In late 2022, individuals and households who are terminated from MAGI Medi-Cal will be automatically enrolled into a Covered California private health insurance plan. The goal of the automatic Medi-Cal to Covered California enrollment is to prevent a gap or total loss of health insurance coverage. Covered California has created a special portal on their website to accommodate the transition from Medi-Cal to Covered California enrollment.

When a MAGI (Modified Adjusted Gross Income) Medi-Cal beneficiary loses their coverage, they have a 60-day period to enroll in another health plan, outside of open enrollment. Medi-Cal typically sends a notice of termination several weeks before the final termination date. This advance notice gives the beneficiary time to enroll health plan through Covered California or off-exchange directly with a carrier. The automatic enrollment only applies to MAGI Medi-Cal beneficiaries and individuals in the Medi-Cal Access Program for pregnant women. Non-MAGI Medi-Cal recipients (disabled or aged) are not subject to the automatic enrollment.

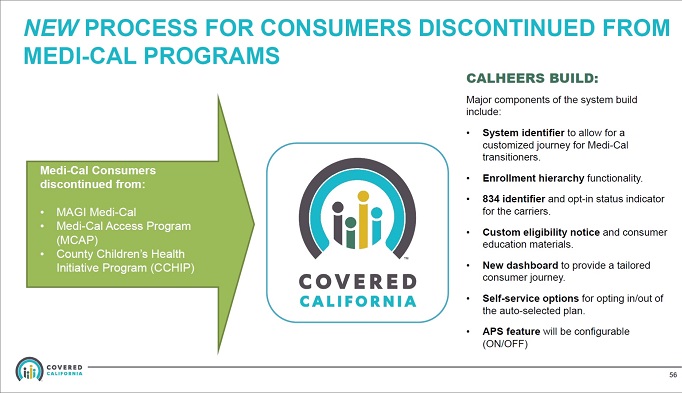

Medi-Cal to Covered California Automatic Enrollment to Address Coverage Gaps

The problem that has arisen is that some people don’t get the notice because they have moved, they are busy with life, or the process is too confusing. If the individual enrolls after the Medi-Cal termination date, the new health plan will not become effective until the following month, leaving the individual with a gap in coverage. If the individual waits longer than 60-days to attempt to enroll in a health plan, they are outside their Special Enrollment Period and may not be able to enroll in any health plan until the next open enrollment period.

To address the potential gap or total loss of health care coverage, under certain conditions, Covered California will enroll the terminated Medi-Cal beneficiary in the lowest cost Silver plan in their region. This automatic enrollment process will be particularly beneficial for many people when the Covid public health emergency conditions are lifted and millions of people will have their Medi-Cal eligibility redetermined.

Under the public health emergency rules, no one was terminated from Medi-Cal unless they specifically worked with Medi-Cal to show they were not eligible such as gaining employer sponsored health insurance. When the public health emergency rules are lifted, Medi-Cal beneficiaries will have their eligibility redetermined during their annual Medi-Cal enrollment period. People who do not return the redetermination paperwork must necessarily be terminated from Medi-Cal.

Covered California has been planning for the automatic enrollment transition and has released several documents addressing the program and the flow of enrollments.

Fact Sheet: Medi-Cal To Marketplace Automatic Enrollment Program

Plan Selection and Effectuation Policy

Covered California will automatically plan select consumers into the lowest cost silver plan available to them to maximize premium tax credit and cost sharing support. They must then take action to effectuate their coverage to ensure that they are willing to accept the tax liability for APTC.

Opting-In to Coverage

- Consumers with a monthly net premium must pay their first month’s premium to effectuate coverage.

- Consumers without a monthly net premium must effectuate coverage online or by phone by agreeing to certain terms and conditions. (Covered California estimates that about half of auto-enrolled individuals in 2022 will not have a net premium for the lowest cost silver plan due to the generosity of the American Rescue Plan premium subsidies.)

Opting-Out of Coverage

- Consumers not wanting Covered California coverage can actively opt-out to cancel their plan while still retaining their 60-day special enrollment period.

Covered California’s coverage will begin the day after Medi-Cal coverage ends provided that the consumer effectuates their coverage within the first month. If not, their plan will be canceled; however, they will have the remainder of their 60-day special enrollment period to select a plan on their own.

Consumer Experience

Covered California is customizing the consumer experience as follows:

- Notices: Covered California will send customized notices to consumers to explain their plan enrollment and financial assistance amounts; options to keep, switch or cancel their coverage; and how to get help. Notice packets will also include educational material to address frequently asked questions related to Covered California coverage, plan benefits and cost sharing, key insurance terms and health insurer options.

- Website: Covered California will provide a dedicated dot com landing page for consumers to efficiently direct them to their account information. Once logged in to Covered California’s eligibility system, consumers will see a “dashboard” showing their pre-selected plan, coverage effectuation options, and short-cuts to search for a preferred provider. They can also shop for a different plan and update account information.

- Phone support: Covered California will provide specialized phone support including a vanity phone number, an interactive voice response menu with automated opt-in and opt-out options and prompts for Service Center Representatives to facilitate live assistance.

In many instances, Medi-Cal will have updated the individual or household income information if the consumer has a Covered California account. However, the income section updates may not be correct. It is important to review the Covered California income section in order to make sure you are offered the correct plan and subsidy.

For instance, if the household income is low enough, they may qualify for an enhanced Silver plan (73, 87, 94) with reduced member cost-sharing. If the income Medi-Cal has entered into the system is too low, you may receive too much monthly subsidy and have to repay some or all of it when you file your federal tax return.

For consumers who do not have a Covered California account, the special Covered California portal will help them create an account. They can then enter current income information so they are offered the correct health plan and monthly subsidy.

Plan Enrollment and Selection

Consumers transitioned to Covered California do not have to keep the lowest cost Silver plan they have been enrolled into. You can select a lower or higher metal tier plan (Bronze, Gold, or Platinum.) You can select a different health plan that may support your doctors. For example, you may have been enrolled in a Kaiser Silver plan, but your doctors are affiliated a different medical group; you can change the plan selection.

Dependent Enrollment

By default, if dependents have been terminated from Medi-Cal, and the parents or guardians are already enrolled in a Covered California health plan, the dependents will be enrolled in the same health plan. You can select a different metal tier plan and carrier for the dependents.

First Month’s Binder Payment

In general, there is no grace period for the first month’s binder payment to effectuate a new health plan. Consumers automatically enrolled will have a little extra time to pay the first month’s premium. If there is no monthly premium because the subsidy is greater than the cost of the health plan, the consumer must still opt-in to the plan through Covered California in order for the plan to become effective.

Assistance

Covered California can be complicated by itself. With the automatic enrollment process and new special website portal for MAGI Medi-Cal beneficiaries being transitioned to Covered California, the process may get a little more complicated and confusing. Covered California will have a dedicated team of customer service representatives to assist with enrollment and plan changes. In addition, a consumer can delegate a Certified Insurance Agent to assist them with the enrollment and to understand the plan designs.

Medi-Cal to Covered California