Medicare Supplements Plan G and Plan N are very similar. Both plans offer protection against exorbitant Original Medicare cost sharing for health care services. However, because Plan N includes copayments for some health care services, the monthly premium rate is lower. When shopping for a Medicare Supplement, always give Plan N careful consideration if you are leaning toward Plan G.

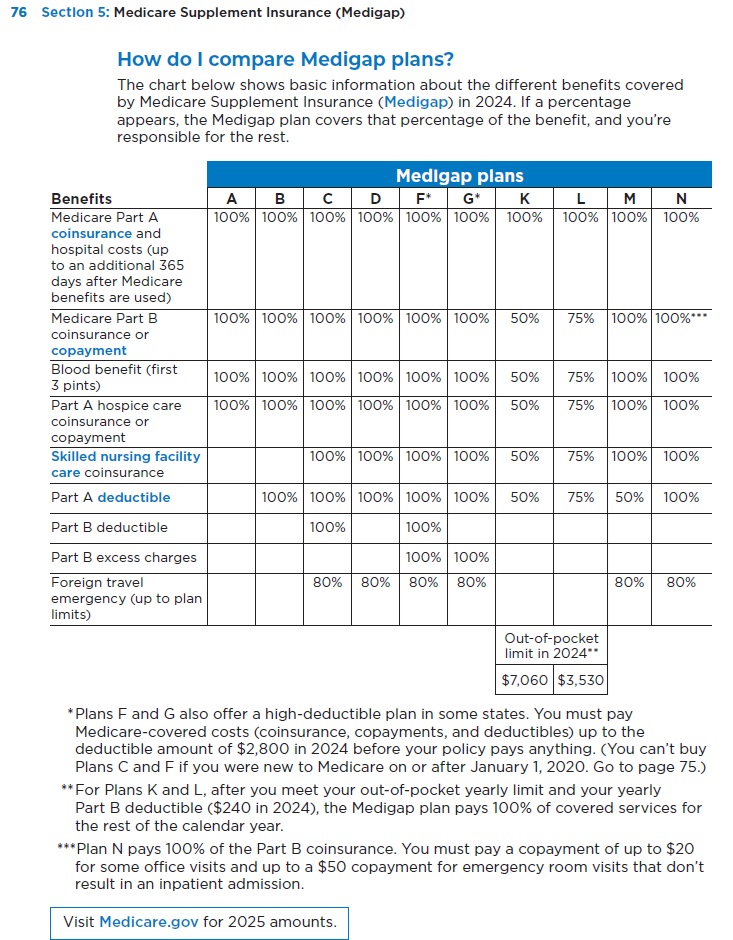

Medicare beneficiaries will have a variety of Medicare Supplements, also known as Medi-Gap policies, to select from. The plan that offers the greatest coverage for Original Medicare cost-sharing for individuals turning 65 after January 1, 2020, is Plan G. Unfortunately, the number of Medicare Supplement plans offered can be confusing with their various levels of coverage.

