Young adults and families will notice a health insurance rate increase larger than the average because rates for individuals under 21 have been hiked up.

Because of new federal guidelines regarding health insurance rates for young adults, families with dependents between 15 and 20 years of age will notice an above average increase in their monthly health insurance premiums in 2018. A review of health insurance rates in Northern and Southern California shows rates for young adults will increase between 30% to over 40%. Instead of the 6% to 16% increase in rates for adults only, families could experience a 20% increase in health insurance rates in 2018.

Feds Mandate Young Adult Rate Increase For 2018

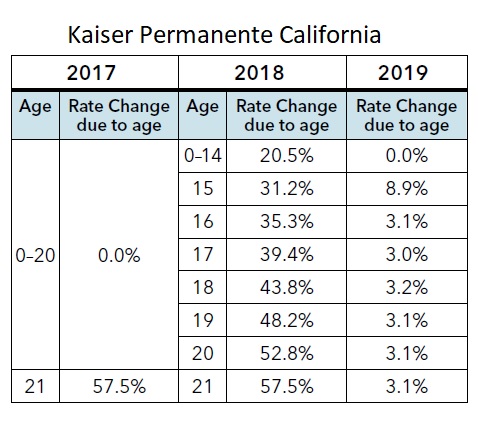

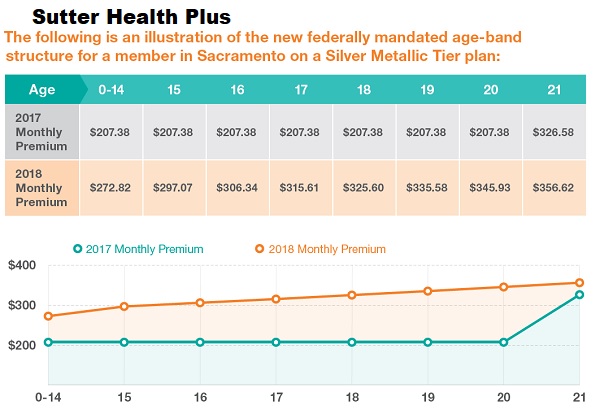

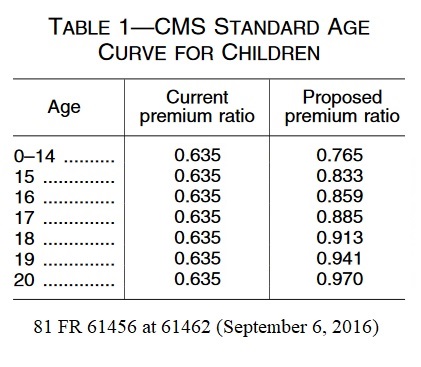

From 2014 through 2017 under the Affordable Care Act individuals between the ages of 0 and 20 had one set rate. The 20-year-old had the same rate as a 5 year. The original premium ratio was that ages 0 -20 would be 0.635 of the 21-year-old adult rate. In 2018, 0 – 14 will be 0.765 and it increases with each year of age until the 20-year-old rate is 0.970 of the adult rate.

New age ratios from the federal government will hike up all rates for individuals under 21 years old.

In general, health insurance rates are influenced by two factors. First, people get a year older and the new age has a higher rate attached to it. Second, health insurance companies will increase rates for all ages based on the increasing costs of health care and any additional coverage benefits. But in 2018 families will get hit with a new form of rate increase from the higher allowable rate ratios for their dependents.

