The following FAQ comes from information Covered California has released regarding the implementation of the California Premium Subsidy program as of October 2019. Some program details such as the repayment limitations of the state subsidy are still being finalized and will be updated here as they occur.

Frequently Asked Questions about the 2020 California Premium Subsidy Program

California has allocated $428 million for the 2020 plan year to help subsidize the health insurance premiums for individuals and families with incomes.*

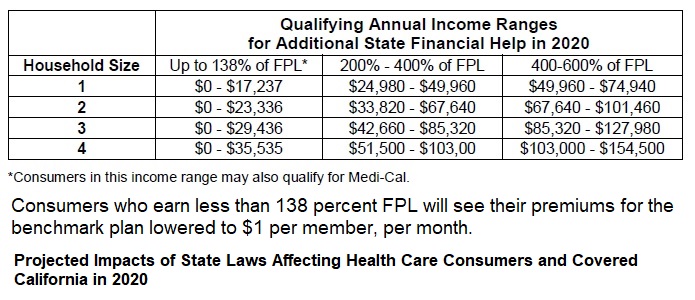

– between $0 and 138% of the federal poverty level (FPL)

– 200% and 400% of the FPL

– 401% and 600% of the FPL

Approximately 17% of the funding will go toward households who earn between 200% and 400% of FPL. 83% of the money will go toward subsidizing household’s whose income is between 401% and 600% of the FPL.

*Income is the Modified Adjusted Gross Income (MAGI) calculation. The MAGI is the Adjusted Gross Income from the federal income tax return plus Social Security retirement benefits, tax exempt interest, and foreign earned income. When I use the term income, I’m referencing the MAGI.

The federal poverty level (FPL) is an income amount determined by the federal government. The FPL increases as the household size increases. When an individual or family falls below the federal poverty level, or certain ranges above 100% FPL, they may become eligible for assistance and subsidies. From the Covered California income table for 2020, 100% of the FPL for an individual is $12,490.

In California, adults who have an income below 138% of the FPL are eligible for MAGI Medi-Cal. For a single adult, 138% FPL is $17,237 and for a family of four it is $35,535 on the Covered California 2020 FPL for 2020 income table. All of the state and federal subsidies work off of the federal poverty level for income for determining eligibility.

Your household is comprised of all the individuals you include on your federal income tax return: spouse and dependents. Even if some of the household members are covered by other health insurance such as Medicare, they are still part of the tax household for determining the federal poverty level income amount.

The federal ACA Premium Tax Credit subsidies stop at 400% of the federal poverty level. The California Premium Subsidy will be available to households who earn between 401% and 600% of the FPL. Some consumers between 200% and 400% of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums.

California will also provide a subsidy for people who are ineligible for Medi-Cal and whose income is below 138% FPL.

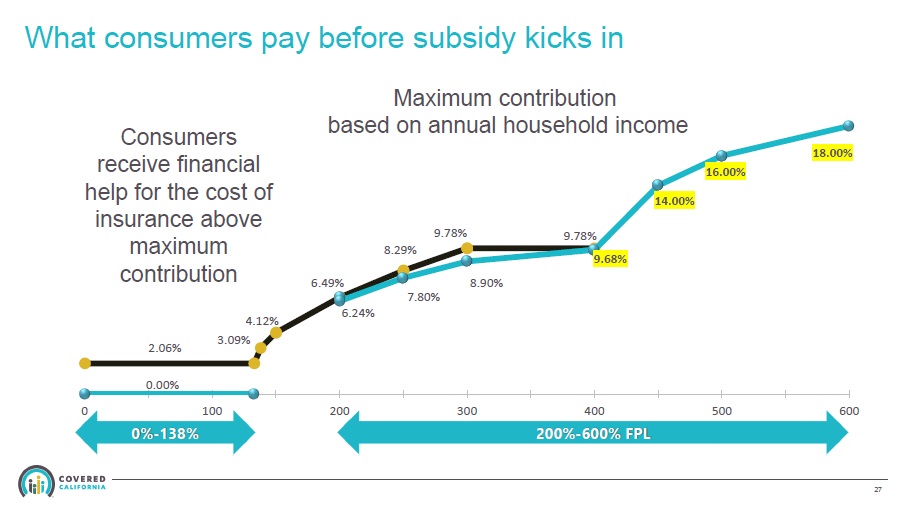

Both the federal and state subsidy are set up to make the second lowest cost Silver plan in a consumer’s region affordable based on an affordability percentage or, also referred to as, the consumer’s responsibility percentage. For example, if the household income is 300% of the FPL, the ACA rules are that the household should spend no more than 9.78% of their income on health insurance premiums. IF the second lowest cost Silver plan would be 12% of the household income, the federal government provides a subsidy to the consumer to lower their monthly premium down to 9.78% for that Silver plan.

