It is perplexing to many Covered California plan members why their monthly health insurance cost does not decrease when they remove one of their family members from their health plan. The expectation is that removing the family member will proportionally reduce the family’s monthly health insurance premium. Sometimes the monthly insurance bill increases. Why? A factor for determining the subsidy is the household income. With one less person to insure, the subsidy decreases, increasing the monthly rate. This is all a function of the consumer responsibility percentage of the Affordable Care Act.

Removing Family Member May Not Reduce Your Covered California Monthly Health Insurance Premium

While there are several factors that can influence the subsidy, it is the income and consumer responsibility percentage variables that create the confusing situation of health insurance costs increasing when fewer people are insured. The caveat for this particular subsidy situation is that the individual removed from the health plan is STILL a member of the tax household. In other words, the subsidy is meant to keep the cost of health insurance no more than a certain percentage of the household income based on the household size and where the income is relative to the federal poverty level (FPL.)

When the household size and income are constant, the variable that influences the monthly Covered California health insurance premium from being reduced is the consumer responsibility percentage. The monthly subsidy will increase or decrease in order to keep the household annual health insurance premiums no more than the consumer responsibility percentage. Regardless of the number of household individuals enrolled, the subsidized premiums will be based on making the Second Lowest Cost Silver Plan no more than the consumer responsibility percentage.

Consumer Responsibility or Fair Share

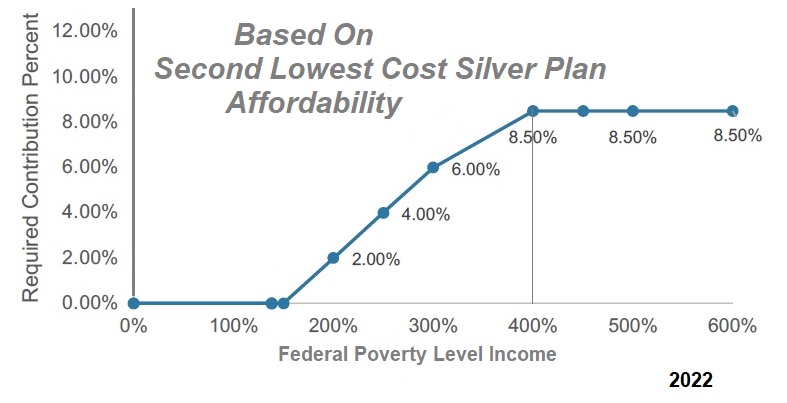

Under the Affordable Care Act the subsidies center around making the Second Lowest Cost Silver Plan affordable for individuals and families. Affordable is making sure that the cost of the health insurance doesn’t exceed a certain percentage of the household income. This percentage is referred to as the consumer responsibility of fair share percentage. The consumer responsibility is 0 percent at 138 percent of the federal poverty level income and goes up to 8.5 percent for household incomes at and over 400 percent of the federal poverty level income.

To rephrase, no household should have to pay more than 8.5 percent of their income toward the Second Lowest Cost Silver Plan offered to them in their region. If the Second Lowest Cost Silver Plan, on an annual basis, costs more than the determined consumer responsibility percentage, the health insurance subsidy makes up the difference. If the annual rate of the Second Lowest Cost Silver plan is less than 8.5 percent of the household income, there will be no subsidy.

You can use the Covered California income table, which is updated a couple times per year, to determine your household income as percentage of the federal poverty level. The IRS also has the information in the instructions for form 8962.

When you remove a family member from the health plan only, not the tax household, and everything else stays the same, the subsidy will decrease. The income is the same. The household size is the same. The full rate of the health insurance has been reduced. As the health insurance cost is reduced, the subsidy is reduced as less subsidy is needed to keep the household’s health insurance premium at the consumer responsibility level.

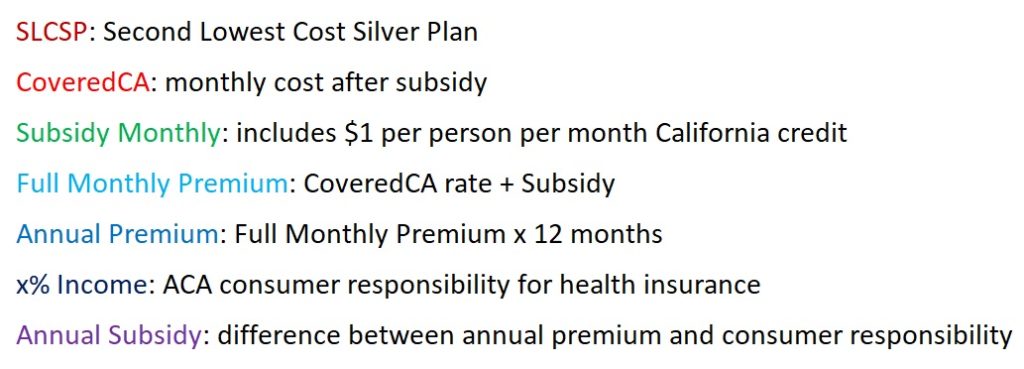

Below are some household examples of the subsidy calculation and the definitions for the terms of the different variables and results.

