A frequently asked question I received is if the individual has to repay Medi-Cal for health care services or health insurance. The two areas of concern are people who are over 55 years old and individuals who forget to report an income increase to Medi-Cal.

First, Medi-Cal, California’s version of Medicaid which is partially funded by the federal government, is big, complex, and has many different programs. Consequently, each separate program has its own rules for eligibility and potential repayment of services.

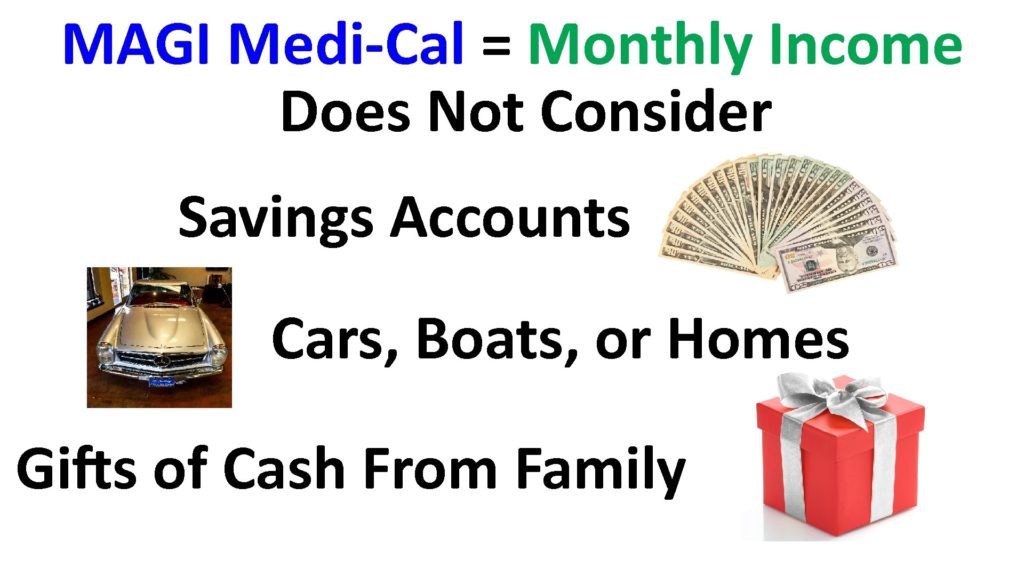

The primary focus of the questions I receive is on the Modified Adjusted Gross Income or MAGI Medi-Cal or the Medi-Cal program expanded by the Affordable Care Act for adults and children. MAGI Medi-Cal only looks at your monthly income, not your assets such as bank accounts, cars, homes, etc. Conditional Medi-Cal, coverage programs for people with disabilities or who are eligible for Medicare has both income and asset limits for eligibilities.

Medi-Cal Estate Recovery Program

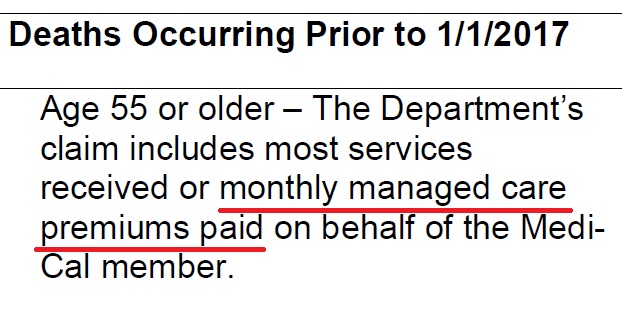

Early in the launch of the Affordable Care Act many older adults were being deemed eligible for Medi-Cal. Back in 2014 Medi-Cal had an Estate Recovery Program that applied to every adult who was 55 years old and older. The Estate Recovery Program seeks to recover the costs of Medi-Cal health care services and insurance upon the beneficiary’s’ death. However, if the person owned nothing, then nothing was owed to Medi-Cal.

A lot of older adults between the ages of 55 and 64, who were just signing up for Covered California, were put into Medi-Cal. Then they became worried that the Estate Recovery Program would come after their assets upon their death to satisfy the collection of the MAGI Medi-Cal HMO plan premiums they received. The monthly capitation amounts for the Medi-Cal HMO plans can run anywhere from $400 to $600 per month.