California will do the same thing. The California Premium Subsidy affordability percentage or consumer responsibility for incomes between 200% and 400% is slightly lower than the ACA. Consequently, consumers in that range may see a small additional subsidy from the state if they are eligible for the ACA subsidy.

For incomes where no federal ACA subsidy is offered (401% – 600% FPL), California has created a consumer’s responsibility percentage that ranges from 9.68% for 401% FPL up to 18% for incomes at 600% FPL. If a household has an income of 500% of the FPL, California has determined they should spend no more 16% of their income on health insurance premiums. If the unsubsidized health insurance premium of the second lowest cost Silver plan would be 25% of the household income, California will add a subsidy to lower the monthly premium down to 16% of the household income for that Silver plan.

Covered California will be handling the eligibility and enrollment for consumers who wish to participate in the state subsidy program. The eligibility conditions mirror that of the ACA. The individual or family must be citizens, naturalized citizens, green card holders, or have other lawfully present designation. There are other conditions such as the consumer must plan to file taxes and if married, be filing a joint return, although some exceptions do apply.

No, the state subsidy will follow the federal rules that state that if the employee only contribution to the group plan is considered affordable (9.56% of household income), then the spouse and dependents are not eligible for either the California state subsidy or the ACA subsidies.

Maybe. The state subsidies go down to 200% FPL. Silver 87 and Silver 73 plans are awarded to households with incomes between 200% and 250% FPL. But it all depends on the rate of the second lowest cost Silver plan as to whether an additional state subsidy will be awarded or not.

When you apply for health insurance through Covered California, and your income is less than 266% FPL, then your dependent children will be eligible for Medi-Cal and NOT eligible for any premium tax subsidy.

If your income is over 266% FPL, dependents usually qualify for a private health plan with the subsidies if they don’t have other health insurance such as Medicare.

If you have a private off-exchange health plan currently, and your income is under 266%, you can keep your children on that health plan while the adults select a health plan with either federal or state subsidies through Covered California.

No. As with the federal ACA subsidy, the consumer can apply the subsidy to any metal tier plan offered: Bronze, Silver, Gold, Platinum. You don’t have to use the subsidy exclusively on the second lowest cost Silver plan.

If you have a health plan bought directly from a health insurance company – also known as off-exchange – you might be able to enroll in the same plan. Not all health plans offered direct to consumers off-exchange are available through Covered California. For example, if you have a Kaiser Silver HDHP HSA compatible plan, it is not offered through Covered California. You would need to select one of the plans Covered California offers in order to get the subsidy.

The Silver 70 plans are more expensive through Covered California because they add a surcharge on all Silver plans to fund certain cost-sharing reduction benefits to lower income households. You will need to compare any subsidy you may be eligible for to see if it brings the Covered California Silver 70 plan below your off-exchange plan cost. The rates for Bronze, Gold, and Platinum standard benefit design plans are the same on- or off-exchange. Standard benefit designed health plans are structured by Covered California.

No. The subsidy is based on making the second lowest cost Silver plan affordable. If the cost of the second lowest Silver plan in your region represents a lower percentage of your household income than what California determined is affordable, you will not get any subsidy. For example, if your income is 500% FPL, your consumer responsibility is 14%. If the second lowest cost Silver plan rate represents 13% of your income (regardless of whether you are enrolled in a Silver or some other metal tier plan) you will not be awarded a subsidy because the cost is already below the consumer responsibility percentage.

The only way to receive the state subsidy is to enroll through Covered California.

