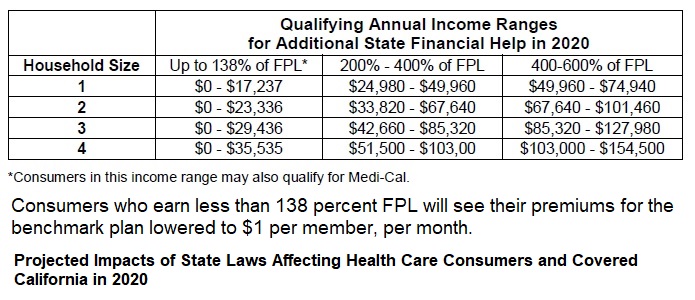

The Covered California Premium Subsidy for health insurance is in addition to any federal ACA subsidy. It is also available for households who don’t qualify for the federal subsidy such as incomes over 400% of the federal poverty level. The subsidy estimator is an online tool to determine if your household might qualify for the new California health insurance subsidy. For more details see Do You Qualify for the New California Health Insurance Premium Subsidy?

Go To California Premium Subsidy Estimator Calculator

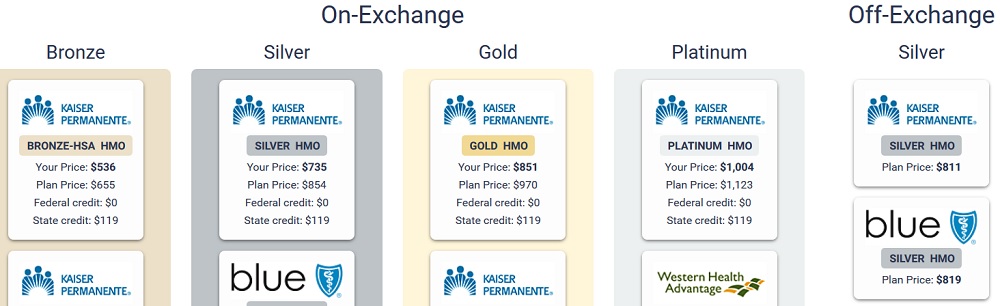

The California Premium Subsidy Estimator Calculator tool is targeted at households who earn between 401% and 600% of the federal poverty level and qualify for no federal ACA premium tax credit. It will show the cost of the off-exchange Silver 70 plan. If you are in a Silver 70 off-exchange plan, which cost less than the Covered California Silver 70 plans, any California Premium Subsidy you may be eligible for should be greater than the differential between the on- and off-exchange rates. In the above example, the state subsidy of $119 makes the Kaiser Silver 70 less expensive through Covered California than continuing with the off-exchange Kaiser Silver 70.

Covered California Shop & Compare Tool

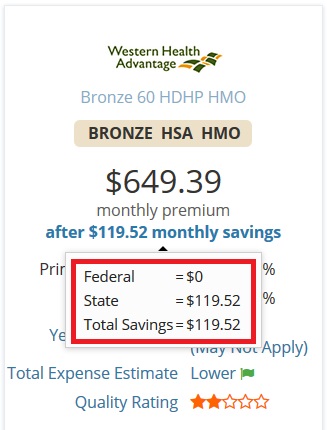

The Covered California Shop and Compare Tool will show not only show the state subsidy, but if your income is between 200% and 400% FPL, will display if you are eligible the federal ACA subsidy. But it does not show the off-exchange Silver 70 rate. Hover your mouse over the text “after $xx.xx monthly savings” and a break down of the state and federal subsides will be displayed.

Covered California Shop and Compare Tool will show both federal and state subsidy if income is below 400% FPL.

Covered California will show the state subsidy if your income is between 401% and 600% FPL.

The following is reprinted from a Covered California description of how the estimated subsidy calculator works.

Using data from the 2020 Federal Poverty Level (FPL) chart, the estimator shows both potential federal Advanced Premium Tax Credit (APTC) and state subsidy financial help, in addition to all product offerings within each metal tier for the consumer’s ZIP code. To help enrollers advise off-exchange consumers, the estimator shows plan pricing for off-exchange Silver mirrored plans available in the consumer’s ZIP code.

$0 Result for State Subsidy After Entering an Income in the 400-600% of FPL Range?

Receiving state subsidy depends on the difference between two numbers: maximum contribution and benchmark premium. Maximum contribution is the amount that the consumer’s household is expected to contribute toward the premium. As income rises, the household is expected to contribute a greater share (or contribution) toward the premium. The benchmark premium is the price of the second-lowest cost Silver plan for that consumer; the benchmark premium will vary based on a consumer’s ZIP code and age. If the benchmark premium costs less than the maximum contribution, the household will receive $0 in state premium, despite having a household income between 400%-600% of Federal Poverty Level (FPL).

The $0 result happens more often with the state subsidy program than with APTC/CSR (Advance Premium Tax Credit/Cost-Sharing Reductions federal subsidy programs) because the maximum contribution is lower for APTC/CSR than it is for the state program. Households in APTC/CSR income ranges are expected to contribute a smaller share of household income toward the premium. As a result, the benchmark premium often costs more than the APTC/CSR maximum contribution, and the household receives APTC/CSR to pay for the gap between the maximum contribution and the cost of the benchmark premium. In the state subsidy program, there is often no gap, and therefore no state subsidy will be given.

In the State Subsidy Estimator, you can check a the maximum contribution and benchmark premium by clicking the “Toggle Details” button and comparing your the specific numbers. If the “Your max contribution after state credits (monthly $)” amount is more than the “Cost of 2nd Lowest Silver Benchmark” amount, the consumer has insurance available at a lower price than the maximum cost calculated based on their income and household size.

Below are some examples using hypothetical households in the 90210 ZIP code:

A 30-year-old couple with a household income of $100,000: Their maximum contribution would be $1,485, and their benchmark plan would be $644. Because their benchmark plan costs less than their maximum contribution, there is no State credit to make up the difference.

A 30-year-old couple with a household income of $68,000: Their maximum contribution is $558, and their benchmark plan would be $644. Because their benchmark plan costs more than their maximum contribution, they would be eligible for $86 in State credit ($644-$558).

A 63-year-old couple with a household income of $100,000: Their maximum contribution is $1,485 and their benchmark plan is $1,675. Because their benchmark plan costs more than their maximum contribution, they would be eligible for $190 in State credit ($1,675-$1,485).