The persistence of unvaccinated individuals consuming health care and hospital services to treat Covid-19 has the potential to increase the health insurance premiums for all residents in their region. Health insurance rates are a reflection of past claims for health care services and expected future claims. Health insurance companies will undoubtedly carefully analyze regions with high populations of unvaccinated individuals and increase the rates to cover future expenses to reflect the risk.

It is doubtful that in California individuals who remain unvaccinated would be slapped with a surcharge to cover the risk of future medical claims associated with treating a Covid-19 infection. That is not the way California approaches health insurance rates. However, the health plans can increase rates in regions that have demonstrated elevated health care costs and reasonably predict the higher cost trend to continue because of unvaccinated adults.

Unvaccinated Hospitalizations Increase Costs and Health Insurance Premiums

When it comes to insurance, the management of risk for paying high claims expenses, insurance companies would like to rate each individual for their potential risk. They way they used to do before the Affordable Care Act (ACA.) This is common in life insurance where medical history and current physical status (height, weight, tobacco use, etc.) are considered when offering life insurance at a specified rate for set death benefit.

Before the ACA, women of child bearing age had health insurance rates higher than men of the same age and zip code. The increased health insurance premiums reflected the probability that a woman could become pregnant leading to higher health care claims. Some states still allow for higher rates for individuals who use tobacco. California does not allow a rate differential for tobacco use. Oddly, people who oppose being vaccinated on issues surrounding personal choice, are the beneficiaries of the ACA’s generous structure that prohibits health plans from increasing rates for people who opt against preventative health care.

Initially, with the advent of the ACA, individuals between the ages of 0 – 20 years old received the same rate. That changed in 2018 when, after the health plans successfully lobbied for a change, individuals between 0 – 14 years old have one rate. This meant that the health plans could charge more for ages 15 – 19 years of age. Otherwise, the health plans are regulated to have their highest health insurance premium at age 64 years of age no more than 300 percent of the base adult rate at 21 years of age. The change for higher rates for teenagers reflected the experience that individuals in that age range were incurring higher claims than their younger counterparts.

Pre-Existing Condition Rate Increases

Currently, rates are based on age and zip code. Gender, pre-existing conditions, alcohol consumption, tobacco use, extreme sports participation, recreational drug use, and Covid-19 vaccination status are not considered for individual health insurance rates. This means that the health plans must focus on the region that make up the pool of potential health plan members and the trends of disease and accidents in the communities.

California is broken up into 19 different rating regions. Some regions comprise multiple counties and other regions are a single county. Los Angeles is split into two regions. Southern California regions can have health insurance rates 10 to 30 percent lower than Northern California. This difference in rates is a reflection of the hard costs associated with health care services. In short, hospitals charge more in Northern California for the same services as hospitals and some doctors in Southern California.

Outside of the costs of regional health care services, it is claims experience (past, current, and future) that drive health insurance premiums. Some regions have inherently more health care services specific to the location. Southern California probably has more claims for health care services involving skin disease than the North Coast. More people in Southern California are exposed to damaging sunlight because of the pleasant weather than in Mendocino County where it is colder and has more rain. Consequently, the health insurance premiums in Southern California counties factor in for more incidents of treatment of skin related diseases than in Norther Counties.

If the health insurance companies see a persistent trend within specific regions experiencing higher claims for Covid-19 related treatments and hospitalizations, that also will be factored into the rates. The easiest way to reduce the regional costs is with increased vaccination rates which will translate into lower hospitalizations. Of all the health care expenses a health plan covers, hospitalization is perhaps the most expensive. It only takes less than 100 extra hospitalizations over the normally expected frequency in a rating region to add millions of dollars in claims the health plans must partially or totally cover.

