2018 Federal Poverty Levels (FPL)

2018 Federal Poverty Levels (FPL)

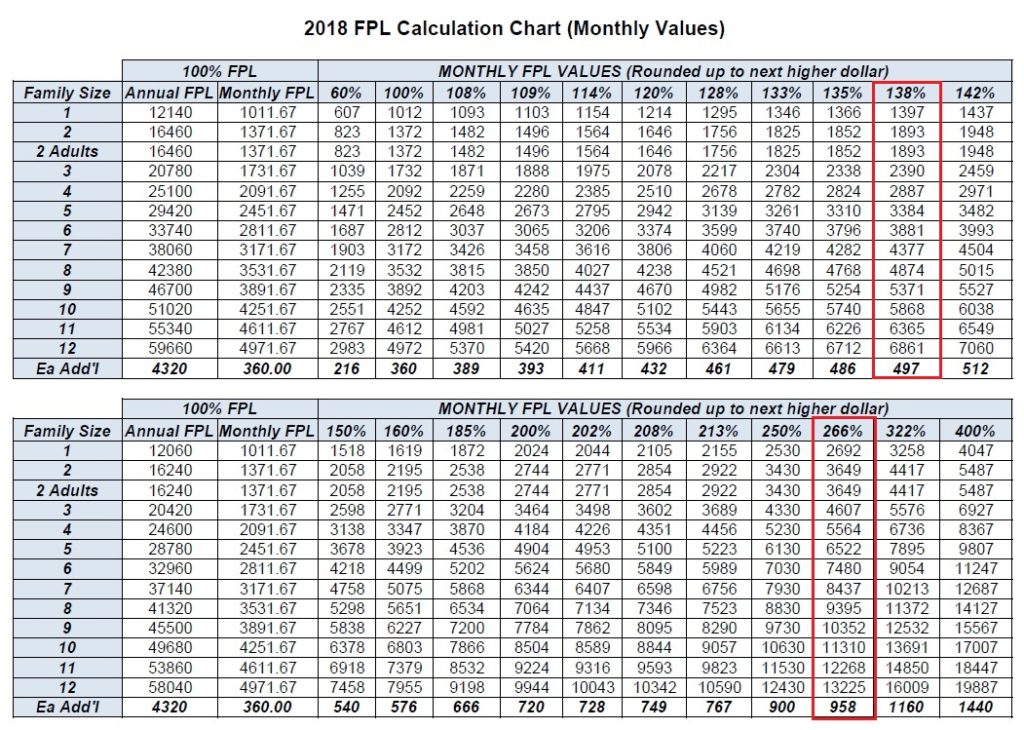

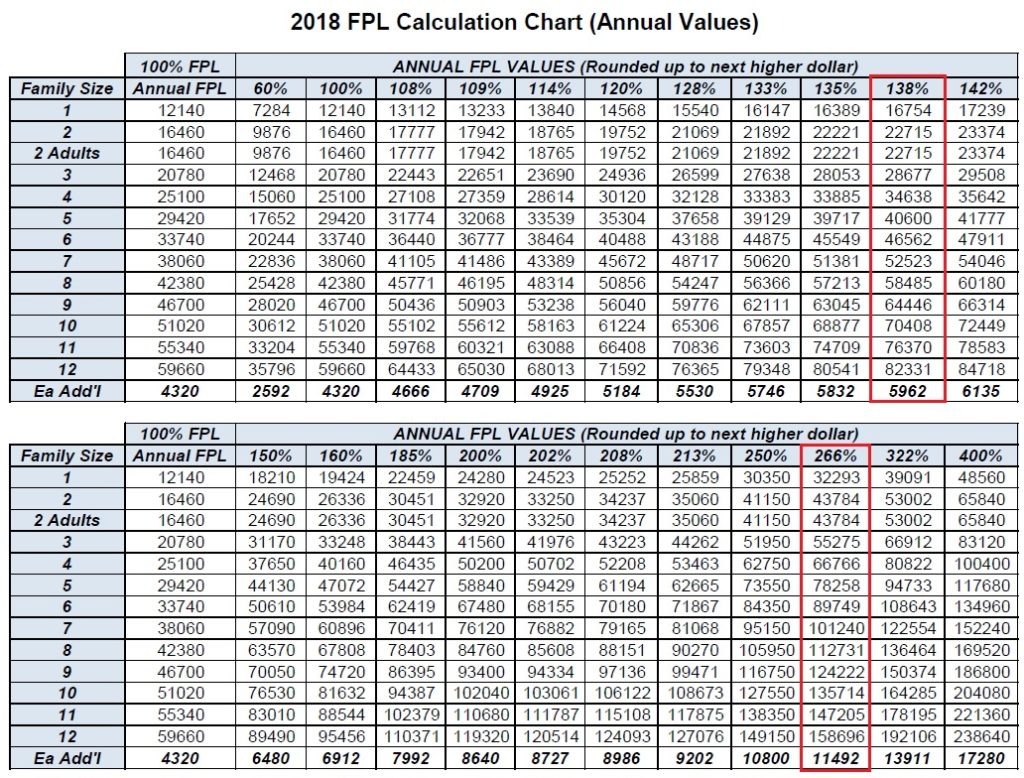

The charts below reflect the 2018 poverty level ceilings for a variety of Medi-Cal administered programs including

- Medi-Cal based on Modified Adjusted Gross Income (MAGI)

- Medi-Cal Access Program (MCAP)

- MCAP – Linked Infants

- County Children’s Health Initiative Program (C-CHIP: San Francisco, Santa Clara, San Mateo counties only)

Covered California Eligibility

For a single adult applying through Covered California, the monthly income must be greater than 138% of the Federal Poverty Level ($1,397 monthly, $16,754 annually) in order to qualify for private health insurance with the premium tax credit subsidy. If the individual or household is below 138% of the FPL, they will be deemed eligible for Medi-Cal.

2018 Medi-Cal Monthly Income Amounts

Counties will be reviewing all denials and discontinuances for specific groups back to the effective date of the new FPL income levels for:

- Parents and Caretaker Relatives

- Children

- Pregnant women

- Adults between the ages of 19 and 65 whose eligibility is determined based upon MAGI.

Due to delays in implementing these FPLs in the California Healthcare Eligibility, Enrollment, and Retention System (CalHEERS), DHCS has initiated a Change Request for the CalHEERS system to update the annual FPL amounts automatically. However, DHCS will still need to send a notice to the beneficiaries potentially impacted by the change to inform them of the FPL increase and that they may request a redetermination. The Centers for Medicare and Medicaid Services has decided that there will be no reimbursement for premiums paid. The notice will state that no premium reimbursements will be available. Therefore, counties shall retroactively change eligibility only for those Optional Targeted Low-Income Children’s Program eligible children, Advance Premium Tax Credit eligible individuals who did not enroll in a plan or did not pay a premium, and individuals who are eligible only for the Medi-Cal programs with a Share-of-Cost in the same month.

