Medi-Cal breaks up the income into unearned income, earned income, in kind income, and exempt income. Finally, there are certain expenses that will reduce the final countable income for eligibility in the Medicare Savings Program.

Kevin Knauss: Health, History, Travel, Insurance

Posts related to California's Medi-Cal program, specifically MAGI based, income eligibility, enrollment, costs, children, Covered California.

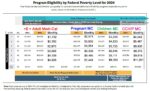

I have created this income table that has the monthly income numbers for Medi-Cal eligibility next to the 2024 annual income amounts for the Covered California subsidies.The Medi-Cal income columns of the Covered California income table are 138% FPL for adults, 213% FPL for pregnant women, 266% FPL for children 18 years and younger, and 322% FPL for children in certain counties of California.

Starting on January 1, 2024, assets, such as bank accounts, cash, a second vehicle, and homes, will no longer be counted when determining Medi-Cal eligibility. Income and income from assets, such as income from property, will continue to be counted. If you’re already a Medi-Cal member, this rule applies to you now, and you don’t need to report assets during your renewal.

Individuals and families in Medi-Cal HMO plans in 22 counties across the state may have to select a new health plan and doctors beginning January 2024. The Department of Health Care Services is transforming the Medi-Cal health plans with new requirements with the aim to improve health care quality. Implementation of the new contracts, along […]

Some people only learn they have been flipped into Medi-Cal when they are at their doctor’s office and the receptionist tells them their health insurance has been cancelled. What follows for many people is a nightmare scenario of trying to learn why their Covered California plan was terminated, who terminated it, why they are in Medi-Cal, and how to get of the Medi-Cal system.

The purpose of this All-County Welfare Directors Letter (ACWDL) is to provide counties with guidance regarding the elimination of assets for Non-Modified Adjusted Gross Income (Non-MAGI) Medi-Cal programs and the elimination of the requirement to compute and report potential overpayments based on excess property.

Spam prevention powered by Akismet