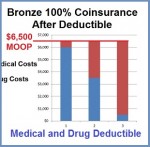

One of the most baffling health plan descriptions is the 2016 Bronze 60 health plan that states that the member is responsible for 100% coinsurance after the deductible. Most people who read this immediately shake their head and think, “I have to pay for all of my health care services EVEN AFTER I meet the deductible?” There really is no reason to buy health insurance if it never helps with the costs. The second part of the equation, not always referenced, is the calendar year maximum out-of-pocket amount of the Bronze plan which does limit a health plan members health care expenses.