The formula for calculating the Affordable Care Act subsidies dispensed by Covered California is complicated and sometimes counter-intuitive. Consequently, it can be difficult to determine why your premium increased more than the average or why it dropped from one year to the next. Two of the key inputs is the annual premium of the second lowest cost Silver plan in your region and consumer responsibility percentage.

Subsidy Calculations May Wipe Out Any Rate Increase

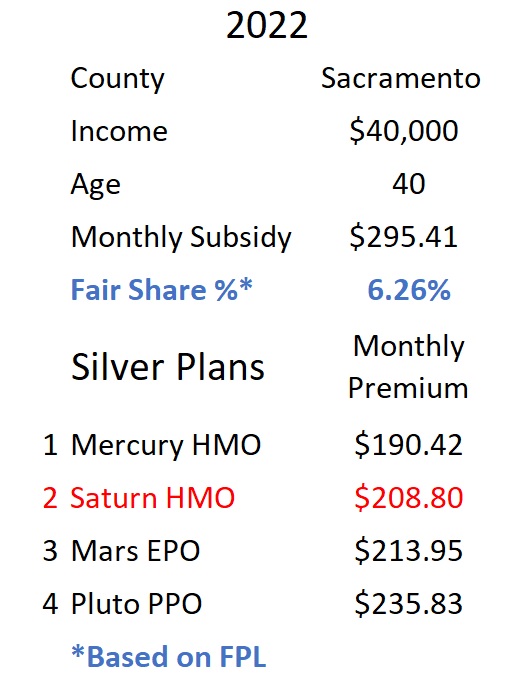

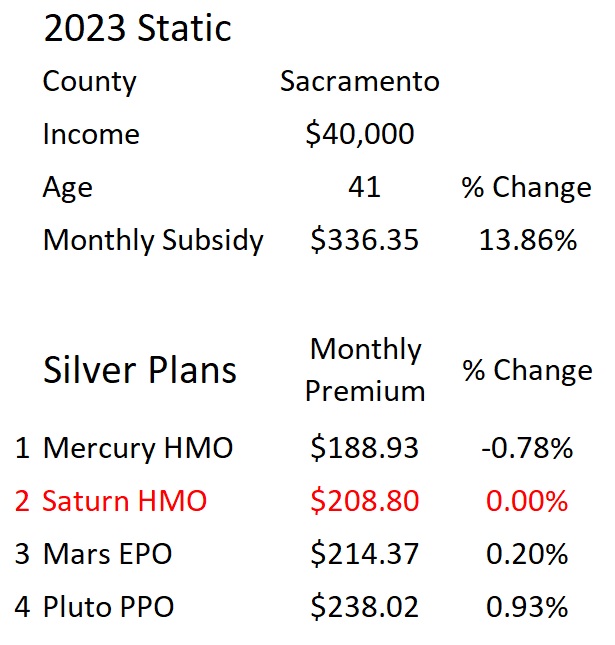

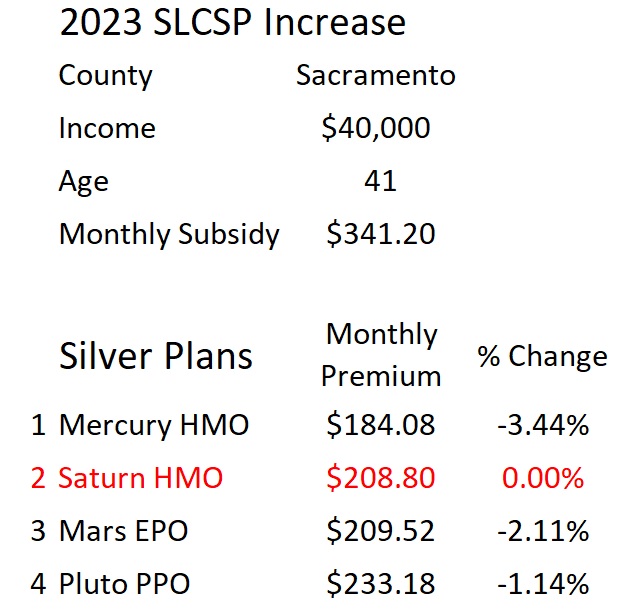

To illustrate the influence of the second lowest cost Silver plan on the subsidy, I created a sample enrollment that spans from one year to the next. To simplify the variables in the subsidy calculation, I kept the county, income, and consumer responsibility fair share percentage the same from one year to the next.