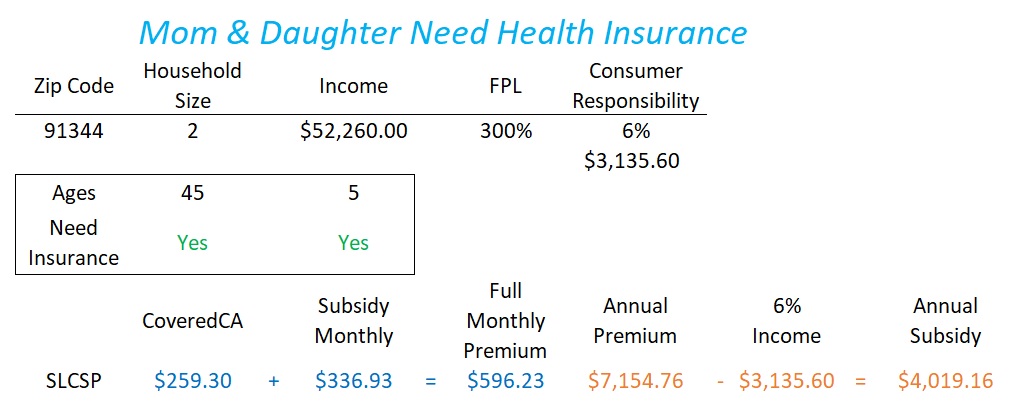

Mom & Daughter Need Health Insurance

In this scenario, we have a 45-year-old mother and her 5-year-old daughter. They both need health insurance. The tax household is two, estimated income of $52,260, which is 300 percent of the federal poverty level (FPL.) At 300 percent of the FPL, the household is expected spend no more than 6 percent of the household income on the health insurance for the Second Lowest Cost Silver Plan (SLCSP), which is $3,135.60 for this family.

When the information is put into the Covered California Shop and Compare tool, the Second Lowest Cost Silver Plan (SLCSP) is determined to be $259.30. The subsidy* offered is $336.93 per month. The sum of the Covered California premium ($259.30) and the subsidy offered (336.93) equals the full unsubsidized of the Silver plan.

*The Covered California subsidy includes a $1 per person per month credit. Consequently, the sum of the monthly subsidy over 12 months will differ from the Annual Subsidy result by $12 to $24.

The monthly premium multiplied by 12 months yields an annual premium of $7,154.76. This is more than the consumer responsibility (6%) of $3,135.60. The subsidy is determined by subtracting the consumer responsibility dollar amount from the annual premium. In this case, the annual subsidy is $4,019.16, or approximately $336.93 per month. The subsidy can be applied to any carrier or metal tier plan. However, it is the SLCSP that is the input in determining the subsidy.

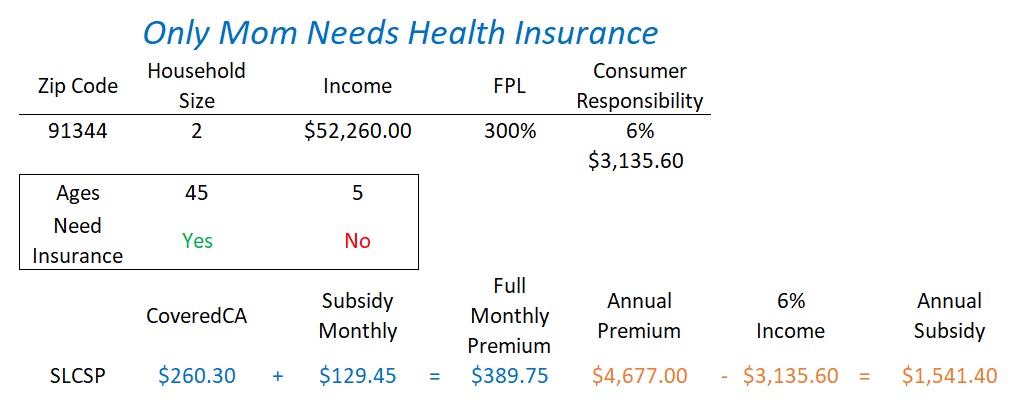

Only Mom Needs Health Insurance

In this scenario, the daughter does not need health insurance because she might be covered under her father’s plan. As long as the mother declares her daughter as a tax dependent, the daughter is still part of the tax household. With the family size and income the same, the consumer responsibility is still at 6 percent of income or $3,135.60.