Plan G vs. Plan N Medicare Supplement Comparison

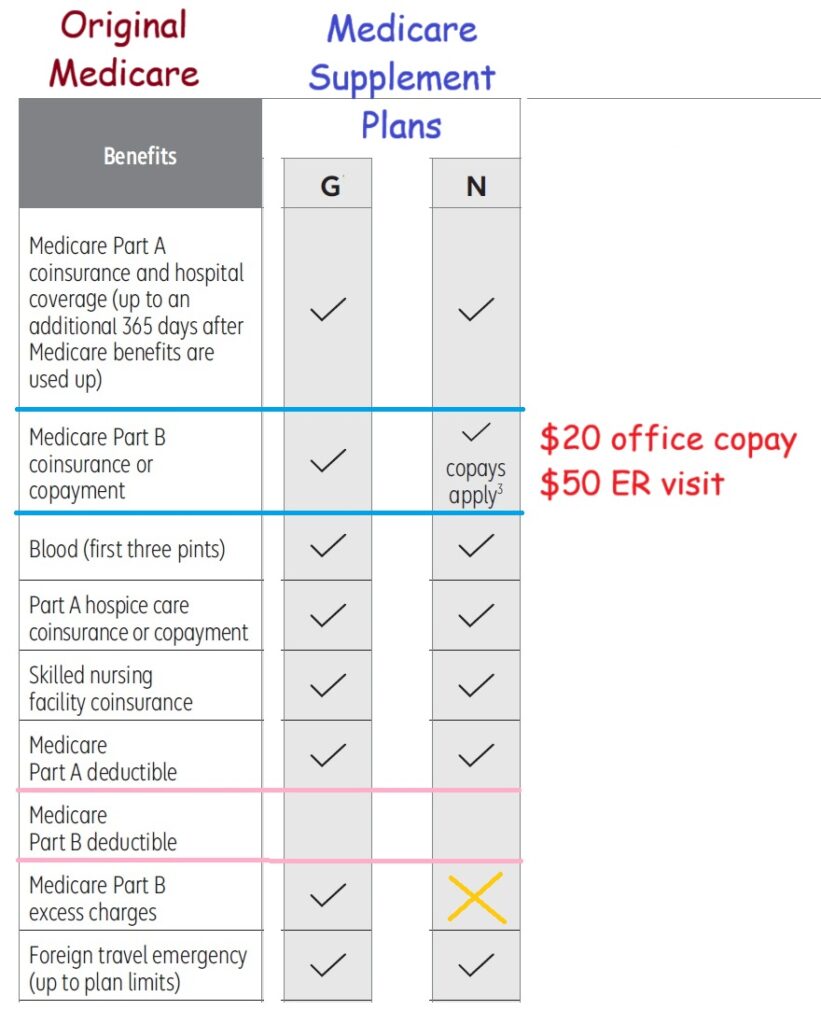

If we stripped out all of the other plans, Plan G and Plan N are very similar. The main difference is that Plan N has copayments for some outpatient services, when Plan G covers all those costs.

Both Plan G and N cover copayments and coinsurance for inpatient hospitalizations and stays in a skilled Nursing Facility. As with all the Medicare Supplement plans, neither Plan G or Plan N will cover the Part B deductible of $257 (2025.) After the Part B deductible is met, most health care services and durable medical equipment is subject to 20 percent under Original Medicare cost-sharing structure. Plan G covers all of the 20 percent coinsurance.

Plan N Copayments

Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room services. The other difference is that Plan N does not cover Part B excess charges when receiving services from some providers who are allowed to charge 15 percent over the Medicare reimbursement rate.

