Health insurance rates can increase for many different reasons. Some people can experience a rate increase of over 100 percent from one year to the next, in seeming contradiction to Covered California’s proclamation that rates only increased less than 2 percent. There are four essential factors that can greatly influence an individual’s rate change year over year if they stay with the same health insurance company and metal tier plan. The big four factors are region, age, universal blanket rate change, and the Second Lowest Cost Silver Plan if a Covered California subsidy is involved.

Estimated reading time: 9 minutes

The Spike in Health Insurance Rates has Four Factors

- Where You Live

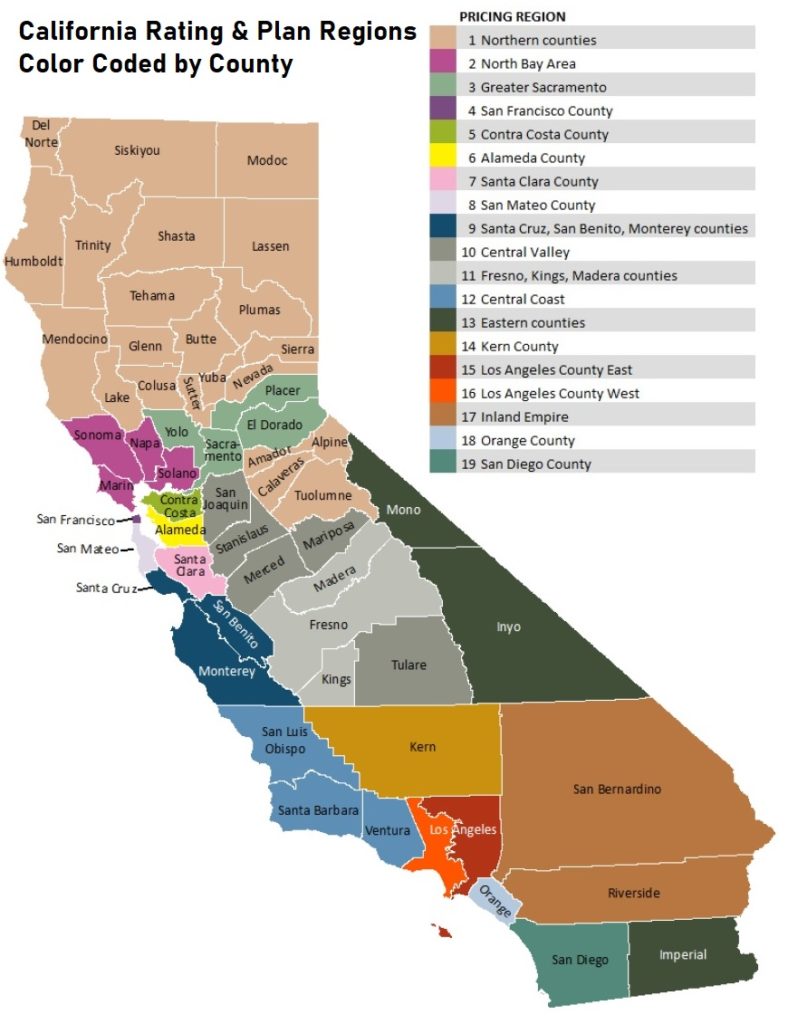

California is broken up into 19 different rating regions. Some of these regions are a single county while others may encompass multiple counties. The rates for the exact same plan from the exact same carrier may be drastically different.

