Are Medicare Supplement plans a good value? Or, do you end up paying more in premiums than the plans save in reducing your Medicare medical health care costs. Here are a couple of Medicare health care scenarios that compare the savings versus the cost of the Medicare Supplements.

Are Medicare Supplement Plans Worth The Cost?

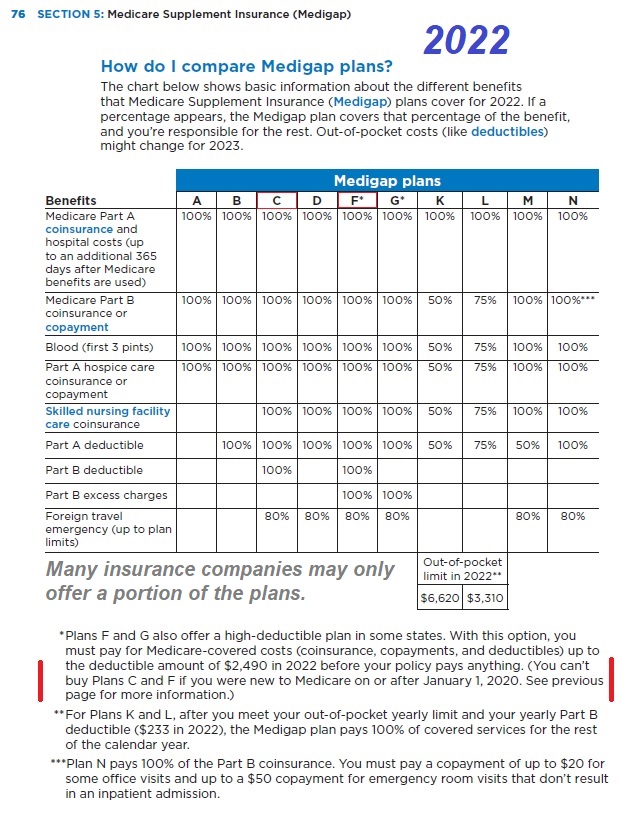

There are various Medicare Supplement or Medigap plans that have different benefits for covering certain Original Medicare Part A and Part B beneficiary member responsibility. In general, the more a plan covers, the higher the monthly premium. The plan that covers the least amount of Original Medicare member cost-sharing is Plan A. For individuals who turns 65 after 2020, the highest benefit coverage plan is Plan G.

While it is nice to have the highest benefit Plan G to limit your out-of-pocket costs associated with Original Medicare, does Plan G save more money than Plan A? It depends on the particular health scenario and your age. The biggest downside to Original Medicare is that there is no maximum out-of-pocket amount like a traditional health plan. In other words, there is no patient responsibility cap on how high the Medicare member costs can go. Medicare Supplements help contain the costs.

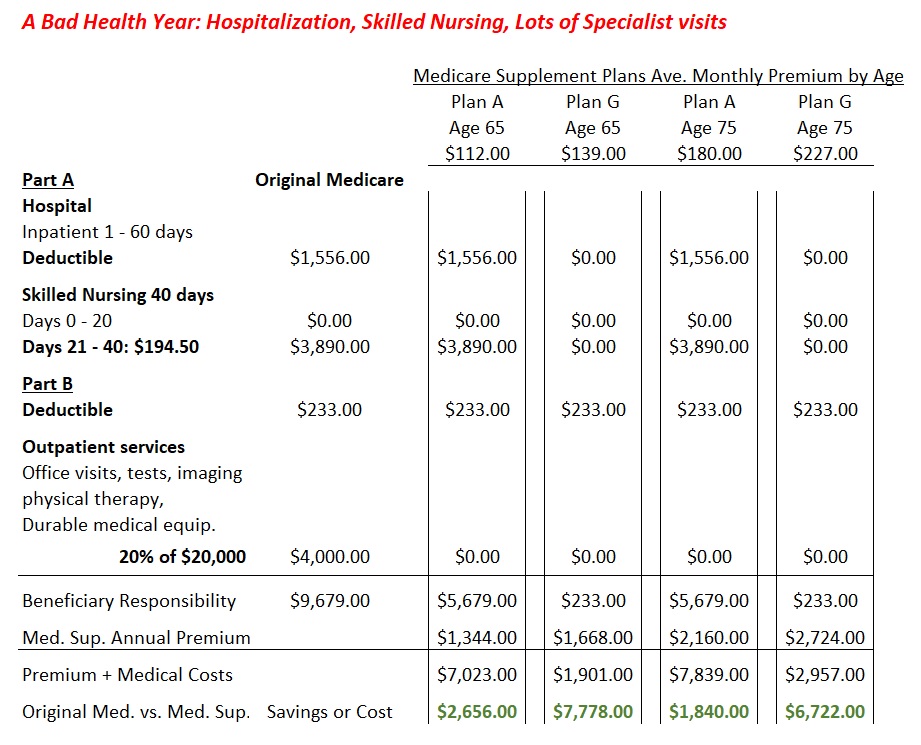

A Bad Health Year Scenario

In this scenario, you have a bad health year. You are hospitalized for major surgery and stay there for 4 weeks. You are then discharged to a skilled nursing facility for 40 days to regain your strength and for physical therapy. After the surgery and nursing home vacation, you have multiple specialist visits, tests, imaging, additional therapy, and durable medical equipment that amounts to $20,000.