Comparing Plan G and Plan N Premiums

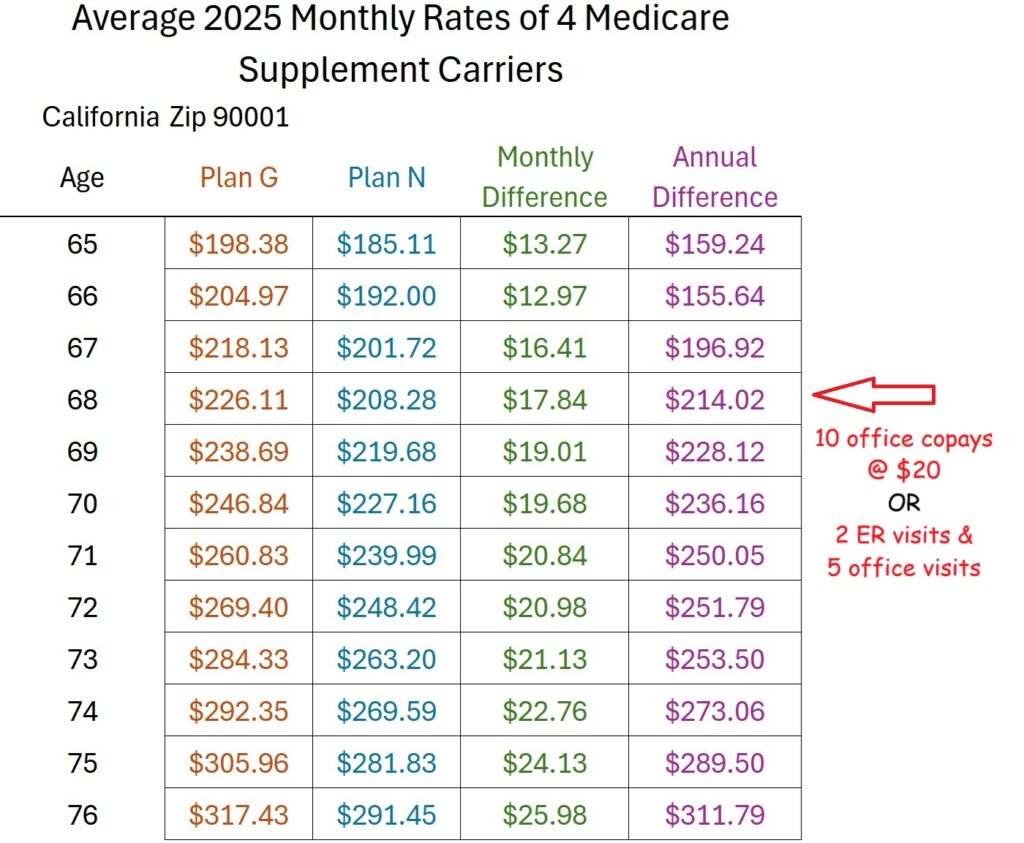

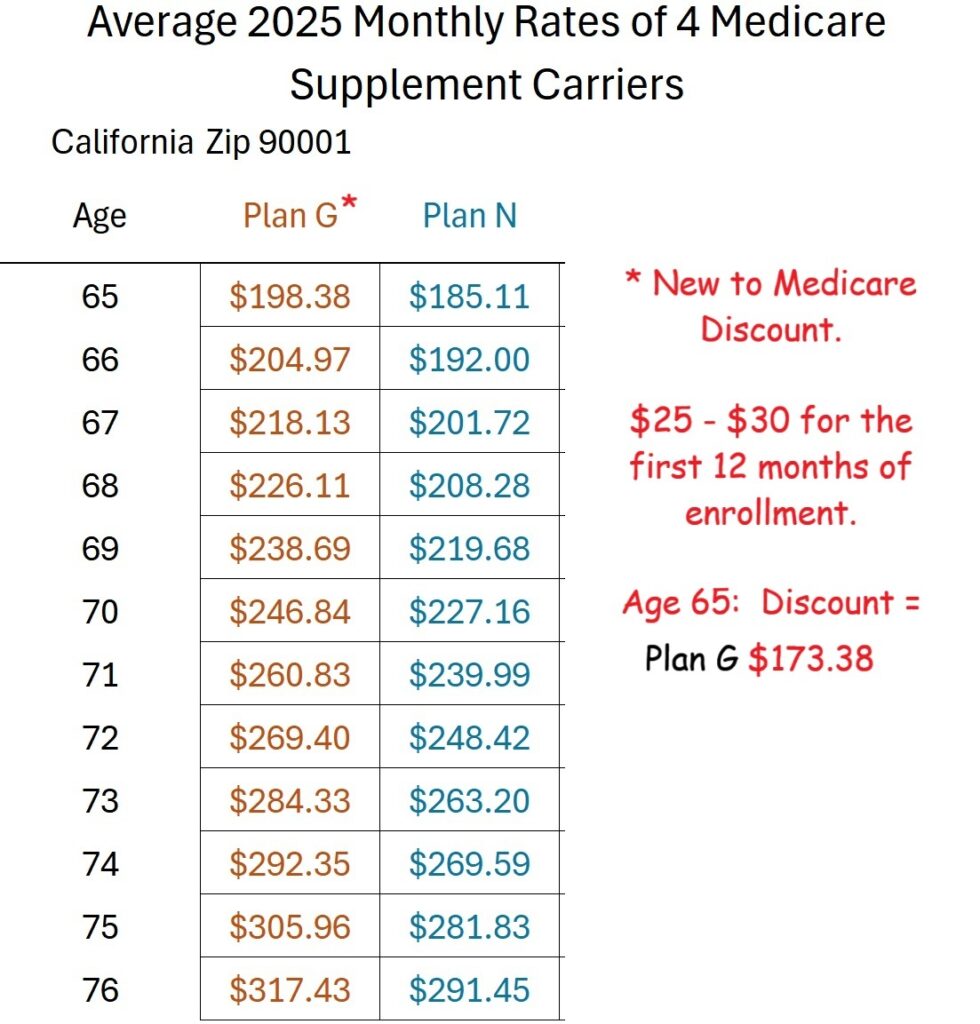

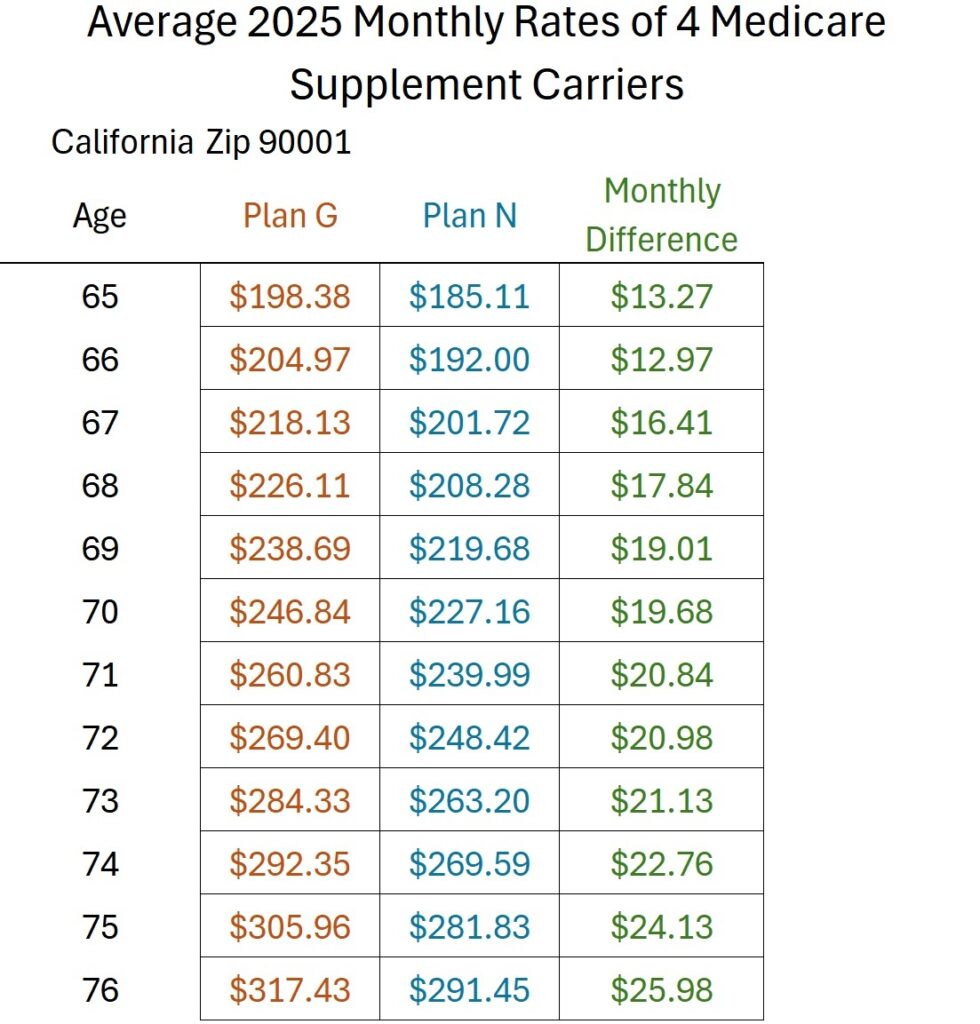

The question for many of my clients is if Plan N is worth a lower monthly rate when they will have additional cost-sharing because of the Part B copayments? I selected four insurance companies with competitive rates and averaged their monthly rates for ages 65 through 76. This average rate comparison is from a zip code in Los Angeles County. While some areas will have lower or higher rates, the monthly premiums follow a set increase by age.

One confusing aspect of comparing rates is that several insurance companies will offer a new to Medicare discount of $25 to $30 per month for the first 12 months of enrollment for Plan G. This effectively makes Plan G less expensive than Plan N for the first year. Once the new to Medicare discount expires after 12 months, Plan G will be higher than Plan N.

Without any discounts, Plan N is consistently lower than Plan G. In the averaged rate table, the monthly difference quickly approaches $20 per month by age 70.

Plan N may save money over several years

When we extrapolate the savings to an annual basis, Plan N rates are $214 lower than Plan G by age 68. This means that at age 68, an individual could incur ten $20 office visit copayments during the year and still pay less than Plan G (annual premiums plus copayments.) The individual could also have two emergency visits at $50 and five office visits at $20 and still pay less money.

This is not to say that Plan N makes more economic sense than Plan G. There are health care scenarios where an individual has numerous office visits during the year to manage a chronic illness. In such a situation, Plan G may make better financial sense if you can predict your health care utilization.

Each person must evaluate how they may be using health care services once they become eligible for Original Medicare. It is possible to start with Plan G, with the discount, then switch to Plan N for the lower rate. Regardless, Medicare Supplement Plan N can save thousands of dollars for individuals who rarely use health care services but want the security of being protected from excessive Original Medicare cost-sharing.

YouTube video comparing Plan G to Plan N