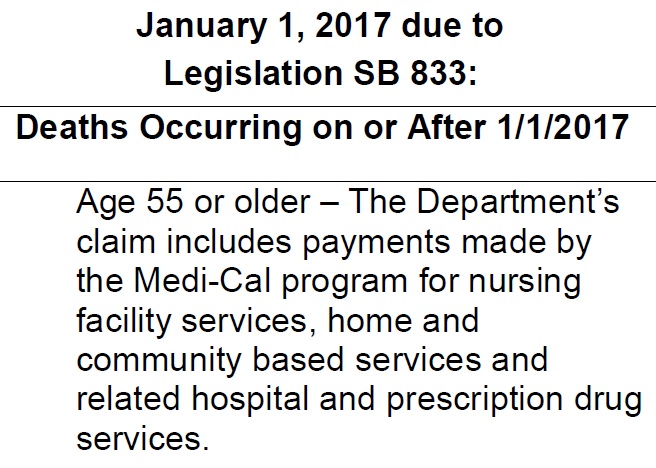

This all changed with the implementation of SB 833. People who are over 55 years old and die after January 1, 2017 will not be subject to Estate Recovery for MAGI Medi-Cal plan premiums, but are still on the hook for nursing facility services, home and community-based services and related hospital and prescription drug services.

Medi-Cal Reporting Requirements for Income Changes

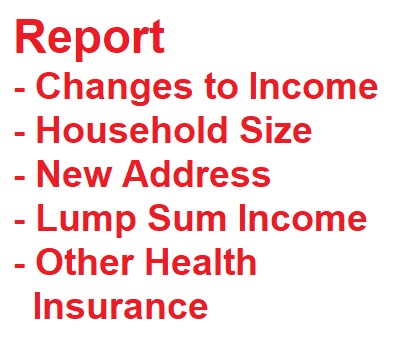

The second area of consternation comes from people who have forgotten to notify Medi-Cal that their income has increased or they gained employer sponsored health insurance.

Millions of adults and children have been enrolled in MAGI Medi-Cal HMO plans since 2014. For many individuals and families, this was their first experience with the Medi-Cal system and all of the bureaucracy and rules. One of the rules is that you agree to report any changes to the household – including income or employer sponsored health insurance – within 10 days to your county Medi-Cal social services office. For people not used to interacting with a government agency on possibly a monthly basis, there has been a lot of noncompliance with the 10-day rule.

If you have been offered employer sponsored health insurance, you are almost certainly not eligible for MAGI Medi-Cal. You just need to report that you have it.

If your income increases, many people incorrectly assume they are no longer eligible for MAGI Medi-Cal. That is not the case. Medi-Cal is based on your monthly income, not necessarily your annual income. Just because you had an unexpected bump in your hours for one month, does not mean you are no longer eligible. Just report the change to Medi-Cal and let them make the determination. The same applies if you receive a one-time lump sum income amount. These types of events are not necessary counted against you.

In a few conversations with Medi-Cal county eligible workers, they have noted that in the absence of beneficiaries reporting and increase of income, the eligibility is corrected during the annual redetermination paperwork. This is where the household notes their current monthly income or enrollment in employer sponsored health insurance.

Medi-Cal Fraud

While this is all important information, what about repaying Medi-Cal. I can only make two statements.

- Of the hundreds of individuals and families and I have worked with, who belatedly reported an income increase, or even enrollment in employer sponsored health insurance, none have ever said they were asked to repay any MAGI Medi-Cal plan premiums.

- California does have a fraud unit who pursues cases where people, with intent, fraudulent try to get benefits and services they are not entitled to.

The people I have spoken to have made honest mistakes in failing to report their income changes in a timely manner.

My guidance to people who find themselves in this situation is to immediately report their income change. Even if the income increased several months ago, that still doesn’t mean you are not still eligible for Medi-Cal. You need to put the eligibility determination in the hands of the county eligibility case workers.

And let me stress again – I have yet to hear of a single adult or family who has received a bill from Medi-Cal for past MAGI Medi-Cal HMO plan premiums after they reported an increase of income, even if the report was several months late.

Once you realize that you forgot to report your increase of income, it is the honest and ethical path to immediately report the change of income. Medi-Cal is not out to kick people out of the system. Some families find it extra-ordinarily hard to get out of Medi-Cal even when they do report circumstances that clearly make them ineligible.

If your income has increased, just report the change. Your stress level will decrease knowing that you have done the right thing. And feel secure in knowing that Medi-Cal is not on some sort of war path to track down late reporters.

Video Explanation of Medi-Cal Repayment/Reporting