The SLCSP for the mother is $389.75 per month. After a $129.45 subsidy, the mother’s Covered California premium is $260.30, one dollar more when two people were on the health plan. The annual premium is still greater the consumer responsibility percentage. The subsidy is smaller, $1,541.40, because fewer dollars are needed to keep the total annual subsidized premium at 6 percent of the household income.

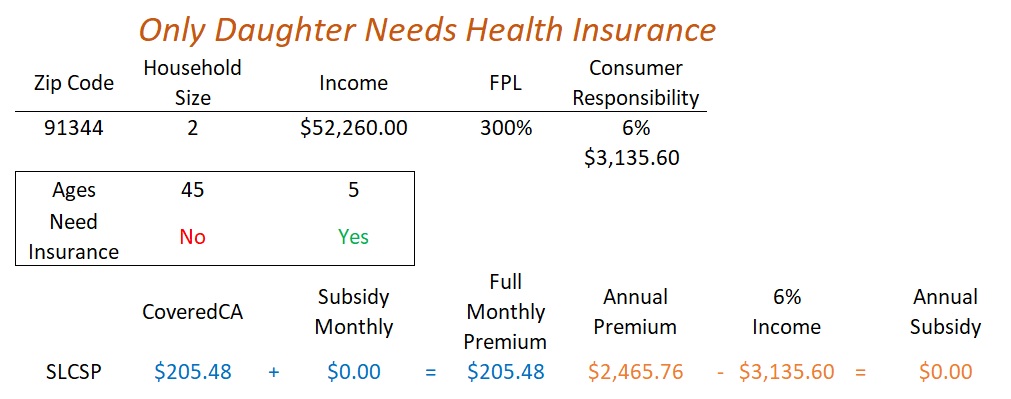

Only Daughter Needs Health Insurance

In this family, the mother has gained Medicare because of a disability and no longer qualifies for Covered California. Only the daughter needs health insurance. The income, household size, and consumer responsibility remain unchanged. Because the annual cost of the daughter’s health insurance ($2,465.76) is less than the consumer responsibility of $3,135.60, there is no need for a subsidy to reduce the cost. The SLCSP is consider affordable. There is no subsidy to reduce a more expensive Silver, Gold, Platinum plans.

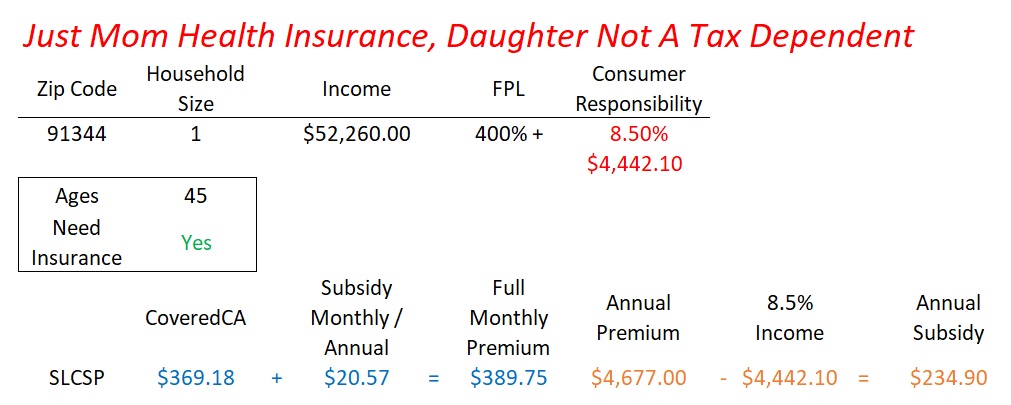

Just Mom, Daughter Not A Tax Dependent

In some families, non-married parents may switch every year which parent take the children as a tax dependents. In this year, a 45-year-old mother is letting the father take her daughter as a tax dependent and provide the health insurance. Only the 45-year-old is applying for health insurance and the household size is 1. The income is unchanged at $52,260, but for a smaller household size, the dollar amount is now greater than 400 percent of the FPL. The consumer responsibiity percentage is higher at 8.5 percent of the household income or $4,442.10.

