Because you do not have a crystal ball to predict the future, selecting a health plan can be complicated. Fortunately, in California we have standardized cost sharing health plans to make the selection process slightly easier. However, there are still many complicated aspects of health plans such as deductibles, copayments, coinsurance, and the maximum out of pocket amount that add complications to a health plan selection.

Maximum Liability, Maximum Out of Pocket Amount

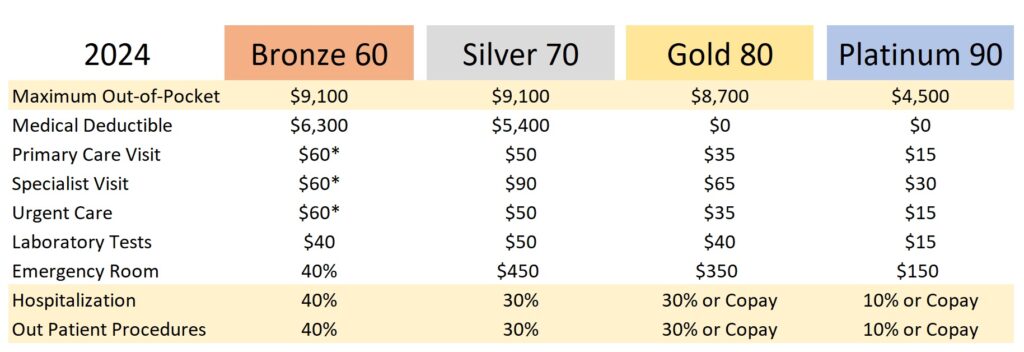

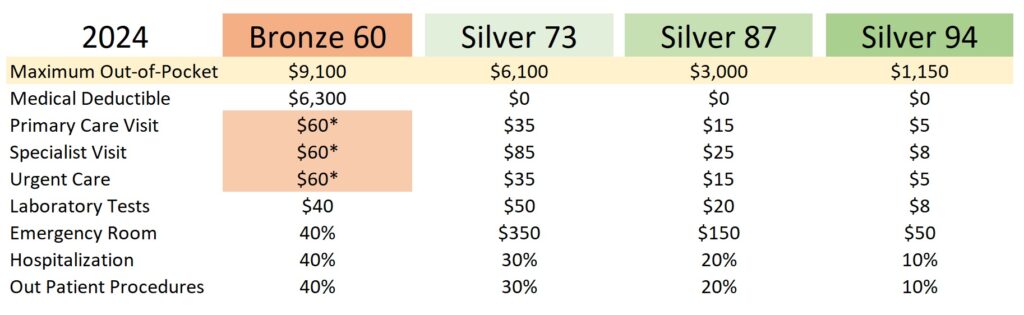

All health plans have an annual maximum out-of-pocket dollar amount (MOOP.) Once you have met the MOOP, all in-network health care services and medications are covered 100 percent for the remainder of the year. As the MOOP decreases with the metal tier plan, the monthly premiums increase.

Deductible, Bronze and Silver Plans

The Bronze and Silver plans have a medical deductible. With the Bronze plan, after 3 health care visits, you must pay the full negotiated rate for health care services until you meet the deductible of $6,300. The laboratory tests are a set $40 not subject to the deductible. After you have met the deductible, you go into coinsurance of 40 percent. You pay $0.40 of the next dollar over the deductible until you have met the MOOP.

For the Silver plans, the medical deductible only comes into play IF you are hospitalized or on a skilled nursing facility. Otherwise, most of the routine health care services have a set copayment with generally no limits. Outpatient procedures under the Silver plan for 2024 will be subject to 30 percent coinsurance. That means you pay 30% of the cost of the procedure and it is not subject to the medical deductible. When your accumulated health care expenses, including prescription medication reach the MOOP, you are done for the year.

Big Hit of Hospitalization

If you are hospitalized under the Silver plan, you must move through the deductible, then you go into the coinsurance percentage. The Gold and Platinum plans have no medical or pharmacy deductible. If you are hospitalized, under the Gold and Platinum plans, you go straight into coinsurance or a copayment liability. Generally, PPO plans will apply coinsurance to inpatient hospitalization and outpatient procedures. HMO plans can have a set copayment per hospital day or procedure reducing the health care expenses you incur.

Prescription Medication

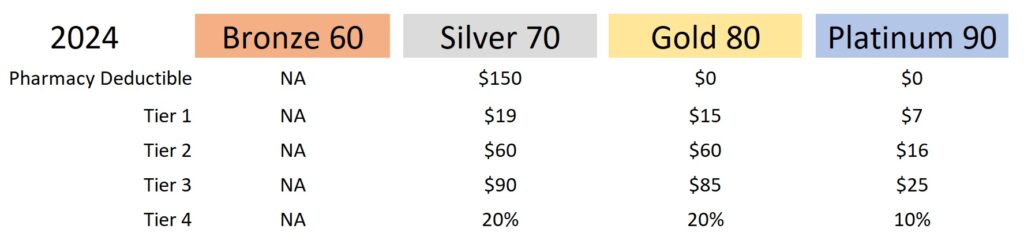

The Bronze plan does not really have any prescription drug coverage to help reduce the cost of drugs. The Silver, Gold, Platinum plans have set copayments for most of the drug tier. The Silver plan has a pharmacy deductible of $150 for 2024. Gold and Platinum plans have no pharmacy deductible. The Platinum has very low copayments for generic, Brand name, specialty tier 4 drugs.

