Casket and cremation insurance is designed to help pay for the final expenses after your death. But the death benefit of this life insurance does not have to be used for a casket or cremation. You could direct your family to spend the money on a big party, erect a park bench in your honor, or donate the money to a favorite charity.

Life Insurance for the Final Party Expenses

The casket and cremation insurance is life insurance designed to be accessible by older adults (age 50 to 80) who may need some extra money at the time of their death to polish the end of their lives. This final expense insurance has a simplified evaluation process that does not require a physical exam or laboratory samples.

Most of the applications have questions about your past and current health condition along with prescription medications. Just because you had a severe health challenge in the past, that is currently under control, does not mean you would be denied the casket and cremation life insurance.

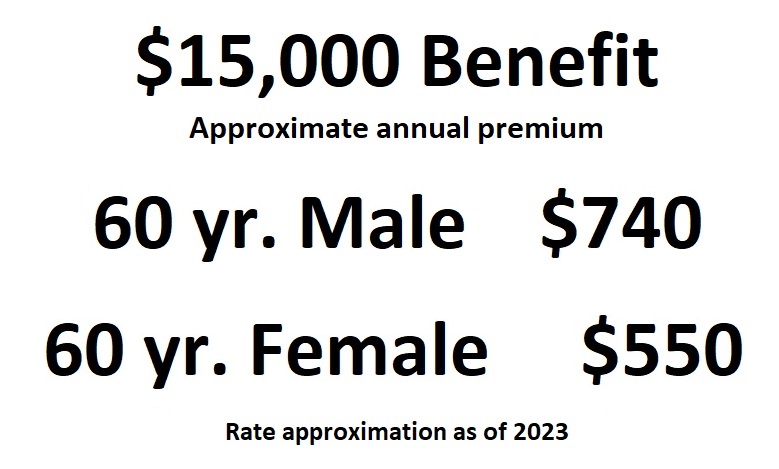

Casket and cremation life insurance usually have small death benefits from $5,000 to $15,000. Some life insurance companies offer death benefits up to $50,000. Regardless of the amount, the life insurance is permanent and guaranteed renewable as long as the premiums are paid. The insured designates a beneficiary of the death benefit. It is up to the insured to express their wishes for how the death benefit proceeds are used.

Some of the items the death benefit funds could go to pay for:

- Ash scattering boat trip

- Burial expenses

- Burial plot

- Car loan

- Casket

- Charitable donation

- Columbarium

- Credit card balance

- Cremation

- Family inheritance

- Funeral home

- Life Celebration

- Medical expenses

- Memorial

- Mortgage

- Obituary

- Park bench memorial

- Pet care

- Repair costs

- Urn

- Utilities: phone, gas, electricity

Compared to fully evaluated and underwritten life insurance where medical exams are necessary, casket and cremation insurance is more expensive. The relaxed underwriting guidelines and short medical questionnaire obviously increase the risk to the life insurance carrier. However, many people who would be denied traditional whole life insurance because of current or past medical conditions, can qualify for the casket and cremation final expense life insurance.

Small to Moderate Death Benefits

Because you are not applying for a million-dollar life insurance policy, but a much more modest amount under $50,000, the premiums are more affordable. Premiums can be further reduced if a graded or modified life insurance policy is selected. The graded life option pays only a percentage of the full death benefit – such as 50% – if death occurs within the first 2 years after the policy is issued. After the 3rd year, the policy pays the full death benefit.

A modified final expense policy would return the accumulated cash value of the life insurance policy, plus interest, if you die within a 2-year period. All of the casket and cremation life insurance policies are permanent or whole life insurance. They accumulate cash value and are calculated to be paid up at age 100. If you live to age 100, the policy would have accumulated a cash value equivalent to the death benefit and no more premiums are due. But what this really means is that you cannot outlive the life insurance policy. It will never lapse unless the premiums are not paid.

If you are 60 years old and can set aside $1,000 per year for your casket or cremation expenses, you would have at least $15,000 by the time you were 75. Of course, if you pass away at 66, you may only have $6,000 saved. A casket and cremation life insurance policy of $15,000 would pay the full amount after 6 years.

The casket, cremation, and party insurance does not need to be spent on funeral items. It can be designated to be spent on a party celebrating your life. You can design the celebration, music, beverages, and create an environment where the participants learn about who you were in life.