000.

Not Flipped Into Medi-Cal, No Repayment of Subsidies

Just because Joey’s 2023 final Modified Adjusted Gross Income was in the range for Medi-Cal, he will not lose his 2024 health plan and subsidies. The IRS does not report his income to Covered California to flip him into Medi-Cal. His 2024 subsidy is based on his good faith honest estimate of his 2024 income.

IRS 2023 Premium Tax Credit Forms, Publications

2023