In some counties, Medicare beneficiaries will have over 15 different Medicare Advantage plans to choose from. Many of the plans look virtually identical. One way to sort through the weeds is to create a spreadsheet of benefits and costs.

Medicare Advantage plan comparisons

The first filter for selecting a Medicare Advantage plan is to determine which ones have your preferred doctors, hospitals, and other providers in-network. Unfortunately, making that determination is not always an easy task. You may have to visit the medical group and hospital websites to learn which Medicare Advantage plans they are participating in.

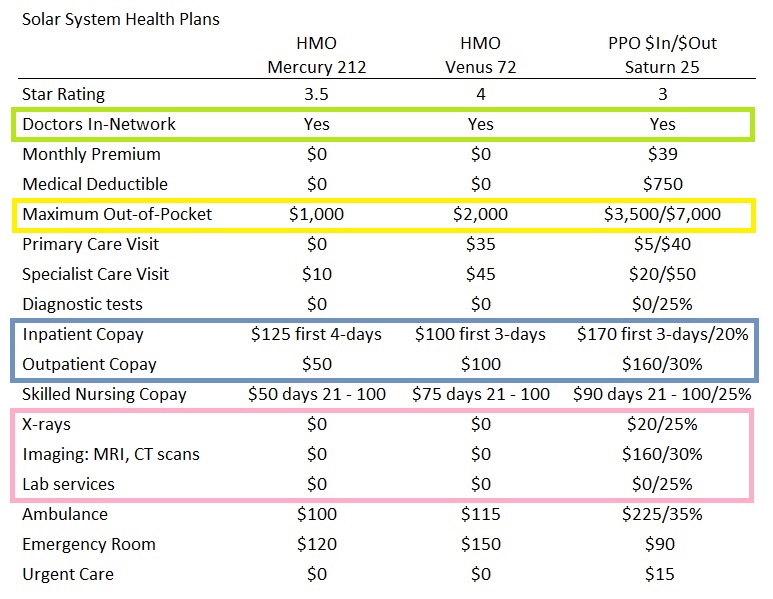

Once you know which plans support your providers, you can begin to build your benefit comparison spreadsheet. I have broken this spreadsheet into 3 categories: medical, prescription drug, and supplemental benefits. I created a fictitious plan sponsor, Solar System Health Plans, and fictitious plan names: Mercury 212, Venus 72, and Saturn 25. The benefits and costs are similar to what might be available in your area.

Comparing medical benefits and member costs between Medicare Advantage plans

The columns across the top are the plans and the rows down the side are the benefits. The intersection of the row and column is either the cost of the benefit to the member or whether the benefit is covered at all. The Saturn 25 PPO can have 2 cost numbers, one for in-network services and the second for out-of-network services. I like to include the Star Rating given to each plan by Medicare because it is gauge of how well the plan is doing with the members from customer service to preventive services. Most of this information can be found either through the summary of benefits for the plans or on the Medicare.gov website.

Once you populate the cells with the different costs or coverage, you can begin to get a sense of how the plans differ. There is no apparent reason why some plans have certain costs. For example, the Mercury 212 HMO has a $1,000 maximum out-of-pocket amount, while the Venus 72 HMO and Saturn 25 PPO have $2,000 and $3,500 amounts respectively for in-network services. However, the Saturn 25 PPO may cover some out-of-network provider costs and that benefit may outweigh the higher maximum out-of-pocket amount.

Only you know how you use health care services and what you anticipate in the coming year. Consequently, the comparison will give you information on how you might save money with one plan.

