You have lost your good Silver 73 health plan from Covered California. For 2026 you are being offered a Silver 70 health plan at a much higher monthly premium. In addition, the maximum out of pocket amount has increased from $6,100 to $9,800. Can you save money moving from a Silver to Bronze health plan? It depends on your situation and health condition.

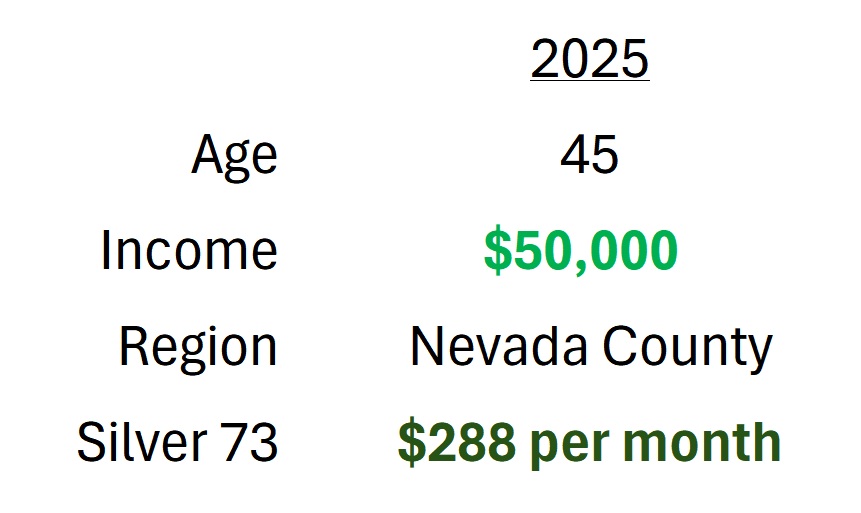

Let’s consider a 45 year old individual living in Nevada County. Their annual income is $50,000. In 2025, they had a Silver 73. After the Covered California Advance Premium Tax Credit subsidy, the monthly premium was $288.

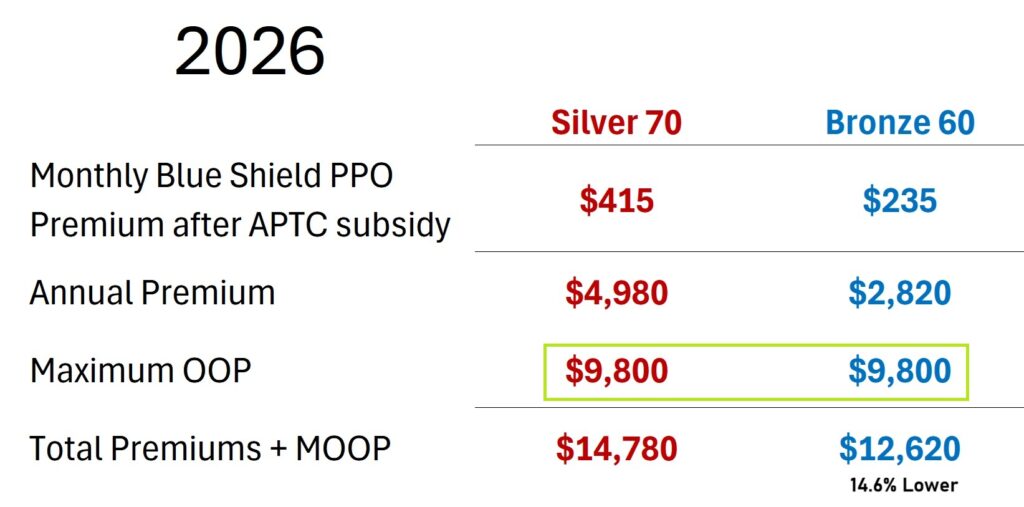

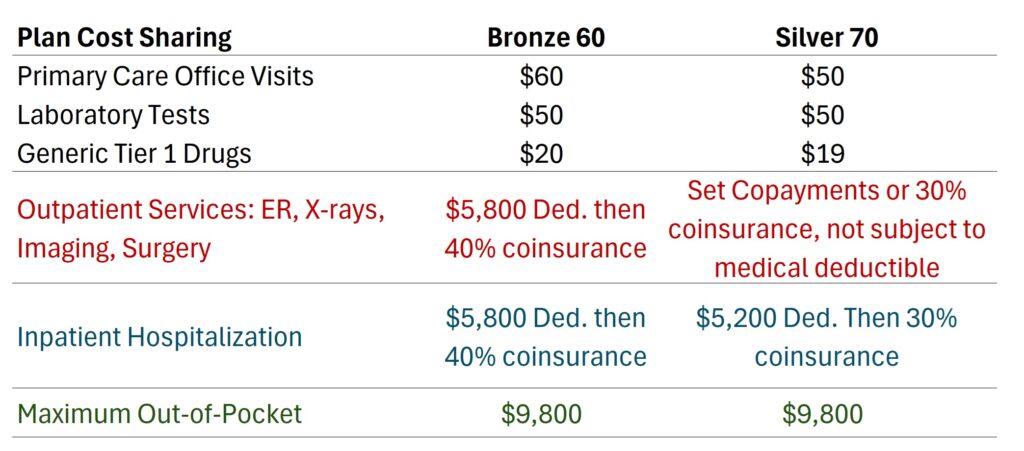

Comparing Silver 70 to Bronze 60 Plans

For 2026, they are only being offered a Silver 70 health plan. The subsidy has been reduced, and their premium has jumped 44 percent to $415 per month. The maximum out of pocket amount is now $9,800. This individual has cancer and will most certainly meet their maximum out of pocket amount.

