After a major upgrade to the Covered California CalHEERS enrollment website over the November 23rd weekend, health agents and businesses and nonprofits can now start an online small group health insurance application. However, don’t expect the process to be necessarily intuitive or easy as the application relies heavily on the user having a solid foundation with Microsoft Excel spreadsheets.

SHOP Employee Roster Spreadsheet

Unlike the individual and family enrollment portal on Covered California that walks applicants through various webpages to collect individual and family member information, the online SHOP application necessitates uploading a MS Excel spreadsheet or roster of all the employees at the organization. For executive directors, small business owners or agents who routinely use spreadsheets like Excel, this shouldn’t be too much of an issue. If navigating the world of computer spreadsheets or scanning and uploading various documents is not part of your business routine, sticking with the good old paper application may make more sense.

Outline of SHOP Quote, Application and Enrollment

- Create company and primary contact page. No SEIN!

- Submit for verification.

- Upload documents: DE9-C, SOI, business license.

- Enter SEIN

- Submit application.

- Download employee roster Excel template.

- Create employee roster and upload to Covered California.

- Employer plan selection, start date, dependent coverage election.

- Determine employer contribution

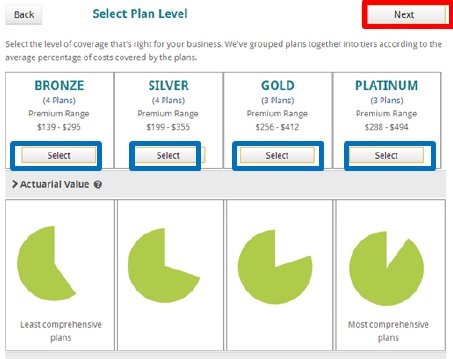

- Select metal level (Bronze, Silver, Gold, or Platinum)

- Select base plan in metal level that determines employer contribution amount per age of employee.

- Finalize employer contribution to employees and dependents.

- Generate quote per employee.

- Finalize plan selection, open enrollment starts, employees receive notices.

- Employee applications and enrollment process begins.

- Employees apply either with special number from notices or agent can apply from employee roster.

- Employee can decline or waive coverage on the application. SHOP needs 70% participation of eligible employees. This is waived during a special enrollment period from November 15th through December 15th, 2013.

- Employee selects a health plan with in the employer designated metal tier level. Available health plans based on employee zip code.

- Employee selects a pediatric dental plan for his or her children.

- Employee sent another notice from Covered California confirming plan selections.

Glitch work around solution

The step of generating a roster of employees in a spreadsheet to be uploaded as part of the SHOP online application only highlights how the Covered California enrollment system for small groups is not a finished product. There were also a few tips and tricks discussed on a recent webinar about the SHOP application that indicate post development testing found failures in the software. Download presentation slides at end of post.

When not to enter SHOP information

For instance, agents were admonished NOT to include the SEIN (State Employment Identification Number) during the creation of the employer account. The inclusion of the SEIN prevents the agent or employer from uploading the necessary documents to verifying small group eligibility. The SEIN is to be added after the documents are uploaded. This is an obvious software coding issue, that to be properly addressed, would have further delayed the release.

Ignore several webpages for employees

Even though a health agent can start the application, upload documents and help the employer select a plan and contribution level, there are some confusing elements with respect to sending out notices to employees and their subsequent enrollment. The system is set up to allow employees to enter the enrollment portal and complete their portion of the application. Unfortunately, half of the web pages, which are taken directly from the individual and family side of CalHEERS, don’t apply to an employee enrollment.

Families catch a break under SHOP employee only

A potential benefit to the Covered California SHOP program is the ability for employers to select an “employee only” small group plan. This allows the families of low and moderate wage employees to apply and receive premium assistance from Covered California. As it stands currently, if the spouse or parent is offered affordable health insurance (monthly premiums less than 9.5% of household income) no one in the household can receive the premium assistance offered through the Affordable Care Act.

Will tax credits attract and keep small groups?

Compared to existing small group quoting and enrollment systems from the insurers and the Cal Choice private exchange, the Covered California SHOP program seems a little clunky and unfinished. If an employer wants to realize the tax credits for contributing to employee health insurance premiums they have to have a small group plan through Covered California. Except for the option to purchase pediatric dental plans for dependent children, SHOP offers no adult dental or vision insurance.