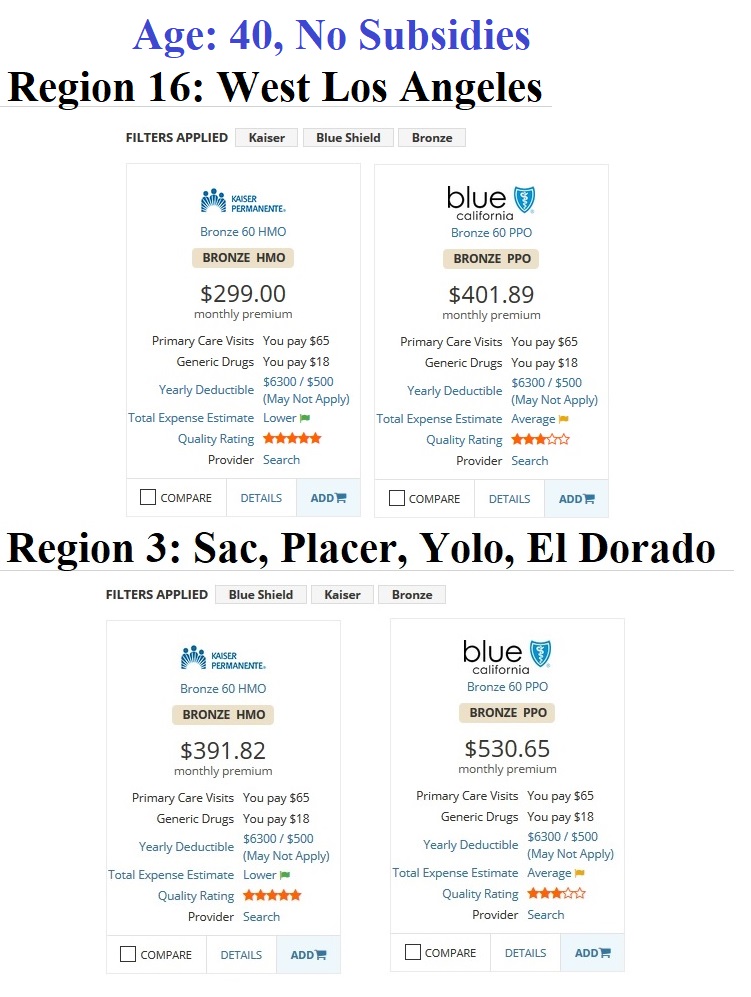

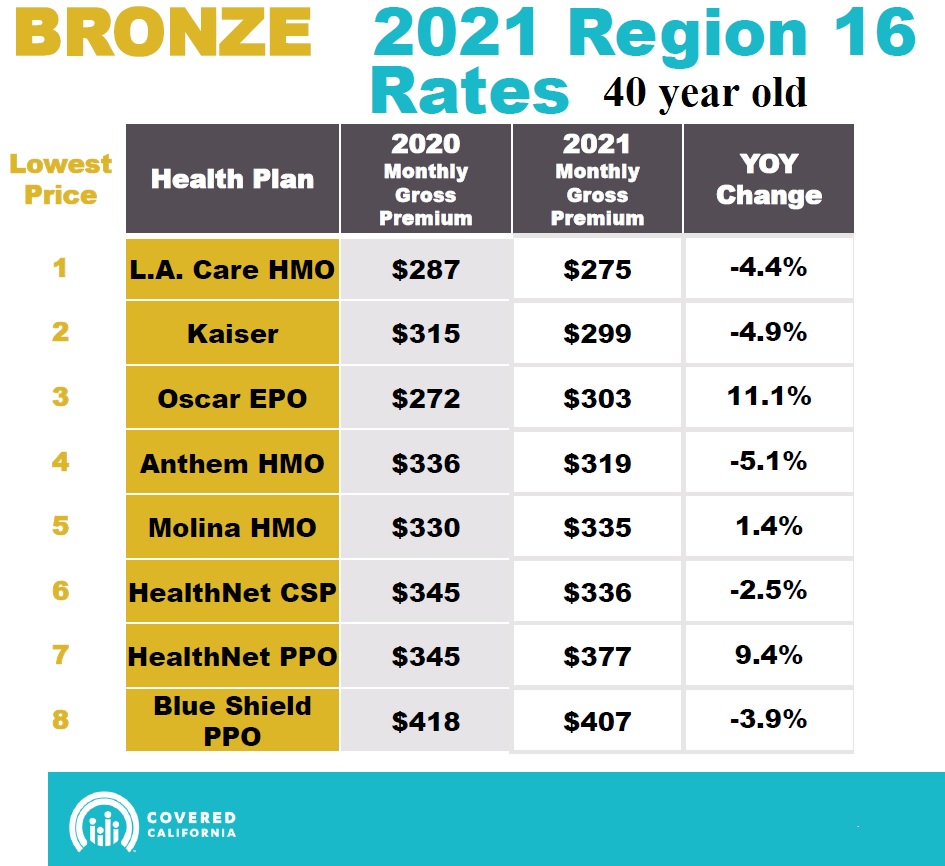

For example, the rate for a 40-year-old individual for a Kaiser Bronze plan in West Los Angeles County is $299 and the Blue Shield PPO Bronze is $401.89. If that person moves to Region 3 in Northern California, the Kaiser Bronze jumps to $391.82 and the Blue Shield PPO Bronze resets to $530.65. Just by moving your residence over one zip code, into a different county, you can trigger a rate change.