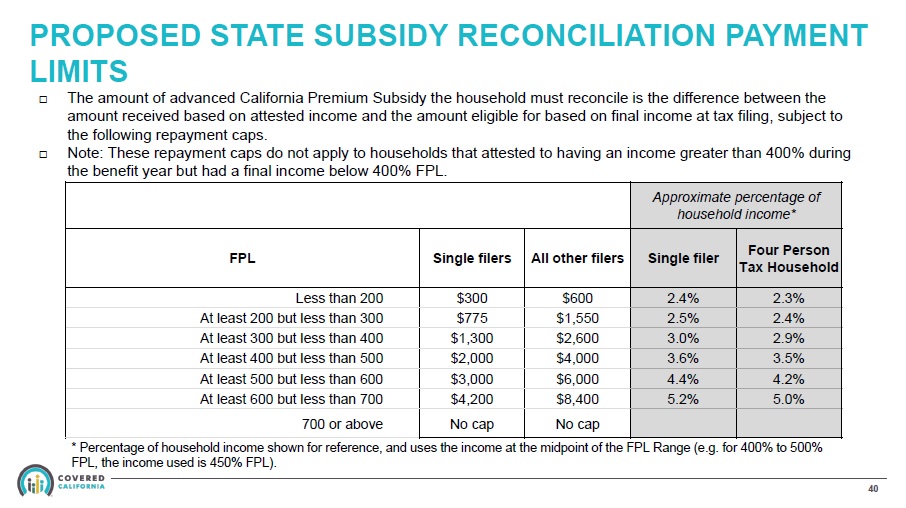

You will have to repay part of the subsidy back to California when you file your California income tax return.

You will be entitled to more state subsidy as long as your income is still over 400% FPL.

If you earn less than 400%, the ACA subsidies will kick in and you might also get a little state subsidy if your income is over 200% FPL. But you will need to repay all of the state subsidy you received during the year based on an income over 400% FPL. It’s possible that the ACA subsidy will be larger than the repayment of the state subsidy. Meaning, you would have a net positive gain in the health insurance subsidy.

You will have to repay all of the ACA Premium Tax Credit back on your federal taxes, but you will be able to claim the state subsidy on your state income tax return.

You will have to repay the state subsidy back to California subject to a repayment limitation similar to the ACA. As of October 2019, there is a proposed repayment limitation for subsidies you received for income up to 700% FPL. Over 700%, all state subsidies would need to be repaid. Covered California, who is administering the state subsidy program, is working with the Covered California Board to determine the final repayment limitations. For more scenarios regarding the ACA and California subsidy, please refer to my blog post Do you Qualify for the New California Health Insurance Premium Subsidy?

For the federal ACA subsidy, you will receive a 1095-A from Covered California that you will file with your federal income tax return. If you received a California Premium Subsidy, you will receive a form similar to the 1095-A and file that with your California state income tax return.

No. Like the ACA subsidy, Covered California will forward the stste subsidy directly to your chosen health plan. The health plan, in turn, will lower your monthly premium bill by that amount.

No. You will reconcile any differences between the state subsidy advanced to your health plan during the year, based on your estimated income, and the subsidy you are entitled to with your final income amount on your California state income tax return through the Franchise Tax Board. If you owe a repayment of the advanced subsidy you received, you will pay it to the Franchise Tax Board. If your income is lower than you estimated, but above 400% FPL, you may receive an additional tax credit when you file your state income tax return.

Unlike the ACA tax credit subsidy, you cannot opt out of receiving the monthly state subsidy you are qualified for based on your estimated income. The subsidy will be advanced directly to your health plan.

Yes. If your income is between 200% and 400%, factoring in the rate of the second lowest cost Silver plan, you may be eligible for both subsidies.

No. If you are eligible for the state subsidy, it will be automatically applied to your account and forwarded to your health plan to lower your monthly premiums.

The subsidy is based on making the second lowest cost Silver plan affordable in your region. At your income level and region where you live, the second lowest cost Silver plan may already be considered affordable under the California affordability or consumer responsibility guidelines.

Health insurance rates are higher in Northern California than in Southern California. The rate of the second lowest Silver plan at your Northern California zip code was above the consumer responsibility percentage, triggering eligibility for a subsidy. The rate in Southern California for the second lowest cost Silver plan in that zip code was already considered affordable, so no subsidy was shown to be available.

The health insurance rate curve is not a straight line. Older adults pay proportionally more for the same plan in the same region as do younger adults. Consequently, your son’s rate for the second lowest cost Silver plan was considered affordable, while the rate for you was above the California consumer responsibility percentage, triggering eligibility for a subsidy.

Do you have a question about the California health insurance subsidies? Send me an email or leave a comment, and I’ll try to track down the answer.