One of the most often asked questions from California families is if their income puts them or their children into Medi-Cal. The confusion rests on the income designated as the federal poverty level, when the new dollar amounts are released, and when Covered California and Medi-Cal actually apply the new income levels to eligibility determinations. One day a family is eligible for Covered California, then the next day they change their phone number on the Covered California application and now the children or adults become Medi-Cal eligible.

Two Different Income Levels For Medi-Cal, Covered California

In December 2018 Covered California hosted a webinar to discuss how they and Medi-Cal update the income levels for eligibility. Even though both of these organizations work closely together, the rules governing their operations and eligibility determinations are not necessarily always in alignment. Because they both must adhere to different eligibility guidelines, the subsequent income tables and conditions for eligibility can be confounding to consumers.

Federal Poverty Level Income Amounts

First let’s start with the federal poverty level. The federal poverty level (FPL) is the annual income below which and individual or family is considered to be in the definition of poverty. The FPL is imprecise as each household’s situation is different. Having an income below the FPL does not necessarily mean a family is impoverished. The Department of Health and Human Services updates the FPL every year. It usually increases according to the Consumer Price Index.

The FPL income amounts are then used as a benchmark for the eligibility of a variety of social services programs at both the state and federal levels. In addition, some of these programs may have other conditions stipulated within the guidelines for eligibility. For example, conditional Medi-Cal for individuals who are disabled or Medicare beneficiaries have additional conditions that limit the amount of certain assets a person may have in order to qualify for the Medi-Cal program assistance.

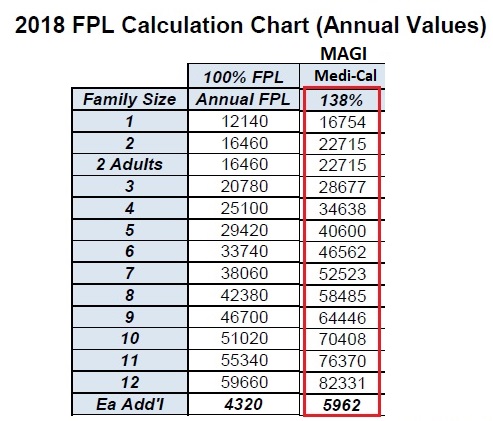

Under the Affordable Care Act (ACA) California decided to participate in the expanded Medicaid (known as Medi-Cal in California). Under the expanded Medi-Cal program adults are eligible for Medi-Cal if their income is below 138% of the FPL for their household size. Dependent children are usually eligible for Medi-Cal if the household income is below 266% of the FPL. It is based solely on the tax household’s Modified Adjusted Gross Income (MAGI). There is no asset test to qualify. In general, with a few exceptions, the income streams counted toward eligibility for the Covered California Premium Tax Credit subsidy are the same for the expanded MAGI Medi-Cal.

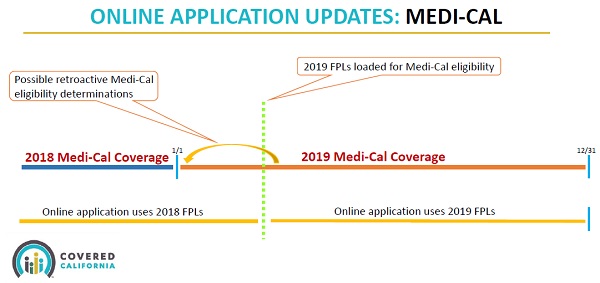

Where a primary source of confusion starts to creep into the preliminary eligibility determination for either Medi-Cal or Covered California hinges on when the new FPL amounts are considered for eligibility. This is where the rules concerning determining eligibility are not necessarily aligned between Medi-Cal and Covered California. The rules put forth by the ACA govern how Covered California applies the FPL amounts for determining eligibility for the Premium Tax Credit subsidy, which are slightly different than Medi-Cal. The Department of Health Care Services, the agency that administers Medi-Cal, must abide by older federal rules for eligibility determinations. (Note: each California county social services department actually makes the final Medi-Cal eligibility determination and enrollment into a manage care HMO plan for eligible individuals.)

