Different interpretations of monthly versus annual income estimates on the part of Covered California and county Medi-Cal administrators have the potential to leave many Californians who are drawing unemployment benefits without any health insurance. At least one person has been denied the ability to purchase a private health plan with ACA tax credits while being simultaneously excluded enrollment in the ACA expanded Medi-Cal health plan. The conflicting interpretations can leave many people ineligible for either ACA tax credits or Medi-Cal.

Monthly versus annual income

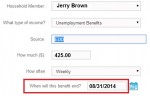

The central problem revolves around how the different agencies are characterizing the monthly unemployment benefits. Under the Covered California CalHEERS enrollment system a person drawing unemployment benefits must put an end date for the unemployment insurance. CalHEERS only recognizes the unemployment income up to the end date to determine the estimated annual income. If that income falls below 138% of the federal poverty line, the individual or household is determined ineligible to receive ACA tax credits to apply toward the purchase of the private plan.

San Diego county rejects Covered California Medi-Cal

Once Covered California determines the person or family is eligible for Medi-Cal, the case is sent to the respective county in which the applicant resides. In the case that I am familiar with, San Diego County looked at the person’s monthly income of unemployment benefits and concluded that she was ineligible for Medi-Cal because her monthly income was above 138% of the federal poverty line. San Diego County instructed her to return to Covered California and purchase health insurance.

Unemployment benefits and ACA tax credits

When an applicant states their unemployment income in the “Other” section of the income page they are prompted to enter an end date for the benefits. The CalHEERS system only calculates the unemployment income for those months that the applicant is eligible when determining the estimated annual income. In this fictitious example, the EDD unemployment income of $1,700.00 is above the federal poverty line for the month. But on an annual basis, because the unemployment will cease in August, the annual income of $13,600 is below 138% of the FPL and Covered California properly determined that the individual was eligible for Medi-Cal. San Diego County is only looking at the monthly total and would determine this individual makes too much to qualify for Medi-Cal. Result – the applicant can get neither private insurance with the ACA tax credits nor Medi-Cal.

Conflicting interpretations of ACA income rules

It is no surprise that there may be conflicting interpretations of the ACA income language given the variety of different bureaucracies that had their fingers in the creation ACA health exchanges: Covered California, Department of Managed Health Care, Department of Health Care Services, Centers for Medicare and Medicaid and the IRS to name a few. What is surprising is that none of the bureaucrats thought to align the monthly income regulations that the counties must work under and the CalHEERS software that made determinations based on an annual income estimate.

IRS uses annual and monthly income estimates

From the stand point of creating enrollment software, it is far easier to determine eligibility based on annual income so those enrolled aren’t under the onerous requirement to update their income every month. The IRS even states that once approved for the ACA Advance Premium Tax Credits (APTC), the household won’t lose that premium assistance even if their income drops unless they report a change to the exchange. One or two weeks of over-time can quite literally change the size of the ACA tax credit or actually lift a household out of Medi-Cal altogether. But the next month, without the additional income, the family slips back under 138% of the federal poverty line.

The IRS final regulations seem to give the state or federal exchange the authority to make the determination for Medicaid and APTC eligibility. From the IRS Final Regulations of the Health Insurance Premium Tax Credit available for download at the end of this post.

§ 1.36B–2 Eligibility for premium tax credit.

(a) In general. An applicable taxpayer (within the meaning of paragraph (b) of this section) is allowed a premium assistance amount only for any month that one or more members of the applicable taxpayer’s family (the applicable taxpayer or the applicable taxpayer’s spouse or dependent)—

(1) Is enrolled in one or more qualified health plans through an Exchange; and

(2) Is not eligible for minimum essential coverage (within the meaning of paragraph (c) of this section) other than coverage described in section 5000A(f)(1)(C) (relating to coverage in the individual market).

IRS taxable year

The IRS also leans toward eligibility based on income for the taxable year and not necessarily monthly.

(b) Applicable taxpayer—(1) In general. Except as otherwise provided in this paragraph (b), an applicable taxpayer is a taxpayer whose household income is at least 100 percent but not more than 400 percent of the Federal poverty line for the taxpayer’s family size for the taxable year.

State exchange makes ACA APTC determination

Under the IRS regulations, even if a household drops below monthly threshold to qualify for Medicaid or Medi-Cal they will still receive the APTC for the remainder of the year.

Example 5. Determination of Medicaid ineligibility. In November 2014, Taxpayer G applies through the Exchange to enroll in health coverage for 2015. The Exchange determines that G is not eligible for Medicaid and estimates that G’s household income will be 140 percent of the Federal poverty line for G’s family size for purposes of determining advance credit payments. G enrolls in a qualified health plan and begins receiving advance credit payments. G experiences a reduction in household income during the year and his household income for 2015 is 130 percent of the Federal poverty line(within the Medicaid income threshold).However, under paragraph (c)(2)(v) of this section, G is treated as not eligible for Medicaid for 2015.

Report an income change for Medi-Cal

An individual or household can report a change to income which will trigger a redetermination their eligibility for Medicaid or Medi-Cal.

Example 6. Mid-year Medicaid eligibility redetermination. The facts are the same as in Example 5, except that G returns to the Exchange in July 2015 and the Exchange determines that G is eligible for Medicaid. Medicaid approves G for coverage and the Exchange discontinues G’s advance credit payments effective August 1. Under paragraphs (c)(2)(iv) and (c)(2)(v) of this section, G is treated as not eligible for Medicaid for the months when G is covered by a qualified health plan. G is eligible for government-sponsored minimum essential coverage for the months after G is approved for Medicaid and can receive benefits, August through December 2015.

IRS doesn’t mention any county authority

All of these IRS examples and definitions point to the exchange as making the final determination for Medicaid and Medi-Cal eligibility and not some county administrator.

File a Covered California appeal

When I queried Covered California about what my client should do about being denied Medi-Cal from San Diego County I was instructed to file an appeal. The only problem is that the appeal relates to a grievance with Covered California. The glitch isn’t with the state exchange but overly zealous county bureaucrats in San Diego. Many counties are accepting the Covered California determination and enrolling individuals and families into Medi-Cal. Covered California needs to get with the Department of Managed Health Care and Department of Health Care Services which oversees the county administration of Medi-Cal and get everyone on the same page. The current situation of denying Californians Medi-Cal based on monthly income instead of following Covered California’s determination of Medi-Cal eligibility only serves to worsen the health status of those left without health coverage because ignorant or feuding agencies can’t remember that their mission is to serve the people and not the regulations.

Update to Medi-Cal Appeal

My client filed an appeal and received a hearing date. However, before the hearing could take place, Covered California acquiesced to San Diego County by granting the APTC so the client could enroll in a private health plan and not Medi-Cal. Instead of using the date on which the EDD letter said the benefits would end, Covered California changed the date to the end of the year. This forced the CalHEERS system to recalculate the income so it would be over 138% of the Federal Poverty Line. While my client could have done this, we followed the rules by entering the date of the end of the benefits. So why even have a system that prompts for the end date if it can be over-ridden by Covered California? I guess this just shows one of the flaws in a very complex system.

October Update

From all the news reports thousands college students who are not taken as a dependent on their parents taxes have successfully enrolled in a county based Medi-Cal HMO plan with no problems at all. However, I have heard reports that San Diego County has been very aggressive with college students trying to determine if they truly have an income below 138% of the Federal Poverty Line. Tactics include numerous letters demanding letter of income and parental assistance and phone calls to verify income. If you are being harassed by San Diego County over your MAGI, let me know so I can document it.

[wpdm_package id=171]