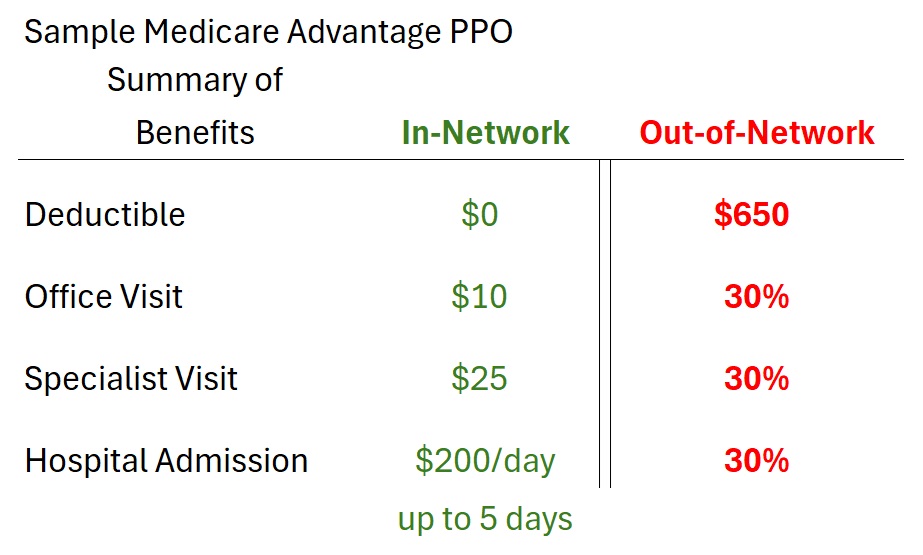

Medicare Advantage PPO plans allow members to receive health care services from out-of-network providers. However, this freedom of choice can come with unexpected costs. Medicare beneficiaries need to carefully examine the Medicare Advantage’s summary of benefits to understand the costs of going out-of-network to receive health care services.

Medicare Advantage PPO compared to HMO Plan Types

The value proposition of Medicare Advantage HMO (Health Maintenance Organization) is that plan member will have predictable health care expenses. In addition, if the plan member must receive expensive health care treatment for an illness, the Medicare Advantage plans have a maximum out of pocket amount. Once this maximum amount is met, the plan covers all health care costs.

Note: emergency health care treatment is always covered as in-network, regardless of the hospital you are taken to or the type of plan you have.

The downside to Medicare Advantage HMO plans is the network of providers. First, the plan member must select a Primary Care Physician (PCP.) The PCP is the gatekeeper for referrals to specialists within their medical group. Some people would like to see physicians that are either not in the PCP’s medical group or not associated with the Medicare Advantage HMO plan at. Providers who are in the plan would be considered out-of-network.

If a member of Medicare Advantage HMO plan receives services from an out-of-network provider, the plan member is responsible for all the costs. Original Medicare will not cover any of the out-of-network health care costs because the plan has assigned the Medicare Advantage HMO plan to handle all claims related to health care services.

To address a growing demand to visit out-of-network providers, plan sponsors have developed Medicare Advantage PPO plans. Sometimes you’ll see these plans referred to as LPPO or Local Preferred Provider Organizations. These plans have a network of in-network providers and allow the members to receive services from out-of-network providers. If the health care services are received from an in-network provider, the plan member will usually pay a lower amount in the form of a copayment or coinsurance when compared to an out-of-network provider.

The first note of caution is that the out-of-network provider must still accept Original Medicare. The plans will generally not cover expenses for providers who do not accept Medicare. For example, you have an orthopedic doctor you visit annually. The orthopedic doctor has a private practice and accepts many private health insurance plans, but not Medicare. If you visit the orthopedist, the Medicare Advantage PPO plan will most likely not cover any of the health care services.

PPO Out-of-Network Service More Expensive

If you review your Medicare Advantage PPO plan options, you will notice that many of those plans have higher premiums than the HMO plans. It is not unusual for Medicare Advantage PPO plans to have a monthly premium of $40 to $100+, while a great many HMO plans have a $0 monthly premium.

