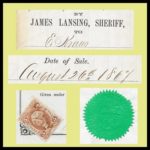

My name is James Lansing. I am 56 years of age. I know l am going to die, and make this statement under the impending crisis of the immediate presence of my demise. I do not know the man who shot me. I may have seen him, but if I did, I do not know it. I had no difficulty with him. I was out in the back yard of my hotel helping fix up a car load of coal about 4 p. m. I saw a man running down the alley and heard people halloo after him.