With Original Medicare, based on 2022 amounts, your Part A hospital deductible is $1,556 for the stay. The first 20 days of the skilled nursing facility is covered by Medicare, but you have a daily copayment of $194.50 for the other 20 days. Before Part B covers any outpatient costs you are on the hook for a deductible of $233. Then you are responsible for 20% of the Medicare expenses for all the labs, tests, office visits, etc. Under this hypothetical scenario, your member responsibility under Original Medicare is $9,679.

The spreadsheet below applies the coverage of a Medicare Supplement of Plan A and Plan G to those Medicare health care expenses. Because Medicare Supplement plan premiums increase with age, I also ran the numbers for a 75-year-old. I have used an average cost for the plans in California at the 65 and 75 age band.

We can see that in the bad health year, all of the plans, regardless of age, reduce the Medicare cost sharing. I included the annual cost of the supplement as a fixed cost for determining the overall cost savings. Plan A, for a 65-year-old, would save $2,656 over Original Medicare and $1,840 for a 75-year-old. The reduced savings for age 75 is because the Plan A premiums are $68 per month more than the 65 age rate.

Of the 4 categories of Medicare expenses (hospital, skilled nursing, Part B deductible, Part B coinsurance), Plan A only covers the Part B coinsurance. Of course, it is usually the Part B coinsurance that becomes most onerous for people, especially when expensive outpatient procedures and imaging are required to treat a disease. Plan A covers the $4,000 Part B coinsurance cost.

Plan G covers the cost for 3 of the expense categories. Plan G does not cover the Part B deductible. Even though the rates for Plan G are $27 to $47 per month more than a Plan A the savings can be twice to three time larger than Plan A. In this case, Plan G is covering the Part A deductible, copayments for days 21 – 40 of the skilled nursing facility, and Part B 20% coinsurance. Regardless of age, Plan G members, in this situation, only pay $233, the Part B deductible.

Insurance is meant to protect us against catastrophic health care expenses. Original Medicare does that. However, most of us only have a few years of catastrophic health care expenses. The average person only uses the health care system for maintenance. In addition, many surgeries are done on an outpatient basis (Part B) and we never use the Part A (hospitalization) benefit.

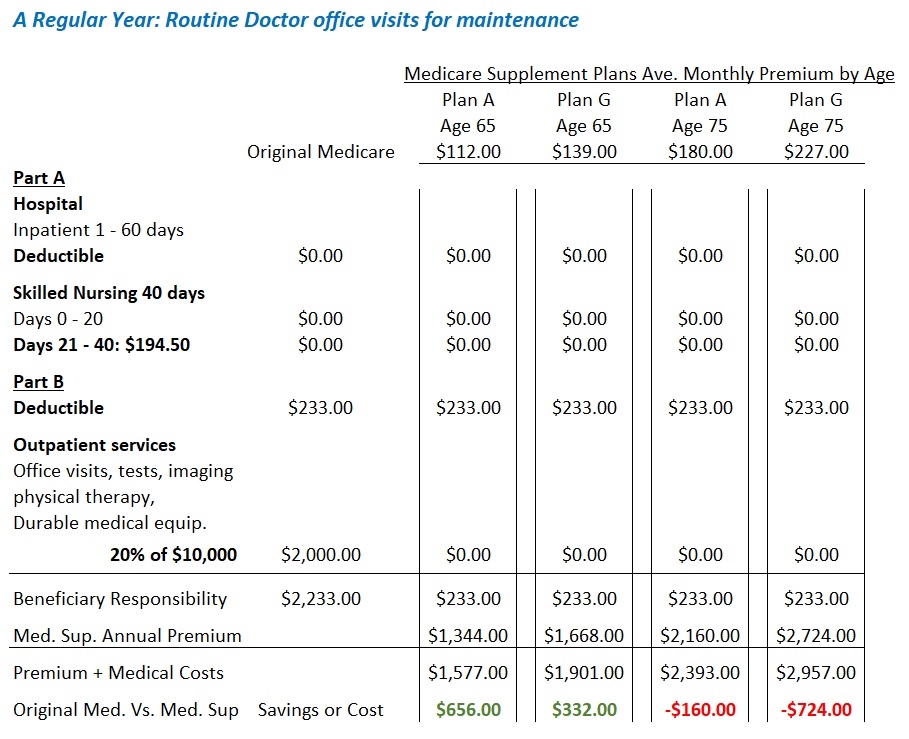

A Good Health Year

So how do the Medicare Supplements compare for a normal year cost savings. In this scenario, there is no hospitalization and no stay in a skilled nursing facility. All of the health care services received fall under Part B. In this scenario, Plan A and Plan G perform the same. The member is responsible only for the Part B deductible. Both Plan A and G cover all of the Part B coinsurance.

In a switch from saving in a bad health year, Plan A with lower benefits delivers more savings than Plan G for the 65-year-old. This is because the premiums are lower and the only Medicare expense category covered is the Part B coinsurance. At age 75, because of the higher premiums, it costs the plan member more in premiums for the Medicare Supplement Plan A or G than the plans deliver in cost savings.

Medicare makes annual increases to the Part A hospital deductible, skilled nursing copayment, and Part B deductible amounts. Regardless of the higher Medicare beneficiary cost-sharing, the Medicare Supplement plans will always cover those expenses as defined in the plan benefits. However, the Medicare Supplement rates seem to increase faster than Medicare cost-sharing. Consequently, older Medicare Supplement members can pay more in premiums than they receive in benefits.

The nature of health care has changed since the introduction of Medicare in the 1960s. There are more outpatient procedures and fewer hospitalizations. This shifts more of the costs into the Part B coinsurance expense category. Consequently, a Medicare Supplement plan that covers the Part B coinsurance can be beneficial.