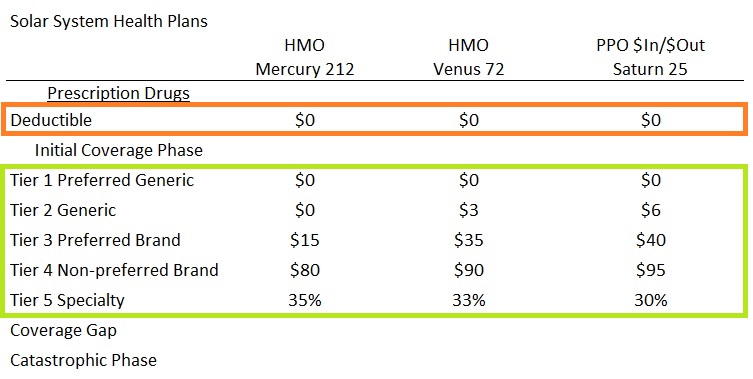

Prescription drug coverage comparison between plans

The prescription drug portion of the Medicare Advantage is its own insurance plan. The costs you pay for prescription drugs does not accrue to the Medicare Advantage medical plan maximum out-of-pocket. The prescription drug plans have their own benefit and cost structure related to deductibles, initial coverage, coverage gap, and catastrophic phase. The prescription drug plans are unnecessarily complicated. Medicare.gov does a good job of estimating your drug costs through the year when you enter your prescription medications into their plan finder tool.

However, you can still compare some of the plan benefits and costs between the Medicare Advantage plans for the drug portion of the plans. I’ve only included the initial coverage phase of the drug component in this spreadsheet. You may encounter Medicare Advantage plans that have more than 5 tiers. If prescription drugs are a significant portion of your overall medical expenses, you’ll want to expand this section and enter specific costs of some of the drugs, especially if you know you will go into the coverage gap.

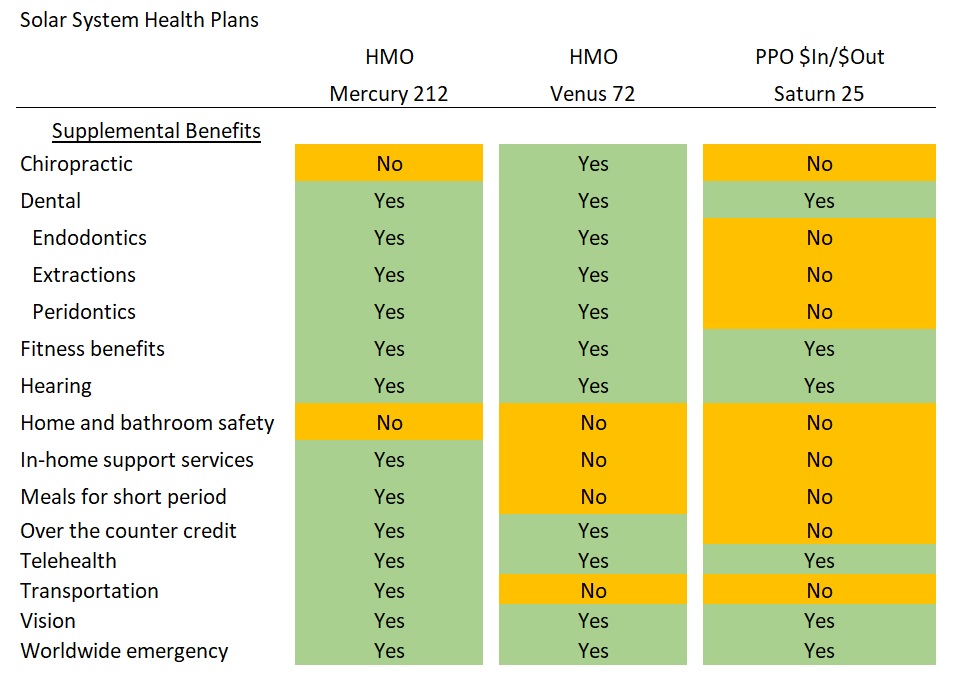

Comparing supplemental benefits of the Medicare plans

Many of the Medicare Advantage are including supplemental benefits not covered under Original Medicare. Some of the benefits may be very important in plan selection. Be aware that many of the supplemental benefits are handled by third-party organizations and not the plan sponsor. Consequently, you may need to register or activate the benefit with another organization in order to receive the benefits.

Some of the supplemental benefits can be very basic. For example, some plans like the Saturn 25 include dental coverage, but it is only the basics of cleanings, x-rays, and exams. There is no coverage for major dental work like extractions. In addition, if you have a preferred optometrist or dentist, you’ll want to confirm that provider accepts or participates in the specific supplement benefit program.

It can take some work to create the spreadsheet. I guarantee you will learn more about the Medicare Advantage plans by completing a comparison when you dig into the details. When you are finished, you will have a better sense of how the plans compare and which ones will best address your particular medical needs while, hopefully, reducing your out-of-pocket costs.