Medicare Supplement insurance companies generally use either a community or attained age rating for published monthly premium rates. While in theory, the two different approaches can yield substantially different rates for the same age and same plan. In practice, what the consumer is offered reveals little difference between the two rating methods after the insurance companies have made competitive adjustments.

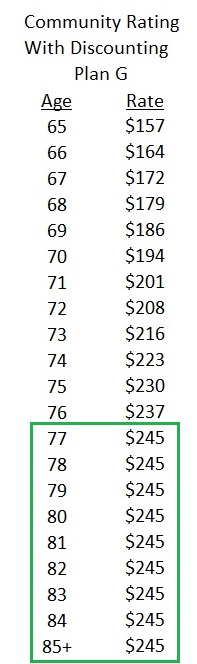

Community rating means that all eligible Medicare beneficiaries in a particular region and rating class pay the same rate for a specific Medicare Supplement plan. For example, an insurance company may offer Plan G at a rate of $245.00 per month regardless of whether the beneficiary is 65 or 85 years of age.

Community rated plans can be more expensive than Attained Age Medicare Supplement plans

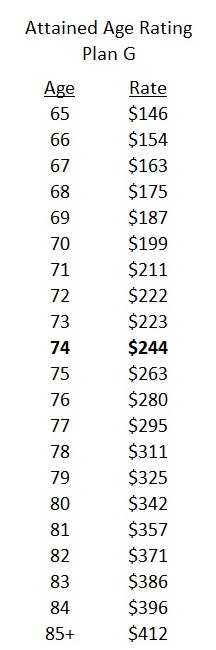

Attained age rating applies a Medicare Supplement premium based on the age of the beneficiary for a specific plan in a particular region. The attained age rating approach has a rate table listing the rate for each age band. A 65-year-old may pay $146 per month for Plan G, while a 75-year-old would pay $263.

Discounts on Community Rating

The rate disparity at the younger age bands puts community rated supplement plans at a competitive disadvantage. Some of the Medicare Supplement insurance carriers have implemented a discount structure to make their plans more competitive. They discount the base community rate by approximately 36 percent applied to age 65. Then reduce the discount by 3 percent each year until there is no discount and the full community rating is in effect.

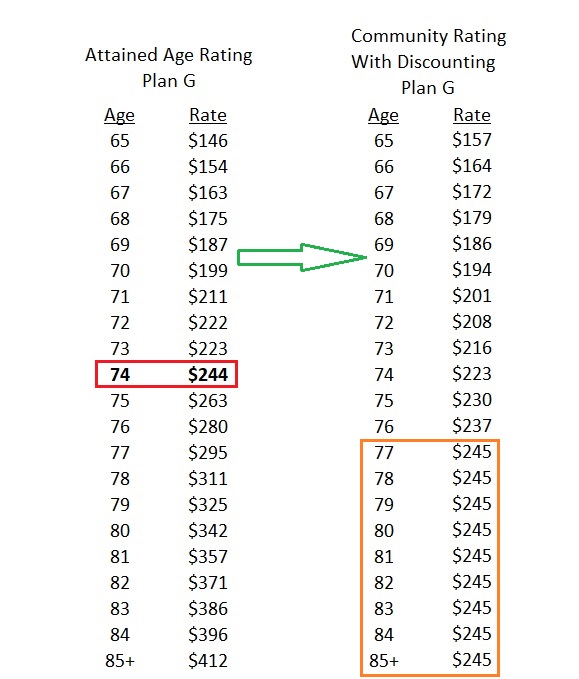

A side-by-side comparison of an attained age rate table next to a discounted community rated Plan G Medicare Supplement plan shows little difference in monthly rates. In this comparison, the discounted community rated premium becomes slightly lower than the attained age rate at 69 years of age. The age at which one rating schedule is better than another will vary by region. At age 74, the attained age rate is almost equivalent to the community base rate at age 77. Of course, the attained age rates will continue beyond the age of 74, whereas the community rates will stabilize at age 77.

The side-by-side comparison of attained age vs. community rating is not the end of the story. Some carriers will offer a new to Medicare discount from the attained age rate of $25 for the first 12 months of enrollment. This can make the Medicare Supplement rate very attractive, at least for the first year.

Other discounts that reduce Medicare Supplement monthly premiums

Several carriers offer multi-insured discounts. If two people residing in the same household, in the same plan, and using one account to pay for both Medicare Supplement plans, the insurance company will discount the amount by up to 7 percent. There can be other discounts for paying by electronic funds transfer (EFT) and paying the entire annual premium with one payment.

Regardless of whether the Medicare Supplement plan is attained age or community rated, all plans are subject to an annual universal increase for inflation. The insurance companies have traditionally applied a rate increase – across all ages, regions, and plans – of 0 to 5 percent annually. Some years there is no rate increase for either age attained or community rated.

This discussion has focused on Medicare Supplement rates when an individual first becomes eligible for Medicare at the age of 65. There are separate rates for individuals who have Medicare and are under 65 years old. From the above Plan G rate illustrations, the community rated under 65 Plan G monthly premium would be in the neighborhood of $307. The age attained under 65 rate would be approximately $980.

All of the rates will vary depending on where you live in California. Regardless of whether the insurance company uses age attained or community rating, the California insurers usually divide the state into 9 or more regions, each with slightly different rates for the different plans. There can also be a separate class rating if the individual does not have a guarantee issue period and is subject to medical underwriting questions and tobacco use.

California Birthday Rule

California does have the birthday rule. Under the birthday rule, a Medicare Supplement plan member can change plans and insurance companies for an effective date of their birthday month with no medical underwriting or answering of medical questions. This allows individuals to easily switch from a potentially high age attained premium Medicare Supplement plan to a community rated plan with a lower premium.

In conclusion, both attained age and community rated Medicare Supplement plans can offer competitive rates regardless of age. Some people may be able to leverage the low introductory rates of attained age supplements, then switch to community rated plan later in life to save money.