The sample Covered California application has a 40-year-old individual, living in Sacramento County, with an annual income of $40,000. The consumer fair share or consumer responsibility percentage can vary slightly from year to year because it tied to the federal poverty level (FPL.) The fair share percentage translates into the consumer’s responsibility for their health insurance premiums. If the second lowest cost Silver plan annual premium is more than the consumer’s responsibility, the subsidy makes up the difference.

In this example the consumer responsibility percentage is 6.26.

In other words, the consumer should spend no more than 6.26% of their household income for the second lowest cost Silver plan.

For the plan year 2022, this 40 year old individual at $40,000 income, received a Covered California subsidy of $295.41 to apply to any plan offered to them. The subsidy made the second lowest cost Silver plan, Saturn HMO, $208.80 per month for this consumer.

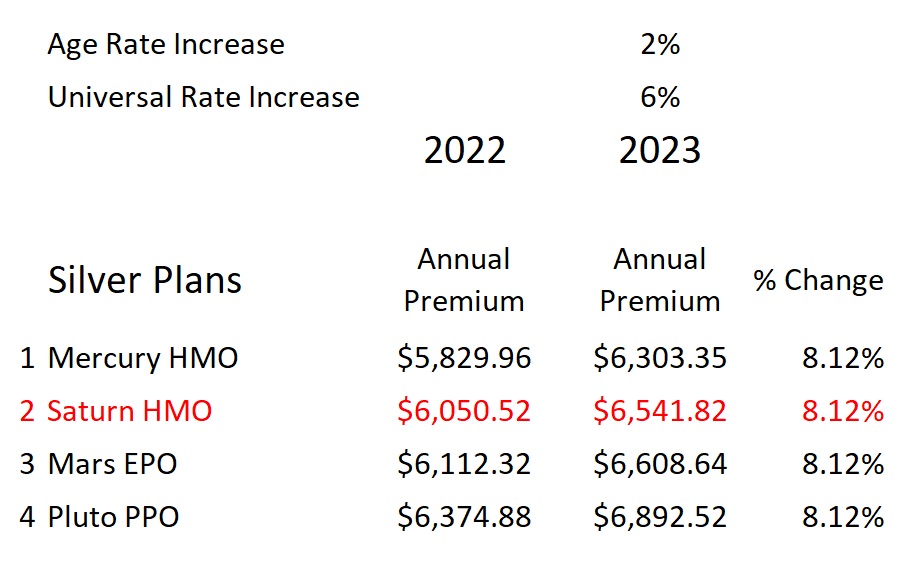

In most years, as we get one year older, the health insurance rates increase. From age 40 to 41 there is a 2 percent increase. Every year the health insurance companies also apply a universal rate increase or decrease. For 2023 the average rate increase is 6 percent. This means unsubsidized health plans will increase a little more than 8 percent for this individual. In order to keep the illustrations simple, I applied the same universal increase to all the health plans in this example, but that may not be the case where you live.

For this consumer, the 2023 subsidy increased 13.86 percent to $336.35 based on the second lowest cost Silver plan annual premium increase. The increased subsidy means that the second lowest cost Silver plan remains constant at $208.80 per month based on the consumer responsibility percentage of 6.26. The lowest cost Silver plan, Mercury HMO, shows a premium decrease from 2022 to 2023. The higher cost Mars EPO and Pluto PPO had less than a 1 percent premium increase. Note, the premium changes are below the unsubsidized 8.12 percent increase.

