President Trump’s Executive order could be interpreted to waive repayment of Advance Premium Tax Credits and the Shared Responsibility Payment.

Under an Executive order signed by President Trump on January 20, 2017, he gave federal bureaucracies the discretion and authority to waive any provision of the Affordable Care Act that might impose a fiscal burden on individuals and families. Two of the most prominent fiscal burdens are the repayment of excess Advance Premium Tax Credits and the Shared Responsibility Payment also known as the individual mandate penalty for not having health insurance. While the executive order may not apply to 2016 tax returns, because the departments must still follow rules governing notice and comment periods to change regulations, it’s unclear if individuals and families will have to repay excess Premium Tax Credits or the Shared Responsibility Payment for 2017.

Trump Executive Order On ACA

Section 2 of the Minimizing The Economic Burden of the Patient Protection and Affordable Care Act Pending Repeal Executive order is rather vague.

Sec. 2. To the maximum extent permitted by law, the Secretary of Health and Human Services (Secretary) and the heads of all other executive departments and agencies (agencies) with authorities and responsibilities under the Act shall exercise all authority and discretion available to them to waive, defer, grant exemptions from, or delay the implementation of any provision or requirement of the Act that would impose a fiscal burden on any State or a cost, fee, tax, penalty, or regulatory burden on individuals, families, healthcare providers, health insurers, patients, recipients of healthcare services, purchasers of health insurance, or makers of medical devices, products, or medications.

[wpfilebase tag=fileurl id=2065 linktext=’ Executive Order Minimizing Economic Burden ACA’ /]

Excess Premium Tax Credit Repayment

The largest penalty any household could anticipate for actually having health insurance through the Marketplace Exchange is having to repay ALL the Advance Premium Tax Credits if their Modified Adjusted Gross Income (MAGI) exceeds 400% of the federal poverty level (FPL). There is no repayment limitation if the MAGI goes over the limit. If a family received $10,000 in a monthly tax credit subsidy during the year to lower their health insurance premium, and the household income exceeds 400% of the FPL, when they do reconcile the tax credits on IRS Form 8962 for the tax year, they must repay all $10,000.

Even if the individual or family does not exceed 400% of the FPL, but their income was still higher than originally estimated, they will have to repay some if not all of the difference. The difference is what the individual or family was advanced versus how much they are actually entitled to with their final MAGI as calculated on form 8962. The maximum repayment amount for incomes below 400% of the FPL is $1,275 for tax payer filing single and $2,550 for all other filing statuses.

Does the Executive order give the Department of Health and Human Services (HHS) the authority to tell the IRS not to collect the excess repayment penalty? It’s clear to most people that having to repay all the APTC, or even a limited amount, can be interpreted as a fiscal burden on a tax payer. This is an area that needs to be worked out between HHS and the IRS.

Shared Responsibility Payment

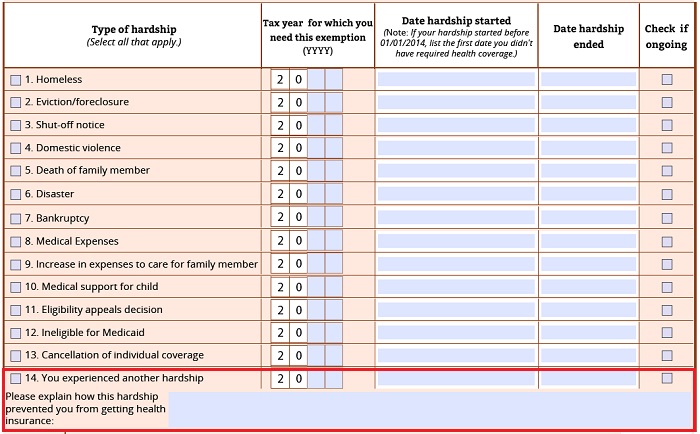

Another fiscal burden in the form of a penalty is the Shared Responsibility Payment for not having health insurance. The Shared Responsibility Payment is also remitted to the IRS. It is reported on line 61 of the 1040 federal tax return and calculated on Form 8965 Health Coverage Exemptions. Better known as the individual mandate, the Shared Responsibility Payment penalty was meant to drive healthy people into the health insurance market to balance the membership pools for the health plans. To qualify for an exemption from the Shared Responsibility Payment, tax payers must generally apply for one of several coverage exemptions through Healthcare.gov.

The easiest exemption to get under the new Executive order might be one for General Hardship. Another might be coverage was unaffordable.

General hardship—The Marketplace determined that you experienced a hardship that prevented you from obtaining coverage under a qualified health plan.

Coverage considered unaffordable based on projected income—The Marketplace determined that you didn’t have access to coverage that is considered affordable based on your projected household income.

Healthcare.gov list of exemptions for Shared Responsibility Payment for IRS.

If granted, Healthcare.gov then issues an Exemption Certificate Number that is included on Form 8965 for each individual who is claiming that particular exemption from the Shared Responsibility Payment. Under the relaxed enforcement rules from the Executive order, Healthcare.gov may grant a hardship exemption for the thinnest of excuses. But we won’t know until the Health and Human Services Department institutes new rules consistent with the Executive order.

If the new HHS rules essentially gut the Shared Responsibility Payment, and they easily grant hardship exemptions, we could see individuals and families begin to drop health insurance later in 2017. If enough people begin to drop coverage, it could seriously undermine the viability of the health plan for the members that retain insurance if the membership pool shrinks too much. It will be up to the new HHS Secretary to implement rule changes consistent with the Executive order and potentially balance those relaxed rules with the sustainability of the health plans already in existence.

[wpfilebase tag=file id=2067 /]

[wpfilebase tag=file id=2066 /]

[wpfilebase tag=file id=1950 /]

[wpfilebase tag=file id=1949 /]

[wpfilebase tag=file id=2074 /]