2. Your Birthday

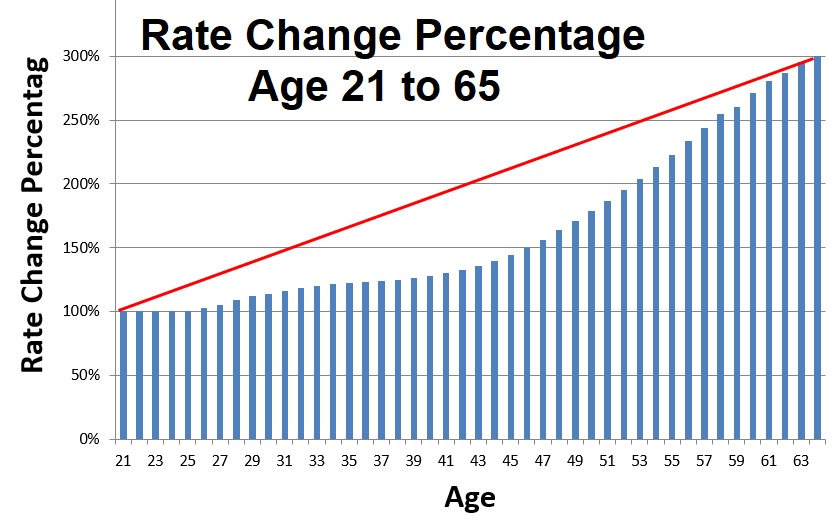

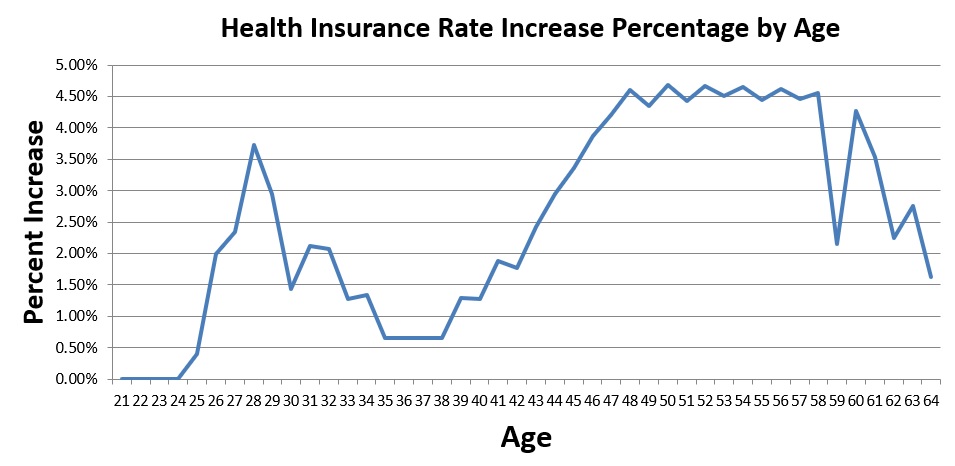

Health insurance rates in the individual and family market are pegged to each age. Under the ACA, health insurance rates can only increase 300 percent between the age of 21 and 64. For example, if the rate for a 21-year-old is $100 per month, the carrier cannot charge more than $300 per month for the same plan for a 64-year-old. However, the rate curve is not a straight line where the rate increases a set percentage every year. The rate increases are larger from one year to the next in the later years of the age range.

Health insurance companies are smarter than your average donkey. They have developed yearly rate increases that reflect some of the risks associated with the age band. There is no rate increase over the base 21-year-old rate until the individual turns 25. Then the yearly rate increases can range from .5 percent up to 3.5 percent for several years. Ages 35 through 38 are the calm years with yearly rate increases of less than 1 percent. After age 40, a person can expect a yearly rate increase of between 1.5 to 4.5 percent through age 58.

If a person is over 25 years old, sticks with the same carrier and metal tier plan, and don’t change their residential address, that person can expect a yearly rate increase of between 1 and 4.5 every year based solely on their age increasing one year.

3. Universal Blanket Rate Increase or Decrease

Every year, the insurance companies apply a universal blanket increase or decrease to their rates. The percentage change is applied to, for the most part, across all ages and metal tier plans. However, each region may have a slightly different percentage change as do the types of plans involved: EPO, HMO, PPO. Some carriers may decrease the rates of their PPO plans while increasing the rates of the HMO plans they offer.

In 2021, many carriers reduced the rates of their health plans in California in many of the 19 different rating regions. The annual changes to the rates are a function of utilization of health care services of the plan members along with contracted or negotiated costs for those health care services and prescription drugs. In years past, if you reviewed the rate filing documents each carrier must submit to the regulating agency, prescription drug cost has been a big driver of rate increase as the cost of drugs has increased faster than inflation.