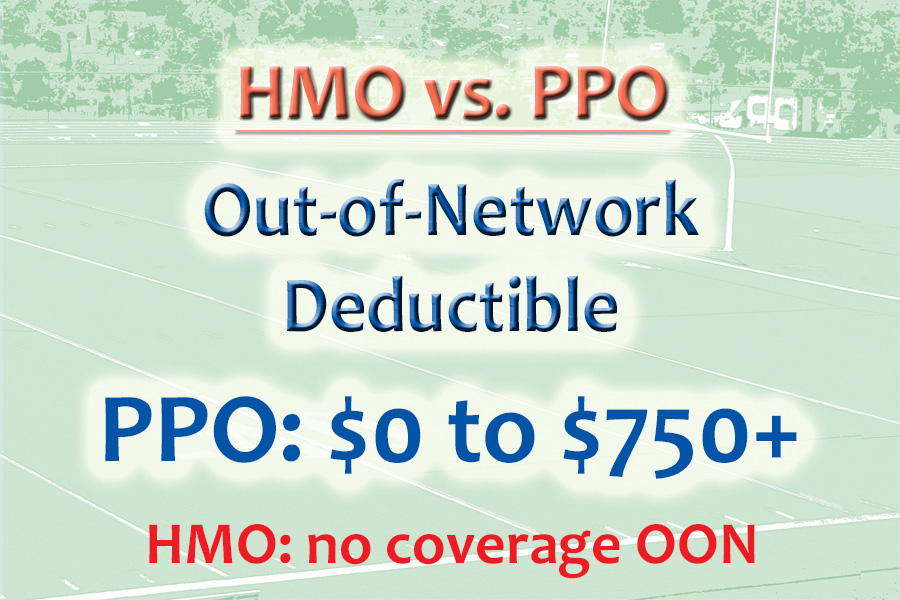

Next, review the medical deductibles of the PPO plans. There may be some PPO plans that have a no medical deductible for out-of-network services. Other plans may have an out-of-network deductible of $500 to $750+. The out-of-network deductible must be satisfied before the plan begins to share in the cost of the health care services or out-of-network services.

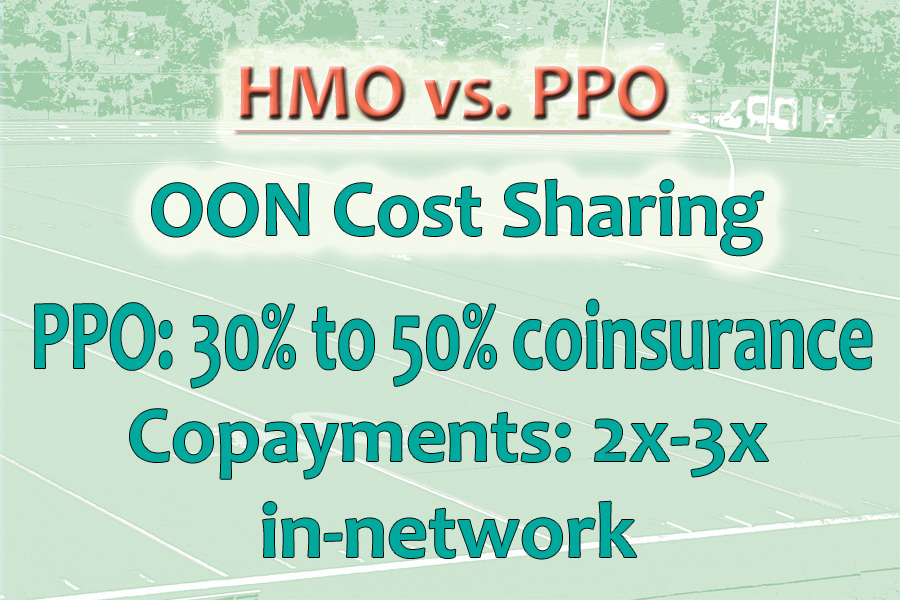

The plan member cost sharing is higher when using an out-of-network provider. The copayment for some services can be double to triple the amount of a copayment if you use an in-network provider. Many plans will apply a coinsurance percentage of 30 to 50 percent to the health care service. In other words, if the health care service has an allowable amount of $1,000, the plan member could pay $300 to $500 for the service (30% to 50%.)

As a comparison, Original Medicare Part B outpatient service coinsurance is 20 percent after the $240 (2024 deductible.) Under Original Medicare, the cost of the $1,000 service would be $200. This is less than many Medicare Advantage PPO with the medical out-of-network deductible and coinsurance. The health costs will be lower with a Medicare Advantage HMO plan or using an in-network provider of the Medicare Advantage PPO plan.

Finally, the maximum out-of-pocket amount for out-of-network service can be double the in-network maximum out-of-pocket amount. Once a plan member meets the maximum out-of-pocket amount, the plan covers all services, 100 percent. A Medicare Advantage PPO plan may have an in-network maximum out-of-pocket amount of $4,000, but the out-of-pocket maximum for out-of-network is $8,000. Of course, this is better than Original Medicare that has no maximum out-of-pocket amount.

Carefully Review Summary of Benefits of MAPD PPO Plan

Medicare Advantage PPO plans are not bad. They offer some flexibility to see doctors out-of-network, albeit at a higher cost. If you can stay in-network and use out-of-network providers sparingly, you will minimize your health care expenses and leverage the Medicare Advantage to your benefit. Medicare Advantage PPO plans are not inherently better than the HMO plan type. The Medicare Advantage HMO plans help contain unexpected health care expenses, while providing predictable costs.

Before you jump into a Medicare Advantage PPO plan, carefully review the summary of benefits. Compare the PPO plan to a comparable HMO plan and try to discern how much you will pay for premiums, deductibles, and out-of-network health care expenses. This is the only way to make an informed decision.