When The Silver Plan Rate Does Not Follow The Average

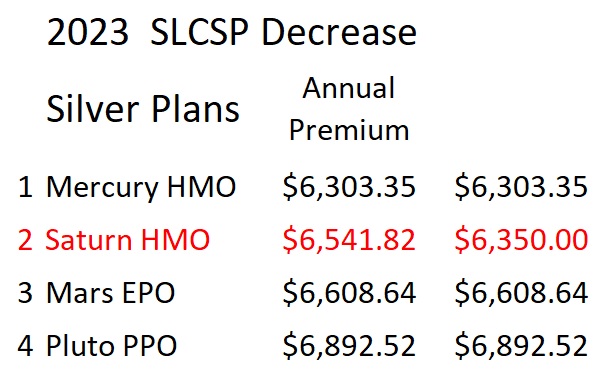

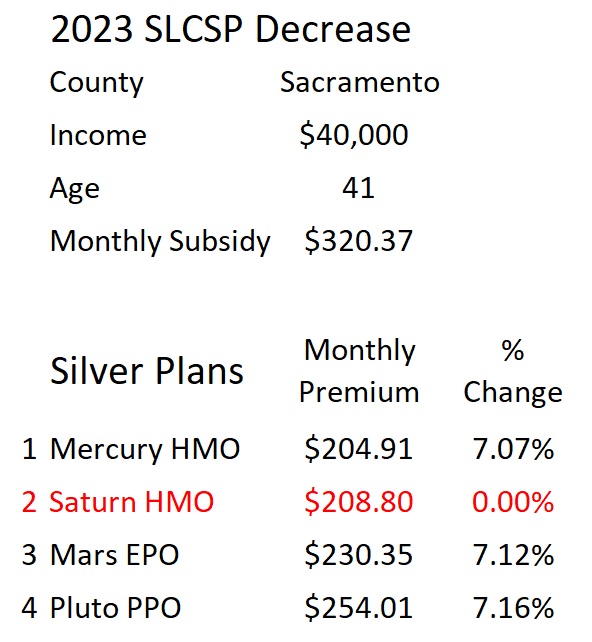

What happens if the second lowest Silver plan decreases in annual cost from one year to the next? Such a decrease can happen in two ways. First, the second lowest cost Silver plan can have rate decrease, as shown with the Saturn HMO plan. Secondly, a new health plan can enter the market place with a lower rate and become the second lowest cost Silver plan. Both scenarios have happened in California. In this example, the Saturn HMO decreases in annual premium by $191.

When the second lowest cost second Silver plan is less expensive than the year before, the subsidy decreases. The consumer would realize a 7 percent increase in their monthly premium if they were enrolled in any other Silver plan. Note how the formula adjusts the subsidy to keep the second lowest cost Silver plan stable with no premium increase.

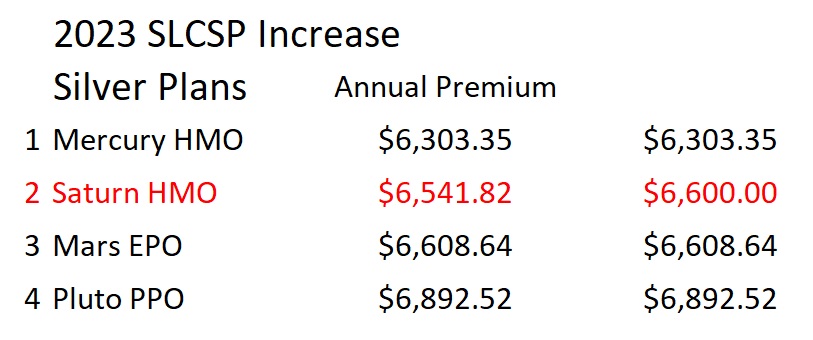

What happens if the second lowest cost Silver plan annual premium increases more than the other health plans? In this example the Saturn HMO increased more than 8 percent and the annual premium is $6,600 for 2023.

Of course, if the annual premium for the second lowest cost Silver plan increases more than the other plans, it increases the subsidy for all consumers. In this example, the consumer would see monthly premiums for most plans below the 2022 levels. However, the second lowest cost Silver plan would have no increase from 2022 to 2023, even with the larger annual unsubsidized premium increase.

This is obviously a simplified version of a real life situation. Most of the time, incomes, household size, and the selected health plan rate changes can all deeply influence the subsidy from one year to the next. Because this is a complicated topic – with too many numbers – I recorded a video that might help some people grasp the concept from a different approach.