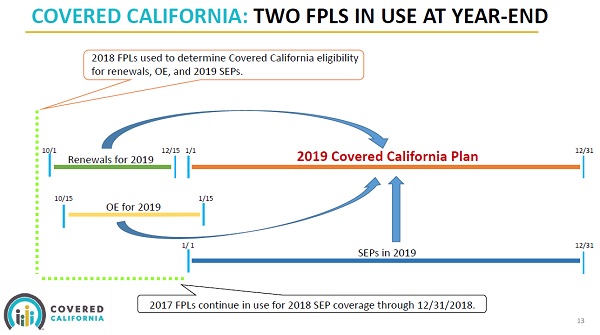

The implementation of the FPLs was the central focus of the Covered California webinar on the topic. Specifically, Covered California uses the federal poverty level income amounts published in the prior year. This means that for 2019 enrollments, Covered California uses the 2018 FPL for determining eligibility for the Advanced Premium Tax Credit subsidies, Enhanced Silver plan cost-sharing reductions, and eligibility for American Indian/Alaska Native plans. Medi-Cal, on the other hand, uses the current year FPLs once they have been published and loaded into their computer system.

The unaligned FPLs between Covered California and Medi-Cal means the Covered California income guidelines must be repeatedly updated through out the year. It also inserts a level of uncertainty regarding eligibility for the two programs. A change in the FPL effects not only whether you are eligible for Medi-Cal (<138% of the FPL) but also if you qualify for Enhanced Silver Plans, which are income based using the FPL, and if children will be Medi-Cal eligible.

Open Enrollment is the one time when both Covered California and Medi-Cal FPLs are aligned. If you are applying for coverage through Covered California, they will use the current year FPL for the next calendar year enrollment. Likewise, Medi-Cal is using the current year to determine eligibility for current enrollment. But after Open Enrollment closes, Covered California will continue to use the prior year’s FPL for eligibility while Medi-Cal, at some point, will transition to higher income FPLs for eligibility determination.

Reporting A Change In Covered California May Trigger Medi-Cal Eligibility

If all a consumer does is enroll in a Covered California plan during open enrollment, and doesn’t touch their account the rest of the year, any new FPL will not affect their eligibility. Supposedly, a new application under the Special Enrollment Period (SEP) with a qualifying life event will use the prior year’s FPL. The snag occurs if a consumer updates their Covered California account during the year. Every time a consumer reports a change, they must submit the application. This triggers the business rules engine of the CalHEERS online software to re-determine eligibility with any new FPLs.

After reporting a change in Covered California and submitting the application, the first thing the system does is compares the current monthly income to the most current Medi-Cal FPLs. If the household income for adults or children is below the new Med-Cal FPLs, the Medi-Cal eligibility determination is triggered. This is regardless of the change you made to your account. You might not have touched the income section and only updated your email address.

If no Medi-Cal eligibility is determined the system screens for eligibility for Enhanced Silver plans. It was not discussed in the webinar or the slides if the eligibility for the Enhanced Silver plans (Silver 73, 87, 94) is based on the current FPLs or the prior year. Covered California noted that the most recent income chart they published are the dollar amounts loaded into their system. Of course, this is at odds with the statement that SEP during the year will have their eligibility determined by the previous year’s FPL.

While the Covered California webinar explained some of the mysteries of the FPL income application, it didn’t lessen the confusion for most consumers. Covered California did mention that they are working to tweak the Report a Change function so that if application information, unrelated income is changed, the system will not run a new eligibility review with the new FPLs. Until that fix is implemented, consumers need to be very careful about reporting a change to their Covered California account if their household incomes are border line for adult or child Medi-Cal eligibility.

Covered California & Medi-Cal FPL Income YouTube Video Webinar

Slide Deck of Covered California FPL Webinar

Podcast of Post