Of course, in 2020, California was beset with the Covid-19 shut down. People were not going in for routine health care services and many elective procedures were cancelled. The carriers factored in the 2020 reduction in utilization of services along with an anticipated future decrease in the demand for those services in 2021. Consequently, many of the carriers reduced their rates to reflect the lower cost-sharing they would be responsible for.

4. Covered California Subsidies

Finally, the biggest wild card to what an individual will pay on a monthly basis for health insurance is if they get a health plan through Covered California with a subsidy. Undoubtedly the largest influence on the subsidy and final monthly rate is the income. The lower the income, the larger the subsidy. But there is another input that throws all the projections out the window and that is the rate of the Second Lowest Cost Silver Plan.

Individuals with a stable income amount from year to year have seen wild swings in their monthly rates because of a change of the Second Lowest Cost Silver Plan. Both the federal and California premium assistance subsidies focus on making the Second Lowest Cost Silver Plan (SLCSP) affordable. If the SLCSP has a blanket rate increase larger than the selected plan, the consumer gets a relatively larger subsidy. If the SLSCSP has a blanket rate decrease and the selected plan has a rate increase, the subsidy shrinks from year to year.

Then there can be the major disruption of a new plan coming into the region’s market and completely reordering the subsidy calculations.

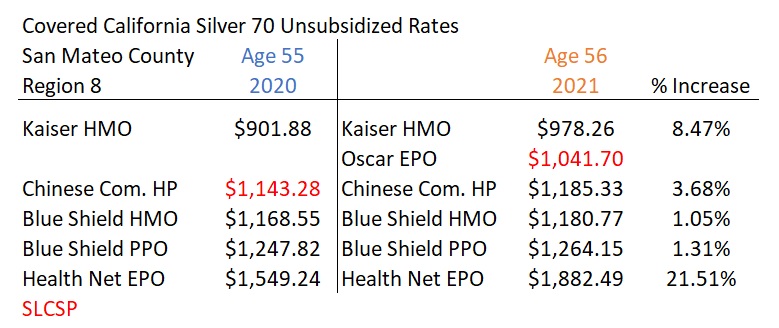

In San Mateo County, Region 8, the 2020 full rate for the Kaiser Silver 70 plan for a 55-year-old individual was $901.88 through Covered California. In 2021, the individual is one year older, now age 56, and Kaiser had a blanket rate increase of approximately 4 percent. This made the year over year rate increase for the 56-year-old 8.47 percent (blanket rate increase + age rate increase.) Note that the Chinese Community Health Plan was the Second Lowest Cost Silver Plan in Region 8 in 2020. In 2021, Oscar health plan expanded into Region 8 and became the new SLCSP.

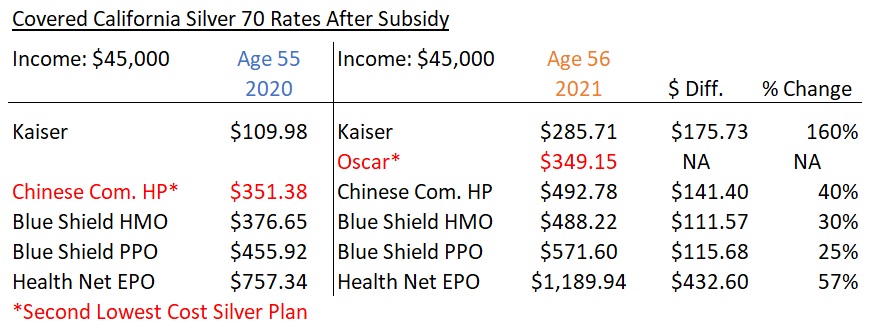

The 56-year-old San Mateo County resident purchased health insurance through Covered California in 2020 and 2021. The estimated income was $45,000. In 2020, after the Covered California subsidy, the individual paid $109.98 per month for the Kaiser Silver 70 plan. In 2021, the Kaiser Silver plan jumped to $285.71, a 160 percent increase over the prior year.

The bulk of the huge rate change is attributable to a decrease in the monthly subsidy. Oscar health plan became the SLCSP with a rate lower than the previous SLCSP of 2020. Because the subsidy is based on the SLCSP, which effectively had a rate decrease in 2021, and the individual realized a rate increase for his age and the blanket increase from Kaiser, the new rate is over double what the consumer had been paying in 2020.

The introduction of the much lower Oscar Silver 70 plan reduced the subsidies for everyone in San Mateo County. In general, the federal and California health insurance subsidies have made comprehensive health care and prescription drug coverage affordable for scores of people. The downside is the volatility introduced by the subsidy calculation when it is based on the Second Lowest Cost Silver Plan in the region.