Slow customer service will cause delays

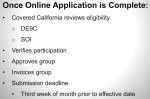

There will be some health agents that become experts in the SHOP program and will be able to shepherd an application through in short order. For others, including the employers, there might be some technical challenges from getting their small group in place by January 1, 2014. My best advice is “don’t wait”, apply now. The holiday season in late December will inevitably slow down the verification of documents and allow the employees enough time to select a health plan. If the current slow response to customer service continues at Covered California then starting an application late may significantly delay the final small group plan.

COVERED CALIFORNIA LAUNCHES SELF-SERVICE WEBSITE FOR THE SMALL BUSINESS HEALTH OPTIONS PROGRAM

Press release from Covered California, December 2, 2013

LOS ANGELES, Calif. — Covered California™ today officially launched the full self-enrollment function of the Small Business Health Options (SHOP) online marketplace. This significant new function on the Covered California website will enable small businesses to fully enroll for coverage that may begin as early as Jan. 1, 2014.

“Small businesses now have new options to provide more choice for their employees and new affordable options for their business,” said Covered California Executive Director Peter V Lee. “Covered California has created the Small Business Health Options Program (SHOP) to help the small business owners to get the best value for themselves and their employees. Since October more than 1,500 small business owners have begun the process of exploring whether the SHOP program is right for them.”

Small-business owners with one to 50 eligible employees may now enroll in Covered California’s Small Business Health Options Program (SHOP) plans for coverage effective Jan. 1, 2014. Like the health insurance plans in Covered California’s individual market, Covered California’s SHOP plans were negotiated to bring a standardized set of benefits, a robust provider network, and a broad choice of health insurance plans with competitive pricing to employers and their employees.

Previously, small business employers have been able to register online, check their eligibility and work with a Certified Insurance Agent to obtain a quote. The new system enhancements now allow online enrollment functionality for SHOP, including online quoting, the ability to submit an online application at www.coveredca.com in real-time, and the ability for employers to initiate electronic open enrollment for their employees.

Many Small-business owners qualify for a federal tax credit to help offset contributions toward employee premiums. Beginning in 2014, the only way for small-business owners to access the tax credits is to purchase insurance through Covered California’s SHOP. Small businesses are eligible for a federal health care tax credit if they have fewer than 25 full-time-equivalent employees for the tax year, pay employees an average of less than $50,000 per year and contribute at least 50 percent of their employees’ premium cost. Employers with 10 or fewer full-time-equivalent employees with wages averaging $25,000 or less per year are eligible for the maximum amount of tax credits.

“The tax credits available to small business through Covered California make quality coverage more affordable,” said Lee. “For example, a beauty shop with 10 full-time employees and total wages of $250,000 that purchases insurance through Covered California’s SHOP may be eligible for a $35,000 tax credit in 2014. We know that the tax credit is meaningful for a lot of small business that have been struggling to obtain quality, affordable coverage for their employees.”

In addition to purchasing coverage on the Covered California website, Covered California SHOP plans are sold through licensed agents who are trained and certified by Covered California. Since registration opened in August, more than 22,000 licensed agents have signed up to become certified to sell Covered California products, with more than 7,000 agents currently certified and available to help individual consumers and small employers in the Covered California marketplace.

The increased website functionality also includes a number of new features available for the Certified Insurance Agent community, such as the ability to create an online profile for an individual consumer or small employer; the ability to start and submit an application on behalf of an individual or small employer; and, the ability to process and manage employer online enrollment applications for SHOP.

About the Small Business Health Options Program (SHOP)

The Affordable Care Act includes provisions to encourage small businesses to offer health coverage for their employees by making insurance more affordable and easier to purchase. Covered California has created the Small Business Health Options Program (SHOP) to facilitate the purchase of affordable health insurance for small-business owners.

SHOP is a second marketplace—separate from the one for individuals—and is designed to give employers and their employees more options for health coverage. Using this marketplace, small-business owners can shop for health insurance in ways that offer convenience and choice, which is comparable to how large companies shop for employee health insurance today.

In 2014, health insurance companies participating in SHOP are: Blue Shield of California, Chinese Community Health Plan, Health Net, Kaiser Permanente, Sharp Health Plan and Western Health Advantage. These plans will be sold through Certified Licensed Insurance Agents trained and certified by Covered California.

Small businesses are not required to buy insurance for their employees. SHOP is completely voluntary, and small businesses will not be penalized for non-participation. Small businesses can enroll in a SHOP plan year round.

###

[wpdm_package id=142]