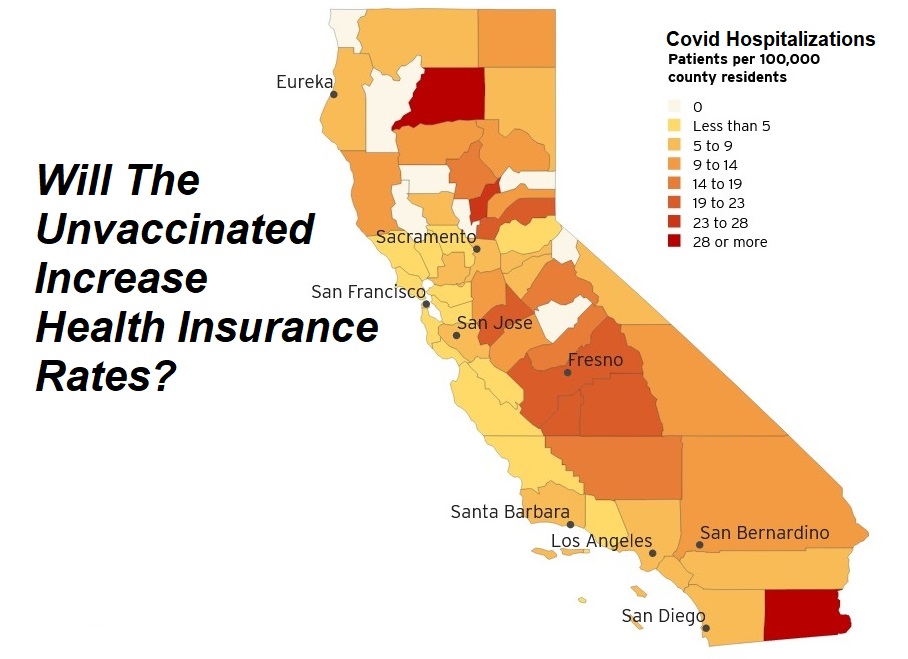

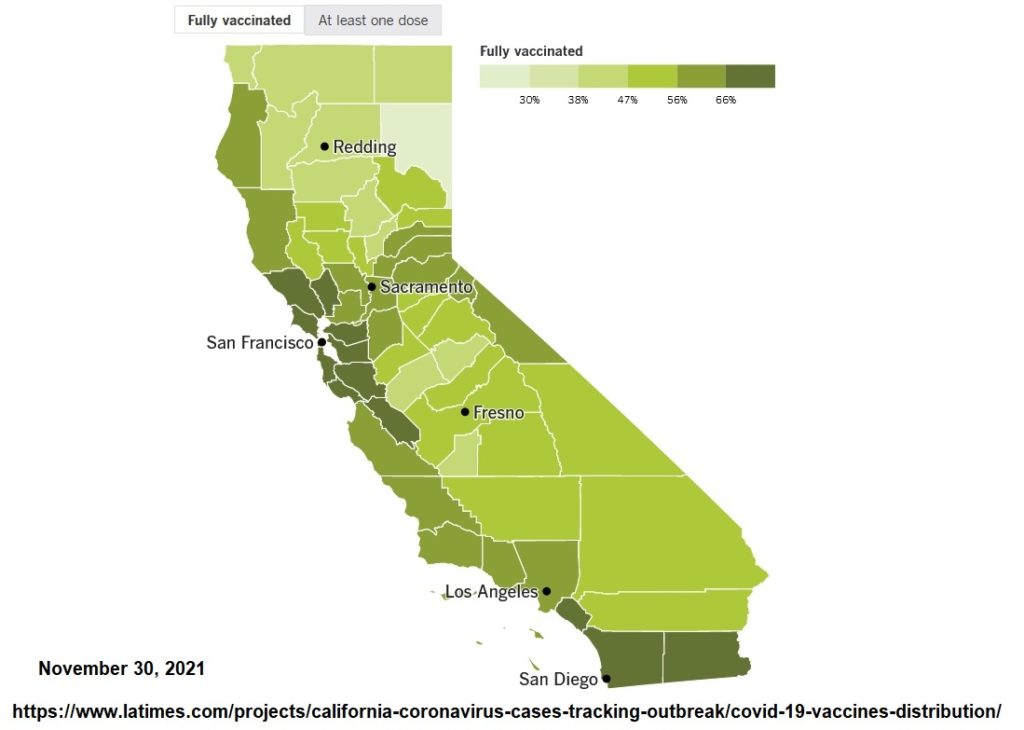

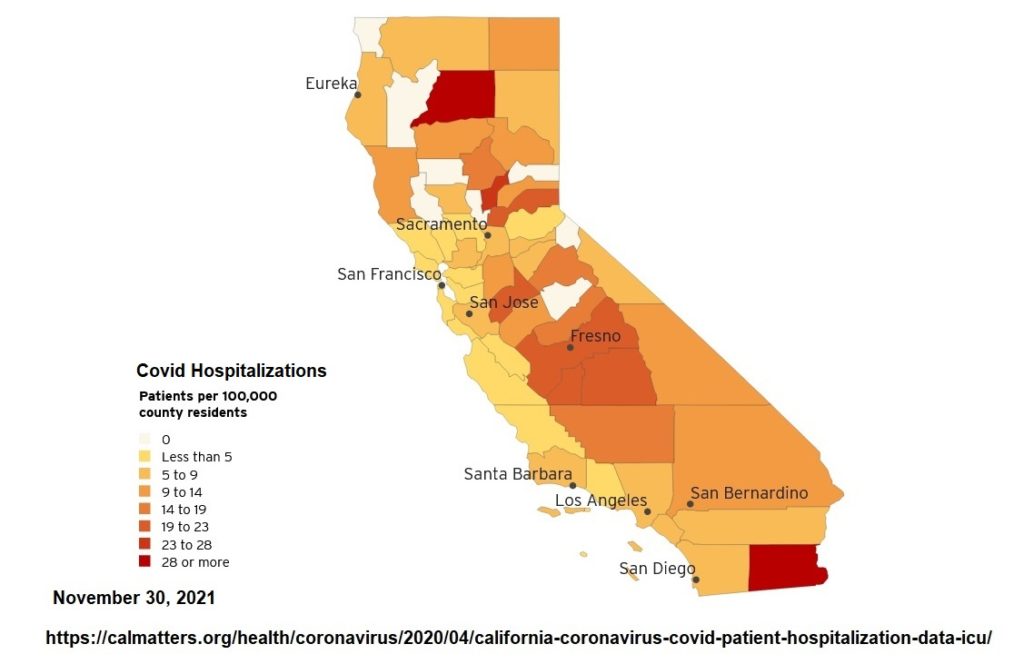

Rating Region Vaccination and Hospitalizations

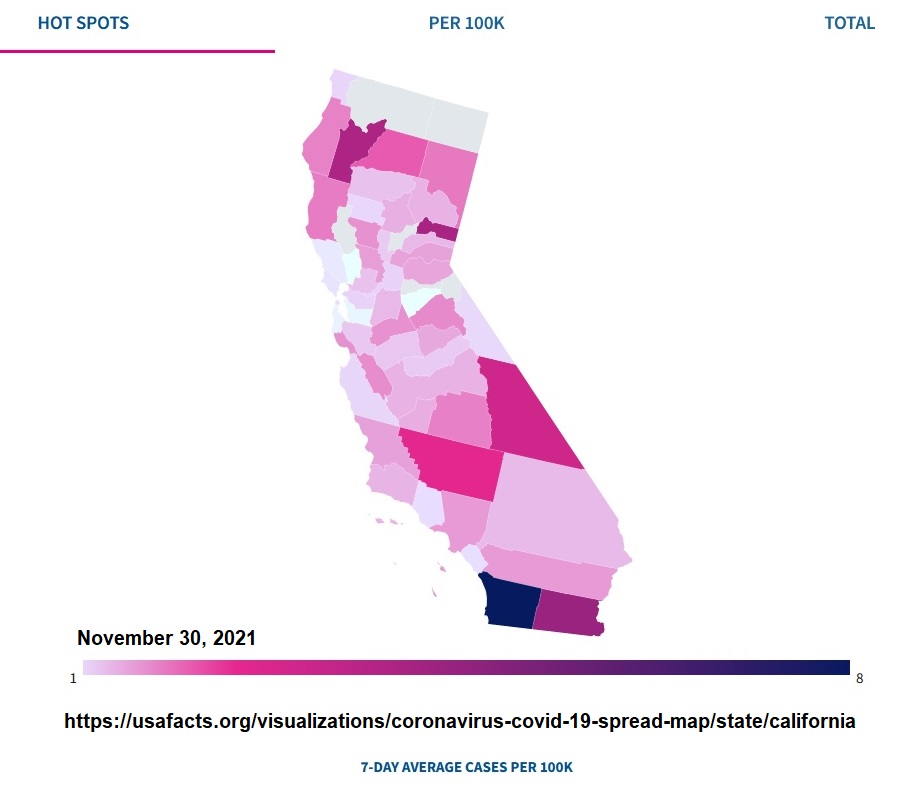

There is a close correlation between increased hospitalization for Covid-19 treatment in counties and regions that have low vaccination rates. Region 1 encompasses eighteen Northern California counties. Except for Mendocino and Humboldt, most of the counties are below 50 percent vaccination rates. Shasta and Yuba counties, as of the end of November 2021, had higher hospitalizations due to Covid-19 than most of the rest of the state. The elevated claims experience for Covid-19, if it persists into 2022, will impact the rates for the rest of the counties in Region 1.

Fresno, King, and Madera counties, that comprise health insurance rating Region 14, are also experiencing above normal Covid-19 hospitalization. That region also has a relatively low adult vaccination rate. Imperial County, which is part of Region 13 Eastern Counties, has very high Covid-19 hospitalizations. Region 13, overall, has a modest vaccination rate among adults. Even though Imperial is not contiguous with the other two counties in the region (Mono and Inyo) for Region 14, Imperial’s increased hospital related Covid-19 treatment claims experience may increase those counties rates as well. Interestingly, Imperial County has a relatively high vaccination rate. The reported high hospitalizations may be an anomaly or have another reason such as individuals hospitalized from nearby regions.

Unvaccinated individuals will not see a direct financial burden from declining the Covid-19 vaccine in California unless they are hospitalized and have to pay a portion of the hospital invoice. However, if the health plans anticipate a low vaccination rate in a region and see a corresponding increase in hospitalization claims for Covid-19 treatment, they will most assuredly increase the rates to cover the potential risk. Indirectly, unvaccinated individuals will drive up the health insurance rates for all of their community members who are enrolled in most California regulated health plans.

The impacts will be felt in the individual and family market, small groups, some large employer groups, and potentially Medicare. Medi-Cal HMO plan rates will most likely be adjusted upward adding to the health insurance costs for the counties, California, and the federal government. If California was one large rating region, the higher vaccination and lower hospitalizations of some counties would dilute the higher costs inflicted by the unvaccinated. Because of the nineteen different rating regions, some regions may experience higher health insurance rates because a sizeable portion of the adult population refuses to get vaccinated, thereby lowering Covid-19 related hospitalization costs.