Silver Plan or higher

There are individuals who should immediately consider only Silver plans and higher metal tiers.

- They have multiple prescriptions that they must refill monthly

- Management of a chronic health challenge

- Expect regular and routine office visits with a primary care physicians and specialists

- Require regular labs, tests, and imaging

- Have a planned hospitalization for maternity or surgery

Bronze Catastrophic HDHP

The Bronze plans are appropriate for individuals who have no current health issues and take no prescription medications. With the Bronze plans there is the maximum out-of-pocket amount that prevents excessive and exorbitant hospital cost in the event of an accident or unforeseen illness.

Some people do have a crystal ball and know they will have a major surgery in the next year. They may opt for Bronze 60 (MOOP $9,100) or Bronze 60 HDHP (MOOP $7,050) where they meet the MOOP early in the year. After the MOOP is met, all health care services are covered 100 percent by the health plan and the individual pays the lower Bronze premium for the remainder of the year.

Enhanced Silver Plans

If you are offered an enhanced Silver plan (73, 87, 94) you should strongly consider it even if you have to pay a higher premium over the Bronze plan. These plans have no medical deductible. The enhanced Silver plans have lower MOOPs and lower copays for routine health care services and prescriptions. They are a very good deal based solely on the lower maximum liability for health care services for the year.

The Crystal Ball Predicts!

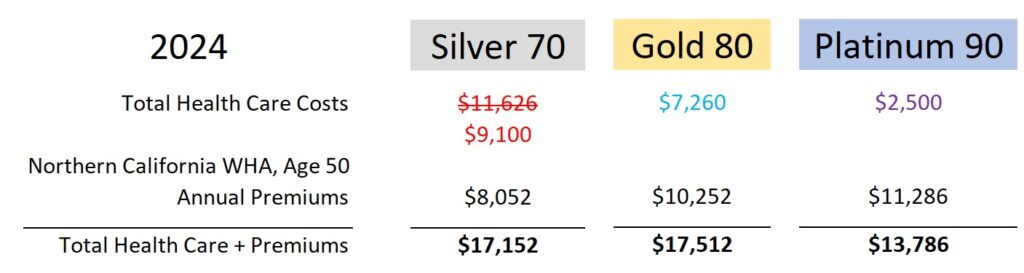

Some people have a good handle on past health care utilization and expected future events. I created a hypothetical scenario to compare health care expenses under the Silver, Gold, and Platinum plans. In this scenario for the year there are:

- 6 primary care visits

- 6 specialist visits

- 2 urgent care visits

- 6 laboratory tests

- 1 emergency room admission

- 1 hospitalization with a cost of $10,000

- 1 outpatient procedure at $3,000

The individual takes various prescription medications that must be refilled monthly.

- 2 Tier 1 prescriptions

- 1 Tier 2 prescriptions

- 1 Tier 3 prescription

With the Silver plan, the individual is subject to the medical deducible for the hospitalization. The deductible plus 30 percent of the remainder of the hospital cost equals $6,780. The outpatient procedure is 30 percent or $900. The prescription drug cost was included the $150 pharmacy deductible before the copayments is triggered for the Tier 1 – 3 drugs. The total costs under the Silver plan is $11,626, but because the Silver plan has maximum out-of-pocket amount of $9,100, that is the maximum liability for the year.

Under the Gold and Platinum, the individual would not meet their maximum out-of-pocket maximum. The total health care and prescriptions costs for the person is $7,260 and $2,500 for the Gold and Platinum plan respectively. Of course, the health care cost is not the only part of the equation. We must also add the annual premiums.

Annual Premium Comparison

The annual premiums are based on a 50 year old individual in Northern California using the rates for the Western Health Advantage HMO Silver, Gold, and Platinum plans. No Covered California subsidy was added to lower the premiums. A significant subsidy could alter the final analysis.

When the Silver plan maximum out-of-pocket amount is added to the annual premium, the total costs is $17,152. The higher premium of the Gold plan offset the lower health expenses making the Gold plan slightly higher than the Silver plan at $17,512. The Platinum plan, with the higher premium but lower health care expenses had the lowest total cost of $13,786.

Platinum plans can save money because they have health care and prescription drug costs half of the Gold and Silver plans. The Platinum plan only makes sense if you can reliably predict the health care and prescription drug utilization in the next year. For everyone else, without that crystal ball, a Silver or Bronze plan work better at containing health care costs.