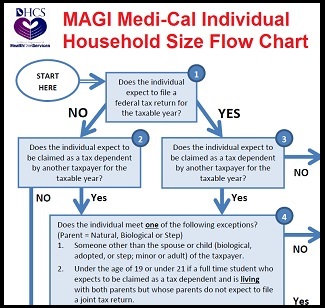

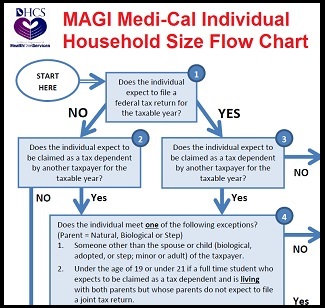

DHCS MAGI Medi-Cal individual household size flow chart.

The Department of Health Care Services (DHCS) has developed a Medi-Cal household size flow chart. The DHCS Guide for Calculating MAGI Medi-Cal Individual Household Size was originally developed to help county eligibility workers ascertain the actual household size under the new Affordable Care Act (ACA) rules. The newly expanded Medi-Cal eligibility under the ACA revolves around on IRS definitions for tax dependents and non-filer rules. Because families can be so diverse and the rules regarding what constitutes a tax family so complicated, the flow chart for determining household size was created.

First of all there are two types of Medi-Cal: MAGI Medi-Cal and Non-MAGI Medi-Cal. MAGI is the acronym for Modified Adjusted Gross Income. It is used for determining the amount of the premium assistance or Premium Tax Credits a household may be eligible for to lower their monthly health insurance premium and if household members are eligible for Medi-Cal. Non-MAGI Medi-Cal is the original Medi-Cal before the expanded or MAGI Medi-Cal was created with the ACA. Non-MAGI Medi-Cal still serves many vulnerable populations such as those in skilled nursing facilities, pregnant women, foster youth, and people with disabilities to name a few. (For more information see: Medi-Cal basics and Covered California.)

Unlike Non-MAGI Medi-Cal, the new expanded MAGI Medi-Cal is based solely on an individual’s or household’s income. There is no asset test. Assets such are cars, home ownership, or bank accounts are not calculated into determining eligibility for MAGI Medi-Cal. The complicated aspect of MAGI Medi-Cal is that it revolves around the federal tax code. Because the whole family can be eligible, and the family is defined by IRS tax code, it can be complicated to determine the actual household size.

The actual household size, how many people are actually in the tax family, is also crucial for Covered California and the premium assistance calculation. The higher the number of people in the tax family, the greater the probability of the children, if not the whole family, being eligible for Medi-Cal benefits and health insurance. Consequently, it is vitally important to determine who is actually in the tax family for determining the eligibility for different programs. This is where the DHCS Household Size Flow Chart comes into play.

The flow chart helps enumerate the different conditions that would cause someone to either be counted in the household or whether they would be excluded. This most often occurs with adult children still living at home or the parent’s the primary tax filer or his or her spouse who is being supported by the household. Just because an individual meets the conditions to be included in the household doesn’t necessarily mean that he or she will be eligible for Medi-Cal or Premium Tax Credits through Covered California. But both are dependent on the number of individuals within the tax household.

There are three exceptions for people who may be filing taxes but will still be claimed as dependents on someone else’s tax return.

- Someone other than the spouse or child of the taxpayer.

- Under the age of 19 or under 21 if a full time student who expects to be claimed as a tax dependent and is living with both parents but whose parents do not expect to file a joint tax return.

- Under age 19 or under age 21 if full time student and the taxpayer is the individual’s non-custodial parent.

There are also special rules for determining household size for people who won’t be required to file taxes and won’t be claimed as a tax dependent. These are known as the Non-Filer Rules for determining household size. Because today’s modern families may have multiple generations and relationship connections all under one roof, one family may consists of two or more actual tax or eligible households. Page two and three of the flow chart allow county eligibility works to diagram the family connections to determine if more than one household exists under one roof.

[gview file=”https://insuremekevin.com/download/medi-cal/MAGI-MCal-HHSizeFlowChart-v1_2-20140815.pdf” height=”600px” width=”600px” save=”0″]

[wpfilebase tag=file id=1319 /]

Household size challenge

A serious challenge for parents trying to determine their house size occurs when there are adult children living at home. The parents are being forced to estimate or predict the future. A parent doesn’t necessarily know if he or she will claim their adult child as dependent on their taxes. Or if is it better for the parent to claim the full time student as a dependent on his or her taxes even if that increases the household size and pushes younger children into Medi-Cal?

The Affordable Care Act brought together two of the most complicated bureaucracies in the world: the IRS and Medicaid (Medi-Cal in California). When you add California’s Marketplace Exchange, Covered California, for health insurance enrollment as the third leg of the stool, even the most seasoned eligibility bureaucrats start to get confused. The household size flow chart gives a little more clarity or road map to help families and county eligibility workers determine the actual size of the household.

*Medi-Cal Household Flow Chart was forwarded to me by a county eligibility worker who frequently comments on my blog posts to assist people who themselves have posed difficult Medi-Cal questions. I appreciate the flow chart and the comments very much.