The SLCSP annual premium is $4,677.00 and the consumer responsibility is $4,442.10 translating into a small $234.90 annual subsidy or $20.57 per month. This illustrates how the household size can substantially influence the subsidy.

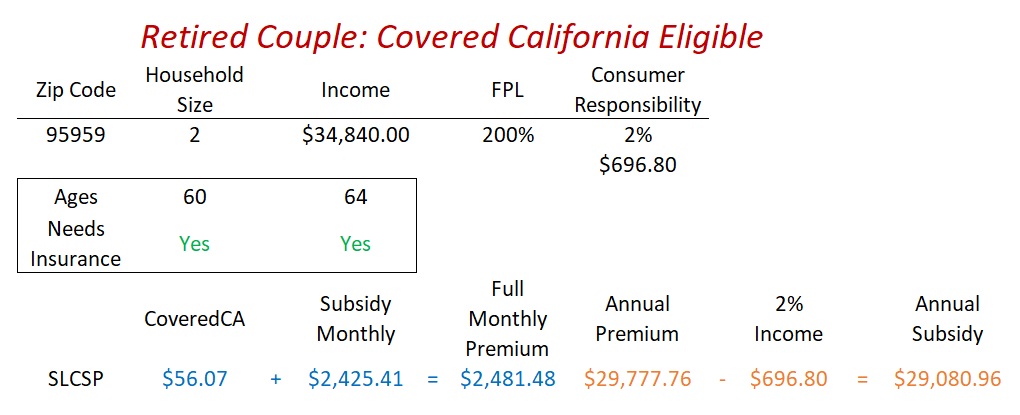

Retired Couple: Covered California Eligible

Another example is a couple living in Northern California who are retired. Their ages are 60 and 64 with an income of $34,840. The household size of two with their income puts them at 200 percent of the FPL. Their consumer responsibility percentage is 2 percent of their household income. This means they should spend no more than $696.80 on health insurance annually for the SLCSP.

The SLCSP premium from Covered California is calculated at $56.07 after a monthly subsidy of $2,425.41. The unsubsidized annual rate for the SLCSP is $29,777.76. Subtracting their consumer responsibility of $696.80, the annual subsidy for the two individuals is $29,080.96.

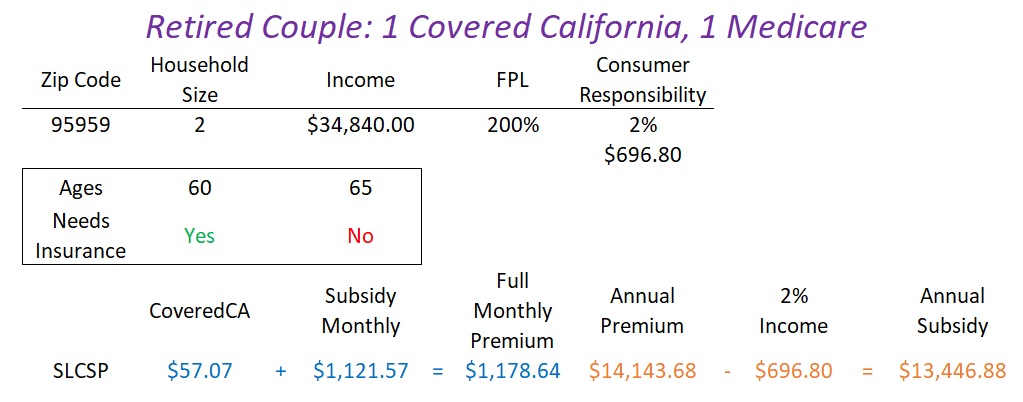

Retired Couple: 1 Covered California, 1 Medicare

When an individual turns 65 years old and is eligible for Medicare, that individual is no longer eligible for Covered California. In this example, one of the members of the household has turned 65 and transitions off of Covered California. It is still a tax household of two with the same income of $34,840, 200 percent of the FPL, 2 percent household consumer responsibility with maximum expenditure on health insurance of $696.80.

Even though the full unsubsidized annual health insurance premium was reduced by $15,634, the monthly subsidized premium for the remaining 60-year-old individual increased by $1. This $1 increase is a function of losing the $1 credit per member per month extended by California to all enrolled Covered California individuals. Since the household size of two and income did not change, the subsidy is adjusted to keep the SLCSP no more than 2 percent of the household income, regardless of the number of people enrolled in a Covered California.