For applicants and recipients of the Medicare Savings Programs (MSP), Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiary, and Qualified Individual 1, who do not receive Title II Retirement Survivors and Disability Insurance (RSDI) income, counties must apply the new FPL figures retroactively to January 1, 2018.

Annual Medi-Cal FPL Income Amounts

100% FPL

= Qualified Medicare Beneficiary (QMB) Program; and

= Children Ages 6 up to 19 Percent Program (Pre-ACA); and

= FPL Program for Aged & Disabled; and

= Section 1931 for certain recipients (Pre-ACA)

109% FPL

= ACA Parents and Caretaker Relatives

114% FPL

= ACA Parents and Caretaker Relatives not eligible for the ACA New Adult Group due to non-financial eligibility criteria such as enrollment in Medicare Parts A or B (109% FPL, plus 5% MAGI disregard)

120% FPL

= < Specified Low-Income Medicare Beneficiaries (SLMB)

128% FPL

= Disabled Individuals in New Adult Group (ACWDL will be released when implemented)

133% FPL

= Children Ages 1-6 (Pre-ACA)

= ACA Children and Title XXI Expansion Children Ages 6-19

135% FPL

= < Qualified Individual 1 Program (QI-1)

138% FPL

= ACA New Adults Ages 19-64

138% FPL and Below

= Full-Scope coverage for ACA pregnant persons

Above 138% to 213% FPL

= pregnancy related Medi-Cal

142% FPL

= ACA Children Ages 1-6

150% FPL

= Targeted Low-Income Program (Pre-ACA)

160% FPL

= ACA Optional Targeted Low-Income Children (OTLIC) Program

250% FPL

= OTLIC Program (Pre-ACA)

= Working Disabled Program

266% FPL

= ACA OTLIC

Above 266% to 322% FPL

= County Children’s Health Initiative Program (C-CHIP)

322% FPL

= ACA MCAP Linked Infants

$35

= Maintenance Need for Resident in LTC Facility

California Department of Health Care Services

January 30, 2018

2018 FPL Income Chart

California Medi-Cal 2018 federal poverty level income chart for eligibility for different programs.