It was perhaps the first newspaper advertisement welcoming Medi-Cal recipients into the mainstream of health insurance. Safeway grocery stores were inviting Medi-Cal beneficiaries to fill their prescriptions at their pharmacies. The Medi-Cal welcome mat was the result of Medicaid expansion under the ACA where scores of middle class families were now enrolled in the no cost health plans. The half-page Medi-Cal advertisement also illustrated the big money that is flowing into Medicaid health plans and the associated providers and suppliers of prescription drug medications.

Fixed capitated amount paid for each Medi-Cal member

Medi-Cal health insurance premiums paid to managed care health plans or Health Maintenance Organizations (HMOs) is a sizeable sum of money. The California Department of Health Care Services estimates the average monthly cost for each Medi-Cal beneficiary is $611. Expanded Medicaid, where families earning less than 138% of the federal poverty line are automatically enrolled in Medi-Cal through Covered California, encompasses a population who is often healthier and use fewer health care services than beneficiaries who qualified under the original Medi-Cal rules.

Expanded Medi-Cal members younger, healthier

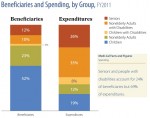

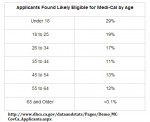

A California HealthCare Foundation study of 2011 Medi-Cal beneficiaries (California Health Care Almanac download at end of post) determined that children and non-elderly adults comprised 75% of the Medi-Cal members, but only accounted for 31% of the overall expenditures. Covered California statistics show that 19% of 18 – 25 year olds and 17% of 26 – 34 year olds who applied for health insurance through the state exchange were eligible for Medi-Cal. Those age ranges, who are typically healthier and may not have qualified for original Medi-Cal, represent just the sort of individuals health insurance companies want – people who use few health care services and generate fewer claims. Click the thumbnail to enlarge.

Big money in Medi-Cal managed care health plans

It’s no coincidence that many large health insurance companies acquired existing companies that focused on the Medicaid managed health plans. They could see that the influx of beneficiaries under the expanded Medicaid rules would be a profitable pool of people to have. Covered California announced that over 1 million people were eligible for Medi-Cal in the state. Safeway, by extension, also recognizes this new group of families with pharmacy benefits in the Medi-Cal Anthem Blue Cross Partnership plan, offered in certain counties, as a growing market to target in advertising.

Local non-profit health plans benefit

Virtually all of the new Medi-Cal beneficiaries will have to enroll in a managed health care plan offered in their county. Some of these plans are organized and run by the local county government and others are private companies that were selected to offer a HMO to Medi-Cal beneficiaries. Regardless of whether the health plan is a local non-profit or a for profit company, they are each paid a monthly capitation rate per person.

Capitation, per capita, per person

Under capitation, health plans receive a fixed fee for each member enrolled, regardless of the amount or intensity of services provided. The word “capitation” is derived from the term “per capita,” which means per person. Generally, capitation payments are expressed as some dollar amount per member per month (PMPM), where the word “member” typically means enrollee in some managed care plan, which is usually a health maintenance organization (HMO). The capitation rate does not vary by age, but it will vary by the county and the aid group. For an adult, it doesn’t matter if the person is 22 or 62 years of age, the health plan receives the same monthly amount. (Many large groups including CalPERS still use a single premium rate per employee regardless of age.)

Complicated formula for capitation

The Medi-Cal capitation formula is complicated. In the early years of Medicaid, managed care programs in the states would look at Fee-For-Service costs to determine a monthly rate. Fee-For-Service (FFS) programs just had Medicaid directly pay each provider for each health care service rendered. In simple terms, the aggregate amount of all expenditures divided by the number of specific people in the group would be the foundation for the monthly capitated reimbursement to the health plan. (Medicare still uses the foundation of FFS for determining the monthly reimbursement rates to private Medicare Advantage Plans).

Will per capita amount decrease?

As most of the Medi-Cal beneficiaries are in managed care plans and the number of FFS individuals has dwindled, creating a pool of expenditures too small for reliable data extrapolation, the capitation rates are being built upon the expenditures of the managed health care plans themselves. It’s possible that the monthly capitation rates will be driven down with the inclusion of healthier people who use fewer health care services. But at least for 2014, Medi-Cal managed health care plans are the recipients of monthly reimbursements that were generally based on a pool of people in original Medi-Cal with more significant health challenges.

58 counties, multiple plans

The DHCS 6-Month ACA expansion Capitation Rate Summary from January 1 – June 30, 2014 shows a fairly consistent monthly payment across the state. Because California is so diverse between urban and rural populations, concentration of providers and the different health plan delivery models between the counties, it is hard to asses if one county is doing a better job of keeping the capitation rates lower than another county. However, in terms of money, the midpoint capitation rate of $611.92 multiplied by 1 million new Medi-Cal members equates to $611,920,000 being spent on expanded Medi-Cal in California every month. Under the ACA the federal government is picking up that tab for the first three years.

