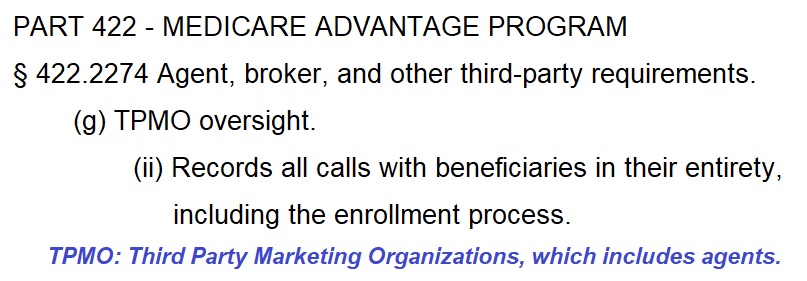

Medicare has mandated that insurance agents record all telephone calls with Medicare beneficiaries regarding the benefits and enrollment into a Medicare Advantage and Part D plans for the 2023 benefit year. This means that if you call your health insurance agent for Medicare information and enrollment in those plans for 2023, expect to have your telephone conversation recorded.

Why Must All Medicare Advantage Calls Be Recorded?

The impetus for this extraordinary marketing rule was that Medicare has received a two-fold increase in complaints from beneficiaries that they had been misled by agents regarding the benefits of the Medicare Advantage plans they were enrolled into. We do not know how many of these complaints were substantiated by Medicare. In other words, how many of the complaints were in fact misrepresentation of the benefits or simply a misunderstanding.

Federal Register, Medicare Program; Contract Year 2023 Policy and Technical Changes

Some agents do misrepresent the benefits either directly or by omission. However, part of the blame for the increase in complaints lies with Medicare. First, Medicare allows plan sponsors of the Medicare Advantage plans to offer multiple plans with almost identical names. Second, Medicare is allowing the plan sponsors to offer non-health supplementary benefits – benefits not covered by Original Medicare – within the Medicare Advantage plans. These two elements lead to confusion on the part of the beneficiary and agent when comparing multiple plans.

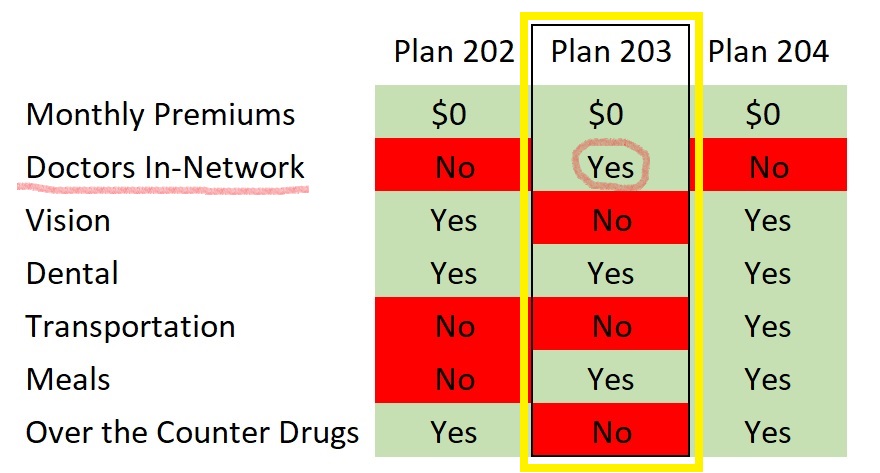

Let’s take a hypothetical example that represents what a Medicare beneficiary may encounter. There may be 3 plans from the same plan sponsor with very similar names. I’ll use Plan 202, 203, and 204. All of the Medicare Advantage plans have a $0 monthly premium, which is what the beneficiary would like.

The beneficiary has heard through TV, direct mail, and newspaper advertisements about supplemental benefits that some of the Medicare Advantage plans offer. The beneficiary would like coverage for vision, dental, transportation to doctor appointments, meals delivered to their home after surgery, and a quarterly credit to buy over-the-counter drugs not covered by the Part D prescription drug portion of the plans.

While the plan names sound similar, not all of the plans cover all of the supplementary benefits the beneficiary wants. Of course, the most important element of a health plan is that the plan includes the current physicians the beneficiary wants and needs in their health care coverage. The insurance agent puts together a comparison chart for the beneficiary showing the important elements that the beneficiary wants.

Both the beneficiary and agent agree that Plan 203 is the best option because it has the doctors in-network, but not all of the supplementary benefits. After a couple months of enrollment, the beneficiary would like use the vision benefits to see an optometrist. But Plan 203 doesn’t have the vision benefit, that was either Plan 202 or Plan 204, neither of which included the beneficiary’s doctors. The lack of a vision benefit can trigger a complaint to Medicare.

Medicare Advantage Plans Have Become More Complicated and Confusing

The confusion over the plan benefits has nothing to do a beneficiary being over 65 years of age. I’ve had clients in Covered California health plans get confused over the covered benefits of their plans. Heck, I look at these plans all the time and I sometimes get confused. Health plans are complicated. Medicare has allowed Medicare Advantage plans to become even more complicated by not regulating plan names and the supplementary benefits.

Because of this confusion and complaints, as an agent for Medicare Advantage plans, I have to decide if I want to record all of my phone calls. Medicare education and enrollment is not linear. At least for me, it is not just one phone call with a Medicare beneficiary. The average number of calls between a beneficiary and me is usually 4 to 5 conversations with several additional email exchanges. We spend, on average, a couple of hours discussing Original Medicare, Medicare Advantage, Part D Plans and Medicare Supplements.

I need and want to the beneficiary to have a good grip on how Medicare and all the options work. When the prospective client is comfortable with Original Medicare and their different options, then we work on the enrollment. To record all of these calls is just a waste of cloud storage.

Some of my prospective clients don’t want their calls recorded and I don’t blame them. We talk about a range of topics from health challenges, children, vacations, hiking, history, music, art, and whatever makes us laugh and smile. One of the joys for me is having long relaxed conversations with people. To have it all recorded seems a bit excessive, intrusive, and chilling on the conversation. It is through these conversations that I learn what is important regarding health care coverage.

Many Agents Considering Not Offering Medicare Assistance In 2023

The alternative for me is not to help existing clients and to decline new Medicare Advantage and Part D prescription drug plan enrollments. It is either a choice between recording the phone conversations or just declining any assistance with Medicare. When I consider the numerous, and almost daily, telephone conversations I have be people regarding Covered California, individual and family plans, Medi-Cal, and small group plans – none of which are recorded – declining any Medicare calls because I have to record them sounds reasonable.

What does not have to be recorded are face-to-face meetings, enrollments at sales events, and Medicare Supplement enrollments. Occasionally, I will have a face-to-face meeting in my immediate area. However, most of my clients live hours away from me in the Bay Area and Southern California. While I ponder my options for recording phone calls, just be aware that if you call an insurance agent for a Medicare Advantage plan for 2023, one of the first sentences will be, “This call is being recorded. Do you allow me to record our conversation?”