We have yet another video and overview of California’s new health insurance market place. My little video presentation will be one of many as Covered California begins open enrollment this fall. What makes my video unique beyond my pictures from around California? Probably not much other than I try to keep it simple. There are no flashy animations or cool music. The text is simple and in large fonts. In short, if you suffer from insomnia, California Health Insurance Market Place video might be the cure.

Health insurance companies didn’t want comparison shopping

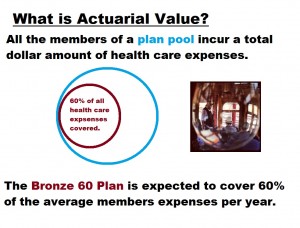

I do take a stab at trying to briefly explain the actuarial values (AV) of the plans. Health insurance companies, with their significant statistical knowledge, have known for years what percentage of health care expenses will be covered for the average person enrolled in their health plans. They have chosen not to promote this knowledge as the actuarial value of coverage is a good measurement for comparing one plan to another.

Actuarial Value is good comparison tool

Instead, the insurance companies have tried to dress their health plans in fancy marketing names like Vital Shield, Open Access, Clear Protection and Value Net. None of these marketing titles, let alone the actual summary of benefits, gave the consumer any indication as to the sort of protection they would receive from exorbitant health care expenses. The new metal level plans (Bronze 60, Silver 70, Gold 80 and Platinum 90) offered in the state exchanges under the ACA at least begin to give a hint at the protection against unexpected hospital expenses.

All the plan members are in big pool. The actuarial value of the plan is designed to covered the stated percentage of the average member’s health care expenses in the pool.

AV is like a nutrition label

Actually designing plans to an actuarial value and then labeling which category the health plan falls into is perhaps one of the greatest consumer shopping benefits provided by the Affordable Care Act. The whole concept of “actuarial value” is abstract for most people. It will take time to be fully recognized by the consuming public just like nutrition labels on packaged foods. Initially, the terms such as calories, saturated fat, Trans fat, and carbohydrates were foreign to most consumers. They have now become part of the American lexicon in our weekly trips to the supermarket. “AV” or actuarial value will be one of the phrases health insurance consumers will become familiar with as they shop and compare health plans.

AV: a simplified explanation

What does actuarial value mean? For a given pool of consumers who enroll in a particular health plan in a particular region, the health insurance company has an actuarial staff that forecasts the total expected health care expenses for the pool of people for a one year period. The health plans are designed with different deductibles, copayments, coinsurance and maximum out-of-pocket limits to cover a certain percentage of health care expense for all those in the plan pool.

Health care expenses vary from year to year

In a given year you may only need nominal health care services for a child’s ear infection or a bad case of the flu. In this case, with your deductible and copay for an office visit, you might only have 10% of your health care expenses covered by your plan. Some one else may need serious surgery after an accident and have 90% of their health care expenses covered by the same plan because the surgery was so expensive.

Same health plan, different coverage

Family A and Family B both have the same health insurance plan. Family A visited the doctor’s office three times for minor issues and was prescribed some medications. Their total health care expenses were $655 but with the insurance they only had to pay $480. Their insurance plan covered just 36% of their health care expenses for the year.

| Yearly Medical Expense | ||

| Family A | Out of Pocket | Actual Cost |

| Office visits | $180 | $240 |

| Prescription Drugs | $300 | $415 |

| Total | $480 | $655 |

| Insurance Covered | 36% of expenses | |

Family B experienced a major illness in the family that necessitated surgery and subsequent rehabilitation. They actually reached the the Maximum Out-of-Pocket limit on their health insurance of $12,700. Once they hit that limit, all covered benefits within the health plan were picked up by the insurance company. While they paid $12,700, they actually incurred $23,360 in health care expenses. Family B had realized an 84% coverage of their medical expenses.

| Yearly Medical Expense | ||

| Family B | Out of Pocket | Actual Cost |

| Office Visits | $360 | $480 |

| Prescription Drug | $750 | $1,000 |

| Labs | $130 | $130 |

| X-Rays and Imaging | $3,000 | $3,500 |

| Surgery | $8,460 | $15,000 |

| Rehabilitation | $3,250 | |

| $12,700 | $23,360 | |

| Insurance Covered | 84% of expenses | |

Two family pool

If the health plan for Family A and B had an actuarial value of 60% and they were the only two families in the membership pool, the AV was essentially met: 36% + 84% = 120 divided by 2 = 60%. In reality, it’s not that simple and the statistics are far more complicated. Well, if that boring explanation of actuarial value didn’t put you to sleep, I invite you to watch my video. That should do the trick!

Additional resources on Actuarial Values

What the Actuarial Values in the Affordable Care Act Mean from the Kaiser Family Foundation

Actuarial Present Value from Wikipedia

Actuarial Value Define from Blue Cross Blue Shield Reform Alert

I have also packaged the video, California Health Insurance Market Place, in a Power Point presentation and PDF you can download below.

[wpdm_file id=90 title=”true” desc=”true” template=”bluebox ” ]

[wpdm_file id=91 title=”true” desc=”true” template=”bluebox ” ]