[gview file=”https://insuremekevin.com/wp-content/uploads/2014/05/Medicaid_ACA_Expansion_Rates.pdf” save=”1″]

No one talks in a bureaucracy

I’ve been interested in the Medi-Cal capitation rate before open enrollment started in 2013. While I knew the expanded Medi-Cal would be a windfall for private and public health plans, no person at any health plan, county or state government agency would return my phone calls or emails requesting information. Today, nothing has changed. Calls made to the DHCS were met with a recording that the phone line had been disconnected or the message box was full. In the six months from my first inquiries there does seem to more information available on various state websites. I present this information and conclusions based on the available data and information I could glean from the various government websites. I welcome clarifications from anyone who may have more in-depth knowledge of the subject.

Many different aid groups in Medi-Cal

Below is the Medi-Cal Managed Care Division Capitation Report for March 2014. I’ve excerpted some data below to show the average capitation amounts by some of the listed Aid Groups: Adults, Aged, BCCTP, Child and Disabled. But what the report shows is how complicated the management of the system is with the health plans credited payment on one line and then being debited on the next. I assume this is a reflection of people coming into and leaving the Medi-Cal system and the DHCS payment system finally reconciling all the changes. (Groups and acronyms are defined after entire report window).

[gview file=”https://insuremekevin.com/wp-content/uploads/2014/05/Medi_cal_cap_rates.xlsx”]

Feds kick in part of Medi-Cal tab

What is also evident is the enormous amounts of money that is being transacted between the state, the counties and the individual health plans. Of course, what is not shown is that the federal government contributes approximately 40% of the Medi-Cal rate for many Aid Groups and 100% of the rates for individuals, mostly children and adults, in expanded Medicaid. Unfortunately, this report doesn’t notate which groups have a cost-sharing with the federal government. For example, the capitation amount of $529.16 being paid on behalf of the 4233 Adults in Sacramento County to Anthem Blue Cross, the federal government is covering 100% of that amount for some of the adults that entered Medi-Cal through the expansion. I wasn’t able to determine if adults previously in original Medi-Cal now fall under expanded Medicaid and have the federal government pick up 100% of their monthly capitated rate.

[gview file=”https://insuremekevin.com/wp-content/uploads/2014/05/ManagedCareCapitation-032014.pdf” save=”1″]

Capitation rate acronyms

COHS (County Organized Health Systems): A managed care health plan created by the local County Board of Supervisors and is run by the county. All residents eligible Medi-Cal are generally in the same COHS.

GMC (Geographic Managed Care): The Department of Health Care Services contracts with several commercial plans to be offered in specific counties. Sacramento and San Diego are GMC counties and generally have more managed health care plans than other counties.

Two Plan: a county that has one local initiative managed health care plan and one commercial plan. The DMHC contracts with both plans.

Regional: a county with two commercial managed health care plans.

Imperial: this county has two commercial plans but somehow is different from the Regional designation.

San Benito: only one plan is offered in this county. Residents can also choose a regular Fee-For-Service Medi-Cal model.

Invoice Type

HQAF (Hospital Quality Assurance Fee Program): The program provides funding for supplemental payments to California hospitals that serve Medi-Cal and uninsured patients. Revenue from the HQAF also provides funding for children’s health care coverage, pays direct grants to public hospitals, and reimburses DHCS for the direct costs of administering the program. http://www.dhcs.ca.gov/provgovpart/Pages/HQAF.aspx

Primary Capitation: the primary payment amount for the specific Aid Code Group.

Aid Groups

Adult: individuals 19 – 64 years old

Aged: individuals 65 years old potentially eligible for Medicare also

BCCTP: Breast and Cervical Cancer Treatment Programs

Disabled: persons that receive Medi-Cal because of a disability

LTC: individuals receiving Medi-Cal for long term care in a nursing facility

Expanded Medi-Cal, expanded revenue

Expanded Medicaid or Medi-Cal in California is an important part of the ACA to extend health insurance to all U.S. residents. It is also one of the reasons why health insurance companies have been quiet in the debate over repealing the ACA. At a minimum, expanded Medicaid removes the lower income families that may require health care services at higher frequencies from purchasing a private health plan and generating claims. This is a boon to existing health plans that don’t have to shoulder the costs of those claims. They further benefit by contracting to provide managed health care plans to Medi-Cal and have the government pick up the full premium. At least in 2014 private Medi-Cal health plans and their partners such as Safeway, will see significant revenue from expanded Medicaid and possibly enhanced profits as well.

[wpdm_package id=273]

Medi-Cal Estate Recovery

California HealthCare Foundation published a report on how California’s Medi-Cal estate recovery regulations will impact individuals over 55 years of age on Medi-Cal and who are subject to estate recovery. Medi-Cal beneficiaries will be responsible for the monthly capitated amount paid to the managed health care plan on their behalf, but not the cost of care which was paid for by the HMO. Download the full report.

[wpfilebase tag=file id=38 /]

See also: Will Medi-Cal try to claw back health care expenses?