Hypothetical Household Hit With Large Premium Increases

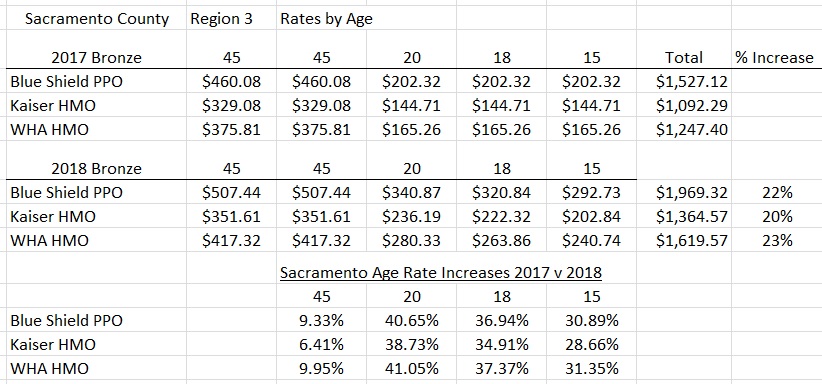

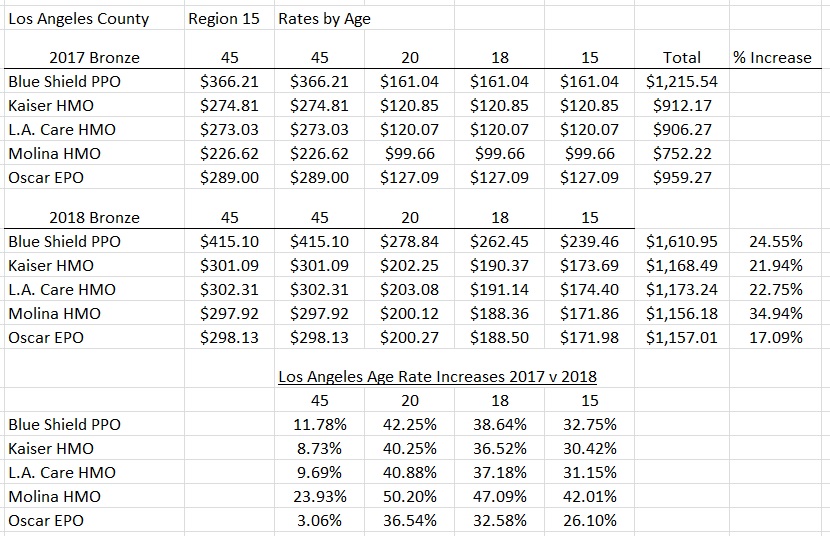

To see how the new dependent rate ratios actually affected families I compared the Bronze plan rates between 2017 and 2018 for a family of five. The ages were two adults at age 45 with three dependents ages 15, 18, and 20. I selected the Bronze plan because Covered California has imposed a surcharge on Silver plan rates for 2018 making them artificially high. The Bronze plan rates for the standard benefit Qualified Health Plans will be the same either through Covered California or off-exchange directly from the carrier. I also limited my review to plans that were offered both in 2017 and will be offered in 2018.

Sacramento Region Families To See 20% Rate Hikes

In Sacramento County, Region 3, my hypothetical household will see an overall rate increase of between 20% and 23% from Blue Shield, Kaiser, and Western Health Advantage Bronze plans. Covered California states in their rate booklet that the lowest cost Bronze (Kaiser) plan in the region increased by 6.6% for 2018. But a family with the dependents in a Kaiser Bronze plan will actually see a 20% rate increase in 2018. The dependent rate hikes of between 28% to 41% accounts for the above average rate increase for the entire household.

Northern California Sacramento County health insurance rates for families for 2018 will be above average because rates for young adults have spiked up over 30%.

Los Angeles Area Families To Feel Large Premium Increases

Los Angeles County, Region 15, experiences a similar increase in rates. Covered California reports that the lowest cost Bronze plan in this region increased by 16%. The family of five would experience a rate increase of between 17% and 34%. Two notable differences between Los Angeles and Sacramento is that Molina had an enormous rate increase of up to 50% and Oscar had a relatively small rate increase for 2018. The health plans of Blue Shield, Kaiser, and L.A. Care show a comparable rate increase for the family of five in the low 20% range. However, just like Sacramento, Los Angeles plans will see rate increases for young adults of between 26% and 50%.

Southern California Los Angeles County health insurance rates for families for 2018 will be above average because rates for young adults have spiked up over 30%.

Covered California and the health plans can put out all sorts of weighted average data showing how the health insurance rates have only modestly increased. The reality is that the only number that matters is what the individual or family will pay in 2018. The data is clear that most households with dependents under 21 years old will see a total premium increase, even after any monthly subsidy tax credit is applied, greater than the stated weighted averages. The new 0 to 20-year-old rate structure is a one-time readjustment. With my fingers crossed, the young adult rates will not drastically increase in 2019 as they have in 2018. They will only increase by the relative amount of the 21-year-old rate. But who knows what will happen in the future.