They are now considering moving to a Bronze 60 plan. Because they know they will meet the maximum out of pocket (MOOP) amount, we can compare the total annual premiums and MOOP of each plan. The Bronze 60 plan, after the subsidy, has a monthly premium of $235. This means they will save 14.6 percent on the annual premiums or $2,160. However, the Bronze 60 has the same MOOP as the Silver 70.

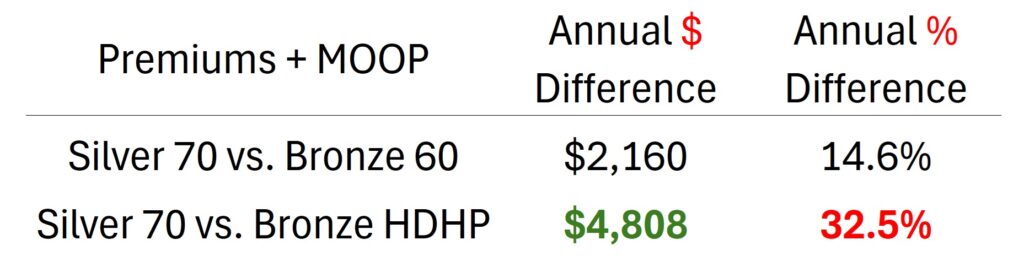

Saving Money with Bronze HDHP

Another alternative is the Bronze HDHP. While the monthly premium is essentially the same as the Bronze 60 at $231 a month, the MOOP is much lower at $7,200. When we total the annual premiums plus the MOOP, the Bronze HDHP saves this consumer $4,808. That is 32.5 percent over the Silver 70 health plan.

Not all carriers will offer a Bronze 60 or High Deductible Health Plan in your region.

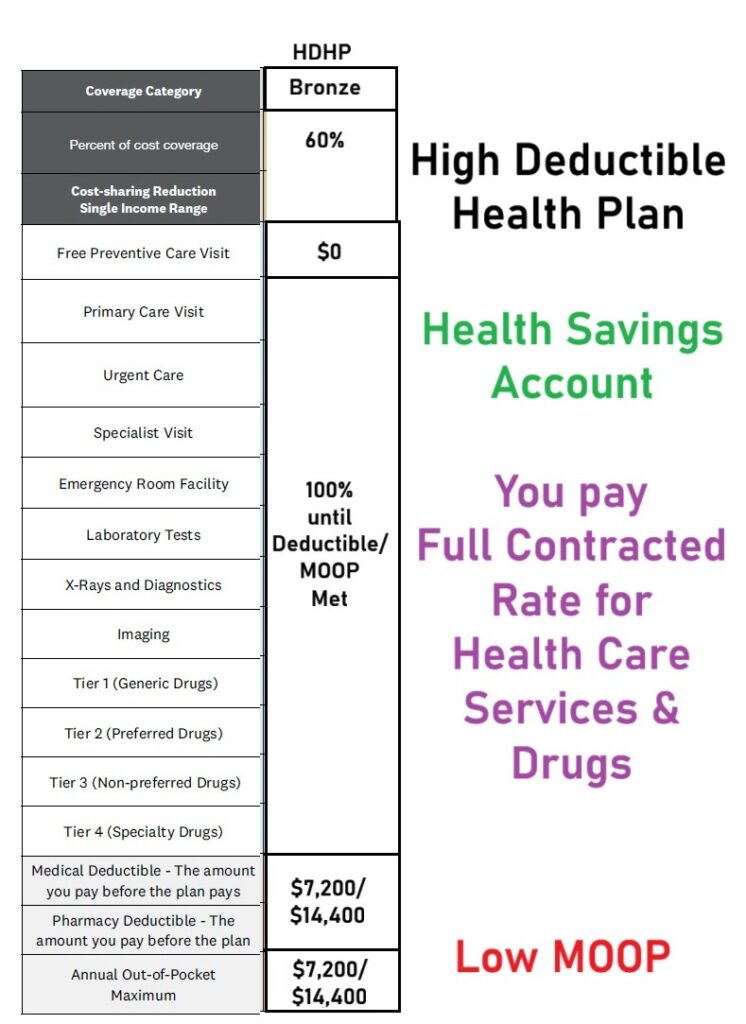

Switching to a High Deductible Health Plan (HDHP) is not without downsides. The health plan does not share in the cost of any health care services or prescription medications. This is until the plan member has met the deductible, which in this case, is also the MOOP. Of course, HDHPs have some tax advantages. Regardless, if you have to pay the full negotiated price for a few health care services and prescription medications, a Bronze 60 may be a better fit.

Bronze 60 and Silver 70 same Maximum Out of Pocket Amount

The Bronze 60 is not too bad if you don’t have a chronic health condition or take expensive brand name drugs. The routine health care services such as office visits, laboratory tests, and generic drugs are similar in cost to the Silver 70. The big difference is that you must meet a $5,800 medical deductible with the Bronze 60 plan for health care services. This includes services like an emergency room visit, X-rays, imaging, or outpatient surgery.

The Silver 70 plan has many health care services at a set copayment. If you need outpatient surgery, you go straight into 30 percent coinsurance with the Silver 70. However, if you need inpatient hospitalization, with the Silver 70 you have to meet a $5,200 medical deductible. If you take expensive brand name medications (Tiers 2, 3, or 4) the Silver 70 can almost always save money over the Bronze 60. The Silver 70 has set copayments or coinsurance for those drugs after a modest pharmacy deductible.

For the individual who has that chronic health condition that needs lots of health care services and prescription medications, the Bronze HDHP will save money if they are certain they will meet the MOOP.

YouTube video review Silver 70 vs. Bronze 60 and HDHP.